Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

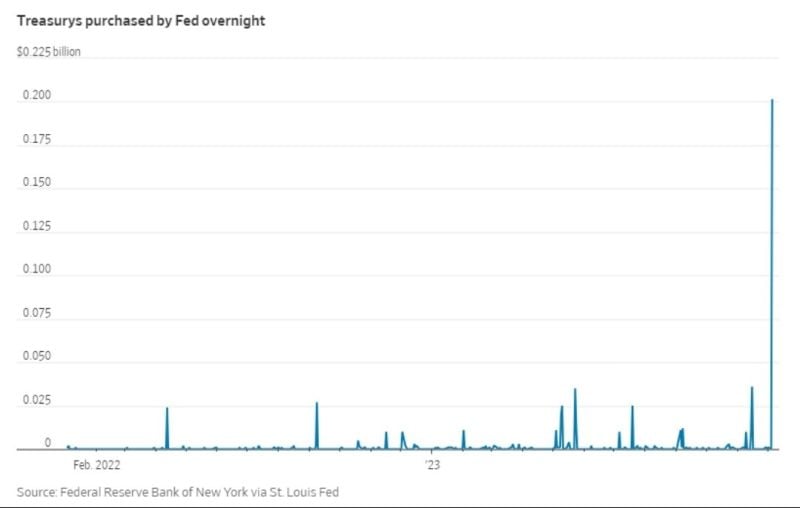

The Federal Reserve lent out roughly $200B in overnight cash on Wednesday through its standing repo facility

This is the highest amount since the onset of covid. What's going on? Is another repo crisis looming? Source: Win Smart, CFA

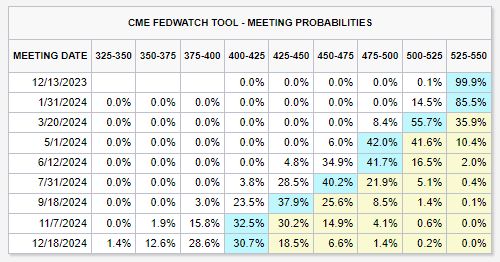

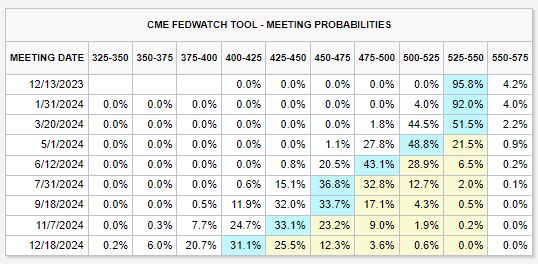

Odds of rate cuts beginning as soon as January 2024 are rising quickly

There is now a ~15% chance of rate cuts beginning next month. The base case shows a ~56% chance of rate cuts beginning in March 2024. Markets are currently expecting a total of FIVE 25 basis point rate cuts in 2024. Still, the Fed has yet to discuss the possibility of any rate cuts at all. Markets are fully bought in to the "Fed pivot." We believe that the economy will continue to slow down and that rate cuts will take place next year. However, a lot pof these cuts are already priced in. This could generate some volatility for bonds and stocks in case of disappoinment (aka macro data surprising on the upside). Source: The Kobeissi Letter

Gold hit record high 2'135.39/oz in early trading hours

Gold surged to a new all-time high as growing expectations for US rate cuts early next year. This latest leg of gold's rally has been turbocharged by comments on Friday from Fed Chair Jerome Powell. Precious metal's strength has been underpinned buy other factors as purchases by governments and central banks as well as geopolitical uncertainty.

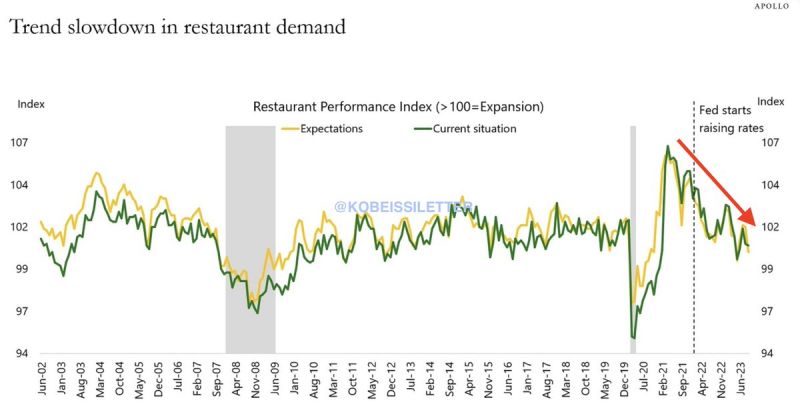

Interesting development highlighted by The Kobeissi Letter:

Is the slowdown in restaurant activity signalling that a FED pivot Indicators of restaurant activity continue to show signs of weakness in the US. Interestingly, this has been almost perfectly correlated with the Fed raising rates. Restaurant activity in the US hit an all time high in August 2021. Since the Fed started raising rates in March 2022, restaurant activity has moved in a straight line lower. As excess savings are depleted and inflation remains an issue, consumers are cutting back. And more credit card debt is not the solution here.

