Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

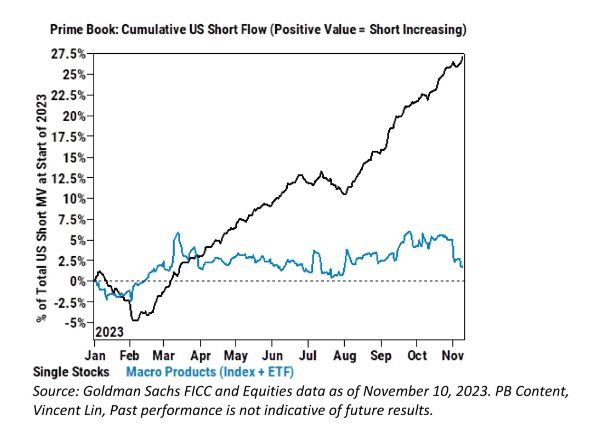

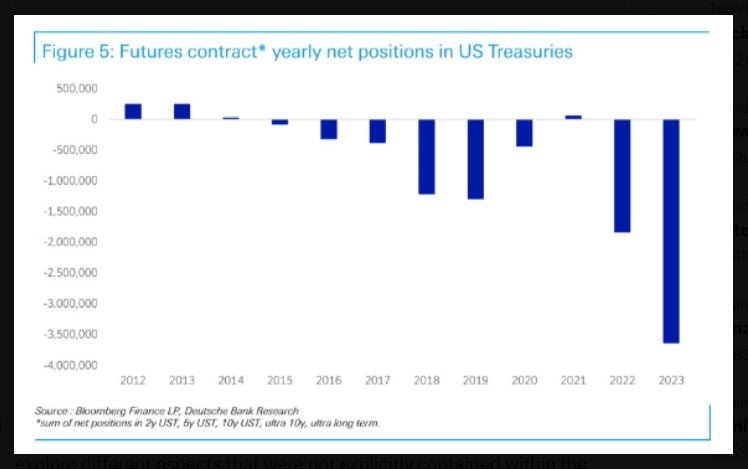

Hedge Funds have increased their short stock positions for 14 consecutive weeks, the longest streak in history

Source: Win Smart, Goldman

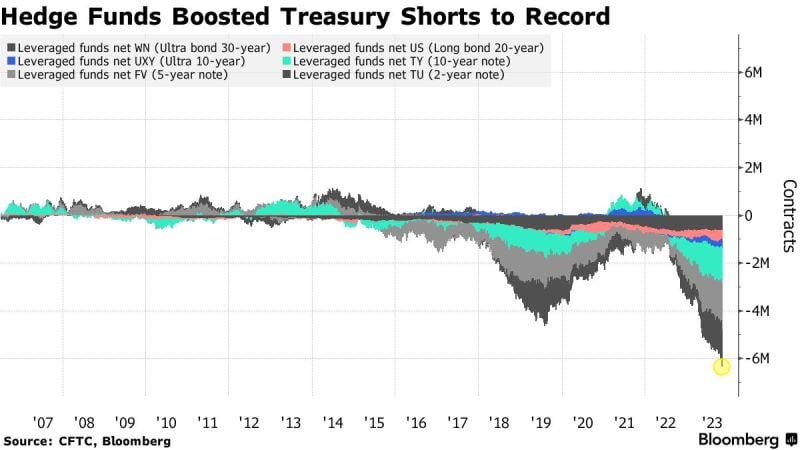

Hedge Funds extended short positions on Treasuries to a record just before smaller-than-expected US bond sales and weaker jobs data spurred a rally

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before. Source: Bloomberg

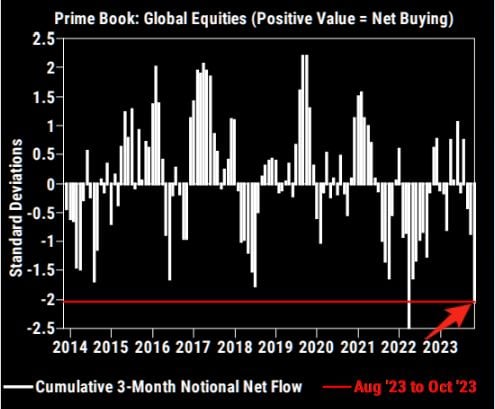

Last week "pain trade" in one chart

-> Last week's Risk On move has pushed Hedge Funds to cover their shorts, triggering violent short squeezes. The Goldman Sachs Most Shorted Stocks Basket jumped by 13% over the week. Source: Bloomberg, HolgerZ

Hedge Funds were quite short going into November

Source: Markets Mayhem, GS

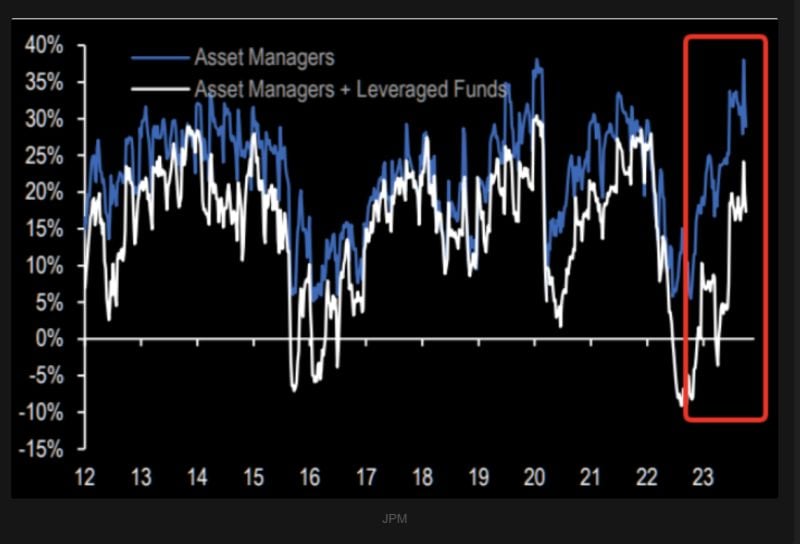

Yes, Hedge funds are short equities

But don't forget the bigger picture: positioning among asset managers and leveraged funds is rather long... Source: TME, JP Morgan

Hedge funds have now built the largest short position in U.S. Treasuries in history

Source: DB, barchart

A tale of two type of investors...

who will be right? Hedge Funds continue to short treasuries at historic levels while asset managers are building their largest long positions ever recorded! Source: FT, Barchart

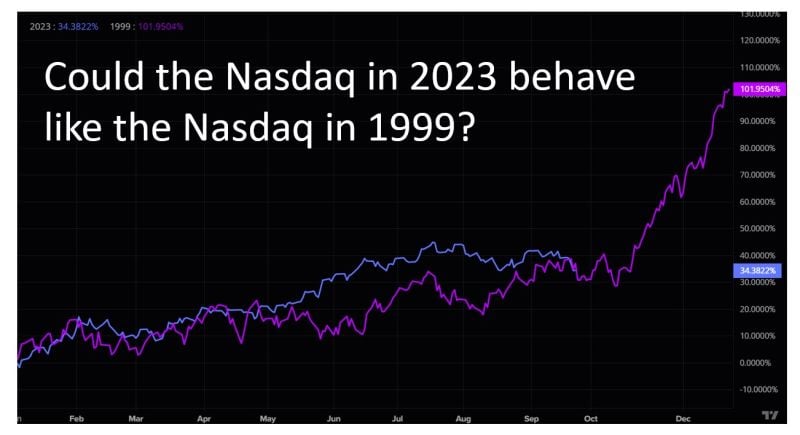

NASDAQ's 1999 analogy chart isn't perfect but given the amount of shorting by hedge funds and short gamma selling by dealers, a squeeze in Q4 (the historically strongest quarter) is a possibility

Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks