Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

Bitcoin has outperformed equities, gold and USD year-to-date It has increased by more than 100% this year, despite:

- War Conflict - Elevated inflation - Rising oil prices - High-interest rates This is what happens when institutions like Blackrock jump on board Institutional adoption is going to be a major theme for this asset class. Source: Game of Trades

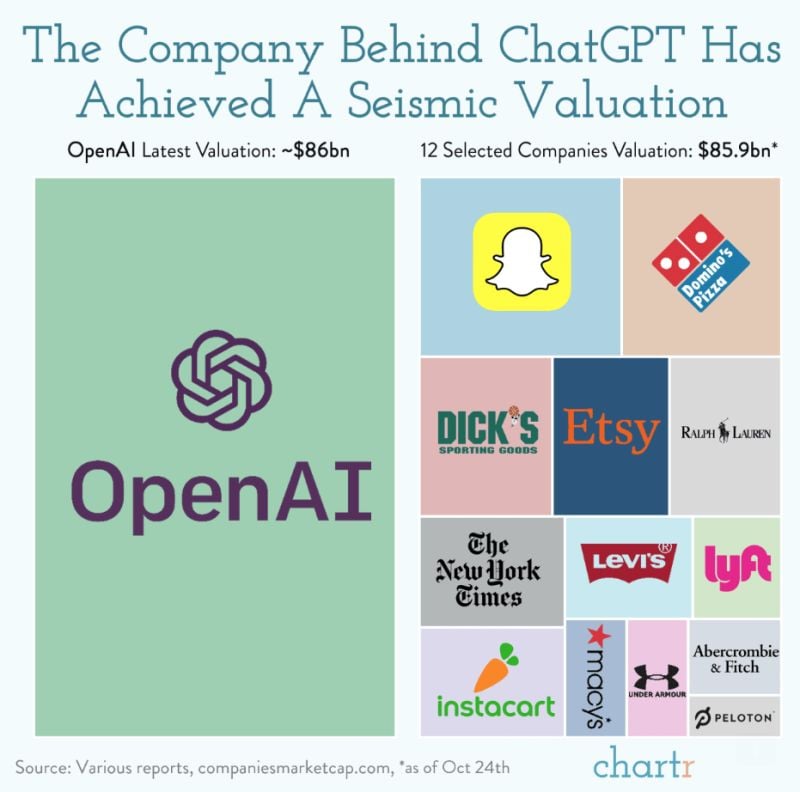

OpenAI valuation in perspective - chart by Chartr

Talk is meant to be cheap, but OpenAI, the force behind the viral hit ChatGPT, has turned it into an absolute goldmine, with the company currently in discussions to sell shares at a valuation of $86 billion. That's a remarkable three-fold increase from just 6 months ago, with the WSJ reporting an initial range of $80-90bn, before Bloomberg narrowed the figure to around $86bn, citing sources familiar with the matter. That would place OpenAI among the most valuable tech startups in the world, only behind giants like ByteDance (TikTok owner) and SpaceX. For context, it’s also roughly equivalent to the value of 12 of the biggest consumer brands in America combined — a theoretical corporate frankenstein including SNAP, The New York Times, Etsy, Domino’s and 8 others.

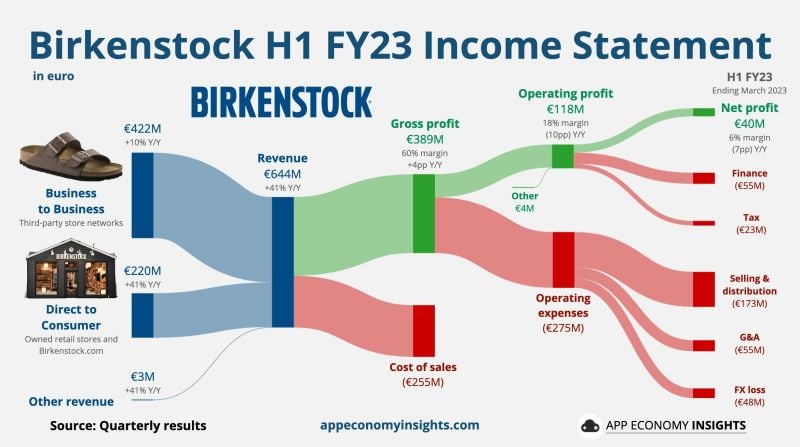

Another week, another IPO

$BIRK Birkenstock could reach a $10B valuation in its US IPO. Here's a look at how they make money. Source: App Economy Insight

A $90 BILLION VALUATION FOR OPENAI?

OpenAI is in discussions to possibly sell shares in a move that would boost the company’s valuation from $29 billion to somewhere between $80 billion and $90 billion, according to a Wall Street Journal report citing people familiar with the talks. Employees would be allowed to sell their existing shares rather than the company issuing new ones, the Wall Street Journal said. In April, OpenAI picked up just over $300 million in funding from backers such as Sequoia Capital, Andreessen Horowitz, Thrive and K2 Global at a valuation of $29 billion. That was separate to a big investment from Microsoft announced earlier this year, which closed in January. The size of Microsoft’s investment was believed to be around $10 billion. Source: Techcrunch

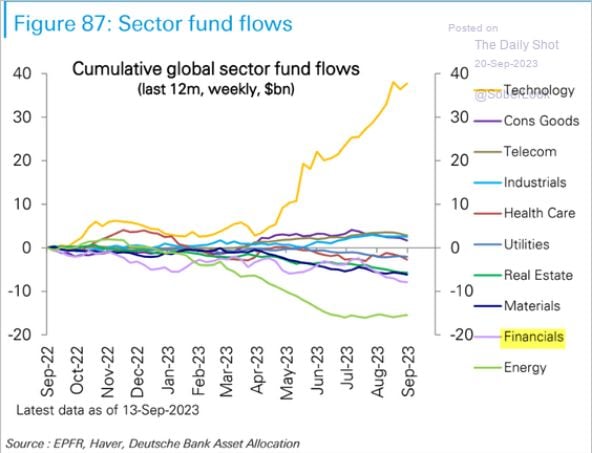

Sector fund flows

Long-only institutional & retail investors are all-in overweight tech and meaningfully underweight energy. Will elevated tech valuations, rising long-end yields, and rising oil prices trigger a squeeze in positioning? Source: The Daily Shot, EPFR, DB

Do you remember these Covid darlings?

Below 4 examples of "Pandemic boom and bust" companies (they are not necessarily bad companies but they exemplify how extreme valuations get corrected over time and how painful it can be for shareholders who bought at the top) Zoom $ZM -> Market capitalization: $21 billion today vs $168 billion at the peak. Peloton $PTON -> Market capitalization: $2 billion today vs $58 billion at the peak. Moderna $MRNA -> Market capitalization: $42 billion today vs $172 billion at the peak. Rivian $RIVN -> Market capitalization: $22 billion today vs $123 billion at the peak. Source: Simpel Investing

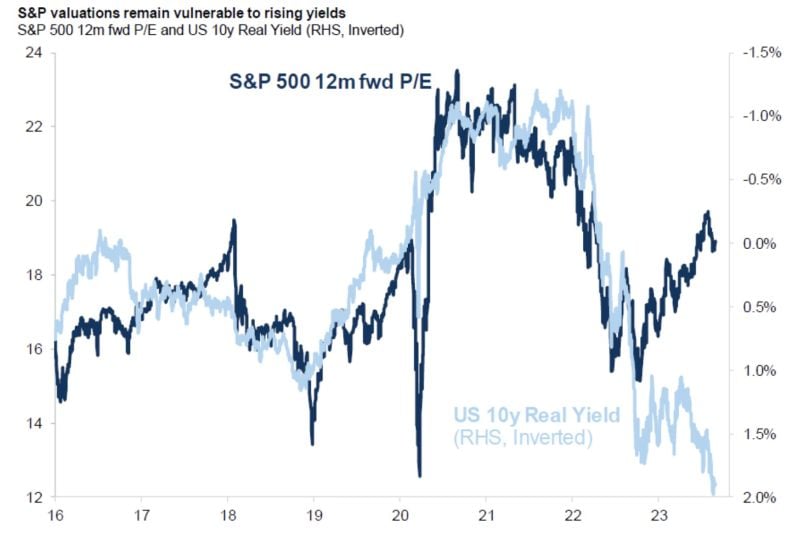

Mind the gap: The valuation of S&P 500 has become cheaper but attractiveness vs interest rates has decreased massively as US 10y real yields now at almost 2%

Chart via Goldman Sachs thru HolgerZ

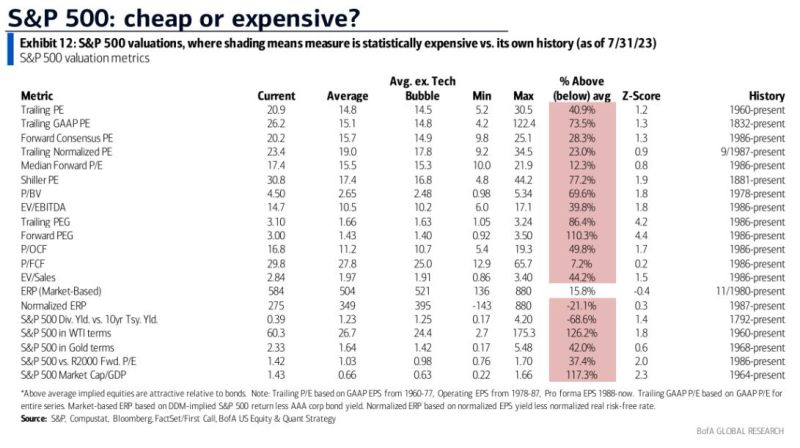

Out of 20 valuation metrics, the SP500 is currently overvalued on 19 of them relative to historical levels

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks