Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

Disinflationary forces are intensifying in Germany

Producer Prices drop for 1st time since 2020, a good leading indicator for Consumer Prices. In July, producer prices (PPI) fell by 6.0% YoY, the biggest decline since October 2009, when the financial crisis has caused prices to collapse. Last year, the prices received by manufacturers for their goods had at times risen at a record rate of 45.8%. Source: HolgerZ, Bloomberg

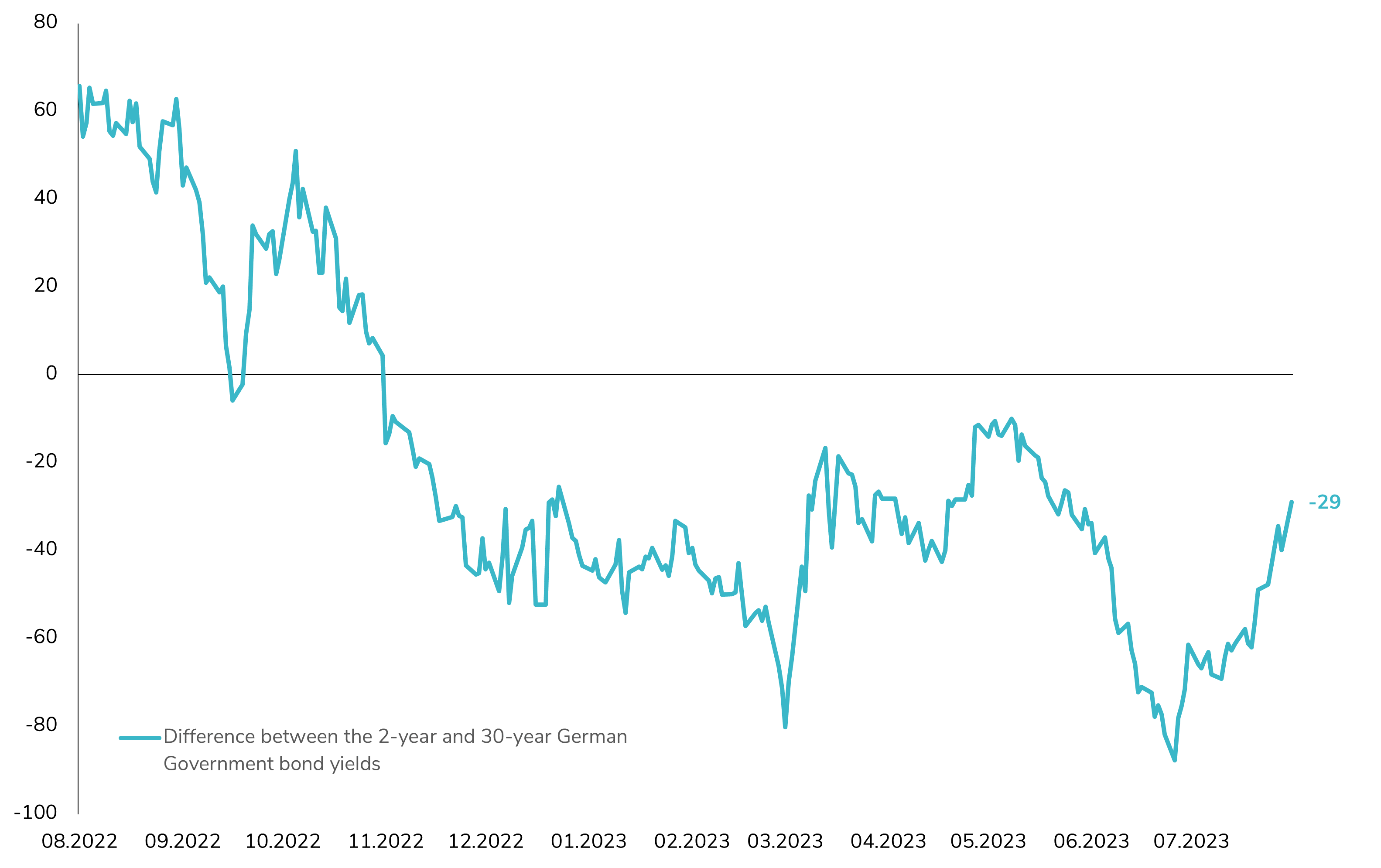

Why is the German Yield Curve Sharply Steepening?

The German yield curve has experienced an impressive steepening of almost 60bps in just one month! This significant movement can be attributed to several key factors that are driving the shift: Fundamentals and Economic Outlook: One of the primary drivers behind this steepening is the market's reassessment of the potential avoidance of a recession. There's a positive repricing of economic fundamentals, suggesting improved prospects for growth and stability. Additionally, there's growing concern about structural inflation running higher than initially expected. Notably, the German 5-year breakeven rate has surged to 2.63%, reaching its highest level since 2009, which has translated into higher long-term yields. Front-End Yield Curve Repricing: The recent decisions made by the European Central Bank (ECB) have also played a role in the steepening. Firstly, the ECB chose to no longer remunerate the bank's minimum reserve held at the central bank. Additionally, today's surprise decision by the Bundesbank's Executive Board further impacted the market. The decision was to remunerate domestic government deposits held with the Bundesbank at 0%, starting from 1 October 2023. Both of these developments could potentially increase demand for German short-term papers. Source: Bloomberg.

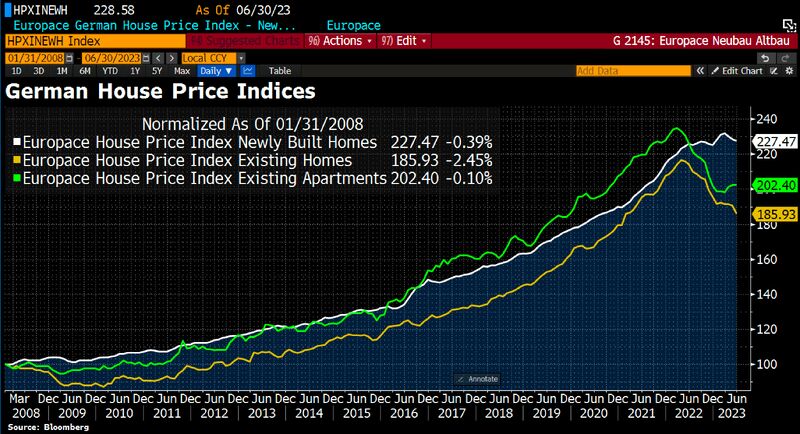

The housing bubble continues to lose more air in Germany

The housing bubble continues to lose more air in Germany. In June, real estate prices slumped sharply, w/existing homes in particular falling by 2.4% MoM. Even new buildings became somewhat cheaper, namely 0.4%. Source: Bloomberg, HolgerZ

Disinflation is on the way in Germany

Disinflation is on the way in Germany. Wholesale prices dropped 2.9% YoY in June, an acceleration from the 2.6% decline from May & the biggest annual decrease since June 2020. Lower wholesale prices could translate to falling #inflation in Germany. Source: HolgerZ, Bloomberg

German ZEW survey highlights concerns over shaky recovery.

ZEW investor expectations fell to -14.7 in Jul (estimate -10.6) from -8.5 in June a bad omen for econ growth. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks