Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- performance

- AI

- gold

- earnings

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- Germany

- Japan

- europe

- bank

- nasdaq

- oil

- fed

- cpi

- warren-buffett

- Forex

- apple

- useful

- interest

- humor

- interest-rates

- market cap

- dollar

- energy

- returns

- GDP

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- semiconductor

- vix

- growth

- mortgage

- Money Market

- cash

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- UK

- assetmanagement

- bearish

- wages

- EV

- Flows

- credit-card

- russia

- saudiarabia

- spending

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- yen

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Brazil

- Election

- amazon

- car

- copper

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- sharebuybacks

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

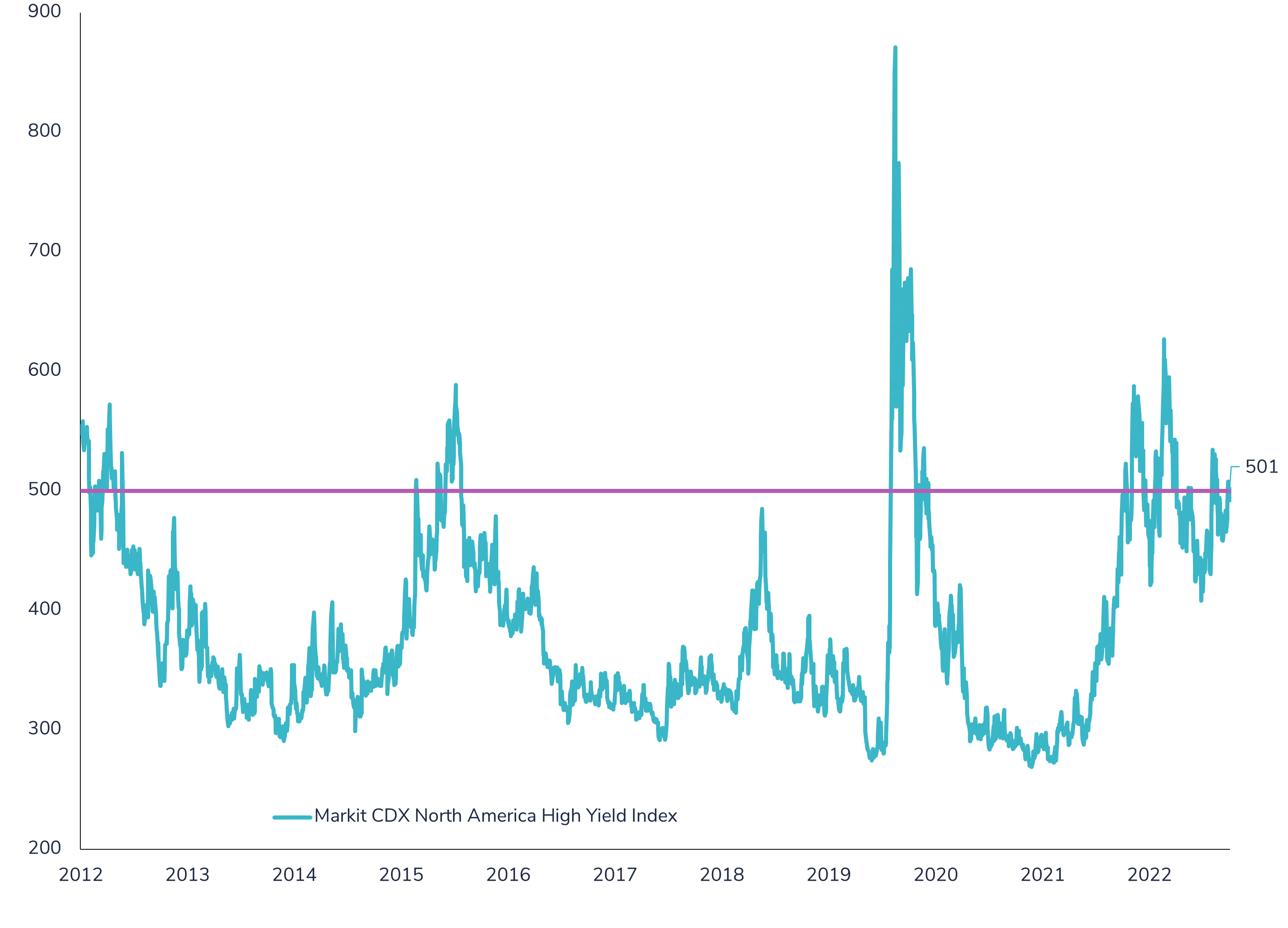

U.S High Yield credit spreads hit 500bps !

📈 The Markit CDX North America high yield index has surpassed the 500bps mark for the first time since March. This index serves as a reliable measure for tracking the upper quality of the US high yield market. 💰 While absolute yields may seem appealing, it's important to note that US high yield credit spreads are not cheap and could potentially widen further. This could be influenced by the sharp tightening of bank lending standards, the drop in US PMI/ISM surveys, and the gradual deterioration of the US employment market. 📉 Despite solid fundamentals at the moment, it begs the question: Do the current levels of US high yield credit spreads indicate an imminent rise in defaults or a forthcoming recession? Source : Bloomberg.

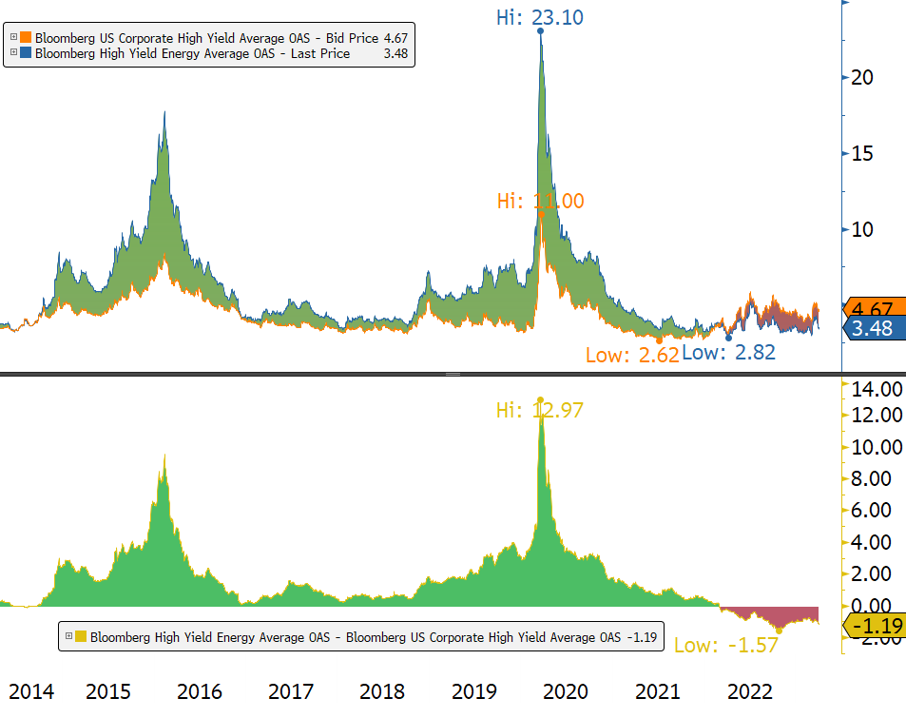

This time, higher oil prices will not contribute much to the performance of high yield?

Since the surprise OPEC+ production cut, oil prices have gained over 7%. At first glance, this could be seen as a positive for U.S. high yield, as energy is a large component of the index (>12%). Unfortunately, HY Energy spreads are already historically tight relative to its index and the potential for further tightening is low. Source : Bloomberg

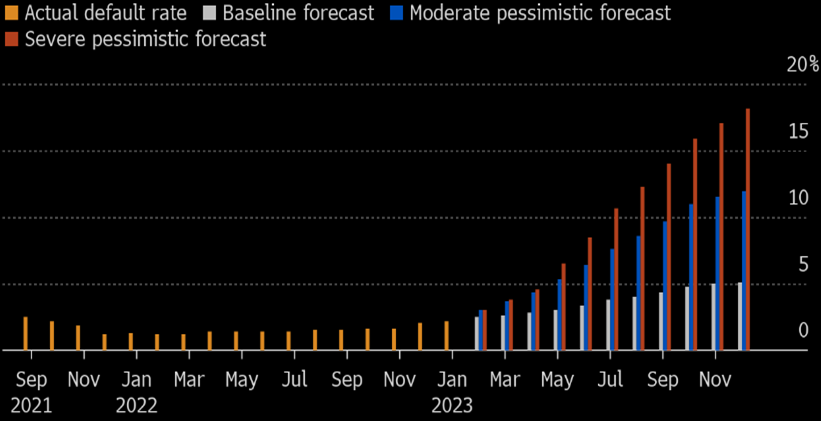

Highest default rate in the US High Yield market since september 2021!

There is some stress building in the U.S. high yield bond market, with the highest default rate since September 2021 occurring in January! While the default rate remains low (2.2% in January), U.S. high yield corporates are being downgraded at their fastest pace since 2020. A sign of future economic deterioration? Source: Bloomberg, Moody's.

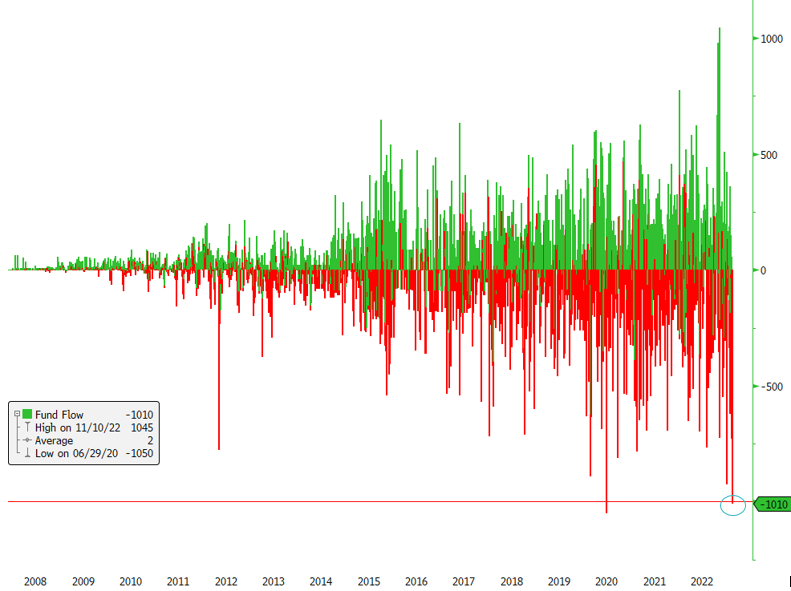

Second largest daily outflow for a US high yield bond ETF!

One of the largest U.S. high-yield bond ETFs had a daily outflow of $1 billion (over 10% of assets under management) yesterday. The only time we've seen it was in June 2020. Capitulation? Source: Bloomberg

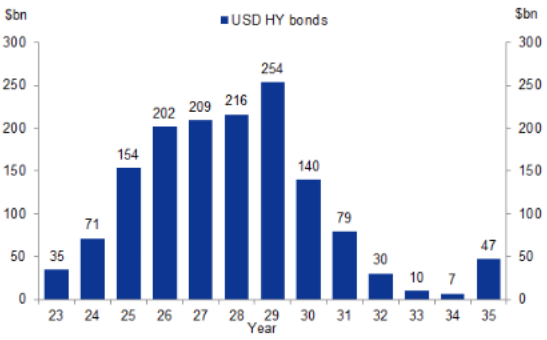

No refinancing pressure yet for US high yield companies!

One of the main factors supporting US high yield is technical. The U.S. high yield market is not facing an "avalanche" of new issuance because refinancing needs are very low for 2023. Therefore, the potential negative impact of rising interest rates should be limited for U.S. high yield companies for the time being. Source: Goldman Sachs

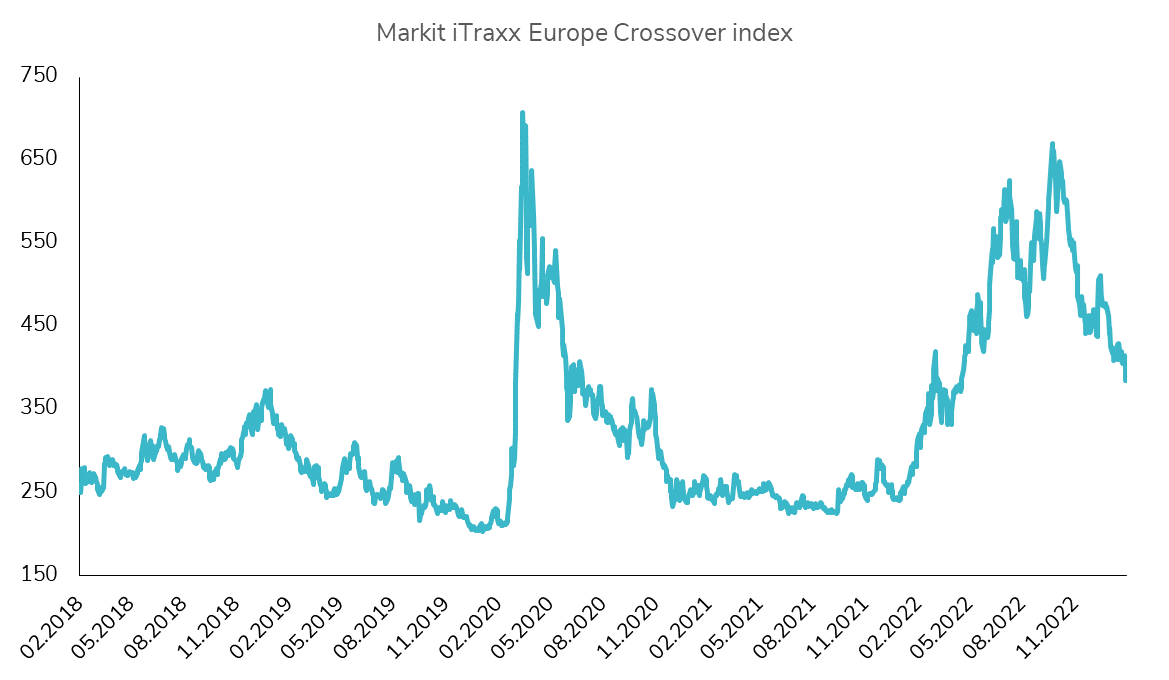

The Itraxx Xover index below 400bps for the first time since April 2022!

The spread of the Markit iTraxx Xover index, which is a good indicator of investor sentiment on European high yield, fell below 400 basis points for the first time since April 2022. The index is tightening by 25 basis points today following Ms. Lagarde's reassuring comment on the growth outlook. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks