Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- warren-buffett

- nasdaq

- oil

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- cash

- semiconductor

- vix

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

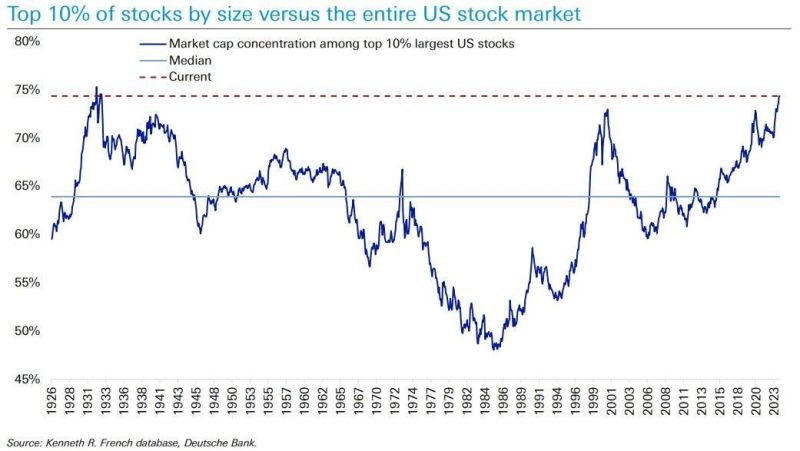

Less and less listed companies; but big companies are getting bigger...

The number of publicly listed companies in the US has declined by 50% since 1995. Currently, there are just over 4200 public companies in the US. The same trend has been seen in the number of banks in the US which was at 31,000 in 1920 but just 4,000 today. Meanwhile, the top 10% of stocks in the US now reflect ~75% of the entire market. This is, by far, the most concentrated 🇺🇸 stock market since the Great Depression in 1931. Even in the Dot-com bubble of 2001, concentration of the top 10% of stocks peaked at ~72% before the 2008 Financial Crisis, it peaked at nearly 66%. Big companies are indeed getting bigger! Source: The Kobeissi Letter, Wall Street Engine

The stock market rally continues in Germany.

The Dax is heading for its 9th daily gain in a row. The rally is being driven by the Dax "Glory 5" stocks - an index consisting of SAP, Siemens, Allianz, Munich Re, and Deutsche Telekom. These 5 stocks have outperformed the Dax Price Index by almost 100%-pts over a 10 year period. Source: HolgerZ, Bloomberg

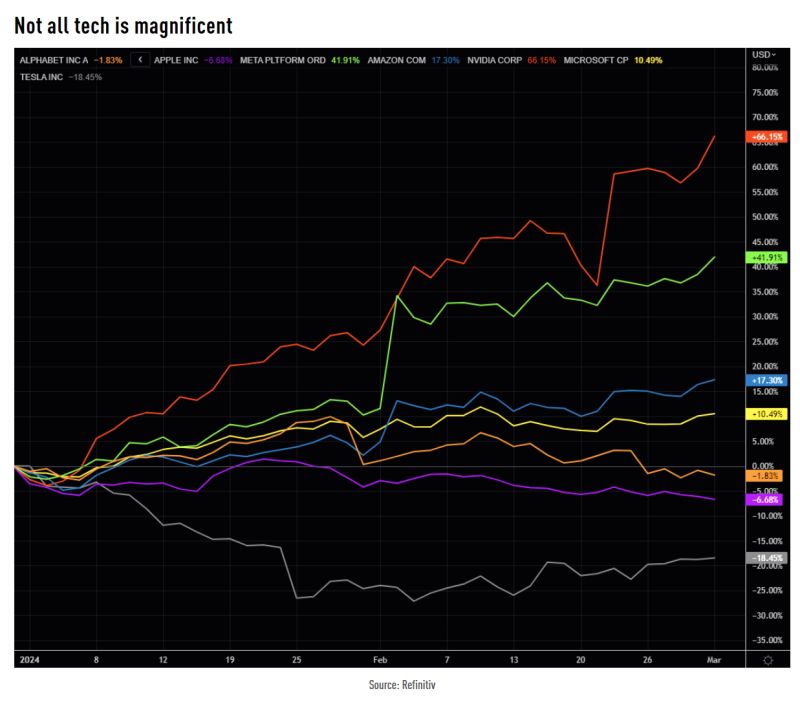

Not all Tech stocks are magnificent...

$AAPL and $TSLA the main downside outliers...

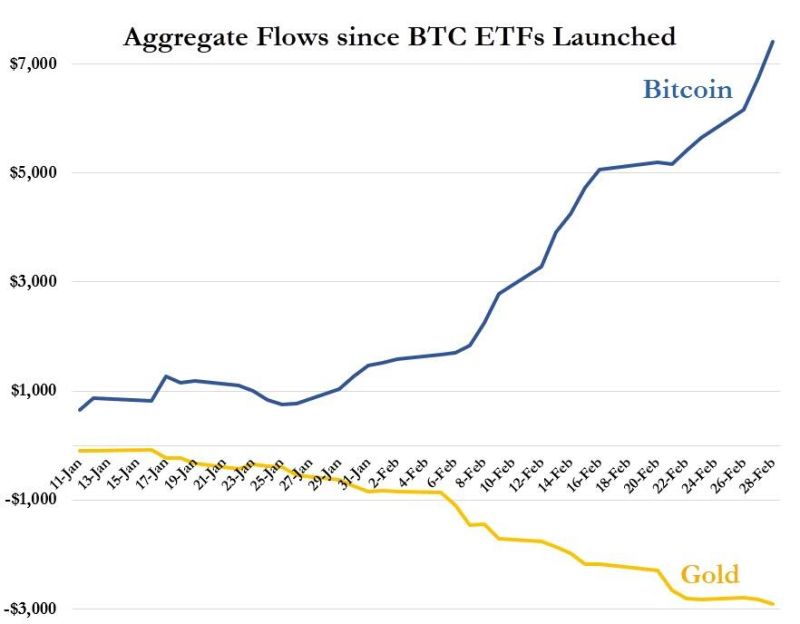

Since inception, Bitcoin ETFs have seen +$7.4BN flows while Gold ETFs have seen $2.9BN outflows...

.

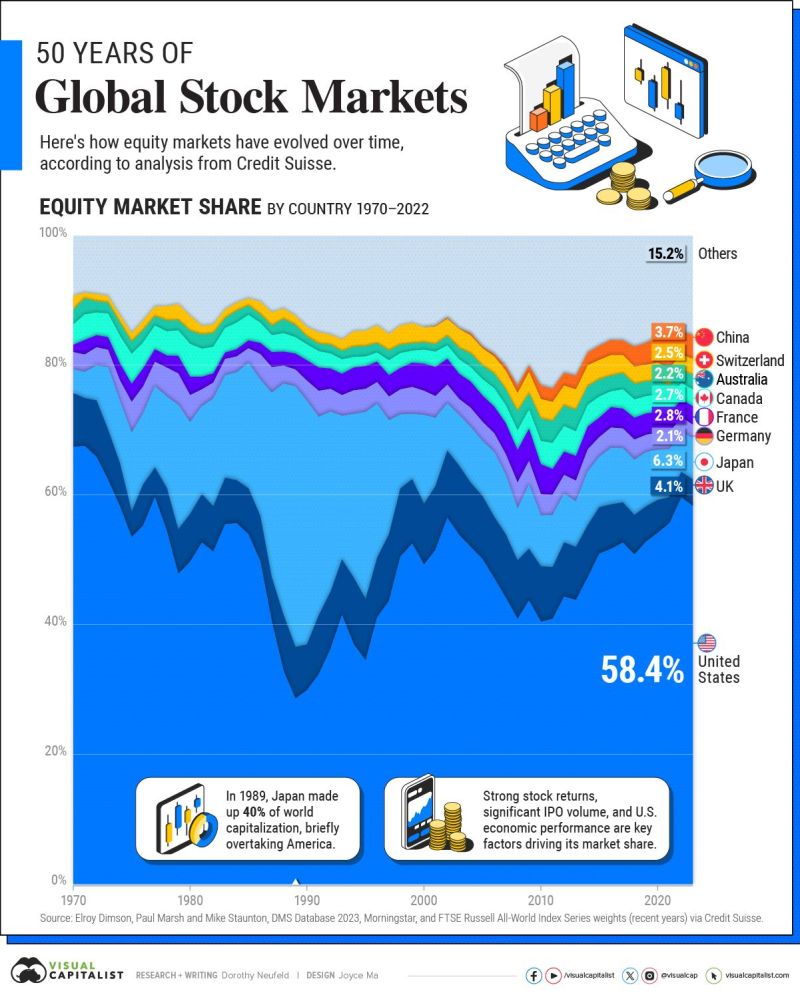

Ranked: The Largest stock markets over time, by Country (1970-Today) 📈

Source; Visual Capitalist

BREAKING >>> THE NANCY PELOSI EFFECT ! Palo Alto Networks stock, $PANW, is now up 10% today after Nancy Pelosi bought call options on the stock.

The call options are reportedly worth up to $1.25 million. This comes just days after $PANW fell over 30% following their earnings results. Markets are effectively treating Pelosi's trades like an activist hedge fund took a stake in the company. Her track record on buying many large cap tech stocks at their lows, including $NVDA, is largely why... Is Nancy ‘Gordon Gecko’ Pelosi the new Cathie Wood ??? Source: The Kobeissi Letter

Chinese Authorities froze a quant hedge fund's account for 3 days after it dumped more than $360 million worth of stocks within the first minute of trading.

Source: Barchart

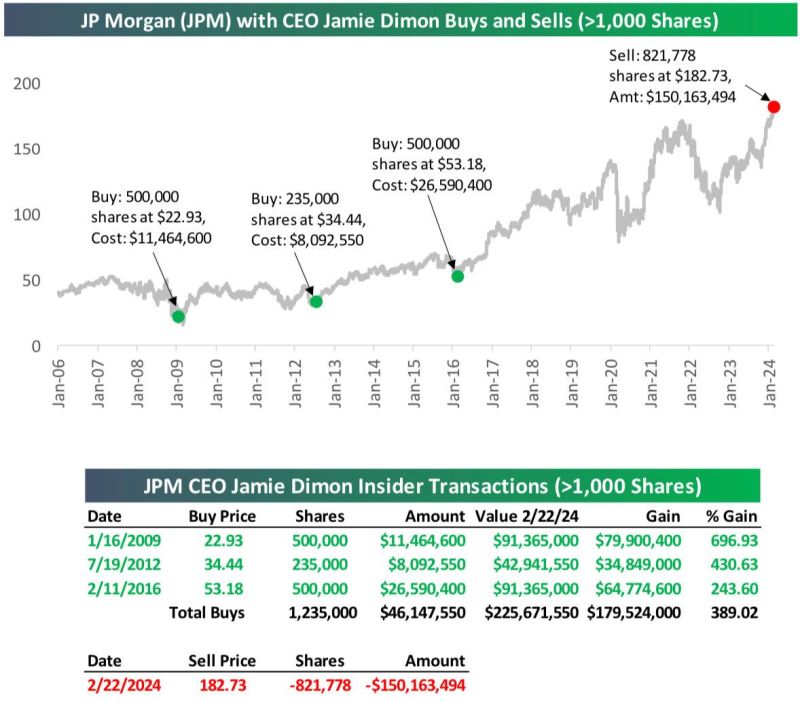

“Maybe” The World’s Most Powerful Banker Knows Something That We Don’t?

Jamie Dimon bought 1.235 million shares in the open market from 2009 to 2016 at the exact times when markets bottomed. Last week, he sold 821,778 shares of JP Morgan stock worth $150 million for the first time ever. Impeccable timing? Time will tell... Chart: Bespoke through Sagar Singh Setia

Investing with intelligence

Our latest research, commentary and market outlooks