Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

Between 2:00 and 4:00 PM ET today, the S&P 500 erased ~$600 billion of market cap

To put this in perspective, the S&P 500 added ~$600 billion of market cap over the last week. The index was up for 10 straight days but erased 5 of those daily gains in 2 hours. The volatility index, $VIX, spiked ~10% in a matter of minutes. Source: The Kobeissi Letter

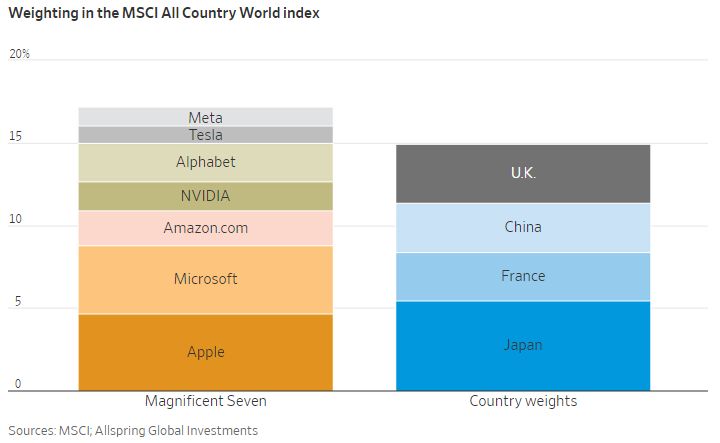

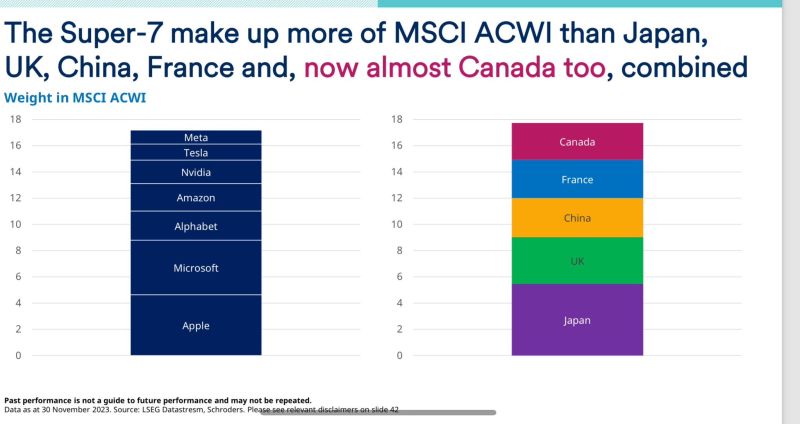

The Magnificent 7 have a higher weighting in the MSCI World Index than all of the stocks in the UK, China, France and Japan combined

Source: MSCI AllSpring Global Investments

Quartr just created this infographic that illustrates the 12 largest luxury companies by market cap

Four fun facts: → $LVMH's market cap is 50% larger than the bottom 10 companies *combined*. → $RMS is by far the largest single-brand company on the list, 3.5x the size of $RACE for example. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' >€13B. → Tiffany & Co. got acquired by LVMH during the pandemic at a $16B valuation, which would place them at #7 on this list. Source: Quartr Activate to view larger image,

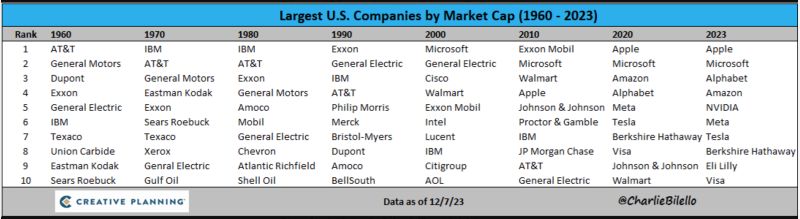

Largest US Companies by Market Cap, 1960 to Today...

Source: Charlie Bilello

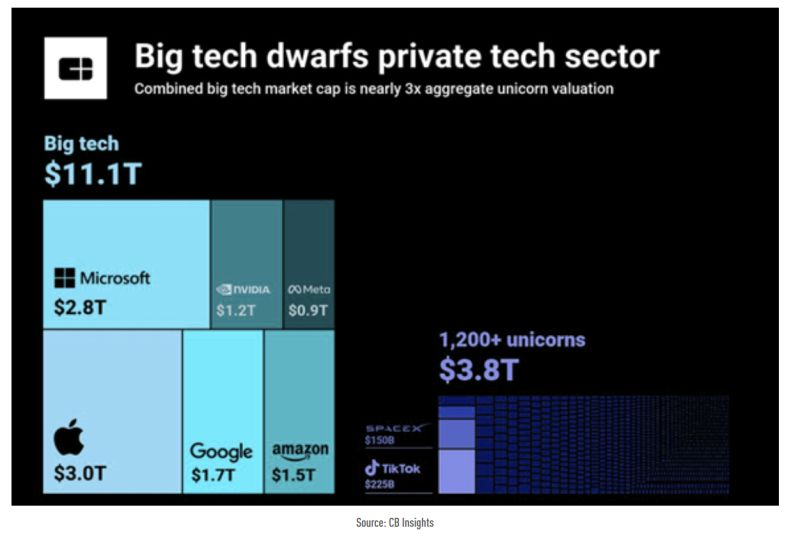

Big tech has notched over $200B in profits in 2023 so far

To see how massive they are, this comparison of their market caps vs. the private tech sector (unicorn valuations) makes it quite clear. Source: CB Insight

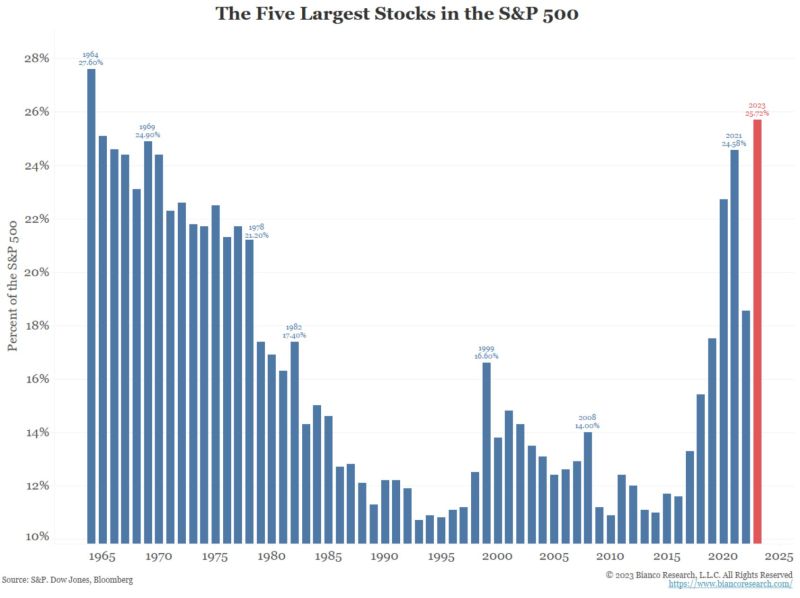

Latest Bianco research presentation highlights Big Tech risk:

The current top 5 companies by market cap make up ~26% of the S&P 500, The last time the top 5 had a greater concentration in the S&P 500 was 1964 w/AT&T, GM, Exxon, IBM, Texaco. Source: HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks