Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

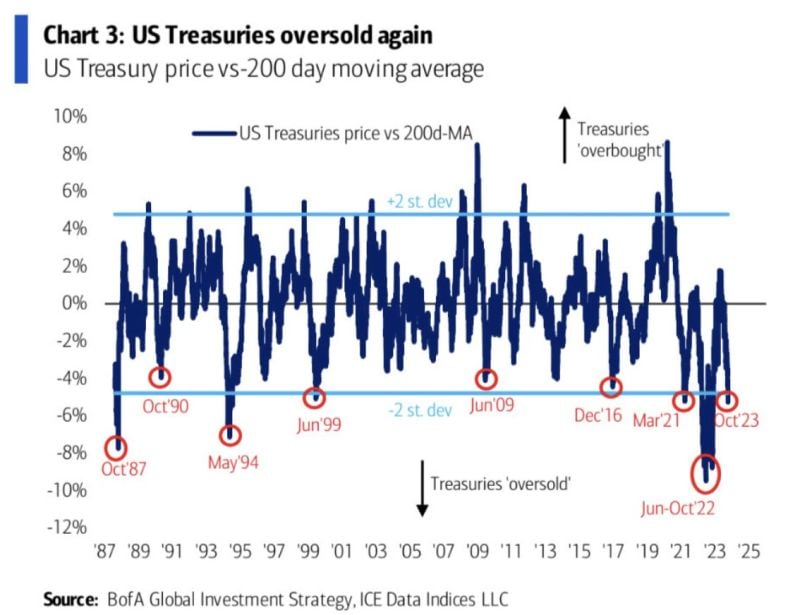

U.S. Treasuries have reached one of the most oversold levels in the last 36 years

This has typically foreshadowed events such as the October 1987 crash, the Dotcom Bubble, and the Nasdaq surge (Oct 2022) Source: Barchart, BofA

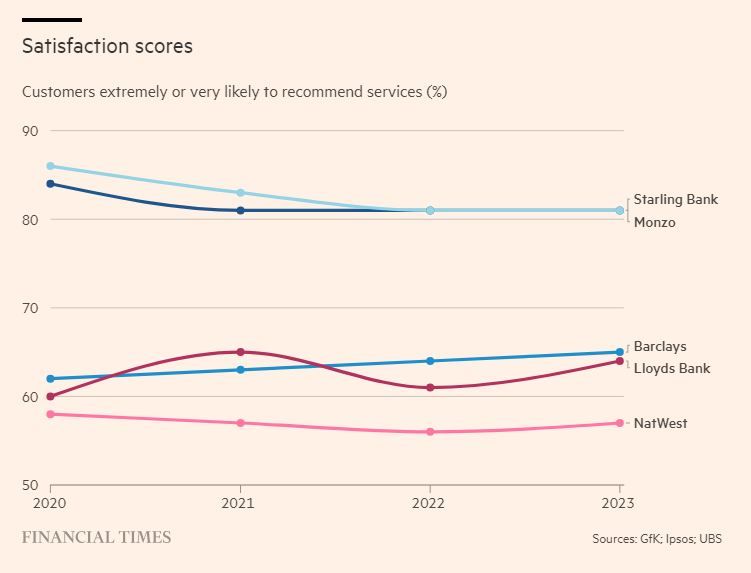

Interesting FT article on UK neobanks: "UK fintech: neobanks may end up blending in"

Low fees mean profits have remained elusive. But higher interest rates are now compensating for that, not least with better returns on client money put out on deposit. Satisfaction scores by customers are also much higher than traditional banks. Some lessons need to be learned. Source: https://lnkd.in/emZyY76d

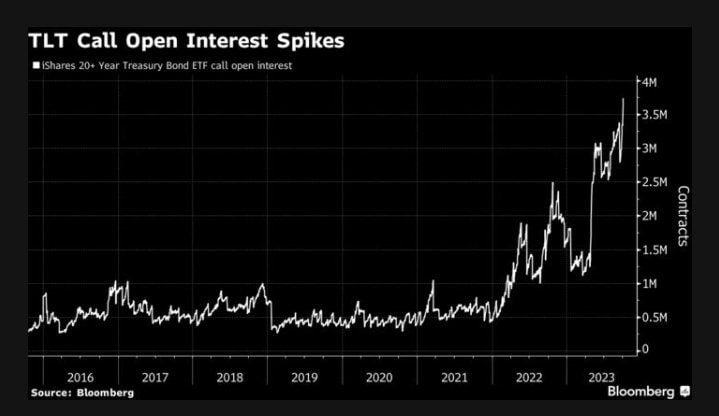

Open interest for bullish call contracts has soared to an all-time high for $TLT

Traders see an end to the market rout that has led to TLT’s longest streak of weekly losses since 2022. Source: Credit From Macro to Micro

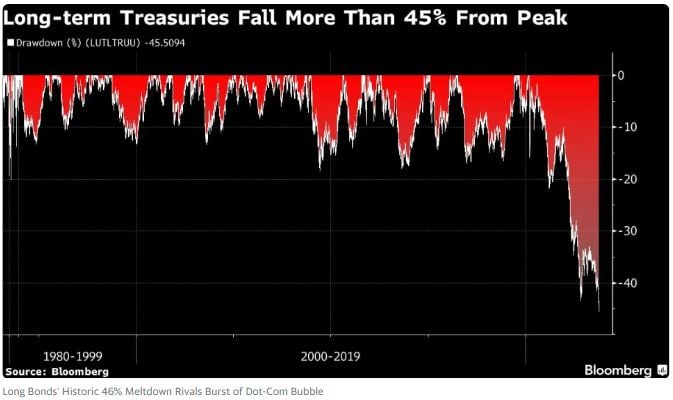

10-Year Treasuries have declined 46% from the peak in March 2020 which is among the greatest meltdowns in financial history including the 49% drop in equities during the Dotcom Bubble

Source: Bloomberg, Barchart

Yields on 10-year Treasuries are now almost equal to the trailing 12-month earnings yield on the S&P 500 index. This is the first time that's the case going back to 2002

Source: Bloomberg, Lisa Abramowitz

Is China to blame for the rise in US long rates?

China has cut its holdings in US Treasuries to $822bn, lowest level since 2009. Beijing has been selling $300bn in Treasuries since 2021, & pace of Chinese selling has been faster in recent months, Apollos's Slok has calculated. Source: HolgerZ, Bloomberg

Incredibly, ultra long-duration Treasury bonds have now lost more in % terms than stocks did during Great Financial Crisis

The drawdown in extended duration Treasury ETF ( 58.3%) now exceeds PEAK-TO-TROUGH losses in S&P 500 during stock market crash of 2007 - 2009 (56.0%) Source: Jack Farley

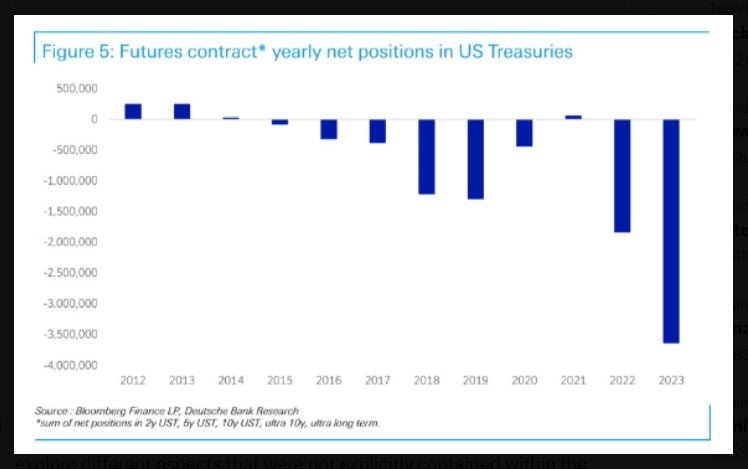

Hedge funds have now built the largest short position in U.S. Treasuries in history

Source: DB, barchart

Investing with intelligence

Our latest research, commentary and market outlooks