Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- performance

- AI

- Rate

- gold

- Real Estate

- earnings

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- Germany

- europe

- Japan

- bank

- nasdaq

- oil

- cpi

- warren-buffett

- useful

- Forex

- interest

- humor

- apple

- fed

- interest-rates

- market cap

- energy

- returns

- dollar

- hedge fund

- GDP

- quotes

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- options

- recession

- semiconductor

- vix

- economy

- growth

- mortgage

- Money Market

- Positioning

- cash

- charts

- exports

- trading

- bubble

- ipo

- deficit

- price

- sales

- EM

- UK

- bearish

- tesla

- wages

- ESG

- EV

- Flows

- credit-card

- saudiarabia

- spending

- Turkey

- futures

- index

- meta

- revenue

- russia

- EUR

- assetmanagement

- bankruptcy

- cocoa

- profit

- supply

- unemployment

- watches

- consumers

- Brazil

- Election

- car

- chart

- credit-rating

- cryptocurrencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- currencies

- insider

- spx

- yen

- FUND

- africa

- amazon

- copper

- deflation

- investmentgrade

- manufacturing

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- microsoft

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- liquidity

- luxury

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jobs

- leadership

- lending

- monetarypolicy

- moneydebasement

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- bankrupt

- behavior

- booking.com

- brics

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

- meetings

- mergers&acquisitions

- microstrategy

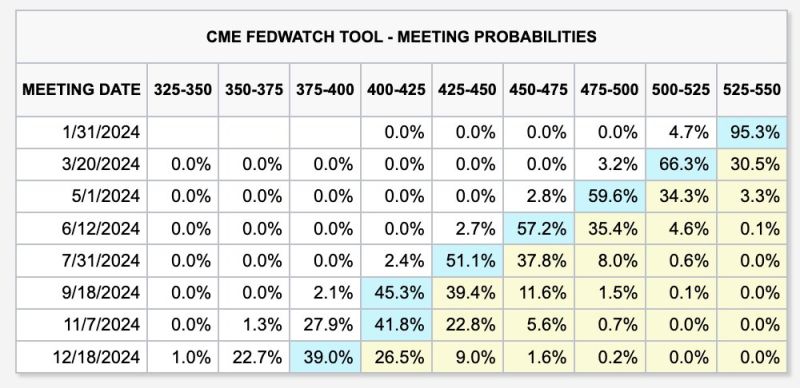

Fed member Bostic just said that he sees just 2 interest rate cuts in 2024 for a total of 50 basis points

As highlighted by the Kobeissi Letter -> This ONE THIRD the amount of rate cuts that futures are currently pricing-in. Bostic also said that he is "not comfortable declaring victory" against inflation at this point. Meanwhile, markets see a base case of 150 basis points in rate cuts in 2024. There is even a ~24% chance of 175 basis points in rate cuts. The Fed to market disconnect is widening. Source: The Kobeissi Letter

Bank of America Corp. expects the Federal Reserve to announce plans to begin tapering the runoff of its Treasuries holdings in March, coinciding with its first 25 basis points interest-rate cut.

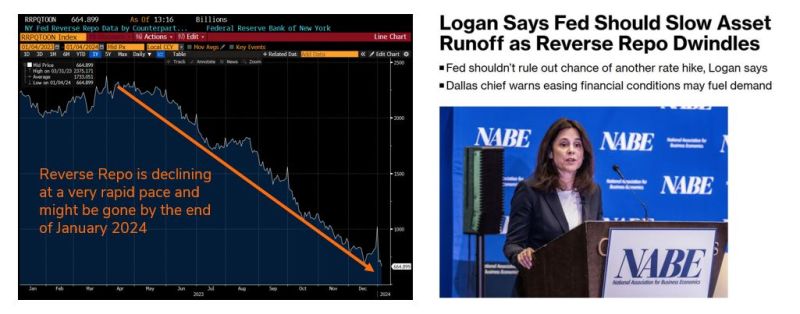

- The Reverse Repo ("RRP") is de facto QE-infinity $ printed during 2020-21 that was sitting dormant. It's now being used to buy up US Treasuries. Problem: it is declining at a very rapid pace and might be gone by the end of January 2024. - Something needs to be done to preserve QB / liquidity. - This is why the Fed is now thinking about slowing down the pace of QT. Over the week-end, Dallas Fed chief Logan said the Fed should slow Asset runoff as Reverse Repo dwindles - 2024 is an election year and we expect net liquidity to be supportive for the economy, bond markets and risk assets

While many economists and financial analysts look at the 1970s as a potential playbook for the current decade, the 1940s could be an interesting reference to consider as well

The 40s was a decade of war and high budget deficit and rising debt level in the US. Monetary policy was mainly about financial repression, i.e keeping rates low despite temporarily high inflation. Overall, it was positive for risk assets. Source: Win Smart, FRED

FED meeting minutes key takeaways:

