Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- performance

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- Germany

- europe

- Japan

- bank

- nasdaq

- oil

- cpi

- warren-buffett

- Forex

- useful

- interest

- apple

- fed

- humor

- interest-rates

- market cap

- dollar

- energy

- returns

- GDP

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- options

- recession

- semiconductor

- vix

- economy

- growth

- mortgage

- Money Market

- cash

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- deficit

- price

- sales

- EM

- ESG

- UK

- assetmanagement

- bearish

- wages

- EV

- Flows

- credit-card

- russia

- saudiarabia

- spending

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- consumers

- profit

- supply

- unemployment

- Brazil

- Election

- car

- chart

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- yen

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- amazon

- copper

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jobs

- lending

- monetarypolicy

- opec

- saudiaramco

- sharebuybacks

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Hong Kong

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

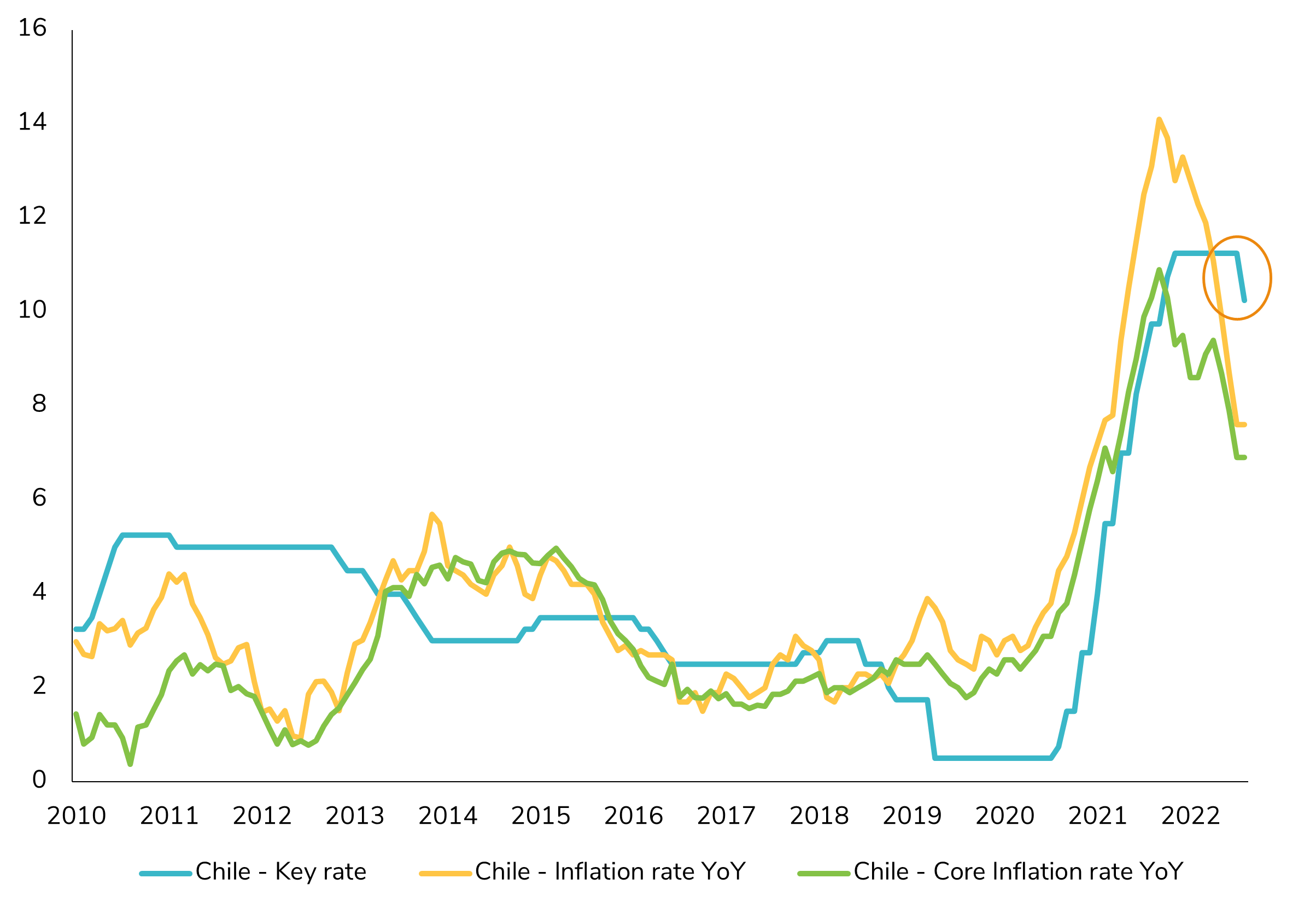

Chile Central bank cut its key rate by 100bps!

Here we go ! The Banco Central de Chile (BCCh) is the first central bank to kick off easing cycle! The Chilean Central Bank made a surprising move by cutting its key interest rate by 100bp to 10.25%, surpassing market expectations of a 50bp reduction. The decision was unanimous, and the BCCh hints at further rate cuts in the near future. This move comes as inflationary pressures ease rapidly, and economic activity weakens. Despite recent challenges, the CLP (Chilean Peso Spot) has shown resilience this year, benefiting from reduced political uncertainty. Policymakers aim to support the #economy amidst deteriorating #sentiment and economic activity. The minutes scheduled for August 14 will provide further insights into the central bank's outlook. Source : Bloomberg

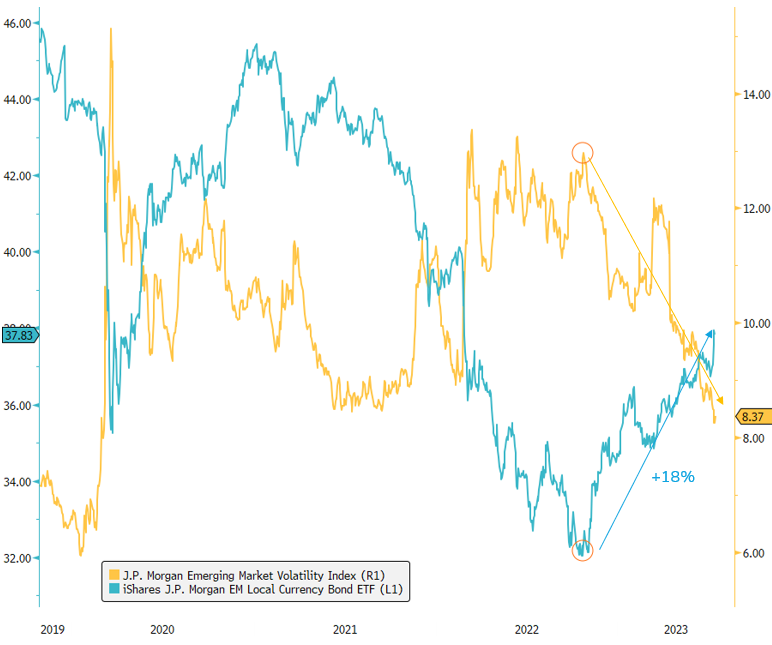

Emerging Market Local Currency Debt: Sustaining the Rally?

Emerging Market local currency debts have proven to be top performers (+18%) since reaching the peak in the 10-year US Treasury yield (4.25%) in October 2022, during this rate hike cycle. This specific segment of the fixed income market has offered attractive real rates, leading to the strengthening of EM currencies against the US Dollar. Notably, volatility in EM currencies has reached its lowest level since March 2020 and the global pandemic. As emerging market central banks prepare for potential monetary policy "pivot" (starting with Chile, Hungary and Brazil?), the question arises: will this trend continue? Or could we see a break in the rally, despite the favorable gap in nominal policy rates between EM and DM, while the gap in headline inflation reaches its tightest level? Source : Bloomberg

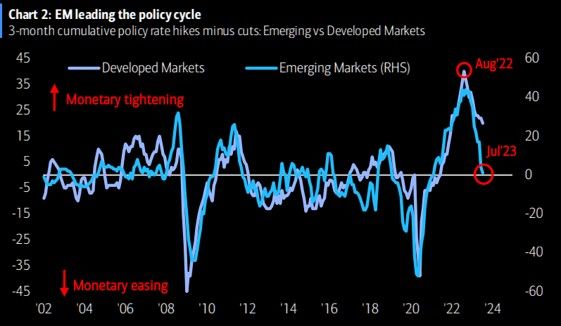

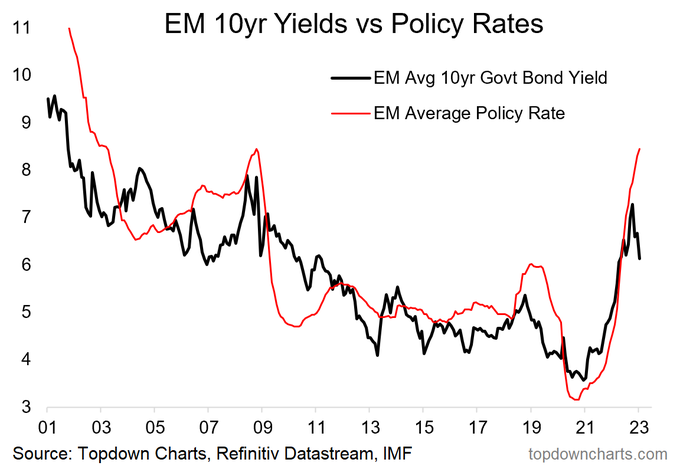

Time for emerging market central banks to pivot?

As the Citi Inflation Surprise Index for emerging markets (EM) turned negative for the first time since July 2020, the bond market appears to be hoping for a pivot from EM central banks (CBs). The end of policy tightening in EM is already visible, as the pace and magnitude of rate hikes by EM CBs has begun to slow. Source: Topdown charts.

Investing with intelligence

Our latest research, commentary and market outlooks