Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- performance

- AI

- gold

- earnings

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- Germany

- Japan

- europe

- bank

- nasdaq

- oil

- fed

- cpi

- warren-buffett

- Forex

- apple

- useful

- interest

- humor

- interest-rates

- market cap

- dollar

- energy

- returns

- GDP

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- semiconductor

- vix

- growth

- mortgage

- Money Market

- cash

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- UK

- assetmanagement

- bearish

- wages

- EV

- Flows

- credit-card

- russia

- saudiarabia

- spending

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- yen

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Brazil

- Election

- amazon

- car

- copper

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- sharebuybacks

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

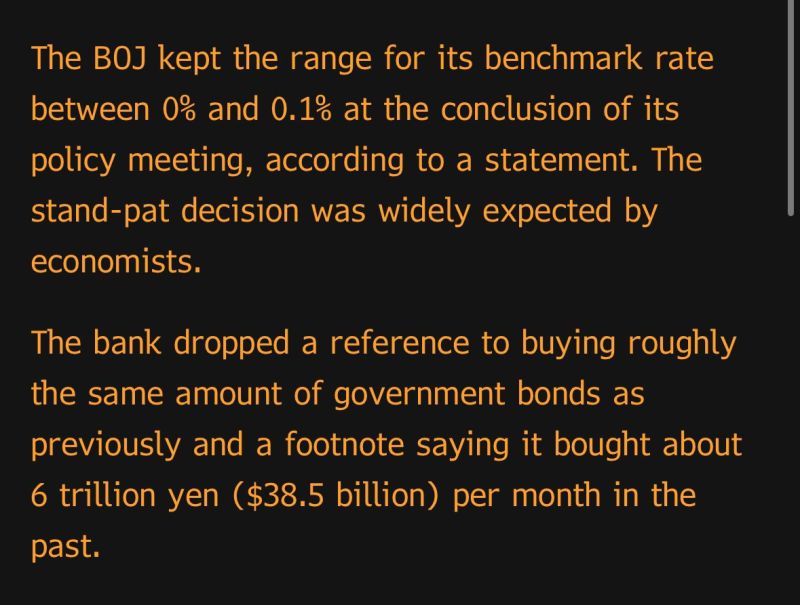

Bloomberg on the outcome of the BoJ Bank of Japan’s monetary policy meeting.

The Bank of Japan kept its policy rate unchanged Friday after its monetary policy meeting, holding its benchmark policy rate at 0%-0.1%. This is in line with expectations from economists polled by Reuters. While the move was expected, this comes after Tokyo’s April inflation came in lower than expected, with the core inflation rate at 1.6% compared to expectations of 2.2% from Reuters. The BOJ also said it will continue to conduct bond purchases. However, they dropped a reference to buying roughly the same amount of bonds as previously. No comment was made by the BOJ on the yen, which has steadily weakened since the BOJ ended its negative interest rate policy last month and abolished its yield curve control policy. The currency broke through the 156 mark against the U.S. dollar Friday after the decision, most recently trading at 156.11. Separately, the central bank also released its second-quarter outlook for Japan’s economy, raising its outlook for inflation in fiscal 2024. The BOJ now expects inflation between 2.5% and 3% for fiscal 2024, up from 2.2% to 2.5% in its January forecast. Inflation is then predicted to decelerate to “around 2%” in fiscal 2025 and 2026, the bank added. The BOJ also downgraded gross domestic product growth forecasts for fiscal 2024 to a range of 0.7% to 1%, down from January’s prediction of 1%-1.2% growth. Think of this as another small step in what the BoJ sees as a relatively long policy normalization journey. As mentioned by Mohamed El Erian, the length of this journey, both on a standalone basis and relative to the US, helps explain the weak Yen. Source: Bloomberg, CNBC

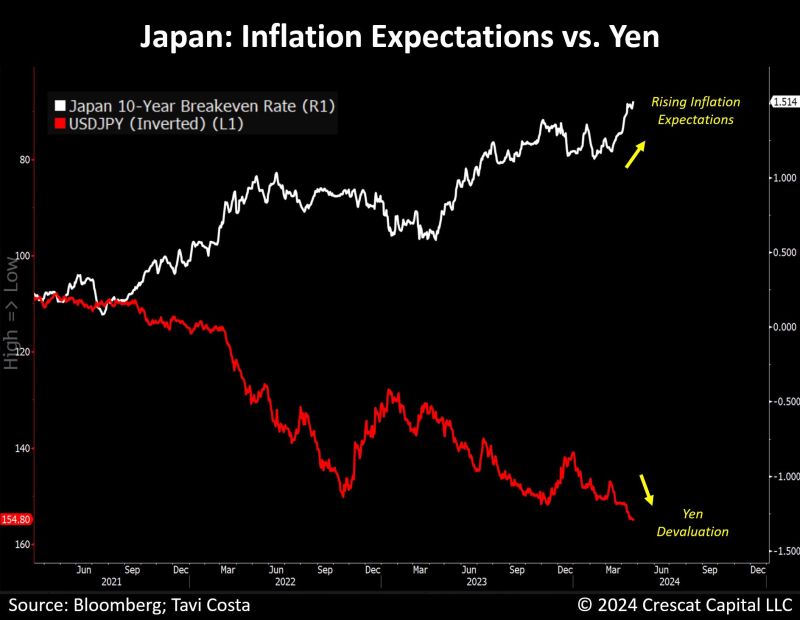

Excellent tweet by Otavio (Tavi) Costa on how money debasement looks like and why the BoJ is "trapped” in one chart.

"Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation. This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures. While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon". Source: Crescat Capital, Tavi Costa

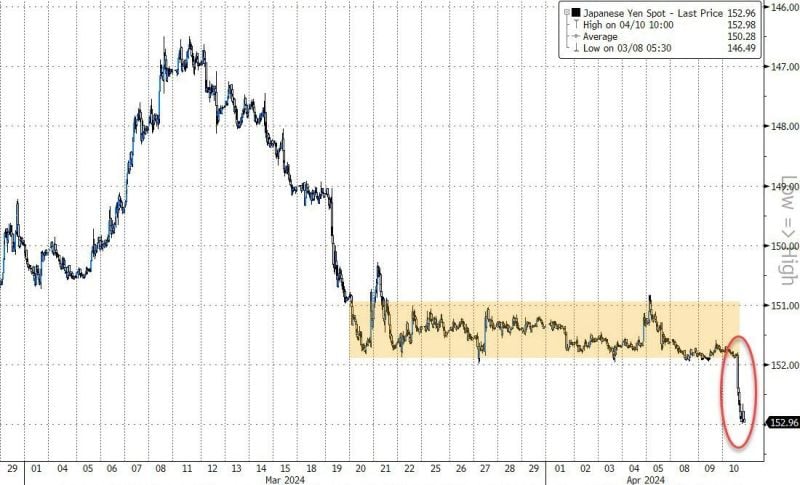

The Bank of Japan (BOJ) has a real problem now as USDJPY surged up to 153 - a fresh 34-year-low for the yen against the dollar and below the level at which the BoJ last intervened...

Source: Bloomberg, www.zerohedge.com

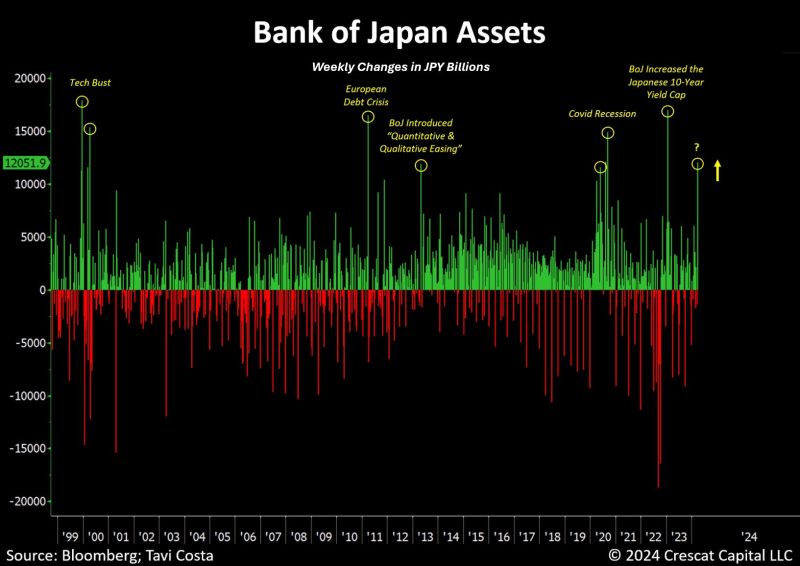

The global economy is addict to easy-money policies.

While everyone is talking about boj hiking rates, we just experienced one of the largest weekly changes in the BoJ balance sheet assets in history. In USD terms, this move accounted for nearly $80 billion in one week... Source: Tavi Costa, Bloomberg

In case you missed it:

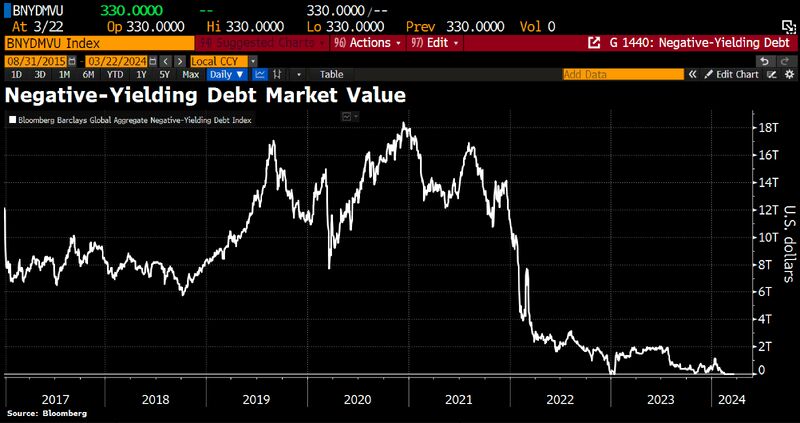

After bank of japan abolished negative interest rates this week for 1st time since 2016, the volume of bonds with negative interest rates has shrunk to $300mln. At its peak, there was a volume of $18tn worth of bonds with negative rates. But this weird experiment seems to be over – for now. Source: HolgerZ, Bloomberg

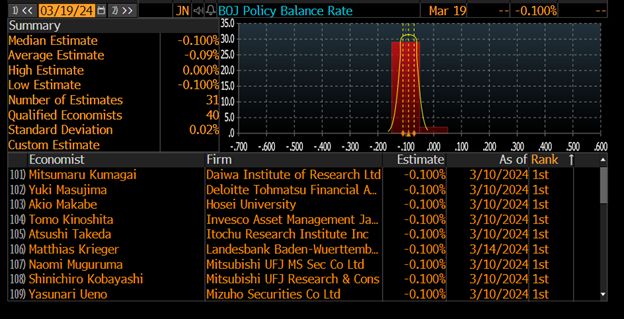

BREAKING - Bank of Japan raises rates to policy range of 0% to 0.1%, the first such rate hike in over a decade 💹 and scraps yield curve control.

The central bank will also stop buying ETFs and phase out buying of corporate debt. 2 key points: 1) That was completely in line with my preview 2) The tone was dovish as the boJ will continue JGB purchases at approximately the same amount as before. It pledged to gradually reduce its purchases of commercial paper and corporate bonds, with the aim of stopping this practice in about a year. Market reaction >>> The Japanese yen weakened to as much as 149.92 against the greenback, while the Nikkei stock index swung between gains and losses following the BOJ decision. Yields on the 10-year and 30-year JGBs dipped. Source: Bloomberg

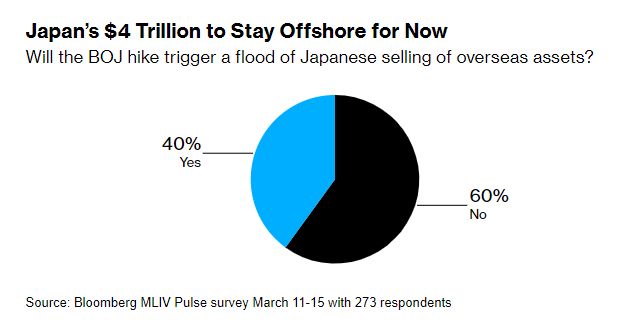

Japan’s $4 Trillion offshore funds will ignore first BOJ Hike - stocks and bonds in the US insulated from impact, survey shows

Japanese money is poised to stay offshore as the central bank creeps toward tighter policy, according to the latest Bloomberg Markets Live Pulse survey. Only about 40% of 273 respondents said the first interest-rate hike by the Bank of Japan since 2007 will prompt the nation’s investors to sell foreign assets and repatriate the proceeds back home. That’s good news for US stocks and bonds. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks