Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- warren-buffett

- nasdaq

- oil

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- cash

- semiconductor

- vix

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

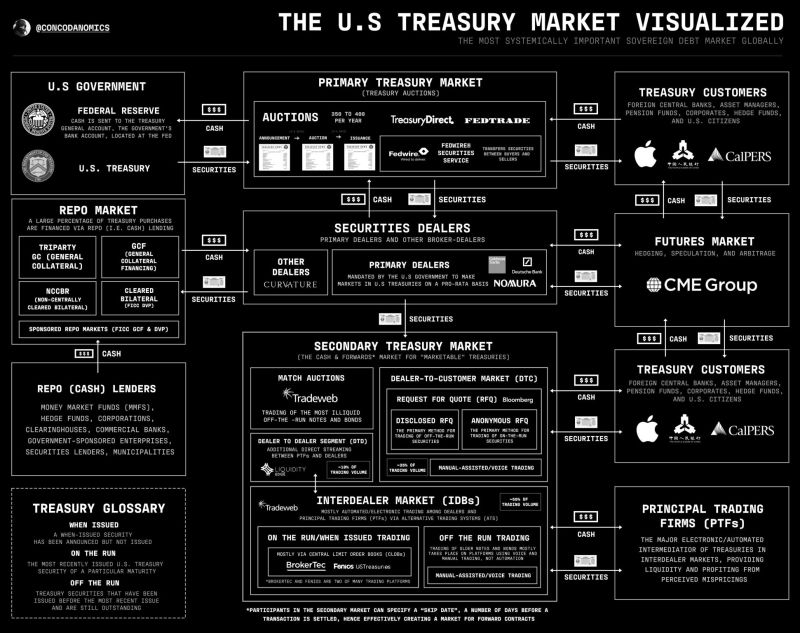

The U.S. Treasury market visualized

Source: X @concodanomics thru Audrey Wang, CFA🇭🇰

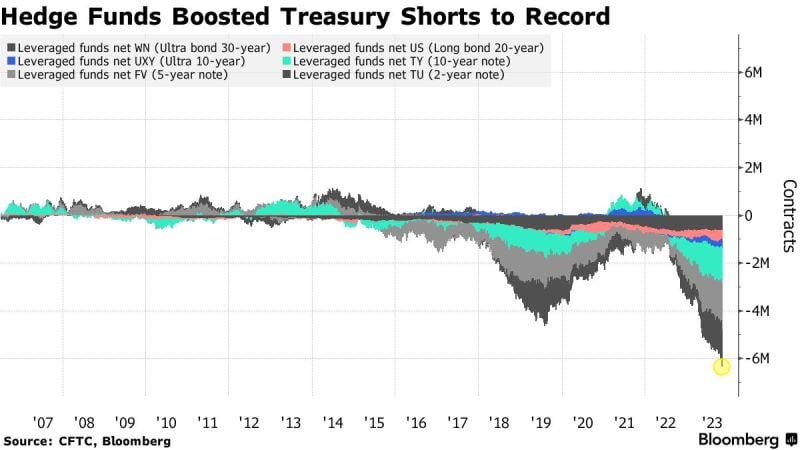

Hedge Funds extended short positions on Treasuries to a record just before smaller-than-expected US bond sales and weaker jobs data spurred a rally

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before. Source: Bloomberg

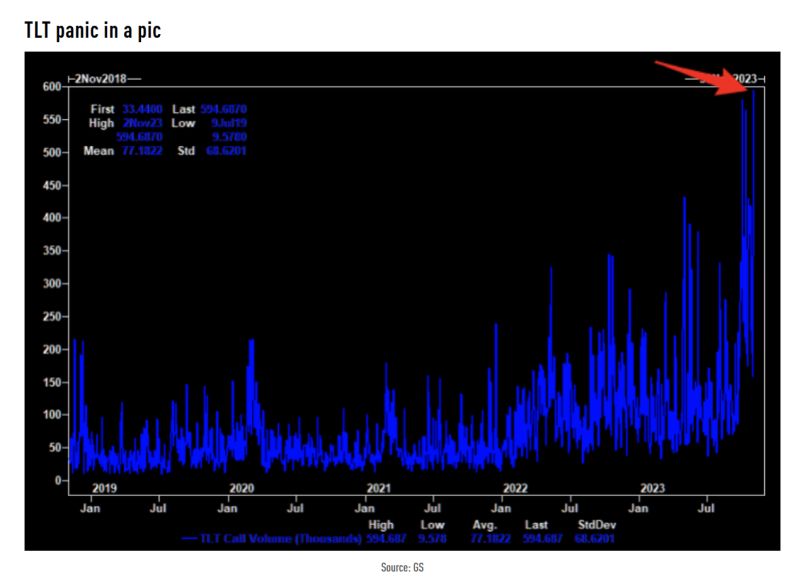

The crowd is piling into TLT (iShares US Treasuries 20y+ ETF) calls

Friday was the largest TLT call volume ever. Source: TME, GS

While there are reasons to turn tactically bullish on long dated US Treasuries ->

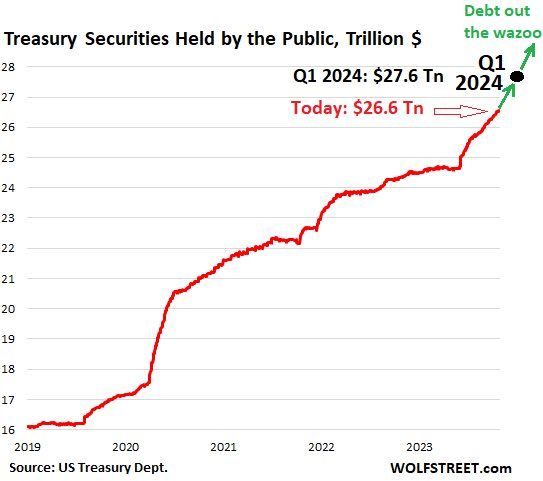

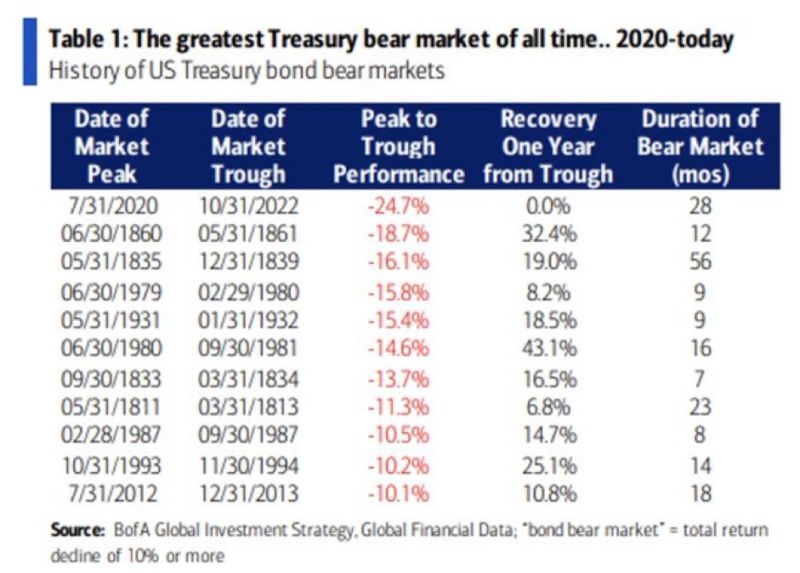

Let's not forget that Treasury supply (at the time of QT and waning demand stemming from China, Saudi and the likes) remains a headwind for the bond market

Marketable US Treasury Debt to Explode by $2.85 Trillion in the 10 Months from End of Debt Ceiling to March 31, 2024

In total, over those two quarters marketable debt will have increased by $1.59 trillion! This follows the $1.01 billion increase in Q3, and the surge in June after the debt ceiling ended. At the beginning of Q4, marketable debt outstanding was $26.04 trillion. The government will add $1.59 trillion to it, pushing it to $27.6 trillion by March 31, 2024. Source: Wolfstreet, WallStreetSilver

The US treasury curve is going in all directions

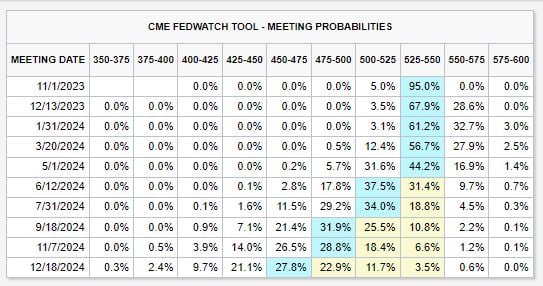

Interest rate futures are beginning to price-in a potential rate CUT this week, at a 5% chance. Meanwhile, the base case still shows rate cuts beginning in June 2024. However, odds of another HIKE in January 2024 are now up to ~36%... Source: The Kobeissi Letter

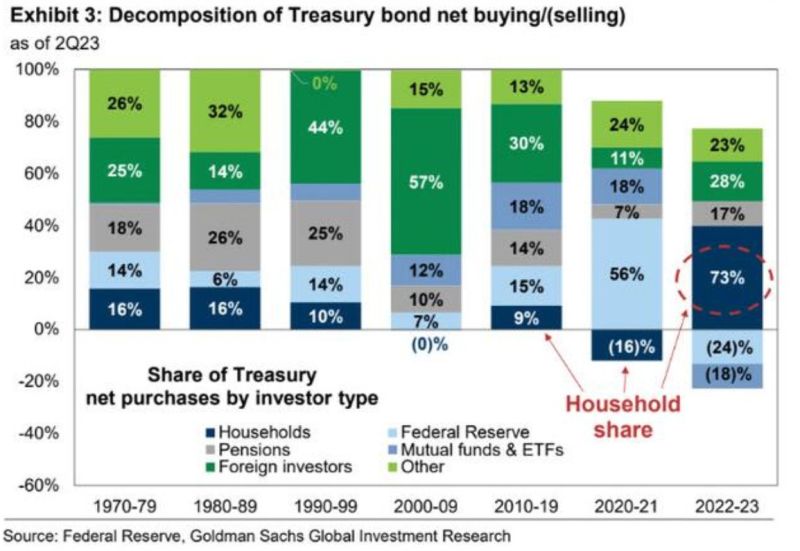

Adding to that Great Rotation theme is this chart

US households account for 73% of Treasury bond buying in 2022-2023 (so far) A lot of pain being experienced for those not willing to hold to maturity amid this bond blood bath... Source: Markets & Mayhem, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks