Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- warren-buffett

- nasdaq

- oil

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- cash

- semiconductor

- vix

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

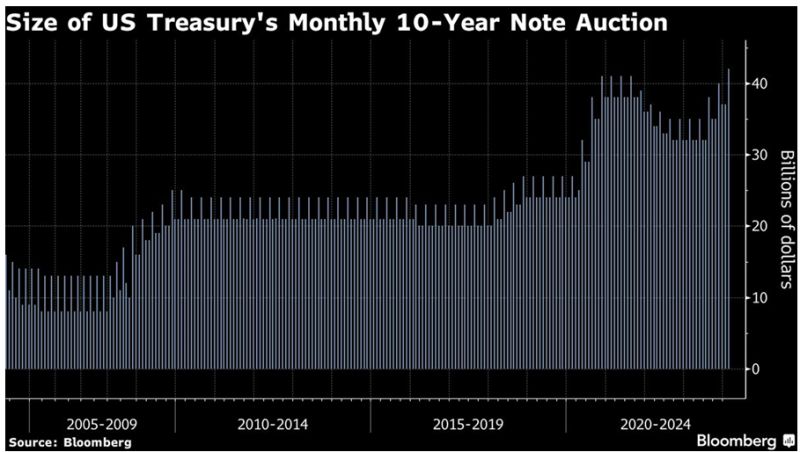

The US government sold a record $42 billion of 10-year notes Wednesday at a lower-than-anticipated yield.

The notes were awarded at 4.093%, compared with a when-issued yield of about 4.105% moments before 1 p.m. New York time, the bidding deadline. The lower yield indicates stronger demand than traders anticipated. The auction result broke a streak of tails — or a weaker result for the previous four monthly sales . source : bloomberg

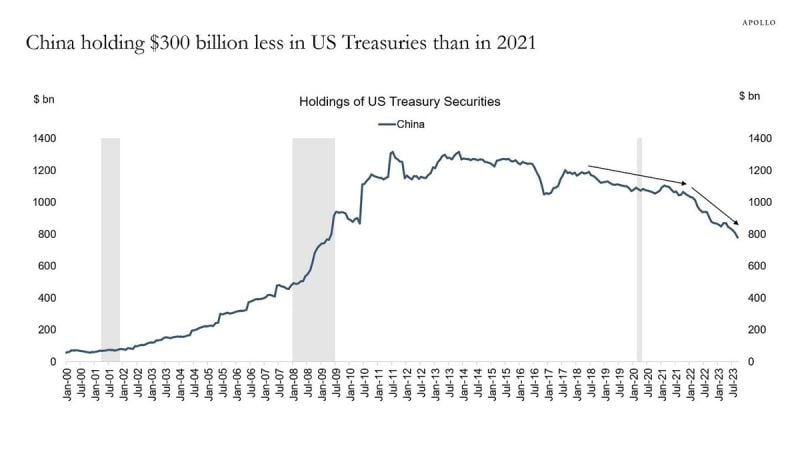

China's holdings of US Treasuries continue to move in a straight line lower

Their holdings of US Treasuries have declined by $300 billion since 2021. Currently, China holds just under $800 billion of US Treasuries, levels not seen since 2009. As interest rates are peaking, the foreign private sector has been slowing purchases. Also, as China faces increasing economic headwinds, it is likely this trend resumes.

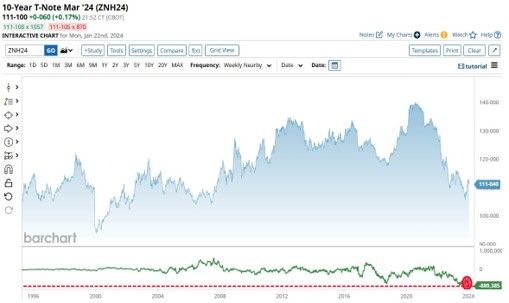

10-Year Treasury Largest Short Position in History 🚨: Hedge Funds are now short more than 889,000 contracts on the 10-Year Treasury, the largest 10-Year Treasury short position in history

Source: Barchart

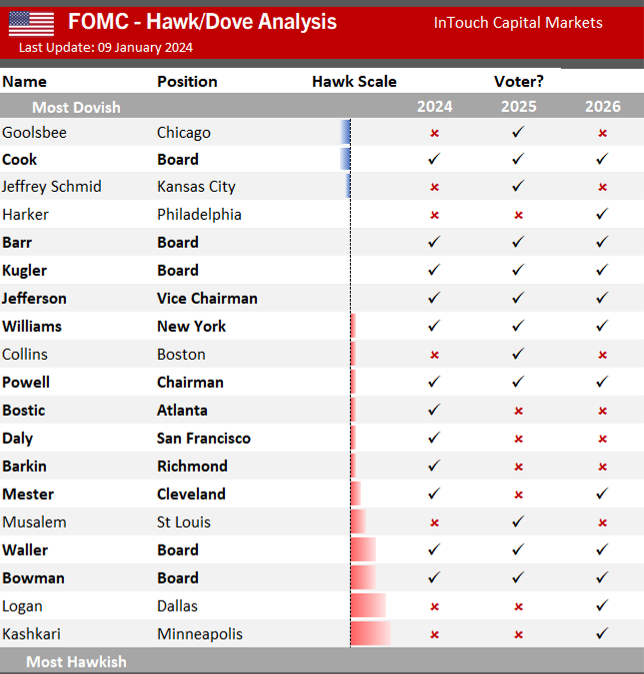

📊 Fed Watch: Insights from Key Fed Members!

This week, several prominent Federal Reserve members shared their perspectives on monetary policy. These insights reflect a general sentiment among Fed speakers that challenges the current market expectations of numerous rate cuts in 2024. They emphasize the importance of data and a measured approach in shaping monetary policy decisions. Here's a snapshot of their views, along with a special focus on the dovish/hawkish scale by Fed members: 🔹 Austan Goolsbee (President, Chicago Fed) highlighted the need for a data-driven approach, suggesting that a continued decline in inflation would merit discussion of cutting interest rates. However, he stressed the importance of evaluating the data meeting by meeting. 🔹 Raphael Bostic (President, Atlanta Fed) urged caution on interest-rate cuts, emphasizing the need to navigate unpredictable events. He believes it would be unwise to rush into rate cuts and wants more evidence of inflation reaching the 2% target. 🔹 Patrick Harker (President, Philadelphia Fed) highlighted the importance of "soft data" from district sources, providing valuable insights for policymakers in setting monetary policy. 🔹 Christopher Waller (Fed Governor) advocated a cautious and systematic approach to rate cuts, emphasizing that the FOMC should move carefully based on data. Check out the dovish/hawkish scale by Fed members for a deeper understanding of their stances. Source: Bloomberg #FederalReserve #MonetaryPolicy #EconomicOutlook

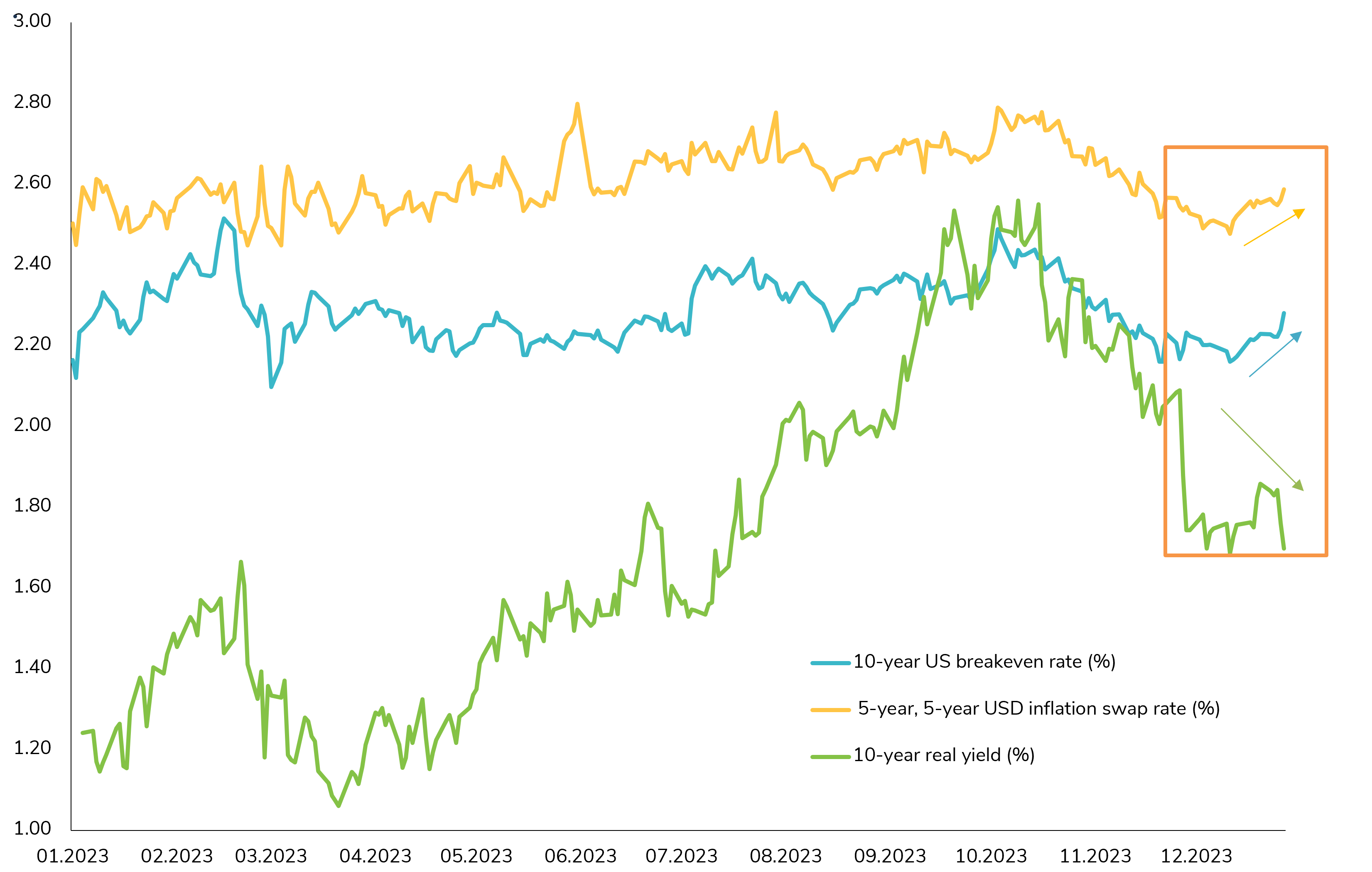

The Dynamic of Rising US Treasury Yields and Inflation Expectations 📈

As we move further into the new year, there's a noteworthy trend unfolding in the world of finance - the steady rise of the 10-year US Treasury nominal yield. However, it's not as straightforward as it may seem. While many have been discussing the prospect of strong disinflation, what's actually exerting pressure on higher rates are the increasing long-term US inflation expectations. You can see this clearly in the chart below, which tracks the 10-year US breakeven (BE) rate and the 5-year, 5-year USD inflation swap rate. Both have climbed by more than 10 basis points, while the US real rate remains lower than at the beginning of the year. So, what is the market pricing in? Is it a reflection of the Federal Reserve's successful navigation toward a soft landing for the US economy? Or is it a response to rate-cut expectations, hinting at the resilience of the US economy? The dynamics at play here are fascinating and open up a world of possibilities. As we continue to monitor these developments, it's clear that 2024 holds some intriguing questions for investors. Source: Bloomberg

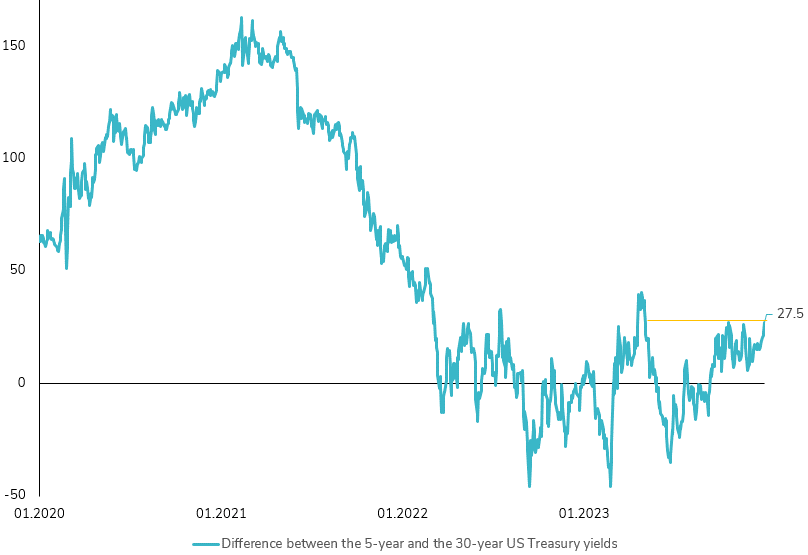

US Treasury Yield Curve Faces Crucial Test Today

Today, the US Treasury market faces a crucial test. Since its low in early December 2023, the spread between the 5-year and 30-year US Treasury yields has surged by 20bps, now touching the highs seen in June 2023. This significant shift sets the stage for today's key event: a $21 billion auction of 30-year US Treasury bonds. 🔍 Notably, the absence of 30-year bond maturities this month suggests that demand will likely stem from investors looking to lengthen their portfolio's duration. This development comes at a time when concerns were already mounting about the long end of the US Treasury yield curve, driven by factors such as negative US term premiums, a heavy supply forecast for Q1, and a resilient US economy that had witnessed a strong rally at the end of 2023. 🏦 This evening's auction is more than just a routine procedure; it's a litmus test for the supply-demand dynamics in the Treasury market. The results will be telling, offering vital insights into market sentiment and future directions, particularly regarding long-term government debt. Keep an eye out for our analysis on the outcome and implications of this pivotal financial event. #Finance #USTreasury #EconomicIndicators"

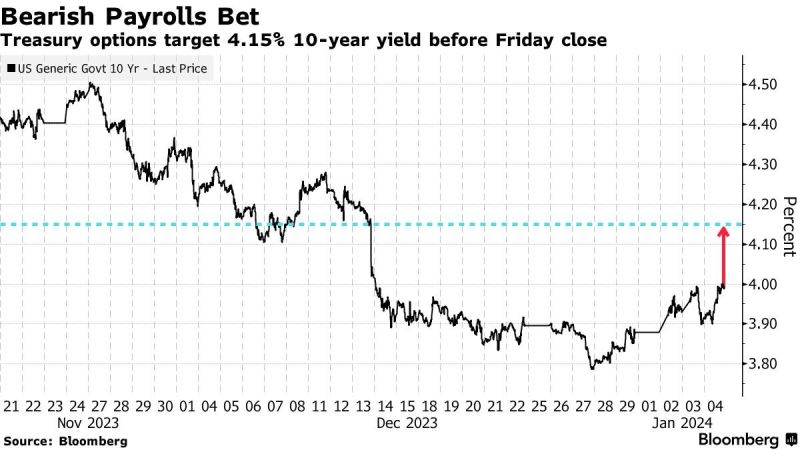

10-Year Treasury Yield Options Bet

Ahead of US jobs data, an Options Trader bet $625,000 that the 10-Year Treasury Yield would surge to at least 4.15% by Friday's close. If the yield were to jump to 4.20%, the bet would pay the trader $10 million in profit. Source: Barchart, Bloomberg

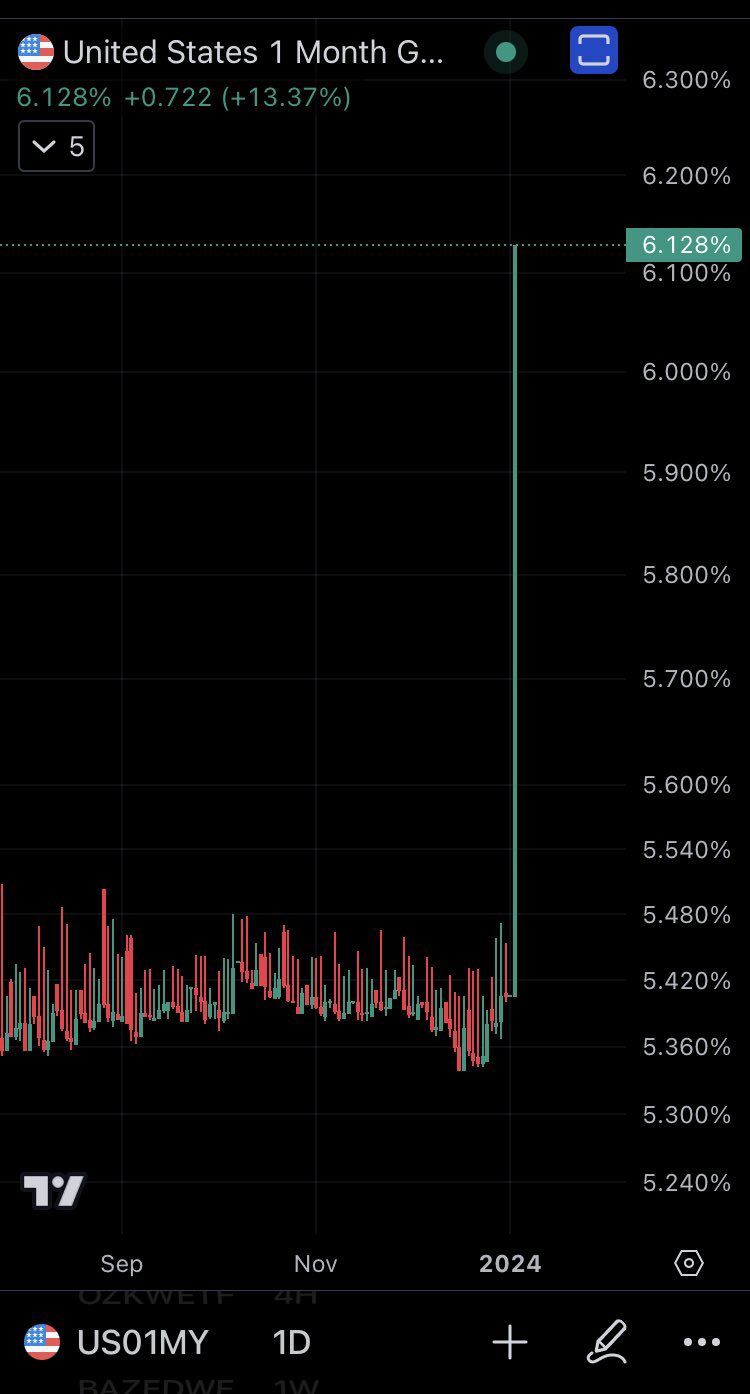

NEWS - The 1-month T-bill yield in the US surged by 13% in one day, coinciding with a significant increase in Bitcoin (now trading above 45k for the 1st time

Typically, sharp spikes in short-term T-bill yields suggest a large financial entity collapsing. Source: Dump Watcher

Investing with intelligence

Our latest research, commentary and market outlooks