Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

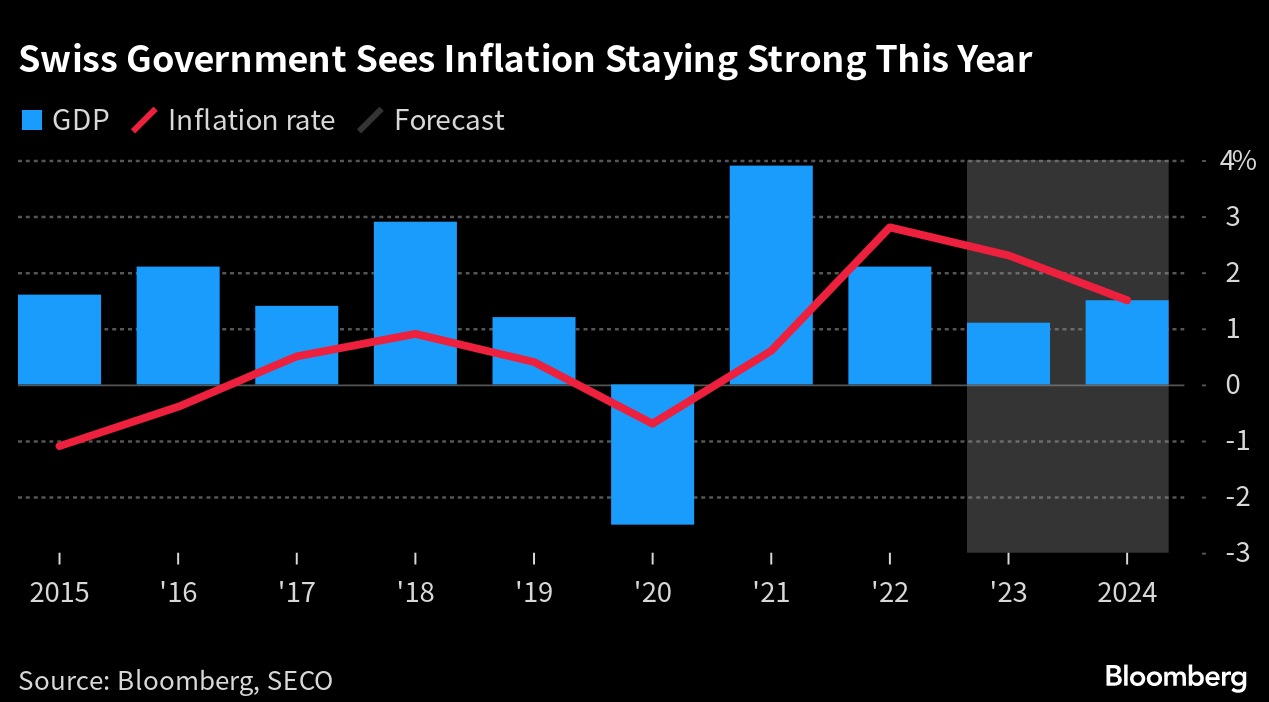

Switzerland’s new inflation forecast supports another SNB hike

The government expects inflation to be above the central bank’s target this year which reinforces a likely interest-rate hike next week. The SECO said consumer prices will rise 2.3% this year. That down from 2022’s 2.8%, and also slightly lower than a March prediction of 2.4%.

Source: Bloomberg, SECO

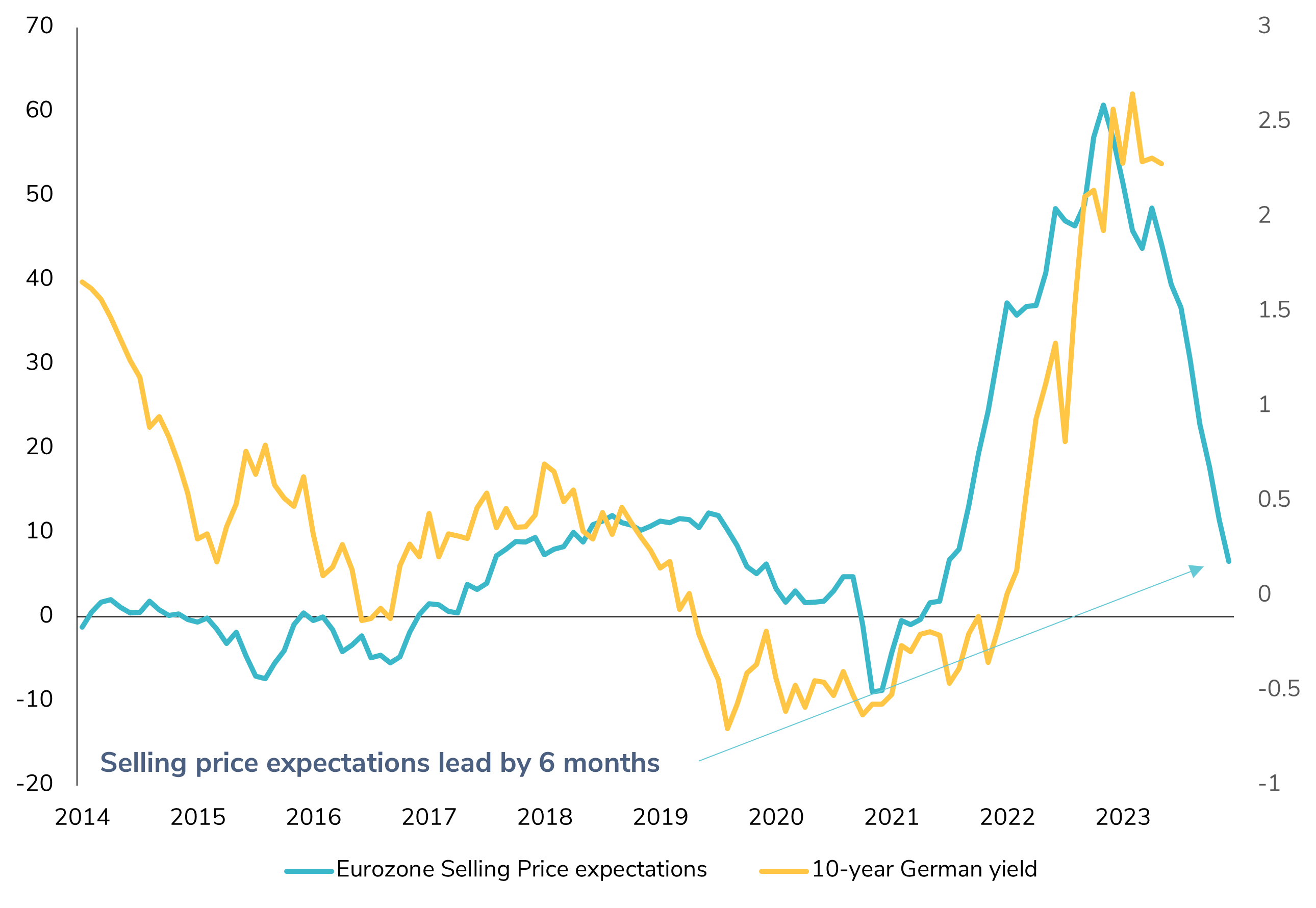

Is it time to increase duration in EUR bonds?

The latest European Commission survey on Eurozone selling price expectations shows a significant decline, suggesting that inflation should continue to decrease in the coming months, alleviating pressure on the ECB to tighten its monetary policy. After a possible one or two final tightening moves by the ECB in June and/or July, is it worth considering a higher allocation to European rates, particularly core bonds? Source : Bloomberg.

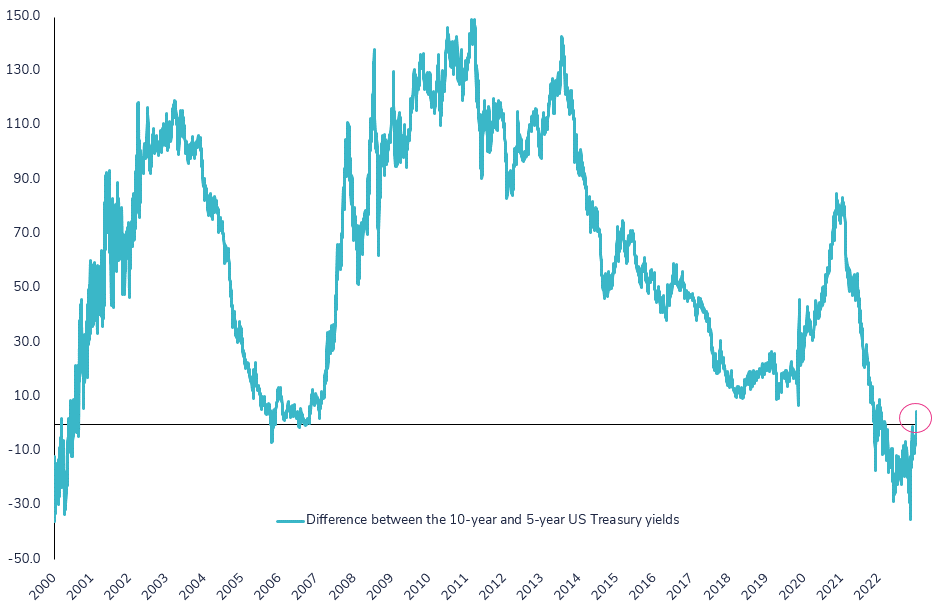

Has the Fed ended the flattening of the US Treasury yield curve?

Yesterday, the Fed hinted that this could be the last rate hike of this cycle, leading some to wonder if the flattening of the US Treasury yield curve is finally over. After the FOMC meeting, the difference between 10-year and 5-year Treasury yields turned positive. It should be noted that this part of the curve was the first to turn negative in March 2022. Will this new trend continue in the weeks and months to come? Source: Bloomberg

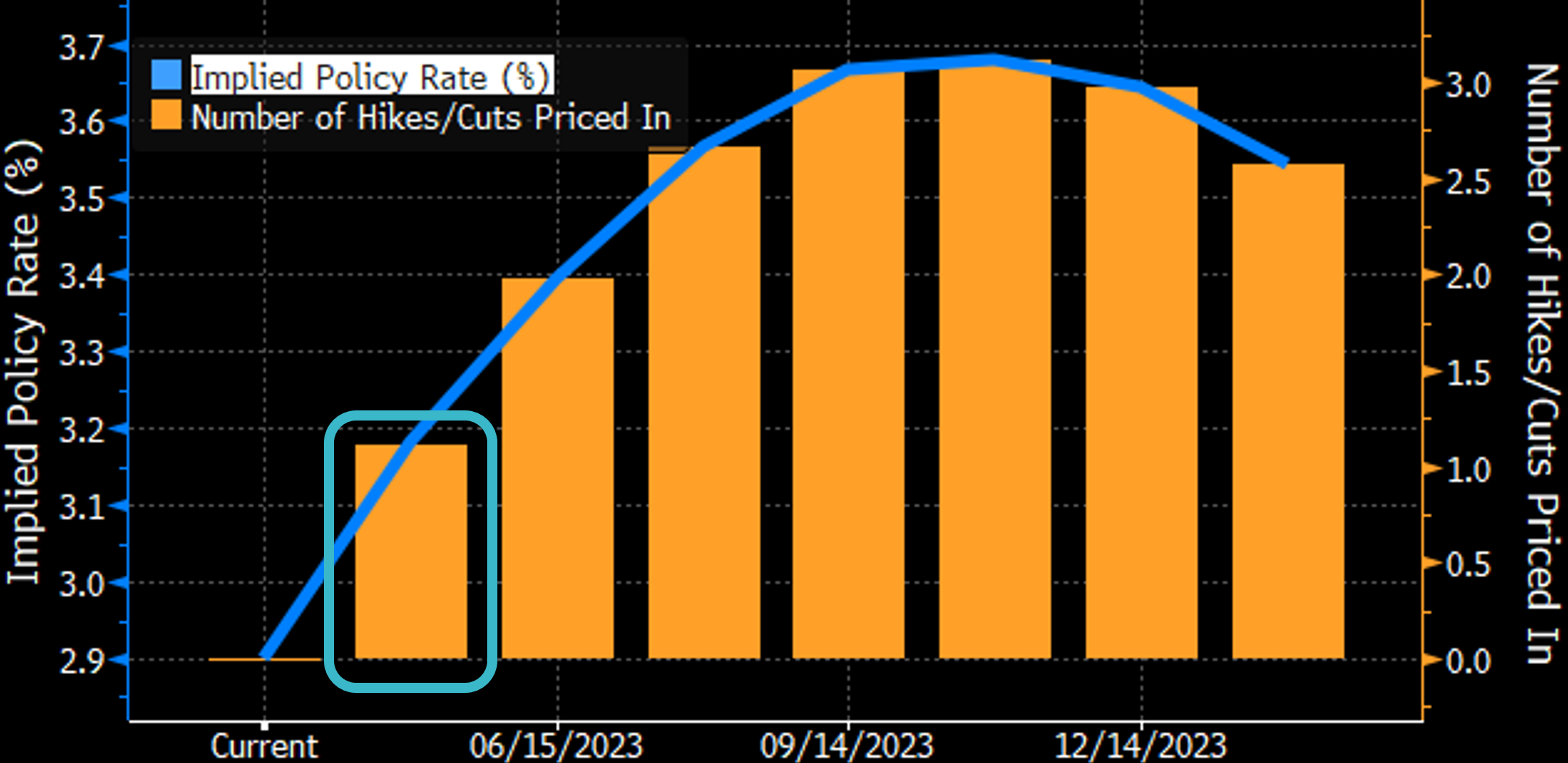

ECB: A 25 Basis Point Hike Carved in Stone?

The next ECB meeting is coming up on Thursday and this morning two crucial data points were released. Eurozone core inflation saw a slight decrease in April from 5.7% to 5.6%, marking the first decline in 10 months. This is a positive sign that core inflation is heading in the right direction. Meanwhile, the ECB's bank lending survey indicated that credit standards "tightened considerably" in Q1. This shows that the ECB's monetary policy, which includes rate hikes and quantitative tightening, is starting to have an impact on the system. Source: Bloomberg

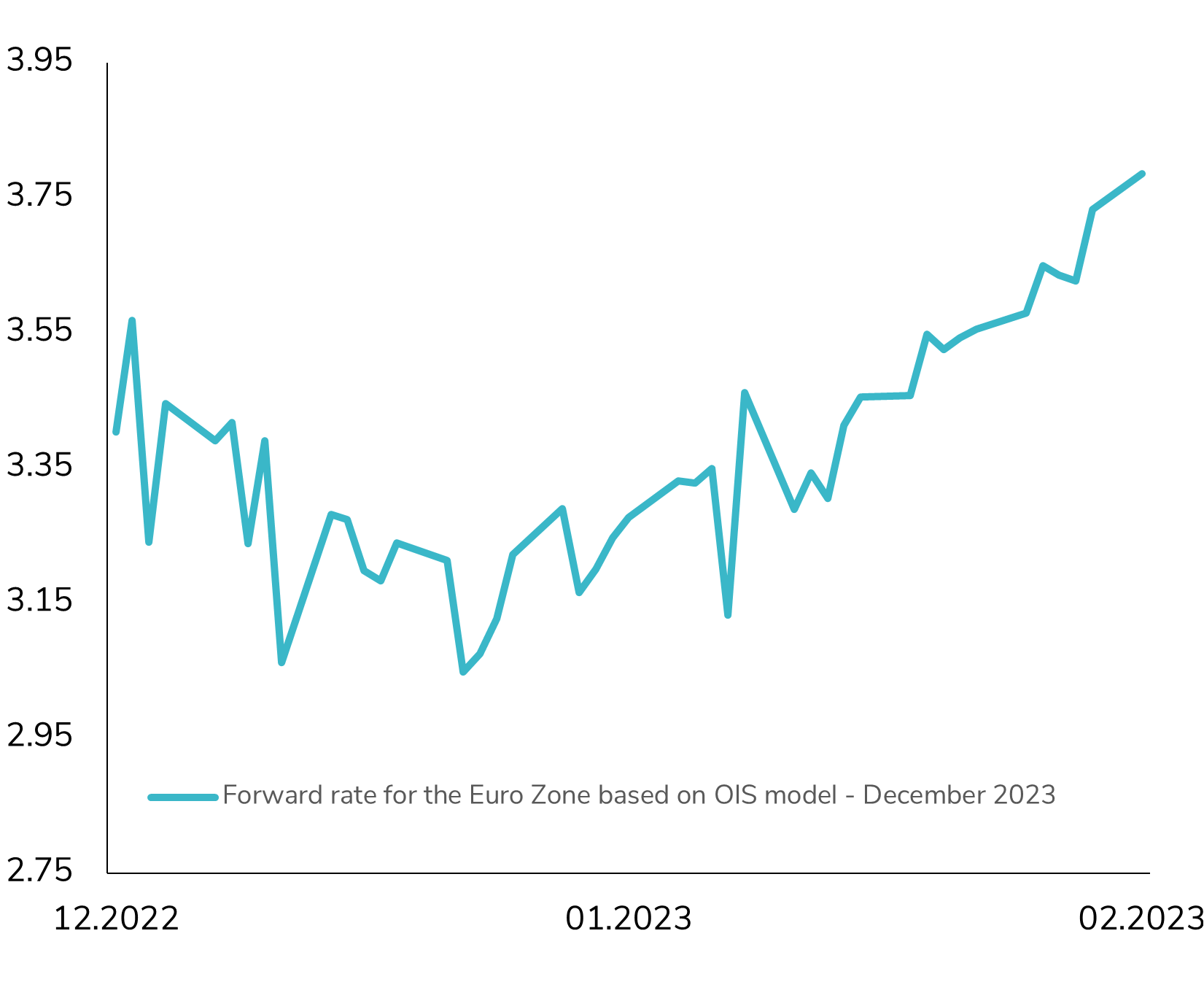

The market now expects the ECB to raise its key rate at the highest level ever!

As reflected in the European swap market, market participants expect the ECB to raise its key interest rates to a level never before seen. The terminal rate is expected to be close to 4%, up from 3.75% in the early 2000s. Interestingly, for the first time in this cycle, the markets believe that the terminal rate will be reached in 2024 (and not in 2023). Higher rates for longer? Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks