Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- performance

- AI

- gold

- earnings

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- Germany

- Japan

- europe

- bank

- nasdaq

- oil

- fed

- cpi

- warren-buffett

- Forex

- apple

- useful

- interest

- humor

- interest-rates

- market cap

- dollar

- energy

- returns

- GDP

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- semiconductor

- vix

- growth

- mortgage

- Money Market

- cash

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- UK

- assetmanagement

- bearish

- wages

- EV

- Flows

- credit-card

- russia

- saudiarabia

- spending

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- yen

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Brazil

- Election

- amazon

- car

- copper

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- sharebuybacks

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

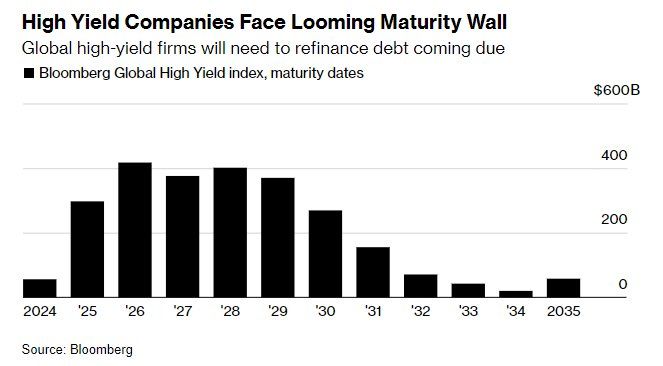

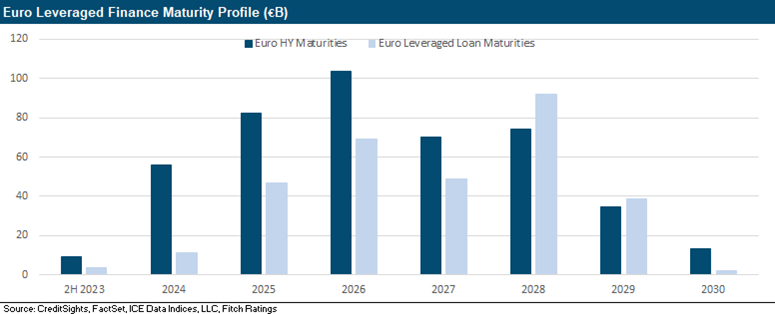

HIGH YIELD BONDS, THE BILL COMES DUE...

Global high yield bonds have been quite resilient so far in this cycle but the reality is that they will hit the maturity wall starting next year. And things will probably become more challenging whatever the economic scenario. If the economy does well and interest rates stay high for longer, the refinancing cost is likely to become more expensive. If the economy moves into recession, credit spreads are likely to go up hence still putting upward pressure on refinancing cost. So either way delinquencies are likely to increase. Source: Bloomberg

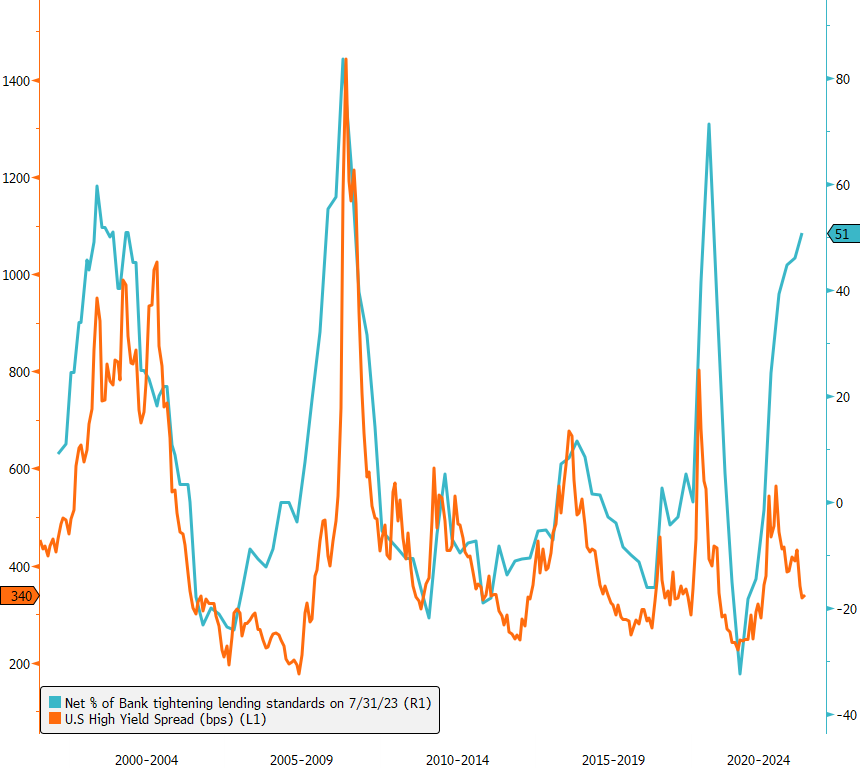

U.S. High Yield credit spreads : time for decompression?

The updated Fed's July senior loan officer survey reveals a notable trend—there's an even higher net share of banks tightening lending standards for C&I compared to the prior survey in April. Historically, this has had implications for US high yield credit spreads. But is this time different? Source : Bloomberg

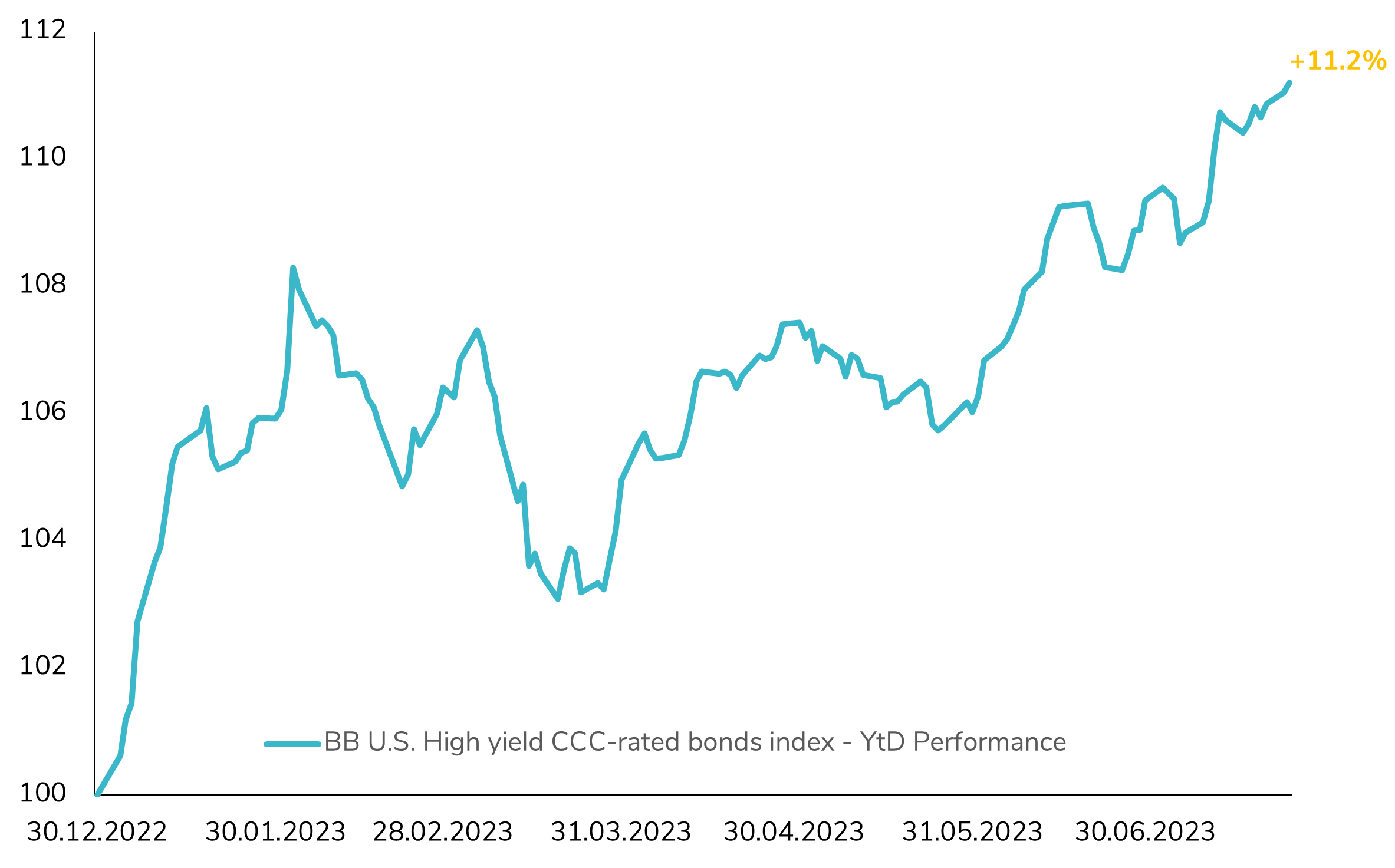

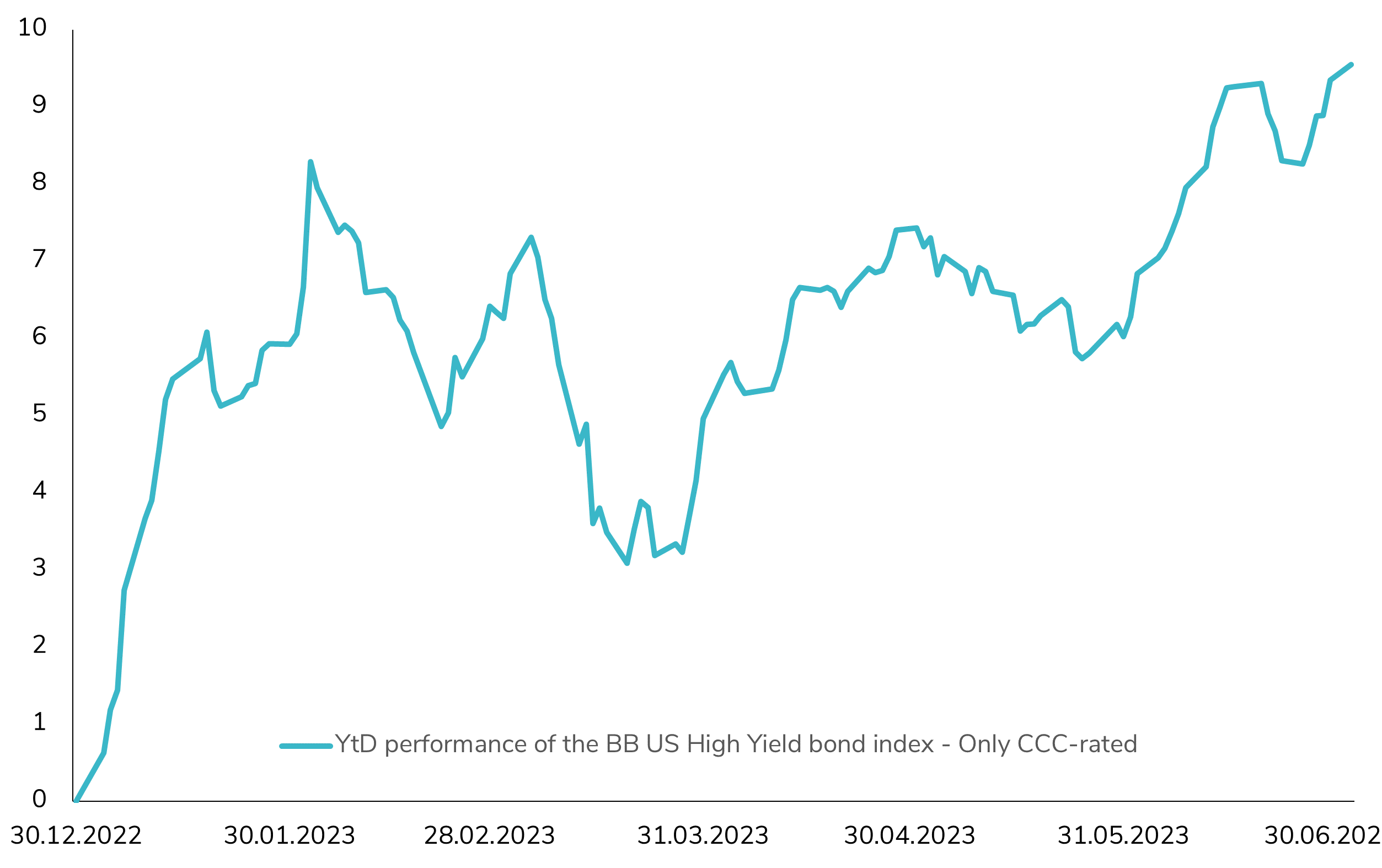

Remarkable Rally Continues in US High Yield CCC-Rated Bonds!

The Bloomberg US High Yield corporate CCC-rated bond index has delivered a staggering return of over 11% in 2023 so far. To put things into perspective, this level of performance has only been surpassed once in the last decade, back in 2016! The impressive rally in this segment can be attributed to the significant tightening of CCC credit spreads, which have contracted by a remarkable 200bps! Additionally, the high carry of the CCC-rated bonds, with an average yield-to-maturity of 13% in 2023, has contributed to the sector's stellar performance. However, as we approach a critical juncture in the economy, with looming concerns over a potential recession, the question arises: can this impressive performance sustain itself? While a soft landing scenario seems currently fully priced in, the possibility of a materialized recession in the coming months adds an element of uncertainty to the equation. Source : Bloomberg

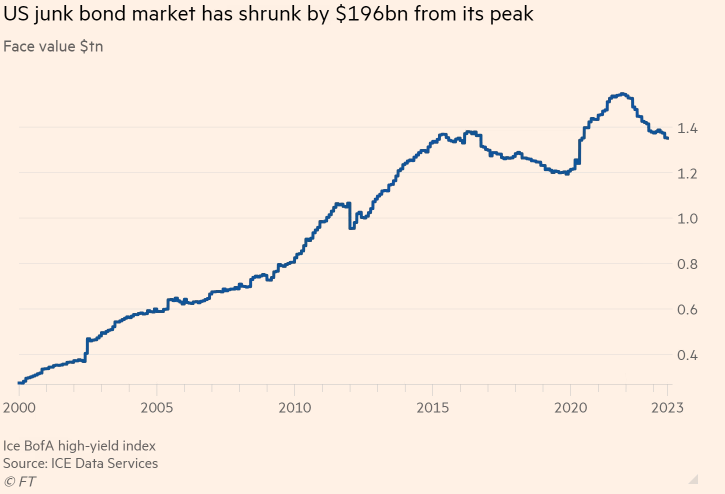

The $1.35tn US junk bond market has shrunk by 13% since all-time peak

High-yield market contracts 13% from 2021 peak amid fears of false signals about American economy’s health.

A steep rise in interest rates since early last year has helped deter companies from selling new bonds, while several companies have climbed out of the high-yield market into investment grade territory. The spread has simultaneously widened out to 4.05% from roughly 3%.

Source: Financial Times

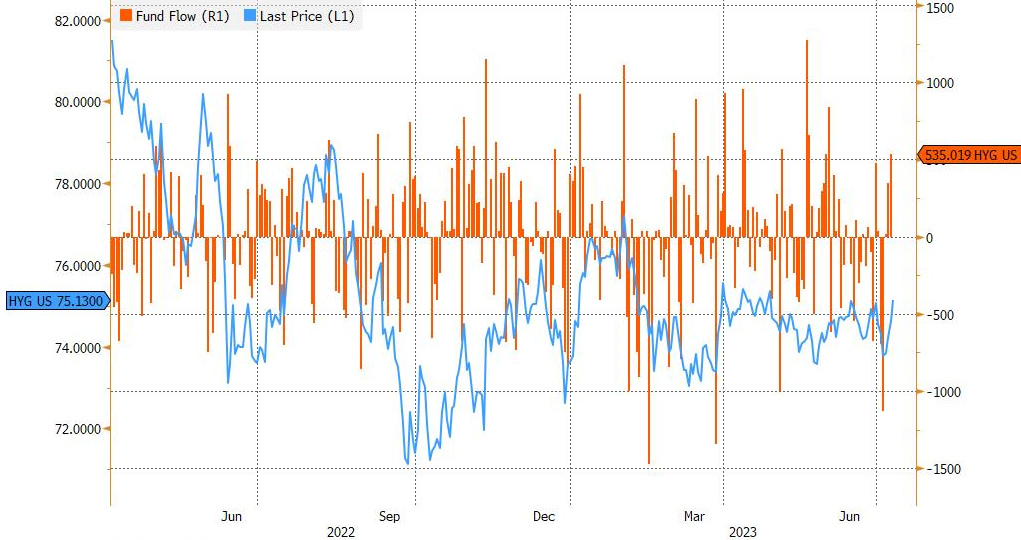

Investors added a net $535 million to IShares iBoxx High Yield corporate bond

This was the biggest one-day increase since June 2 and the third straight day of inflows, totaling $897.9 million. The fund's assets increased by 6.9% during that span. The fund has suffered net outflows of $543.4 million in the past year. Source: Bloomberg

Surprising Performance: U.S. High Yield CCC-rated Bonds up 10% YTD!

The Bloomberg US High Yield CCC-rated bond index has recorded an impressive 9.6% gain in 2023. Despite concerns of an impending U.S. recession, the lowest quality segment of the high yield market has emerged as one of the top performers in the U.S. fixed income space. The resilience of the U.S. economy and robust release of hard data have contributed to a significant tightening of the average credit spread for CCC-rated bonds, reaching a 1-year low of 835bps. This represents a 165bps tightening since the beginning of the year. Notably, CCC-rated credit spreads are currently below the historical average of 925bps, while the average yield remains in line with historical levels at 12.8% compared to 12.7%. Furthermore, it is worth mentioning that less than 2% of the index is set to mature in 2024. The question now arises: will CCC-rated bonds continue to outperform driven by strong technical factors, or have we reached the top? Source: Bloomberg.

Limited Pressure from Issuance Activity for European High Yield Bonds in H2 2023!

The European high-yield (HY) market is expected to maintain a positive technical landscape in the second half of 2023, as corporate high-yield refinancing needs remain moderate. This favorable dynamic should counterbalance any potential outflows, as observed on the US market where HY funds are recording significant outflows, but offset by sluggish activity on the primary market. Source: CreditSights

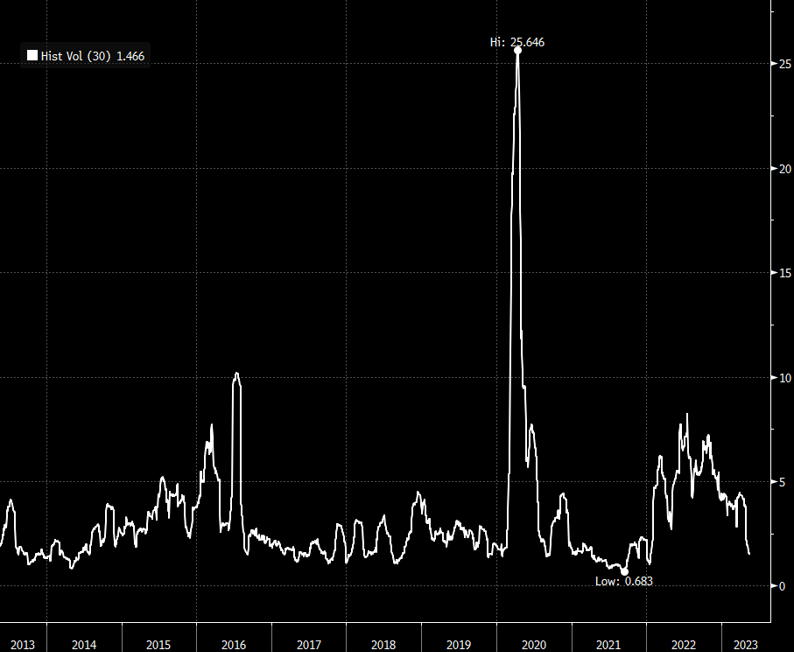

📉 Significant drop in High Yield volatility!

The recent sharp decline in European High Yield volatility highlights the market's complacency towards this fixed income segment. 📊 Examining the 30-day price volatility over the past decade, the High Yield index has reverted to 2021 levels, now standing one standard deviation below the average. 💼 Is the anticipated future recession in Europe already fully priced in on the soft side? Source : Bloomberg, RBC.

Investing with intelligence

Our latest research, commentary and market outlooks