Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- performance

- AI

- Rate

- gold

- Real Estate

- earnings

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- Germany

- europe

- Japan

- bank

- nasdaq

- oil

- cpi

- warren-buffett

- useful

- Forex

- interest

- humor

- apple

- fed

- interest-rates

- market cap

- energy

- returns

- dollar

- hedge fund

- GDP

- quotes

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- options

- recession

- semiconductor

- vix

- economy

- growth

- mortgage

- Money Market

- Positioning

- cash

- charts

- exports

- trading

- bubble

- ipo

- deficit

- price

- sales

- EM

- UK

- bearish

- tesla

- wages

- ESG

- EV

- Flows

- credit-card

- saudiarabia

- spending

- Turkey

- futures

- index

- meta

- revenue

- russia

- EUR

- assetmanagement

- bankruptcy

- cocoa

- profit

- supply

- unemployment

- watches

- consumers

- Brazil

- Election

- car

- chart

- credit-rating

- cryptocurrencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- currencies

- insider

- spx

- yen

- FUND

- africa

- amazon

- copper

- deflation

- investmentgrade

- manufacturing

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- microsoft

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- liquidity

- luxury

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jobs

- leadership

- lending

- monetarypolicy

- moneydebasement

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- bankrupt

- behavior

- booking.com

- brics

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

- meetings

- mergers&acquisitions

- microstrategy

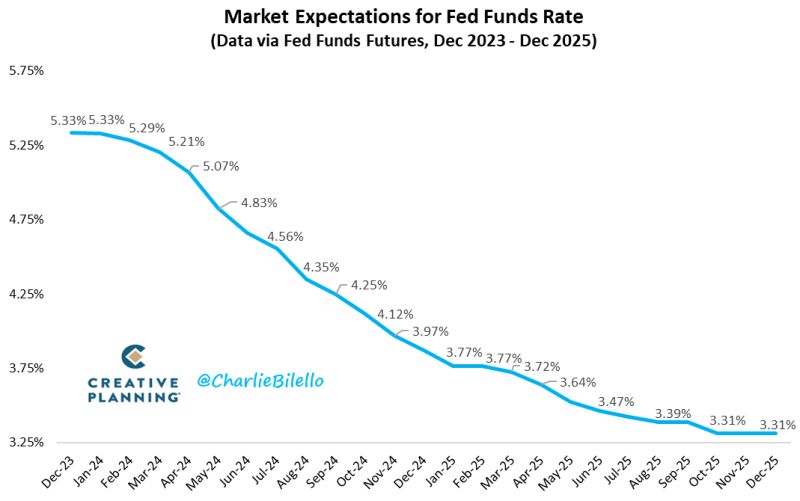

The Fed is still behind the curve...

The market is now pricing in a Fed Funds Rate of 3.8% by the end of 2024, expecting significantly more easing than the Fed's projection of a move down to 4.6%. Source: Charloe Bilello

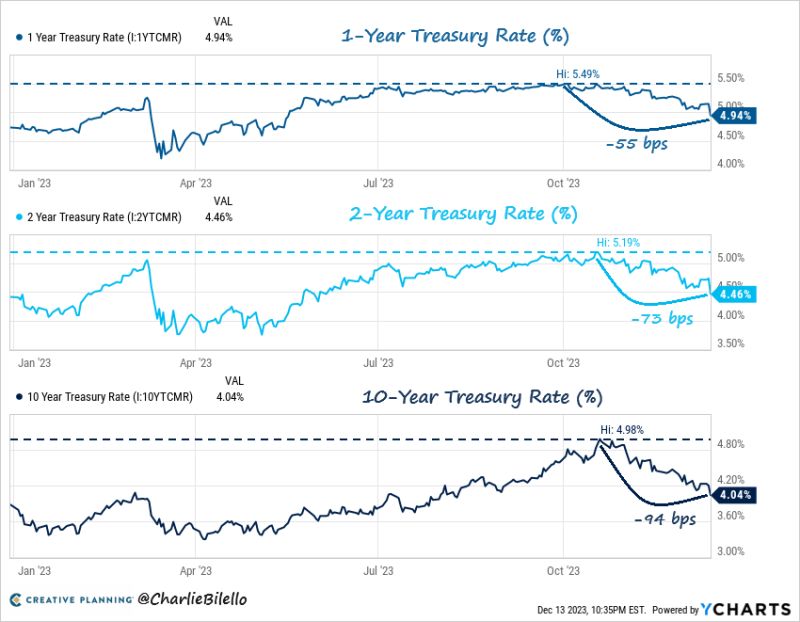

Big move down in Treasury yields yesterday after the FED projected 75 bps of rate cuts in 2024...

1-Year: 4.94%, down 55 bps from Oct high. 2-Year: 4.46%, down 73 bps from Oct high. 10-Year: 4.04%, down 94 bps from Oct high. Source: Charlie Biello

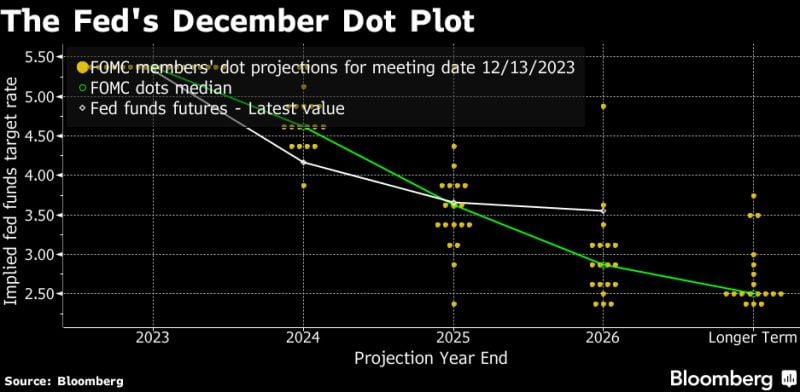

The Fed is finally giving up...

Fed holds rates steady but indicates three cuts coming in 2024. Indeed, the Dot Plot is adjusted down significantly more dovishly than expected, narrowing the gap to the market's expectation significantly... The US 10 year is down 20bp to 4%, the Dow surges by 300 points!

⚠️BREAKING:

*FED'S POWELL: IT IS NOT LIKELY WE WILL HIKE FURTHER *POWELL: POLICYMAKERS ARE THINKING AND TALKING ABOUT WHEN IT WILL BE APPROPRIATE TO CUT RATES Source: www.investing.com

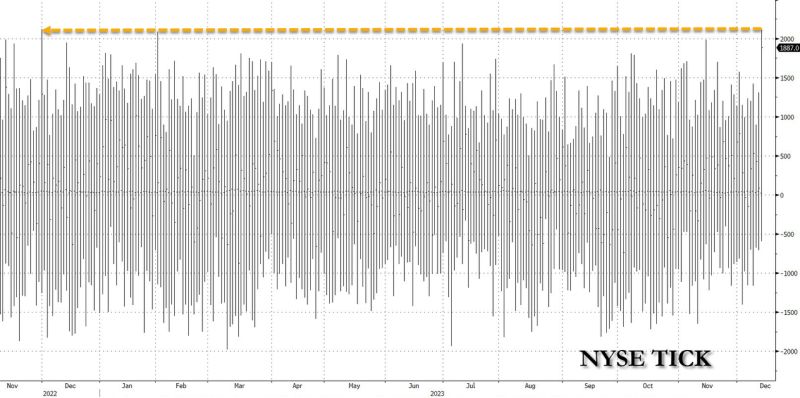

The Fed just triggered the biggest stock-buying program since Nov 2022...

Source: Bloomberg, www.zerohedge.com

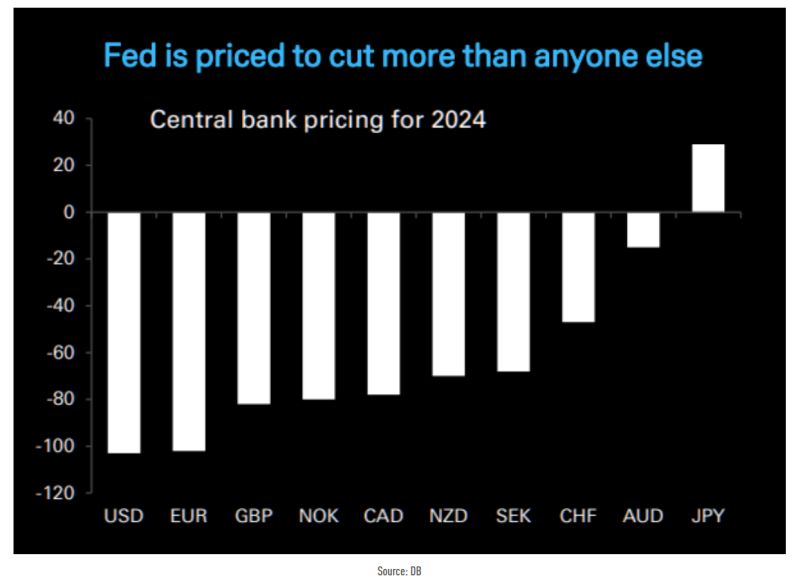

Too much, too fast? Markets is seeing the FED being the most aggressive in terms of rate cuts next year

Source: DB, TME

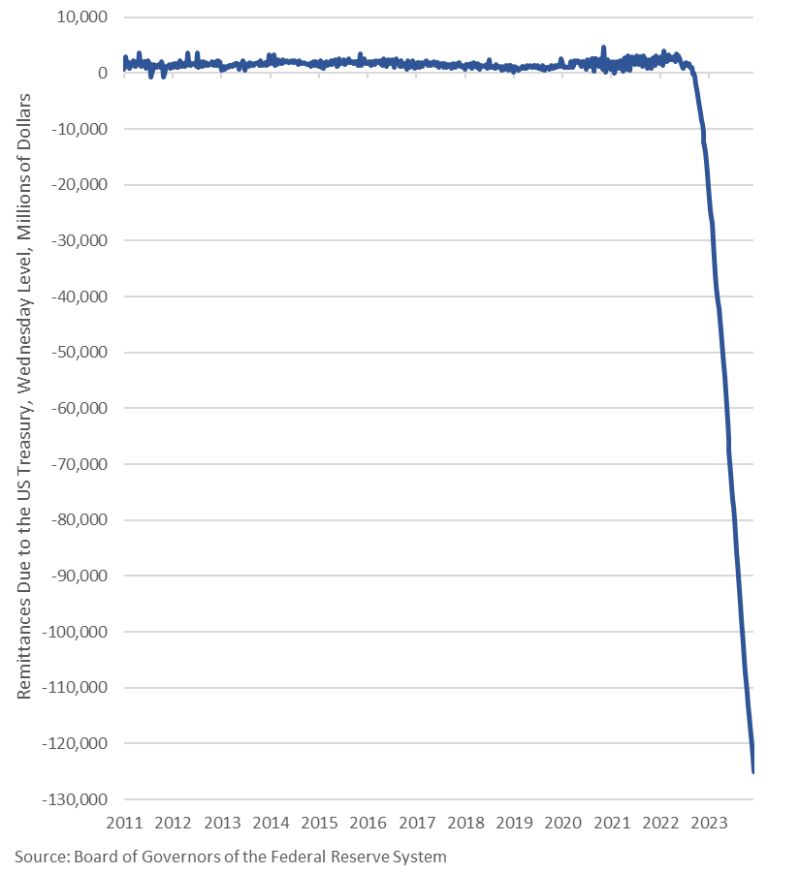

Losses at the Fed have now passed $125 billion

Source: Win Smart, CFA

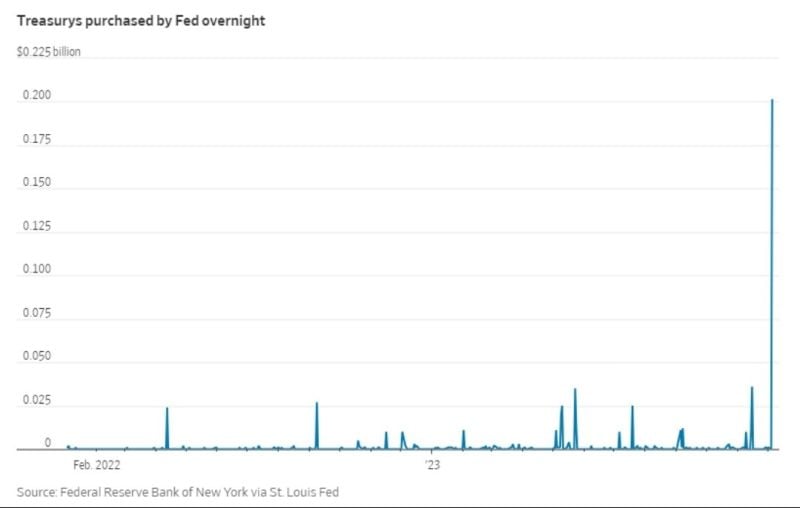

The Federal Reserve lent out roughly $200B in overnight cash on Wednesday through its standing repo facility

This is the highest amount since the onset of covid. What's going on? Is another repo crisis looming? Source: Win Smart, CFA

Investing with intelligence

Our latest research, commentary and market outlooks