1) rates likely at or near their peak 2) 2pct inflation target is maintained 3) monetary policy is likely to stay restrictive for some time 4) clear progress has been made on inflation (dixit the Fed) 5) see rate cuts by the end of 2024 FOMC views continue to diverge from market expectations (2x more rate cuts are currently priced vs. Fed guidance) Source: CNBC, The Kobeissi Letter

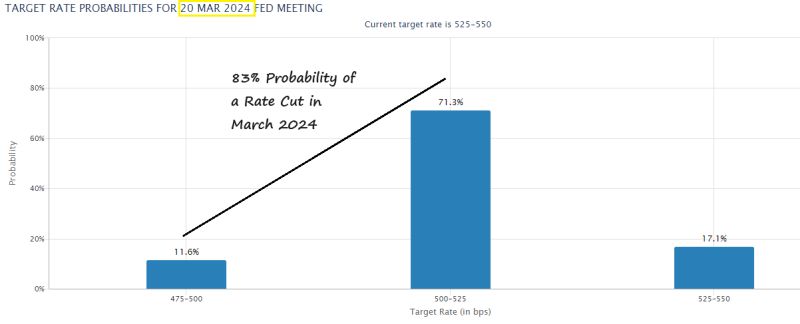

The probability of a Fed rate cut in March 2024 has jumped up to 83%. A month ago the odds were only 29%.

Source: Charlie Bilello

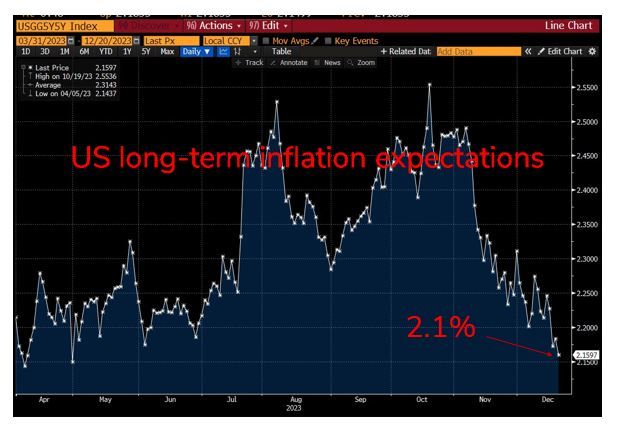

Longer-term US inflation expectations have fallen dramatically over the past two months, to close to the Fed's 2% target

Source: Bloomberg

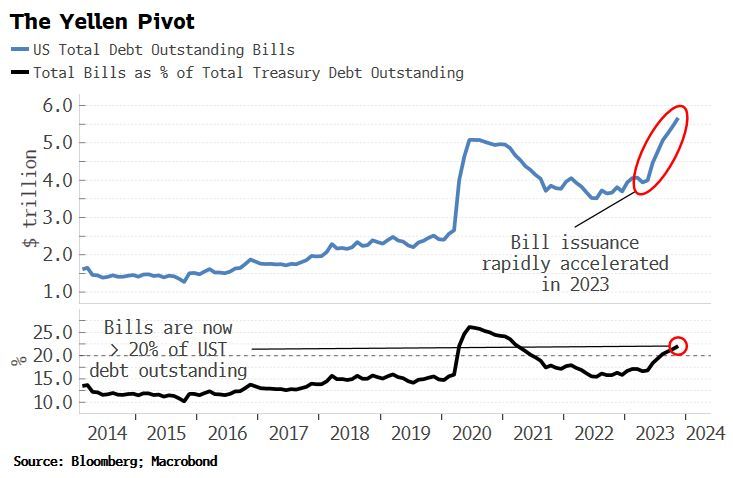

Simon White posted an excellent chart showing the potential short-term gain / long-term pain of the dual Yellen / Powell pivot

Phase 1: The Yellen Pivot. Early 2023, she decided skewing the Treasury's issuance towards bills. This bought time for risk assets, allowing Fed reserves to rise despite QT Phase 2: The Powell Pivot last week -> His dovish turn should buy more time for risk assets next year. He is literally trying to limit the growing amount of liquidity sucked from the government's ballooning interest-rate bill While this leads to short-term gain, there is a huge risk of long-term pain as these dovish operations have significantly increased long-term inflation risks and the prospect of even higher yields in the near-future. Source: Bloomberg, Macrobond

BREAKING >>>New York Fed President John Williams CNBC interview: The Fed "isn't really" talking about rate cuts right now

Mr. Williams said: - The Fed "isn't really" talking about rate cuts right now. - Committee members submit projections regarding path of interest rates. Inflation and economy is still uncertain, but base cases are looking pretty good. - Policy focused on getting inflation down to 2%. - Market reaction to all news events have been larger than normal. - Fed should be ready to hike again if needed. - Fed is at or near right place for monetary policy. - The policy restraints should be dialed back slowly over the next three years.

Investing with intelligence

Our latest research, commentary and market outlooks