Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

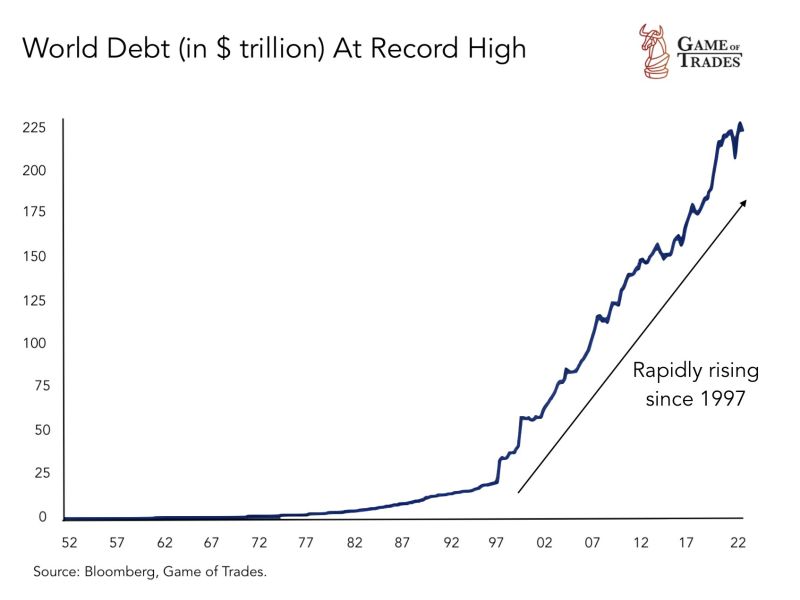

World debt has crossed $225 TRILLION.

This is unlike anything we’ve seen. Source: Game of Trades

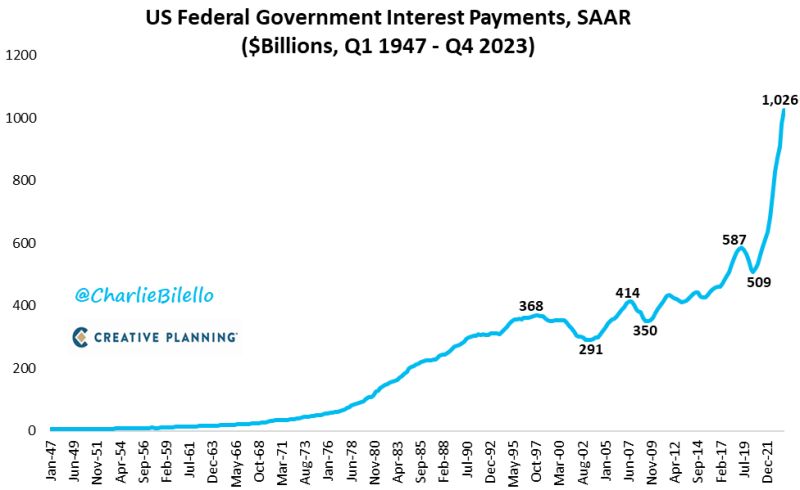

When you invest in US debt, think twice...

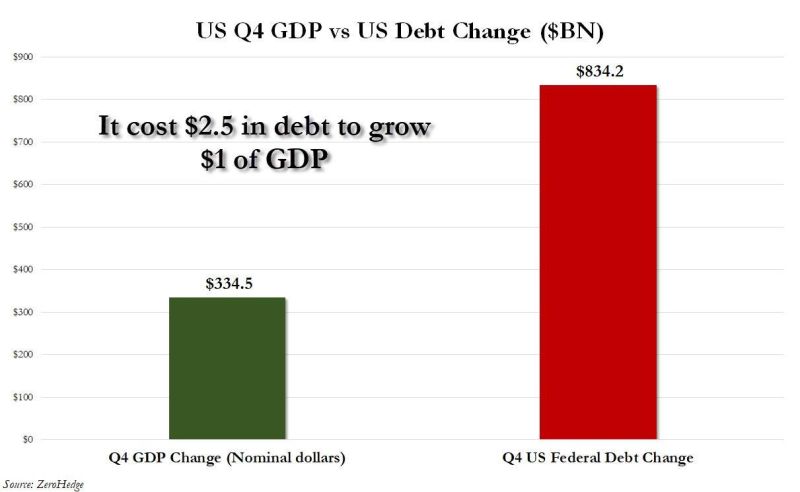

In Q4 2023, nominal GDP grew by 3.2% according to data on Wednesday. This would mean a $334.5 billion increase in nominal GDP. Meanwhile, over the same time period the US added $834.2 billion of debt. In other words, it cost us $2.50 of debt for every $1.00 of GDP last quarter, according to Zerohedge. As Fed Chair Powell recently said, "we are on an unsustainable fiscal path." What's the long term plan here? Source: The Kobeissi Letter, www.zerohedge.com

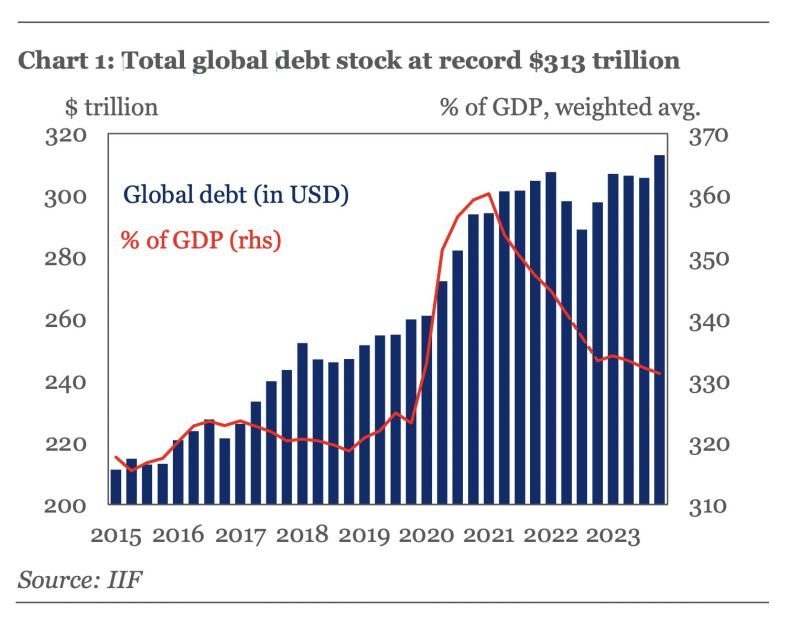

In case you missed it: Global debt surged by >$15tn in 2023 reaching a new record high of $313tn.

55% of this rise originated from mature markets, mainly driven by US, France, & Germany. BUT global debt-to-GDP ratio saw a decline of ~2ppts to 330% in 2023, acc to IIF. This marked the third consecutive annual drop. Source: HolgerZ, IIF

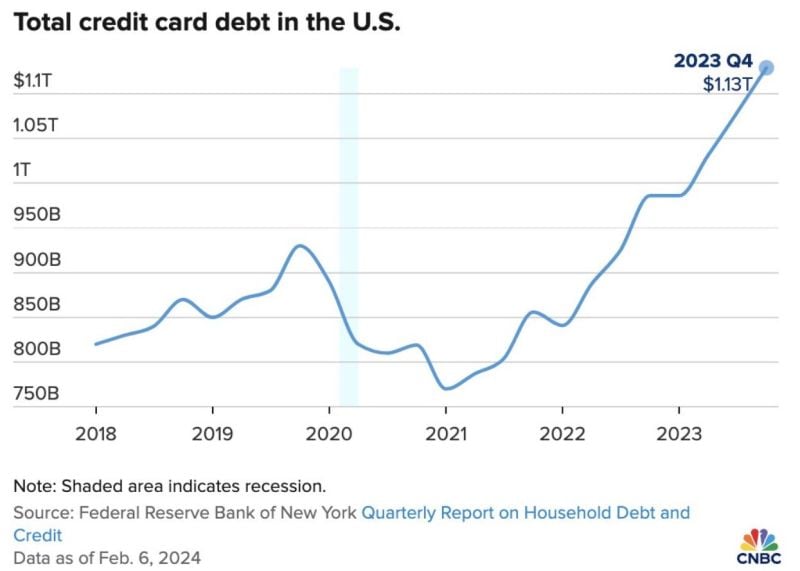

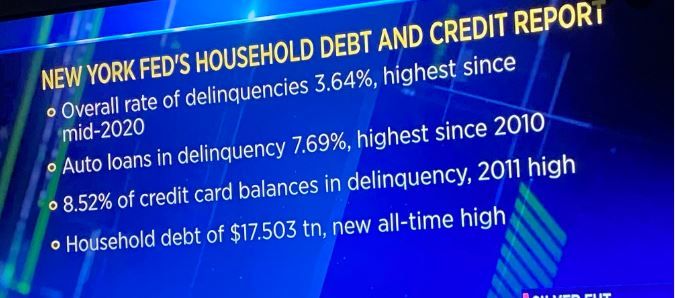

New York Fed's Household Debt and Credit Report

Total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve said in its latest quarterly Household Debt and Credit Report. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher. source : cnbc

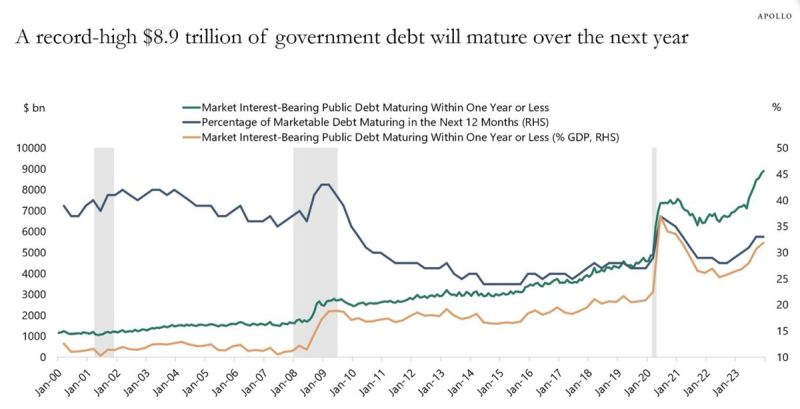

A record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion. This means that someone will need to buy more than $10 trillion in US government bonds in 2024. That's nearly ONE THIRD of all outstanding US federal debt right now. All while the Fed is expected to start cutting rates, making buying these bonds less attractive. Who's going to fund all of this debt? Source: The Kobeissi Letter, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks