Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

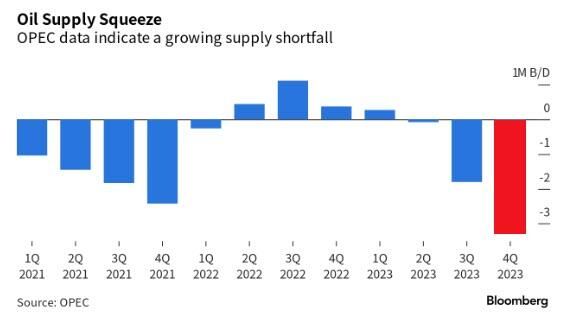

This chart from Bloomberg shows the massive supply shortfall oil markets will face next quarter

OPEC expects a supply shortfall of more than 3 million barrels per day. If OPEC is correct, it would result in the biggest inventory drawdown since 2007. Voluntary production cuts by OPEC members are removing 1.3 million additional barrels of oil supply every day. Higher oil prices are back and the US reserves are at record lows. Source: Bloomberg, The Kobeissi Letter

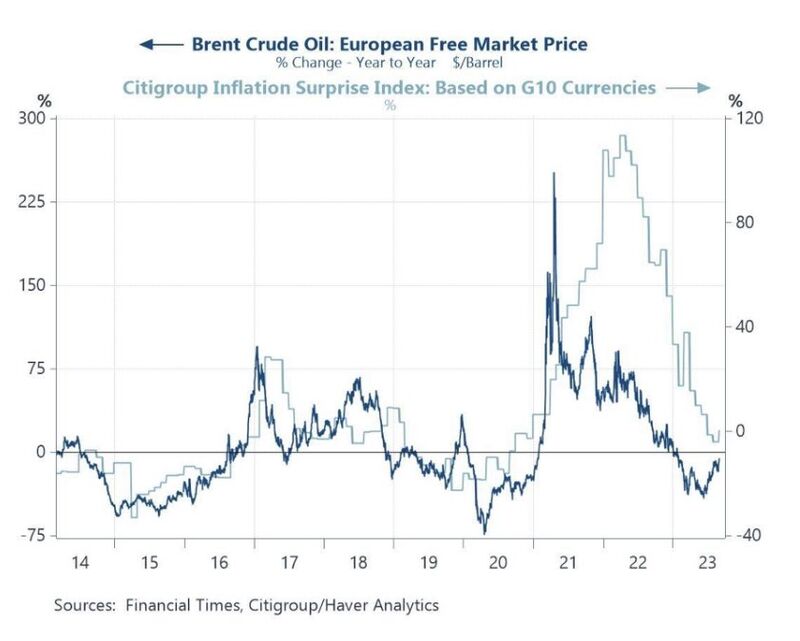

Brent oil vs. Citigroup global inflation surprises index

Oil price usually lead inflation 👇 The recent uptick in oil price will be probably not enough to materially change inflation surprises, but should oil continue to go up it would start to have an impact. Source: Michel A.Arouet

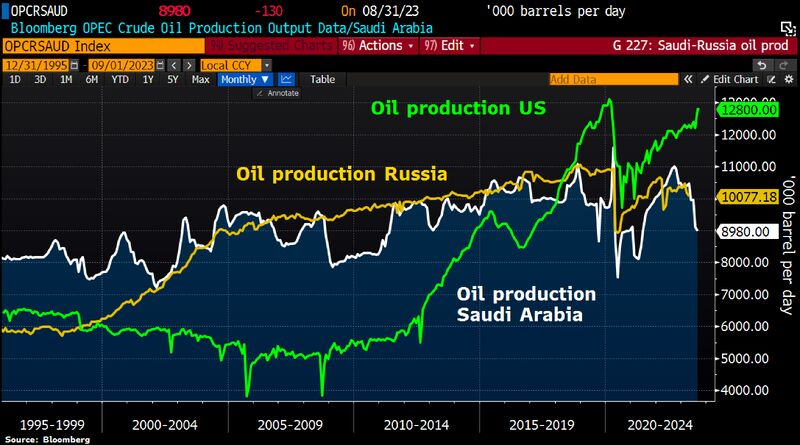

Is oil once again becoming a political commodity: Russia and Saudi Arabia are cutting oil production at the worst time for the Biden administration (hint: next year is an election year in the US)

Source: Bloomberg, HolgerZ

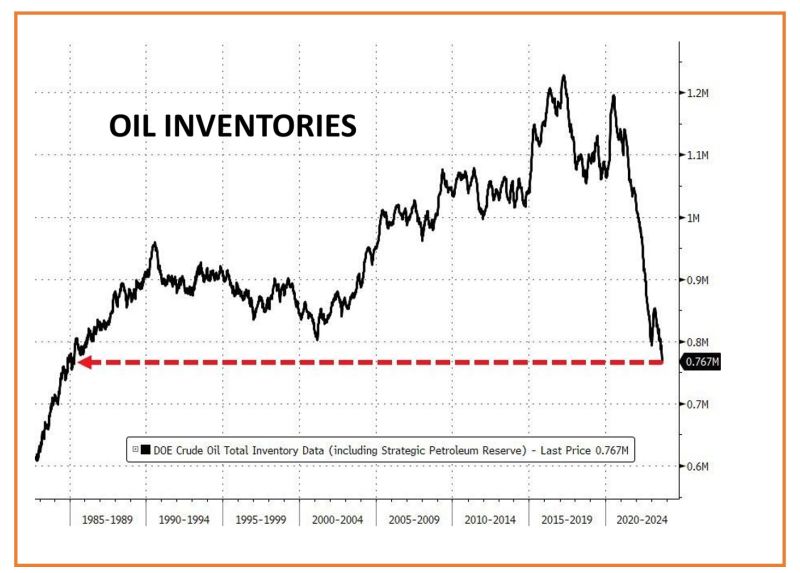

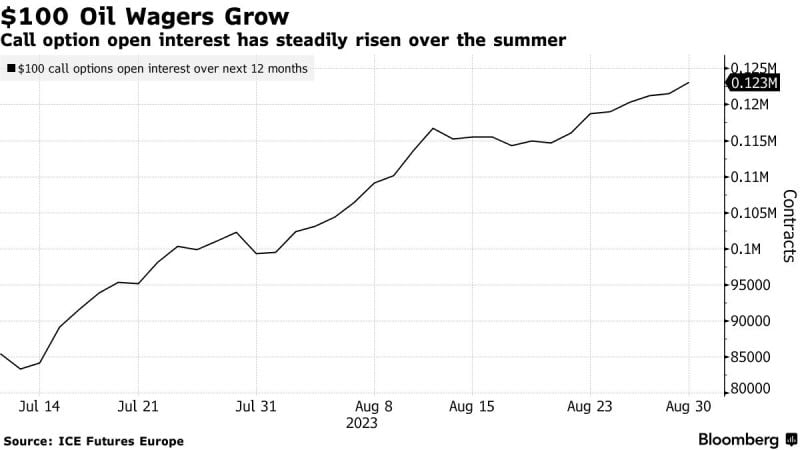

Is oil going to $100?

U.S Crude inventories fell by WAY more than expected ( -6.3mm (-2.1mm expected) to their lowest since early December - and are well below their five-year average for this time of year as the summer driving season ends. Including the SPR (Strategic Petroleum Reserve), this is the lowest level of total crude inventories in America since 1985... Source: Bloomberg, www.zerohedge.com

While WTI oil hit $86, the rig count is still in plunge mode...

*A cumulative $4.9T of investments in global upstream oil and gas are needed by 2030 to meet market needs and prevent a supply shortfall" ---International Energy Forum (IEF) and S&P Global Commodity Insights. Source: Lawrence McDonald, Bloomberg

Trafigura says ‘fragile’ oil market may be prone to price spikes as higher interest rates and underinvestment squeeze the market according to a Bloomberg article

- The consensus view is for prices to remain near current levels, but the market is “more fragile than it looks,” Ben Luckock, the co-head of oil trading said in an interview at APPEC in Singapore. Brent crude is nearing $90 a barrel after OPEC+ heavyweights reduced supply — curbs that could continue further. - “One reason is underinvestment in new oil production,” he said on Monday. “Combined with higher interest rates, which make it more expensive to hold oil in storage, it means there isn’t much slack or flex in the system. Put all together, and you have a market that’s susceptible to price spikes.” - Oil options traders are showing confidence in the recent sustained surge in prices, bolstering wagers that crude will rally toward $100, even as questions remain over China’s outlook. However, Luckock and other attendees at the conference said it wasn’t all bad when it came to nation’s economy.

Investing with intelligence

Our latest research, commentary and market outlooks