Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- ETF

- Crypto

- Central banks

- performance

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- quotes

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

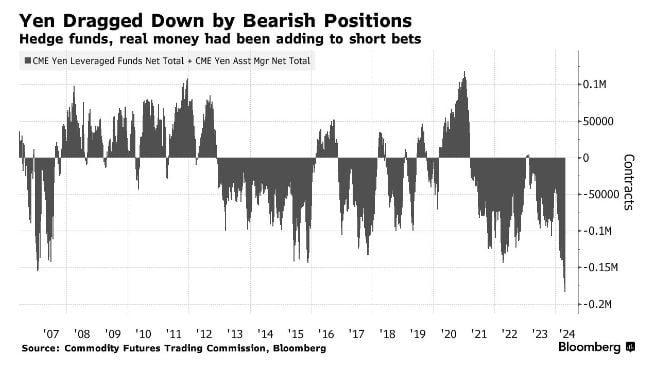

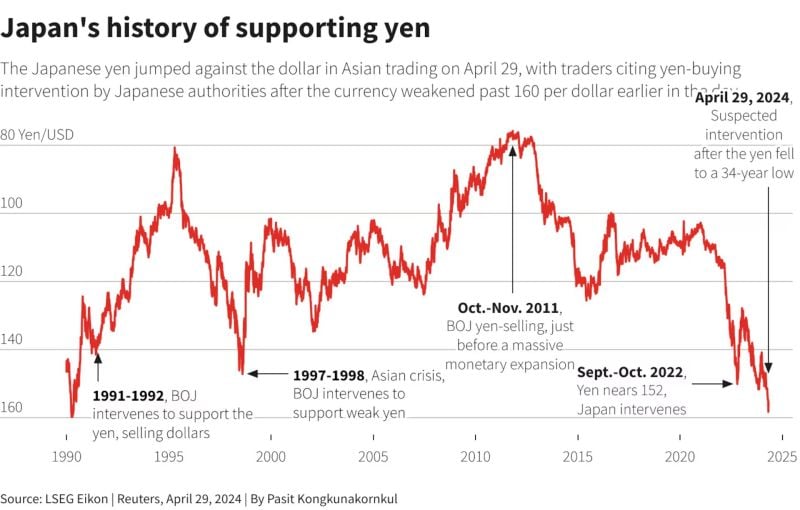

It's clear, Japan is intervening to support the Yen:

Twice this week, we saw the Yen fall to its weakest point against the US Dollar since 1990. This was the first time in 34 years that 1 US Dollar converted to 160 Yen. Immediately after the Yen neared 160 twice this week, we saw a steep drop in the conversion rate, strengthening the Yen. The BOJ reported Tuesday that its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD. This was clearly due to intervention equating to 5.5 trillion Yen, which we last saw in 2022 and 2011. The third largest currency in the world is in trouble. Source: The Kobeissi Letter

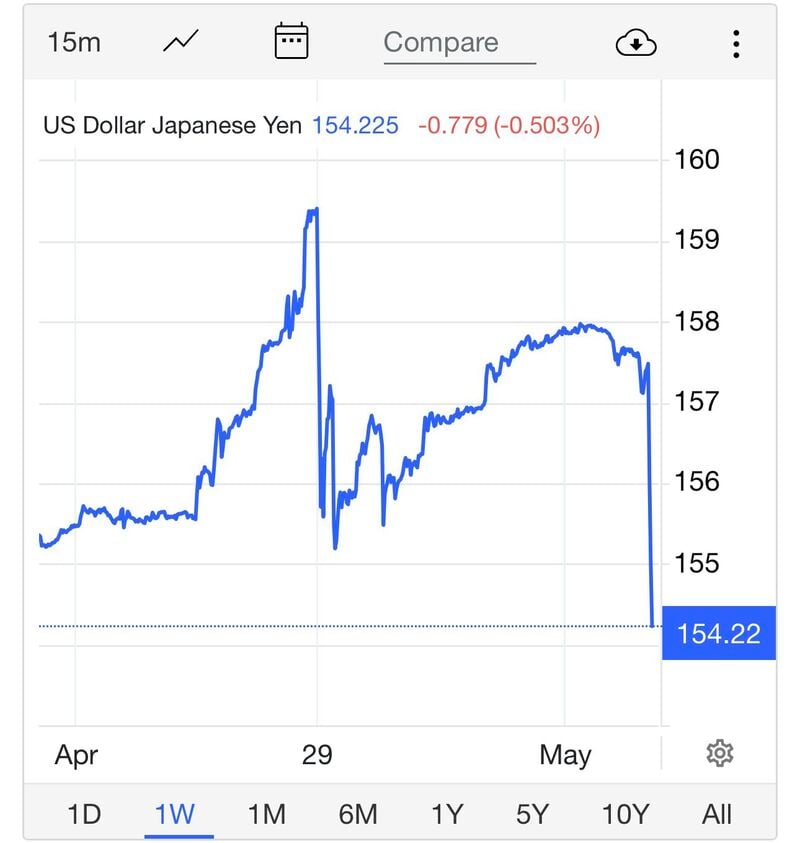

Intervention? At 9:30 PM ET, the Japanese Yen weakened to 160 against the US Dollar for the first time since 1990.

Exactly 2.5 hours after the headlines came out, the ratio just crashed from 160.20 to 156.50. That's a ~2.5% swing in one of the biggest currencies in the world in a matter of minutes. Clearly, something is happening here and it comes just days after the Bank of Japan left rates unchanged. Did someone just intervene? Source: The Kobeissi Letter

The yen briefly topped 155.50.

Expected volatility over the next 24 hours is now at the highest level of the year. Source: David Ingles, FT

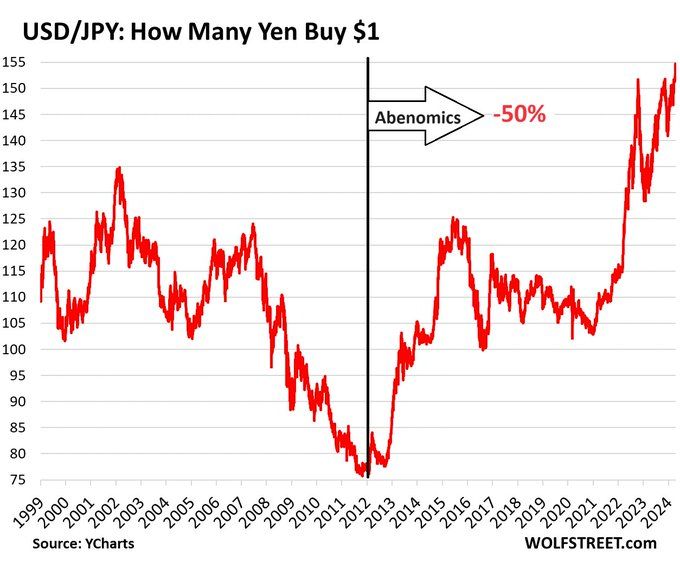

Excellent tweet by Otavio (Tavi) Costa on how money debasement looks like and why the BoJ is "trapped” in one chart.

"Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation. This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures. While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon". Source: Crescat Capital, Tavi Costa

The YEN is COLLAPSING and Abenomics has taught us some lessons:

After years of money printing, Yen now trades to 155 against USD: -32% against USD since 2021, -50% since 2012 The Bank of Japan has been buying over half of the national debt with freshly created yen, plus a bunch of other securities. But there is a price to pay after all: the destruction of the currency: Source Wolfstreet

Investing with intelligence

Our latest research, commentary and market outlooks