Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- performance

- AI

- gold

- earnings

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- Germany

- Japan

- europe

- bank

- nasdaq

- oil

- fed

- cpi

- warren-buffett

- Forex

- apple

- useful

- interest

- humor

- interest-rates

- market cap

- dollar

- energy

- returns

- GDP

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- semiconductor

- vix

- growth

- mortgage

- Money Market

- cash

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- UK

- assetmanagement

- bearish

- wages

- EV

- Flows

- credit-card

- russia

- saudiarabia

- spending

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- yen

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Brazil

- Election

- amazon

- car

- copper

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- sharebuybacks

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

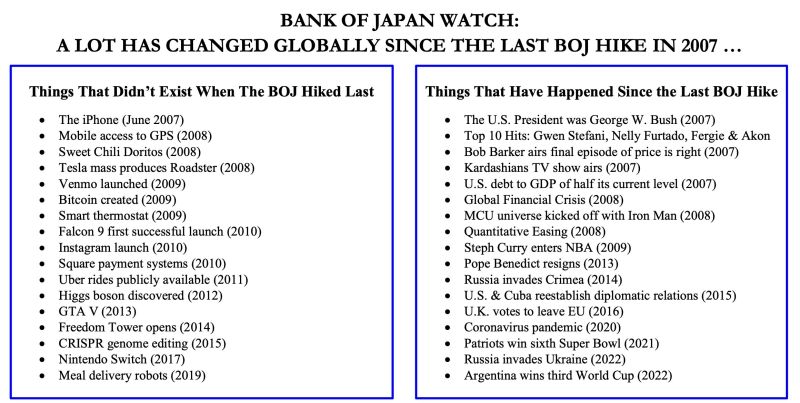

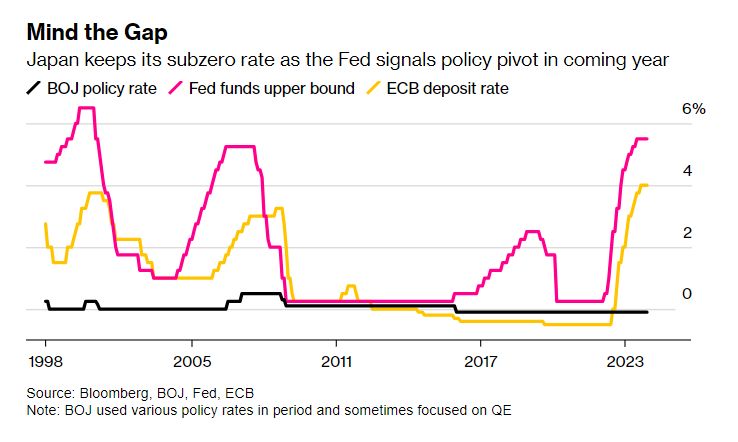

Bank of Japan is expected to end its negative interest rates this week

Marking 1st rate hike since February 2007 in a turning point for hashtag#BoJ's long-running monetary easing pol. A lot' has changed globally since last ³BoJ hike 17 years ago. SRP has a great overview... (through HolgerZ)

Nikkei reported BOJ conducted a gensaki (reverse repo with JGB collateral) operation Monday for the first time in about a month.

*Article cited broad upward pressures on rates amid heightening expectations of an imminent BOJ rate hike, leading traders to conclude the measure was meant to prepare for market reactions Source: C.Barraud https://lnkd.in/e8c8ubcx

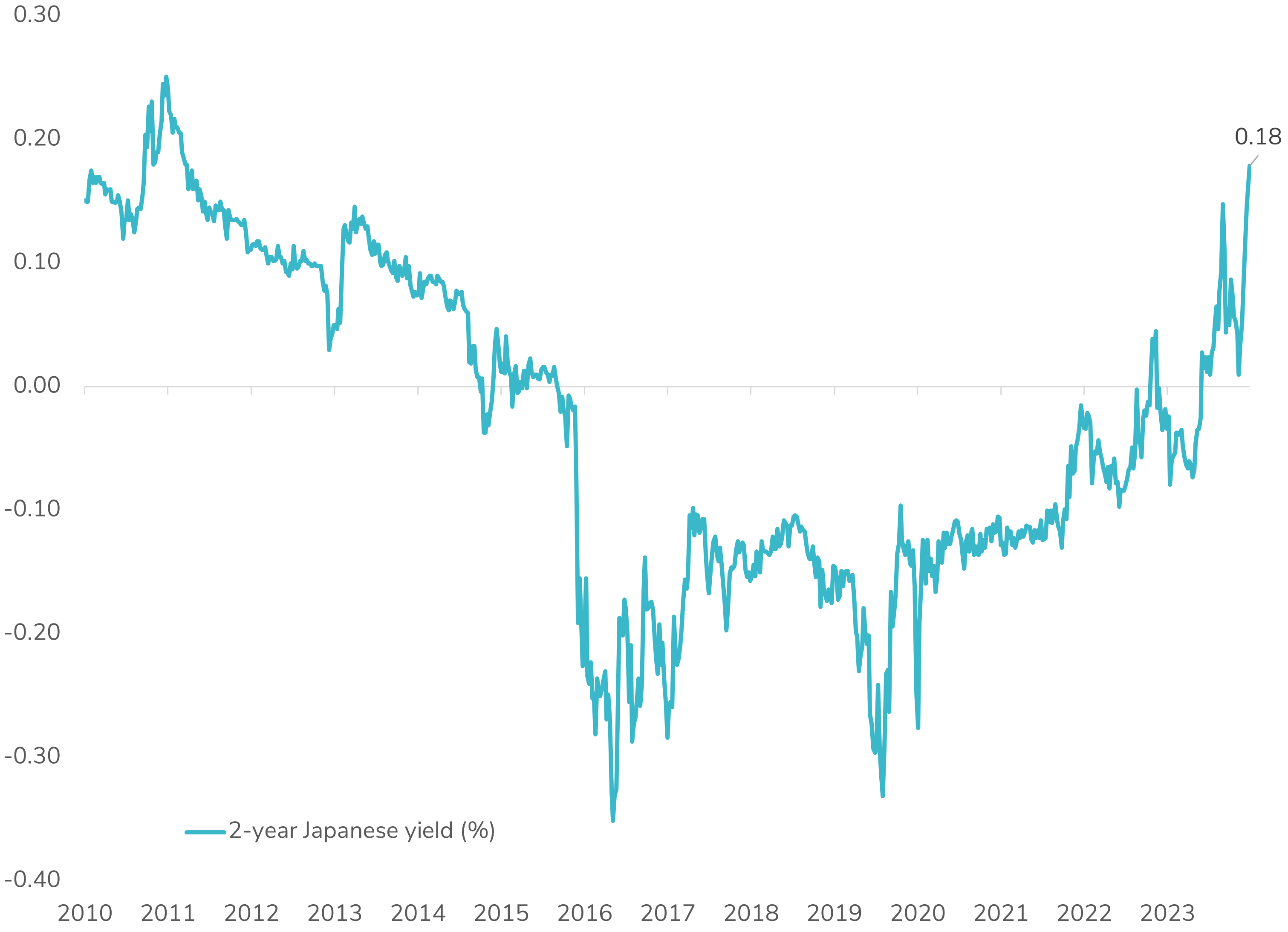

📈 Japanese 2-Year Yield Surges to 14-Year High!

Japanese government bond yields are on the rise across the curve, triggered by Bank of Japan Board Member Hajime Takata's comments hinting at a potential end to the negative interest rate policy. Takata cited progress towards achieving the price target, indicating a possible rate hike—the country's first since 2007—expected in March or April. The front end of the Japanese yield curve is particularly influenced by the BOJ's monetary policy and continues to reprice higher rates. The market anticipates a 0.25% rate hike for the full 2024 year. It appears that Japan will gradually transition away from the negative interest rate monetary policy. 🇯🇵💼 #JapanEconomy #BOJ #MonetaryPolicy #YieldCurve #FinanceNews

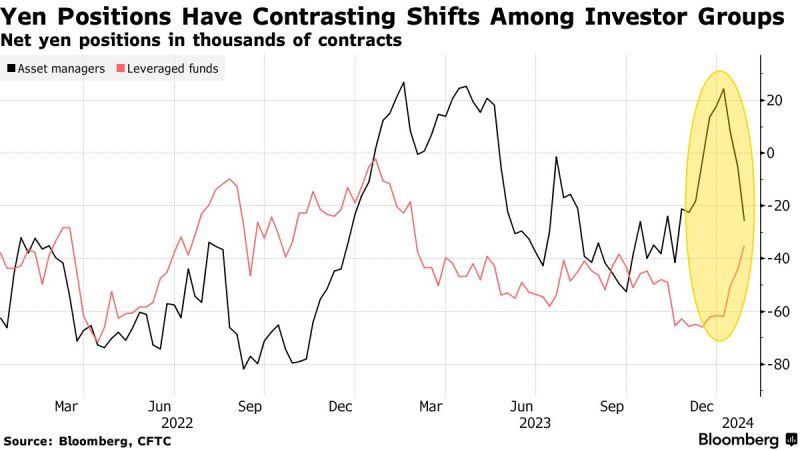

🇯🇵 Hedge Funds, Asset Managers Take Opposite Yen Bets Amid BOJ Talk - Bloomberg, C.Barraud

Hedge funds and asset managers were split on their yen views as the Bank of Japan laid the ground for an end to its negative-rate policy. Leveraged funds cut net yen shorts to the lowest level since February 2023 in the seven days ended Jan. 23 when BOJ announced its last policy decision, according to a report from the Commodity Futures Trading Commission. In contrast, asset managers, such as pension funds and insurance companies, boosted net shorts by the most since May when the investors switched to shorts from longs.

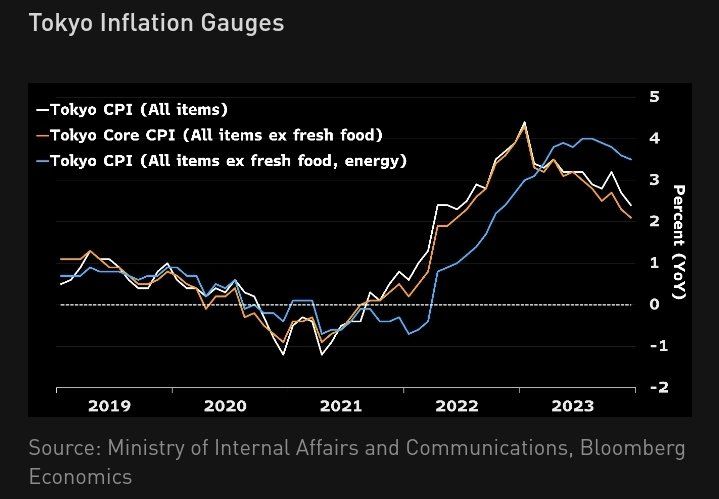

Tokyo CPI down again supports BOJ dovish stance for now

Source: Bloomberg

Japan | BOJ Avoids Rate Hike Signal as It Stands Pat, Driving Yen Lower – Bloomberg

As expected, no change from the BoJ this morning on rates or the YCC. The vote was 9-0, in favor of no change. There wasn’t even a hint of change to the policy statement. No change in language around wages and inflation. The Japanese Yen weakened considerably on the initial press release. Nikkei 225 is up +1.5% Source: Ayesha Tariq, Bloomberg

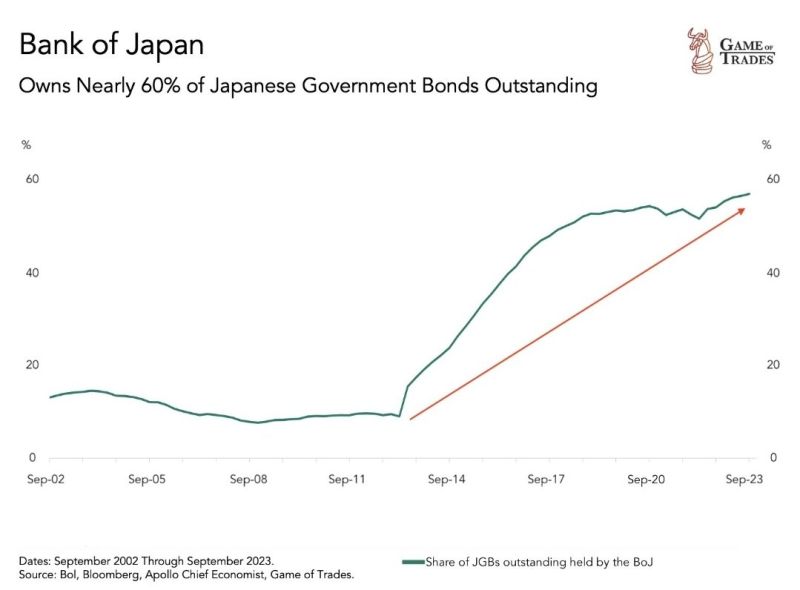

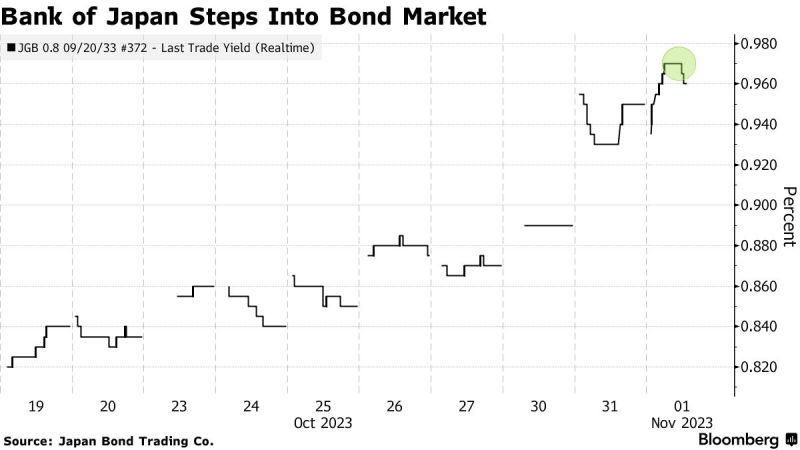

*BREAKING* BOJ Buys More Bonds to Slow Rising Yields a Day After Tweak Central bank acts after 10-year yield touches decade high - BLOOMBERG

The Bank of Japan stepped into the bond market unexpectedly Wednesday to curb the pace of gains in sovereign yields, just a day after announcing it was loosening its grip on debt prices. The central bank’s unscheduled purchase operation statement came as the benchmark 10-year bond yield touched 0.97% — a fresh decade-high but still below the 1% cap it removed in favor of a more flexible policy setting. There was very little immediate market reaction to the move, with traders trimming one basis point off the 10-year yield before it recovered half of that. Bond futures pared losses and the yen, which is sensitive to shifts in interest rates, shed a fraction of its advance versus the dollar.

Investing with intelligence

Our latest research, commentary and market outlooks