Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

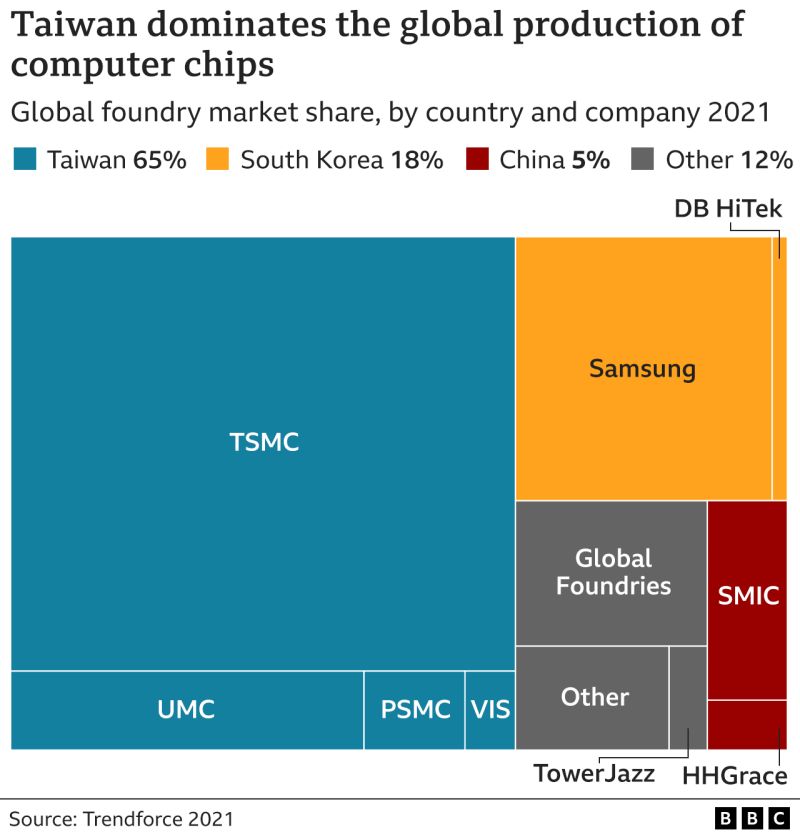

Taiwan Semiconductor is trading at a political discount, which is unlikely to narrow after the election of the China-critical candidate Lai Ching-te.

Source: Bloomberg, HolgerZ

A few days ahead of Taiwan election... Taiwan: the island that matters - or why Taiwan is important to China, USA and the rest of the world...

Imagine the implications of any blocade or invasion on the semiconductor value chain and the magnificent7... Source: BBC

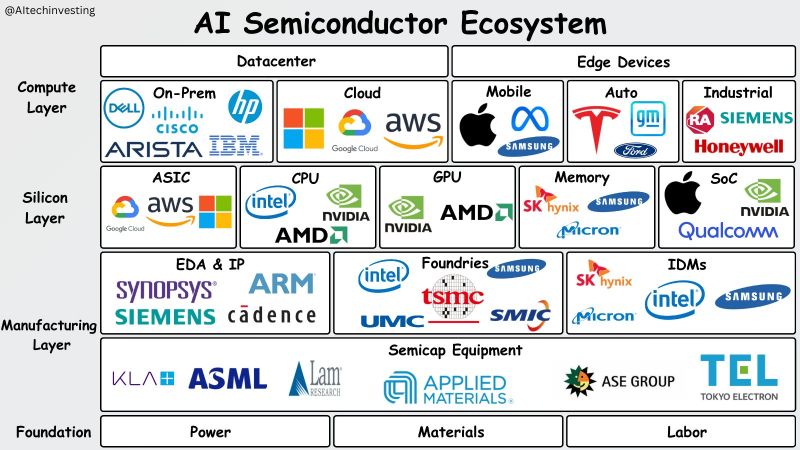

Breaking down the AI semiconductor ecosystem:

While $NVDA gets most of the attention, AI is additive to most of the semiconductor industry. Source: Eric AITechInvesting

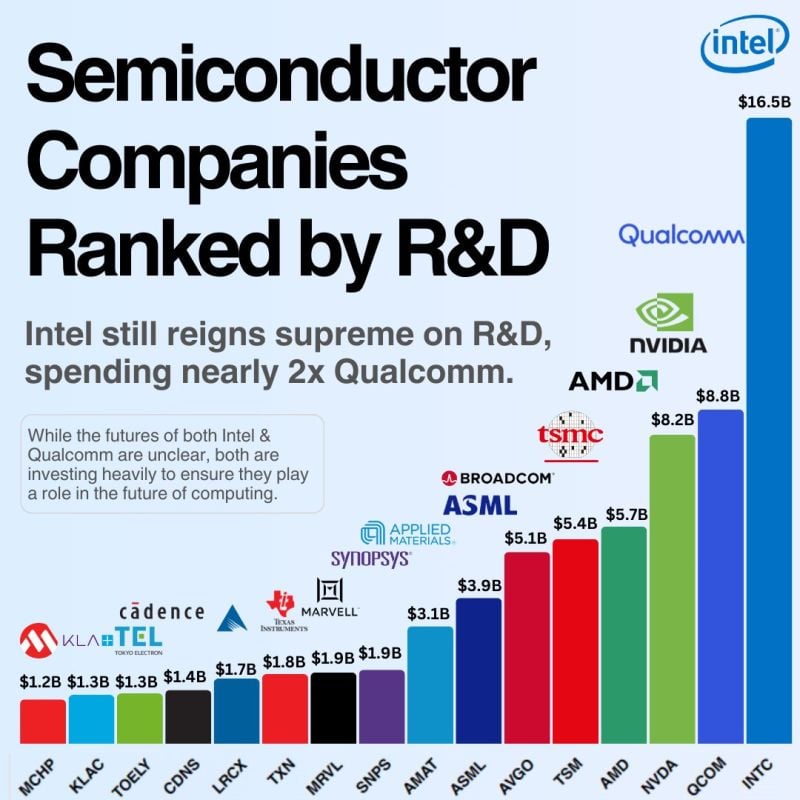

High R&D spending does NOT guarantee growth and/or high shareholder returns

The chart below courtesey of Eric | AI & Tech Investing shows semiconductor companies ranked by R&D over the last 12 months. $INTC $QCOM $NVDA $AMD $TSM lead the way. Intel has spent over $100B in R&D over the last decade. Despite that, they have the 2nd lowest shareholder return of all these companies (see addt'l chart below). Intel has generated $52.9B in revenue over the last twelve months. A decade ago, Intel generated $52.4B in revenue. An important cautionary tale for investors: R&D doesn't guarantee growth. Source: Eric | AI & Tech Investing

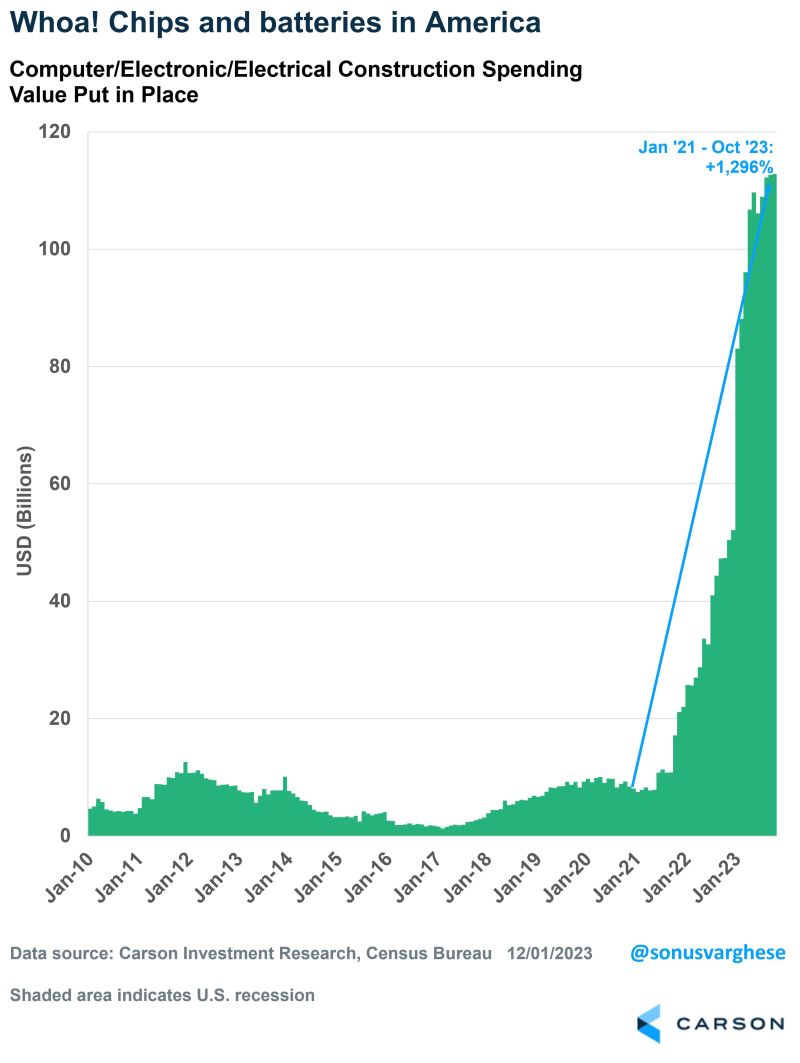

How do you say CHIPS act* in one chart?

Not all fiscal policy has to be a bad thing... this could indeed lead to a big increase in the productivity we will see over the coming years due to this. Source: Ryan Detrick, Carson * CHIPS Act -> In July 2022, Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design and research, fortify the economy and national security, and reinforce America’s chip supply chains. The share of modern semiconductor manufacturing capacity located in the U.S. has eroded from 37% in 1990 to 12% today, mostly because other countries’ governments have invested ambitiously in chip manufacturing incentives and the U.S. government has not. Meanwhile, federal investments in chip research have held flat as a share of GDP, while other countries have significantly ramped up research investments. To address these challenges, Congress passed the CHIPS Act of 2022, which includes semiconductor manufacturing grants, research investments, and an investment tax credit for chip manufacturing. SIA also supports enactment of an investment tax credit for semiconductor design.

In the weeks leading up to his shocking ouster from OpenAI, Sam Altman was actively working to raise billions from some of the world’s largest investors for a new chip venture

(according to people familiar with the matter) Code-named Tigris, Sam planned to spin up an AI-focused chip company that could produce semiconductors that compete against those from $NVDA The goal is to provide lower-cost competition to market incumbent Nvidia and aid OpenAI by lowering the ongoing costs of running its own services like ChatGPT and Dall-E - Bloomberg Source: Cheddar Flow

Nvidia indicated that the latest round of China restrictions will not have a meaningful impact on its business

It’s possible that this is because China frontloaded its GPU orders earlier this year in anticipation of these restrictions. It’s also possible that any lost revenue from China will be made up for by tremendous revenue growth in developed markets. Guidance for the January quarter might be indicative here. Source: Morningstar

Investing with intelligence

Our latest research, commentary and market outlooks