Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

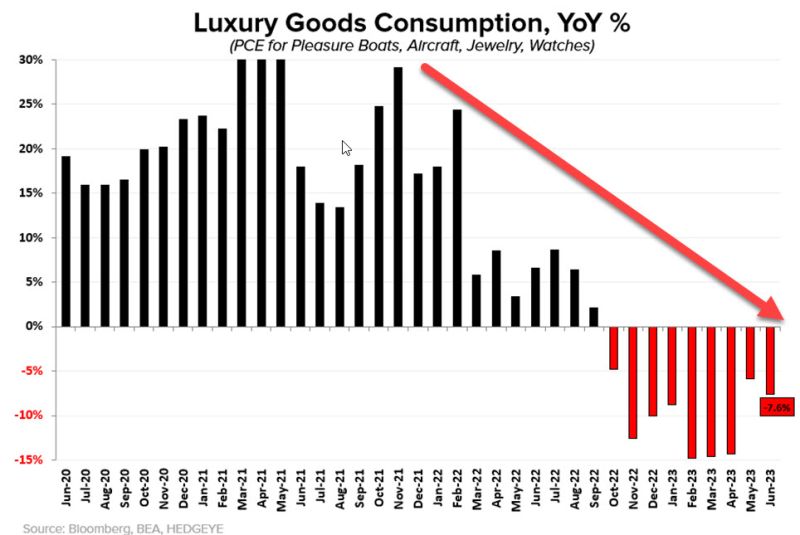

REPORTED RECESSIONS: in US Luxury Goods...

Congruent with dour commentary out of LVMH, luxury spending slowed to a -7.6% Y/Y Recession in June = 9th month of negative Y/Y growth. Source: Keith McCullough

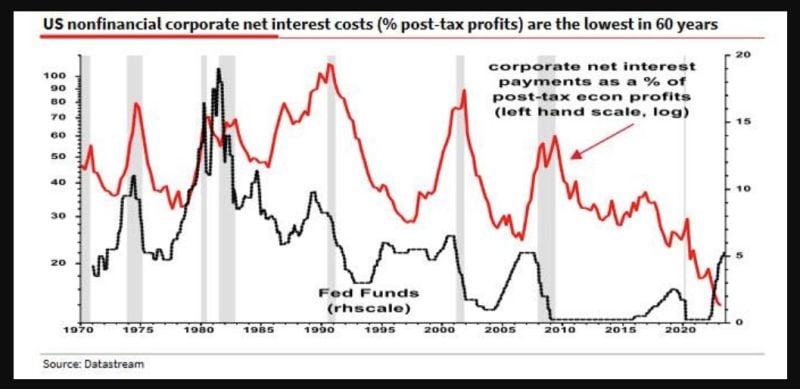

Albert Edwards from SG explains in one chart why this time is different and how the rise #interestrates hasn't triggered a recession yet.

Indeed, as shown on the chart below, Corporate NET interest payments as a % of post-tax economic profits (red line) has been going DOWN despite Fed Funds (black line) going UP! Edwards frames it as such: "We can see clearly from the Fed’s Z1 (table L103) that the US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed (...) something very strange has happened, and it helps explain the recession’s tardy." So what has happened? As Edwards concludes, a sizeable proportion of the "huge, fixed rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits" meaning that corporations continue to benefit from locking in the ultra low rates of 2020 and 2021 even as their cash interest income are soaring. Indeed, as the SocGen strategist adds, "companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual". Putting it all together, Edwards says that "it’s not just ‘Greedflation’ that has boosted US profit margins and delayed the recession (...) Interest rates simply aren’t working as they once did. It is indeed a mad, mad world" Source: www.zerohedge.com, SocGen

Is the yield curve a flawed recession indicator?

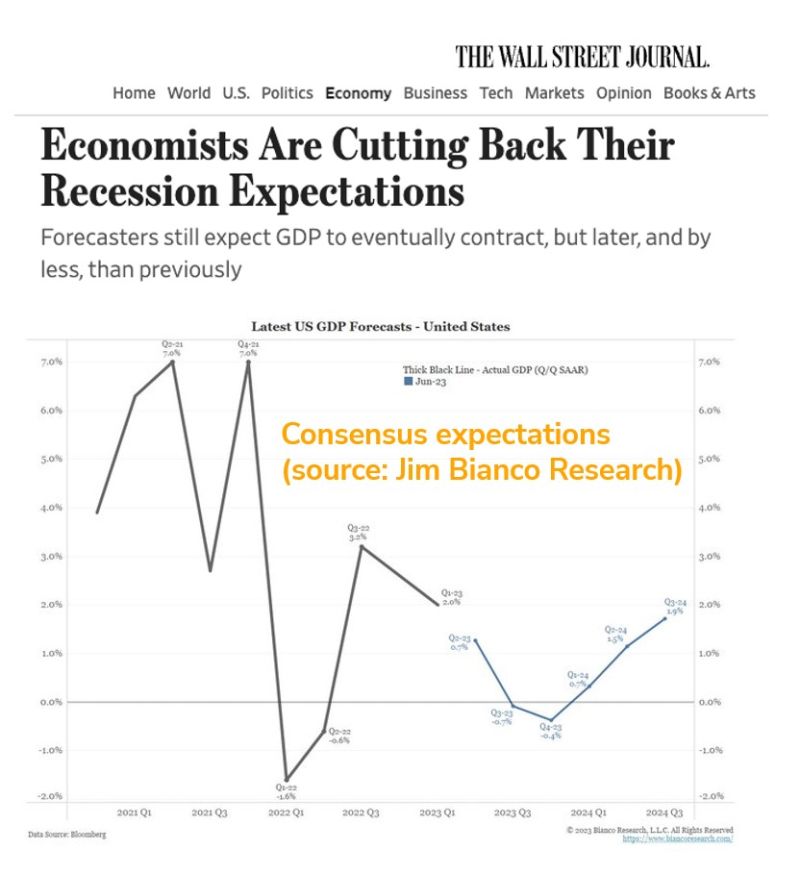

While the deeply inverted yield curve has stoked anxiety among investors about the prospect of a recession, Goldman Sachs has a different message: stop worrying about it. Indeed, the bank's Chief Economist Jan Hatzius just cut his assessment of the probability of a recession to 20% from 25%, following a lower-than-expected inflation report last week.

Wall Street is giving up on us recessoon risk as highlighted by a Wall Street Journal article

Jim Bianco Research shows consensus expectations for the coming quarters are pointing towards a very small contraction. The blue line is the June update of a survey conducted by Bloomberg of around 70 economists showing the median forecast for the next six quarters.

Investing with intelligence

Our latest research, commentary and market outlooks