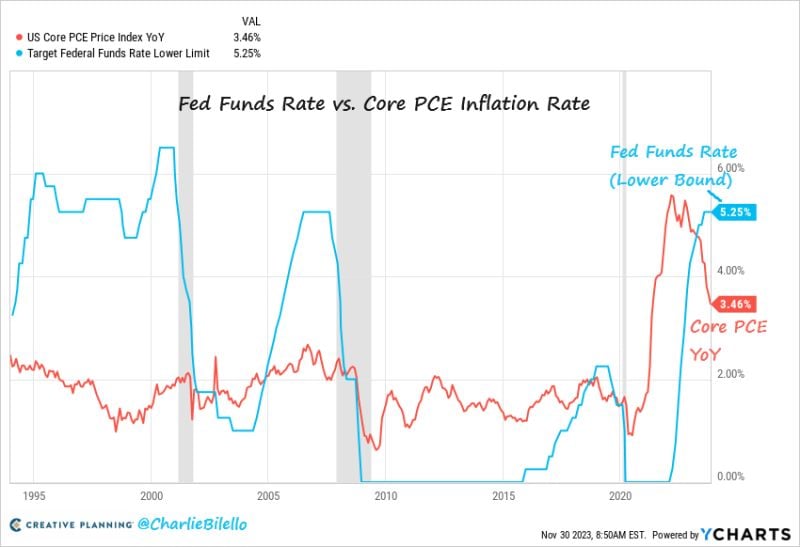

The Fed's preferred measure of inflation (Core PCE) moved down to 3.5% in October, the lowest since April 2021

The Fed Funds Rate is now 1.8% above Core PCE, the most restrictive monetary policy we've seen since 2007. Source: Charlie Bilello

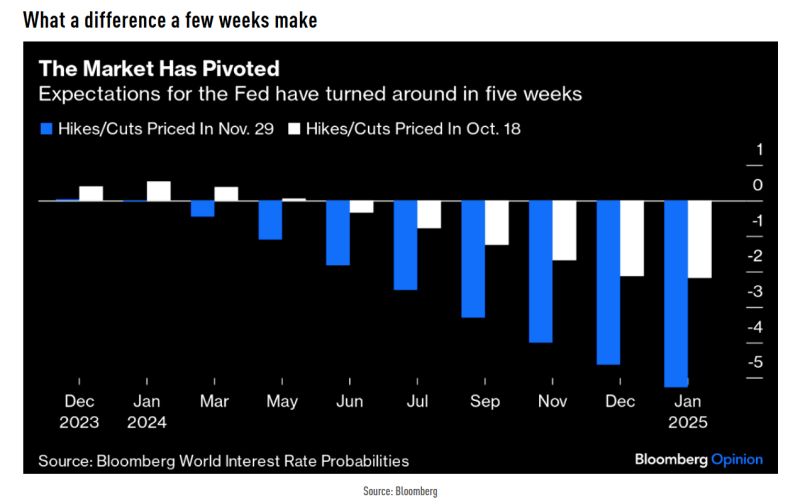

Massive change over the past 5 weeks when it comes to what the market is pricing from FED

Source: TME, Bloomberg

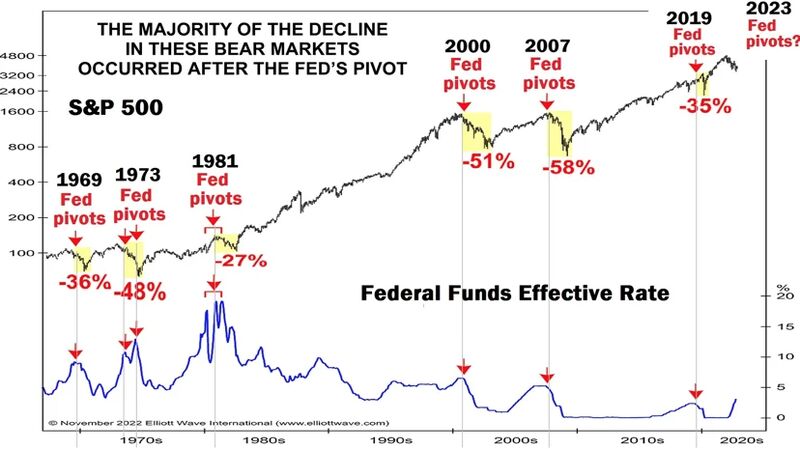

So the FED is expected to pivot next year, maybe as soon as March

Is a pivot good for equity markets? Well, history shows that the months that follow the pivot are not the best ones for stocks... maybe this time will be different... Source: Phoenix Capital

Futures are now showing a ~45% chance that FED rate CUTS begin as soon as March 2024

There's also a growing (but small) chance that rate cuts begin in January 2024, at 4%. Prior to the most recent CPI inflation data, the base case showed rate cuts beginning in June 2024. There was also a 50% chance of another rate HIKE in 2024. This has been a quick turnaround... Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks