Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- performance

- AI

- Rate

- gold

- Real Estate

- earnings

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- Germany

- europe

- Japan

- bank

- nasdaq

- oil

- cpi

- warren-buffett

- useful

- Forex

- interest

- humor

- apple

- fed

- interest-rates

- market cap

- energy

- returns

- dollar

- hedge fund

- GDP

- quotes

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- options

- recession

- semiconductor

- vix

- economy

- growth

- mortgage

- Money Market

- Positioning

- cash

- charts

- exports

- trading

- bubble

- ipo

- deficit

- price

- sales

- EM

- UK

- bearish

- tesla

- wages

- ESG

- EV

- Flows

- credit-card

- saudiarabia

- spending

- Turkey

- futures

- index

- meta

- revenue

- russia

- EUR

- assetmanagement

- bankruptcy

- cocoa

- profit

- supply

- unemployment

- watches

- consumers

- Brazil

- Election

- car

- chart

- credit-rating

- cryptocurrencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- currencies

- insider

- spx

- yen

- FUND

- africa

- amazon

- copper

- deflation

- investmentgrade

- manufacturing

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- microsoft

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- liquidity

- luxury

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jobs

- leadership

- lending

- monetarypolicy

- moneydebasement

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- bankrupt

- behavior

- booking.com

- brics

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

- meetings

- mergers&acquisitions

- microstrategy

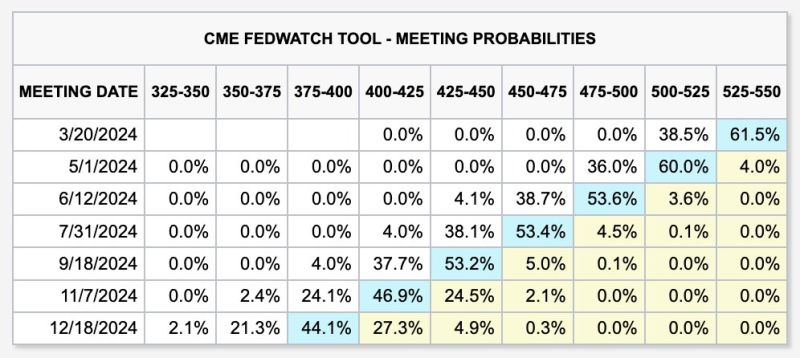

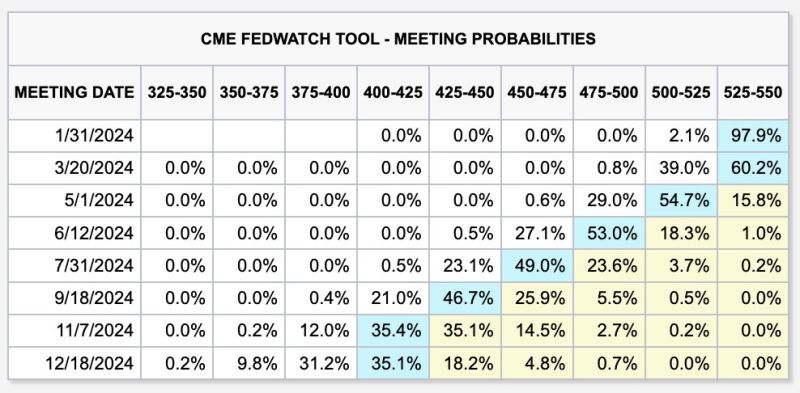

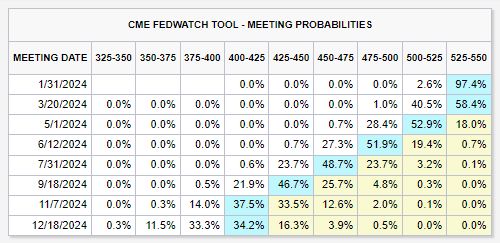

The Fed said that a March rate cut is "unlikely," yet futures are still pricing in a 39% chance it happens

Even as the Fed said they cannot cut rates until inflation is comfortably moving to 2%, markets still see 6 cuts in 2024. There's even a growing 23% chance of 7 interest rate cuts this year. Markets are pricing in a rate cut at EVERY remaining Fed meeting this year. As highlighted by the Kobeissi Letter, if the Fed is on track for a "soft landing," why do we need to many rate cuts? Source: The Kobeissi Lette

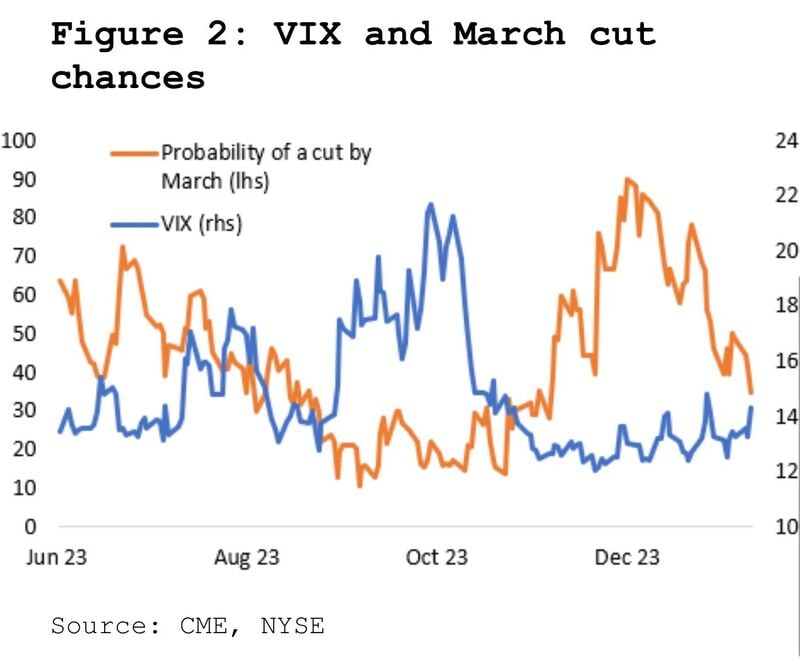

Powell “stayed away from addressing the banking sector but the sharp decline in regional shares is certainly getting attention at the Fed.”

Could the combo "March cut is fully priced out + regional bank stress building" trigger a temporary spike of the VIX? Source: Carl Quintanilla

As we are less than 24 hours away from the first Fed meeting of 2024, odds of rate cuts are pulling back

Odds of a rate cut this week are down to 2% and odds of a rate cut in March are down to ~40%. This is the lowest probability of a March rate cut since November 2023. Still, futures are pricing-in a base case of 6 rate cuts for a total of 150 bps in 2024. - All eyes will be on Fed guidance on June 30zh Source: The Kobeissi Letter

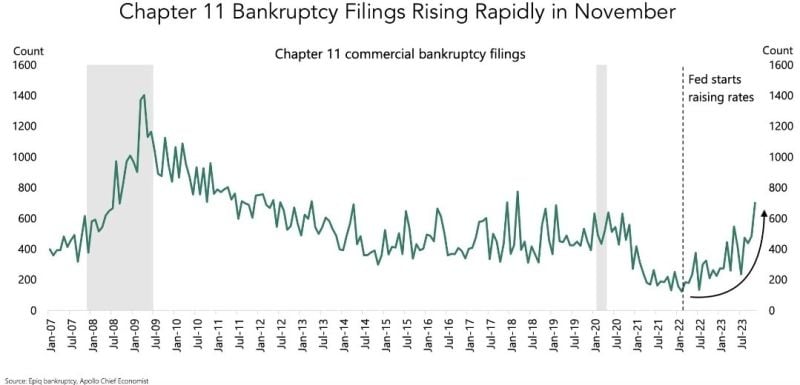

US Bankruptcy filings keep moving higher

This sounds like a logical consequence of 2 years of aggressive FED tightening but still something to keep an eye on Source: Win Smart, CFA

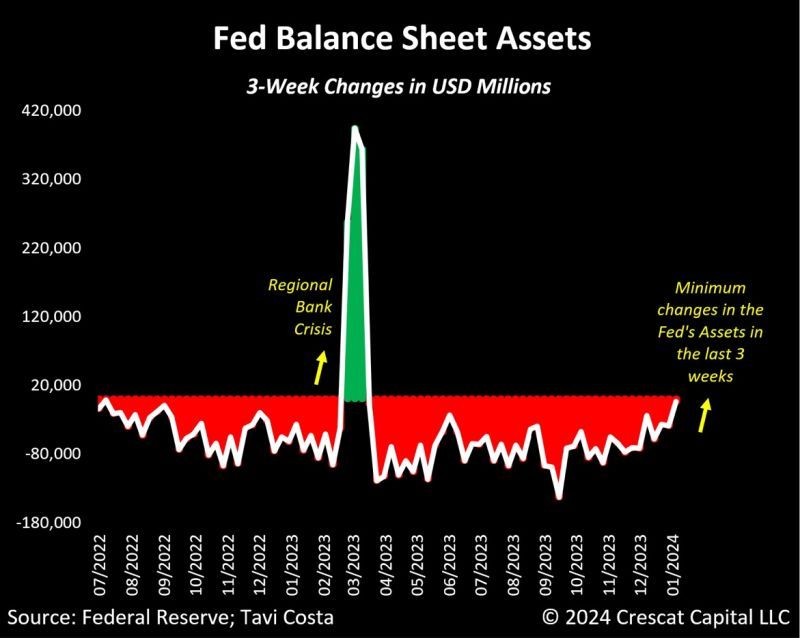

The Fed did almost no QT in the last 3 weeks

As highlighted by Tavi Costa, this was the smallest change in their balance sheet since the regional bank crisis in March 2023. Source: Bloomberg, Crescat Capital

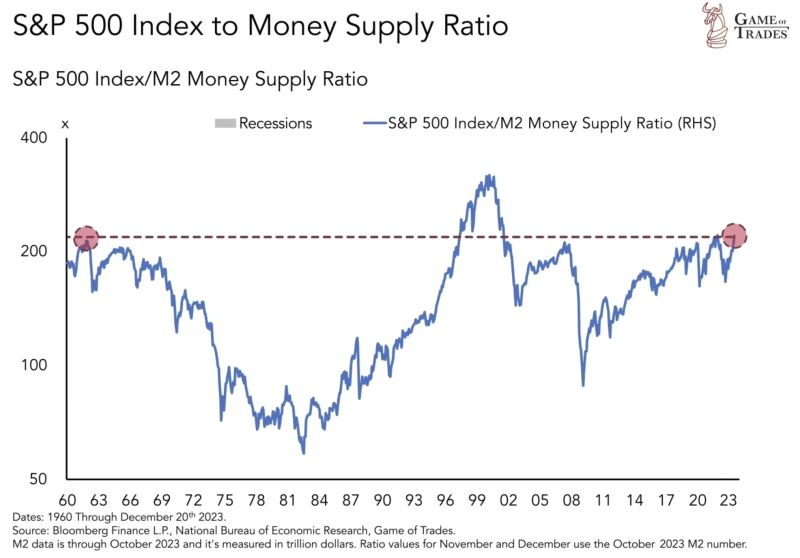

The market is at the same level as 1960 when adjusted for M2 money supply

Source: Game of Trades

It's official: markets are no longer expecting a FED rate cut in March 2024.

There's still a ~42% chance of rate cuts beginning in March, but this is a major shift in expectations. Just two weeks ago, markets saw a 90% chance of rate cuts beginning in March. Odds of rate cuts beginning at next week's Fed meeting are now down to ~2%. We are still seeing ~150 bps of interest rate cuts priced-in to futures. But, Fed pivot hopes are slowly pulling back. Source: The Kobeissi Letter

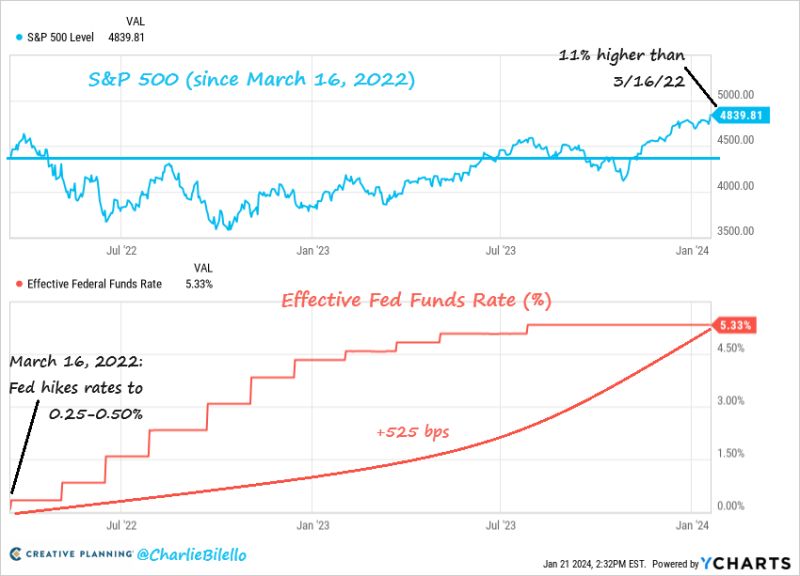

The S&P 500 is now 11% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks