Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

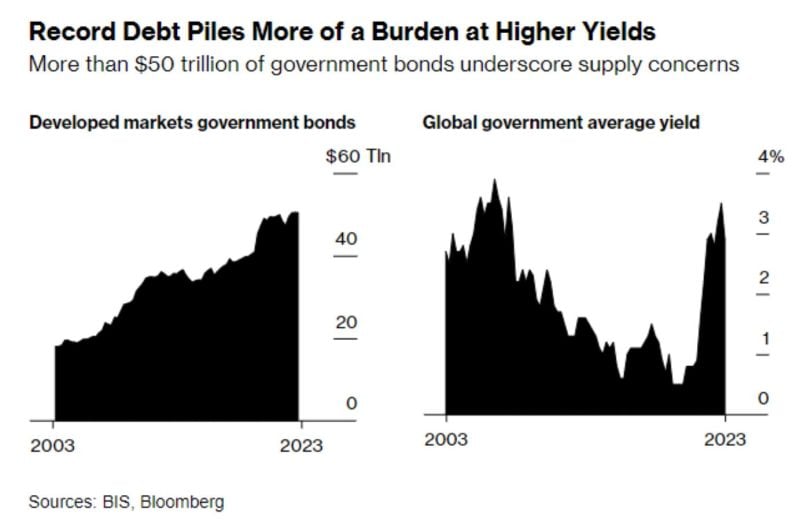

The US is facing a "death spiral" as a result of its mounting debt and the inability of politicians to confront the issue, according to "The Black Swan" author Nassim Taleb.

Per Bloomberg, the Universa Investments advisor who correctly called the 2008 financial crash cast a dire warning about the US debt situation, which has seen the federal debt balance notch $34 trillion for the first time ever to start the year. As long as Congress keeps up its rapid pace of spending, those debts are going to continue to pile up, which could have disastrous consequences for the US economy, Taleb said this week at an event held by Universa Investments. In fact, rising debt in the US is a "white swan," Taleb said, and is an event that poses an obvious risk to markets versus a "black swan" event, which can occur without much warning. That death spiral would necessitate "something to come in from the outside, or maybe some kind of miracle," Taleb said, when asked how the shock would play out, adding that the situation has made him more pessimistic about the political system in the West. Source: Business Insider

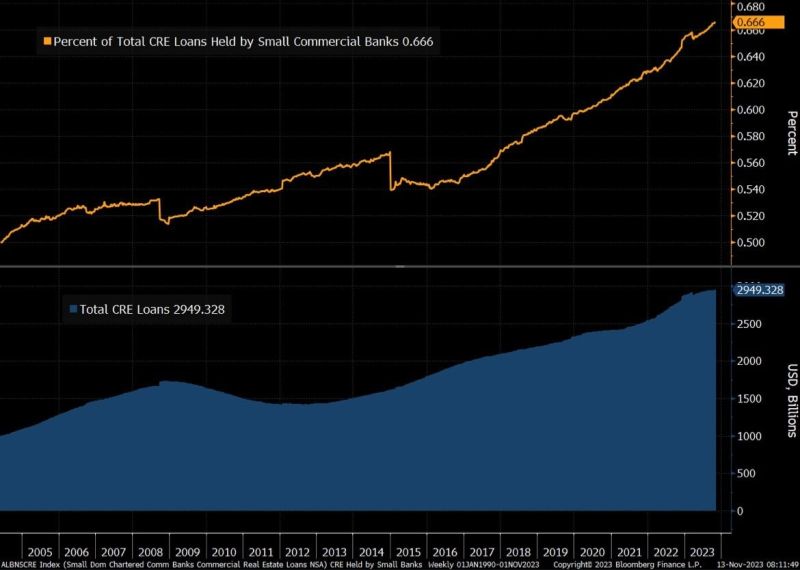

BREAKING: 14% of all commercial real estate (CRE) loans and 44% of office building loans are now in "negative equity."

In other words, the debt is now greater than the property value on all of these properties. Currently, US banks hold over $2.9 trillion of CRE debt, the majority of which is held by regional banks. Office building prices are down 40% from their highs and CRE as a whole is down over 20%. All as rates rise and many of these loans are due CRE is beyond bear market territory.

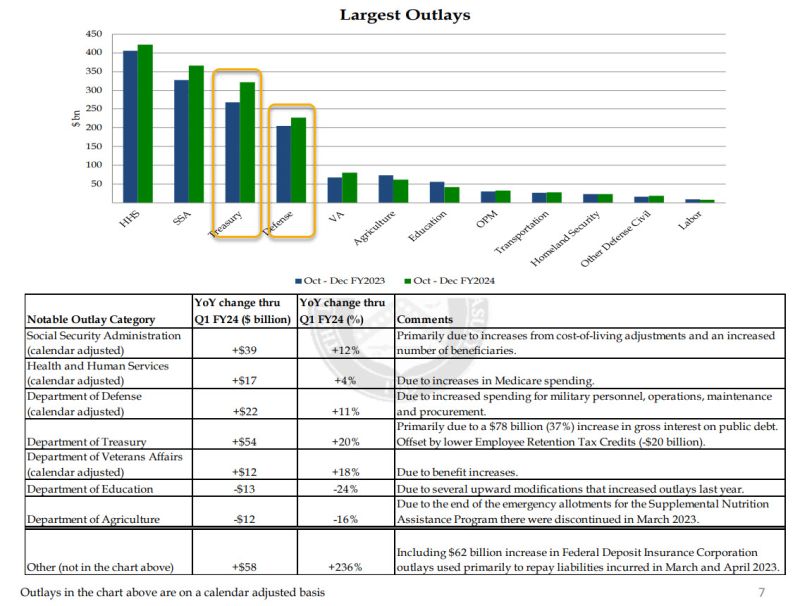

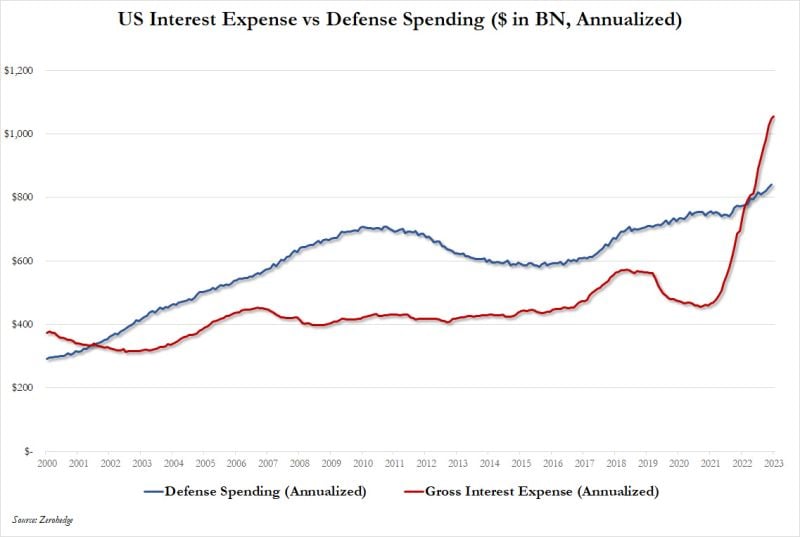

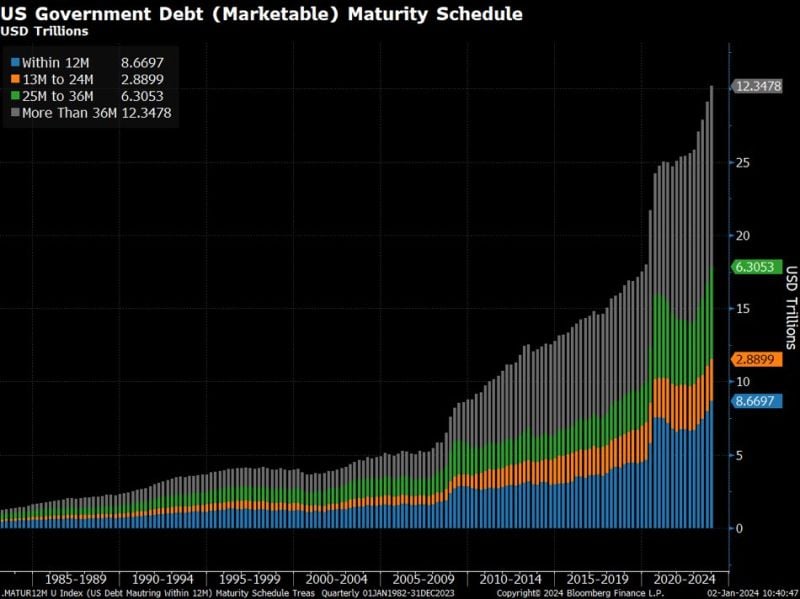

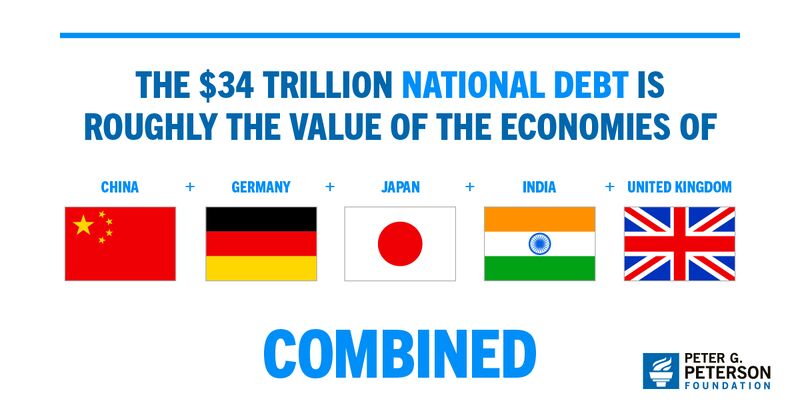

BREAKING: Total US debt hits $34 trillion for the first time in history, putting US debt up 100% since 2014

Since the debt ceiling "crisis" ended in June 2023, total US debt is up nearly $3 trillion. This debt balance is more than the value of the economies of China, Germany, Japan, India and the UK COMBINED. The US is now spending $2 billion PER DAY on interest expense alone. Debt per capita is at a record high of $101,000. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks