Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

Credit Suisse bond investors plot lawsuit against Switzerland

A group of international bond investors is drawing up plans to sue Switzerland in the US courts for expropriation over the losses they suffered after the state-orchestrated rescue of Credit Suisse. The case is being brought together by law firm Quinn Emanuel, according to people familiar with the matter. Quinn Emanuel is already suing Switzerland’s financial regulator, Finma, over its decision to wipe out $17bn of Credit Suisse bonds when the bank was taken over by UBS six months ago. Lawyers at Quinn Emanuel are laying the groundwork to sue Switzerland in the US, where they believe there is a greater chance of convincing a judge to waive the country’s sovereign immunity rights. The suit could be filed by the end of the year, though it is not certain to proceed, according to people involved in the discussions.

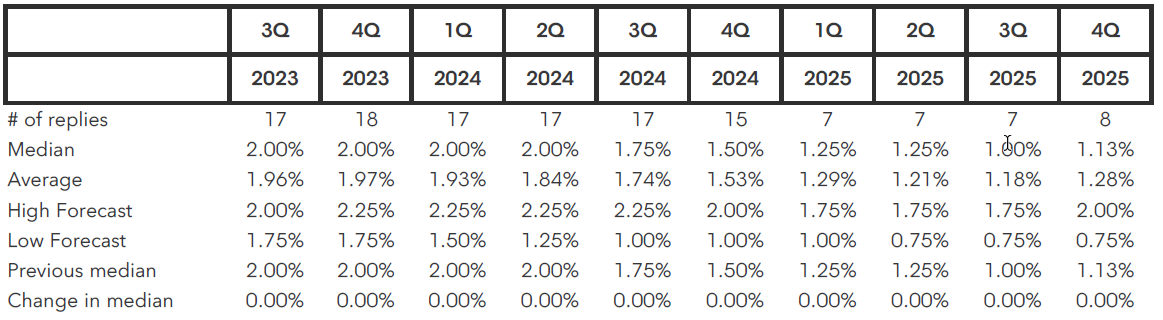

SNB Policy rate at 2.00% by end-Q3 2023 - Survey

The following table shows economists’ forecasts for Switzerland’s benchmark central bank rate as surveyed by Bloomberg News from Sept. 1st to Sept. 7th. All figures are as of the end of the quarter.

Current SNB Policy Rate: 1.75%

Sourcce: Bloomberg

UBS Group AG posted a $29 billion second-quarter profit in first results since Credit Suisse takeover.

This is the biggest-ever quarterly profit for a bank in the second quarter as a result of its emergency takeover of Credit Suisse, and confirmed that it would fully integrate the local business of its former rival by next year. Key takeaways: - UBS said the result primarily reflected $28.93 billion in negative goodwill on the Credit Suisse acquisition (i.e this huge profit is due to a huge one-off gain that reflects how the acquisition costs were far below Credit Suisse's value). Underlying profit before tax, which excludes negative goodwill, integration-related expenses and acquisition costs, came in at $1.1 billion - The accounting gain for the quarter eclipses JPMorgan Chase & Co.’s $14.3 billion profit in the first quarter of 2021, the modern record for US and European lenders; - Analysts had projected a net profit of $12.8 billion for the three months to the end of June, according to a Reuters poll. Source: Bloomberg, CNBC Source illustration: Sonntagzeitung / Melk Thalmann

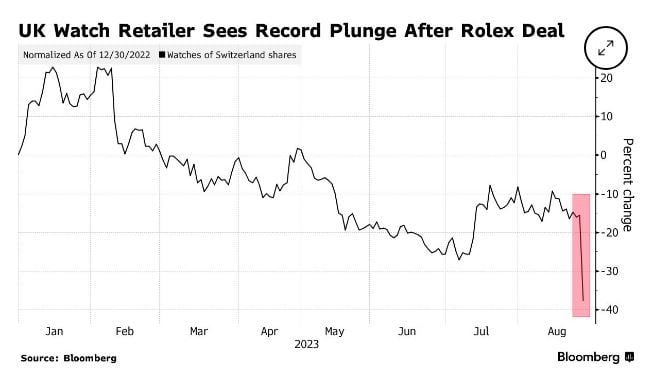

Watches of Switzerland shares plunge by a quarter after Rolex buys retailer Bucherer

The UK’s biggest seller of Rolex watches lost nearly a third of its value on Friday after the Swiss brand bought Bucherer AG, taking its first major step into retailing. Watches of Switzerland Group Plc shares fell as much as 30%, wiping out almost £500 million ($629 million) in market capitalization. Rolex unveiled the surprise move to buy Bucherer late Thursday, prompting analysts to question what the deal means for Watches of Switzerland’s future relationship with the brand. Peel Hunt’s Jonathan Pritchard noted that Rolex accounts for half of the company’s sales, and cut his rating on the stock to hold from buy. Rolex executives assured the UK’s biggest retailer of the brand that it will continue to be allocated watches by the same distribution system, Watches of Switzerland Chief Executive Officer Brian Duffy said in an interview. Source: Bloomberg

BREAKING NEWS FROM CNBC >>> UBS ends Credit Suisse dependence on Swiss central bank loan.

UBS on Friday said that it has ended a 9 billion Swiss franc ($10.27 billion) loss protection agreement and a 100 billion Swiss franc publicly liquidity backstop that were put in place by the Swiss government when it took over rival Credit Suisse in March. UBS said the decision followed a “comprehensive assessment” of Credit Suisse’s non-core assets that were covered by the liquidity support measures. Credit Suisse also fully repaid the emergency liquidity assistance loan of 50 billion Swiss francs to the Swiss National Bank in March, as Credit Suisse teetered after a collapse in shareholder and investor confidence. “These measures, which were created under emergency law to preserve financial stability, will thus cease to exist, and the Confederation and taxpayers will no longer bear any risks arising from these guarantees,” the Swiss government said in a statement Friday. “Furthermore, the Confederation earned receipts of around CHF 200 million on the guarantees.”

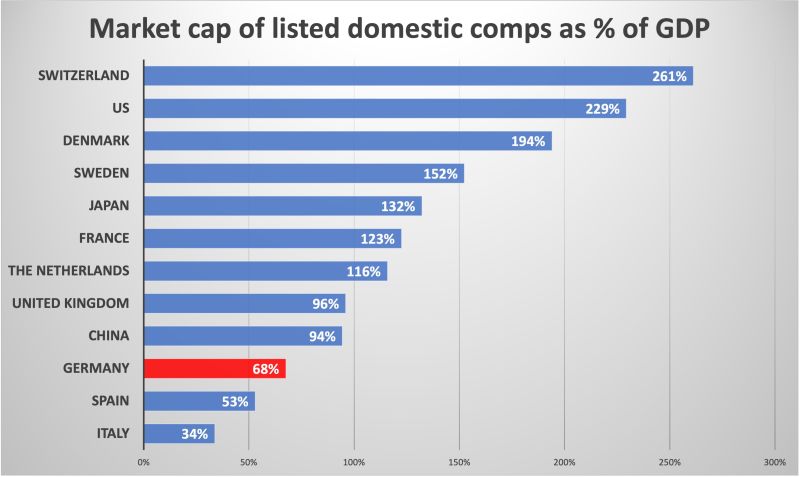

Market cap of listed domestic companies as a % of GDP for selected countries

Switzerland is way ahead of peers in the ranking. US comes next Source: HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks