Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

BREAKING 🚨: U.S. Treasury

U.S. Treasuries are now paying out $2 million per minute! Source: Barchart

In case you missed it: 2-Year Treasury Yield jumps above 5% to its highest level since November 10

Source: Barchart

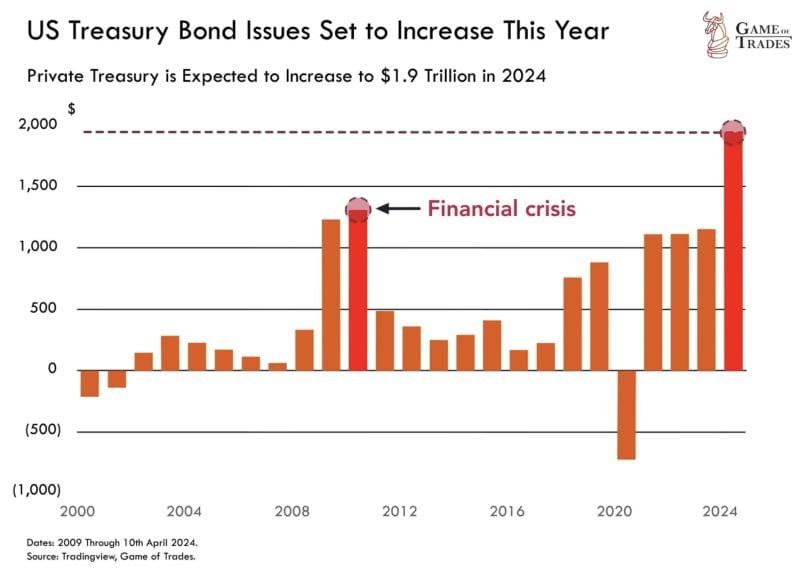

To the moon!!! US Treasury boosts April-June borrowing estimates to $243b from $202b.

US reiterates a cash-balance estimate of $750bn for the end of June. US Treasury cites lower cash receipts for bigger borrowing estimates. No Mrs Yellen, this is not virtual reality... (picture stollen to Jim Bianco)

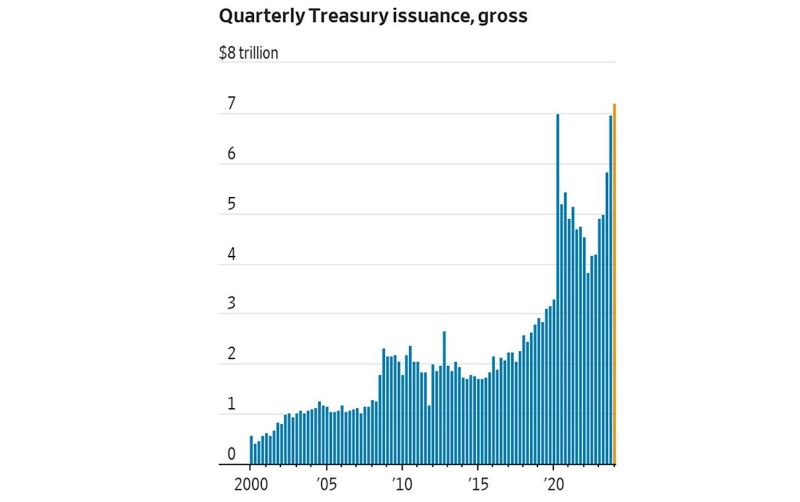

Current treasury issuance exceeded the level seen only during the deepest Covid lockdown.

At full employment, imagine what will happen during next recession. Source: Michel A.Arouet

According to Alfonso Peccatiello, a $1 trillion worth liquidity wave is about to be unleashed on the US economy!

He is not talking about Powell or the Fed. He is talking about Treasury Secretary Yellen unleashing a large sum of stimulus further boosting the US economy right before elections! How? By almost emptying a $1 trillion+ Treasury General Account!

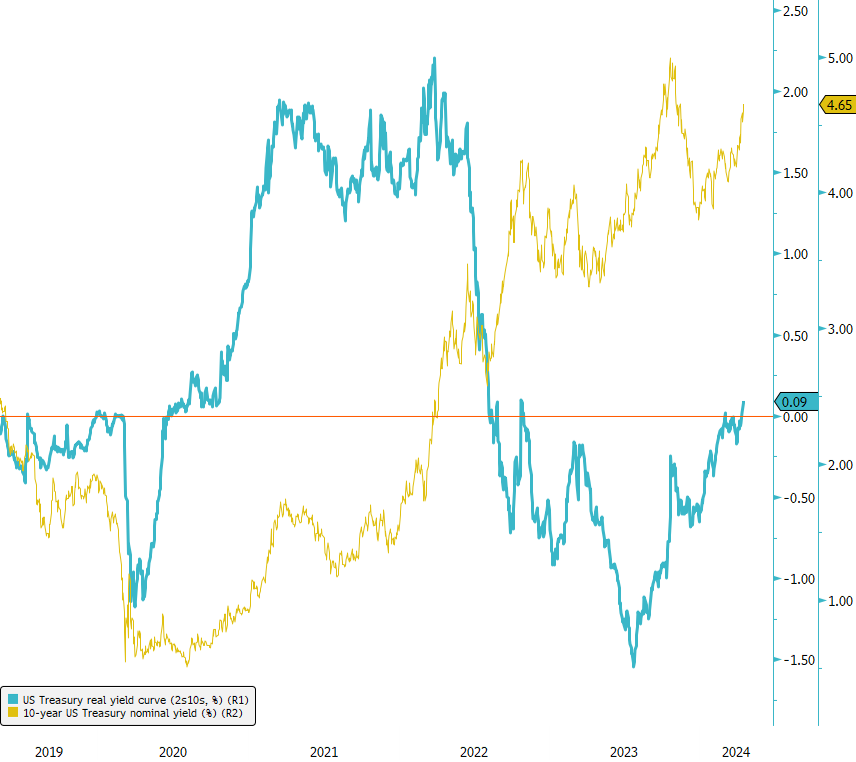

US Treasury Real Yield Curve Returns to Positive Territory!

The US Treasury real yield curve (2s10s) has shifted back into positive territory for the first time since 2022. This comes on the heels of a pronounced steepening trend that has unfolded since the beginning of the year. While this development is certainly noteworthy, it's essential to note that the current real yield curve level still trails its historical average, hovering around 0.6%. The recent uptick in interest rates, combined with the steepening of the real yield curve, raises questions about the potential implications for risky assets. Indeed, we're already witnessing some early signals in the High Yield market. The CDX HY index, which monitors single CDS of US HY companies, has shown notable widening from 310bps to 370bps over the past few weeks, indicating heightened risk perceptions among investors. With this in mind, how might further increases in interest rates, combined with a steeper real yield curve, impact risky assets moving forward? Source: Bloomberg

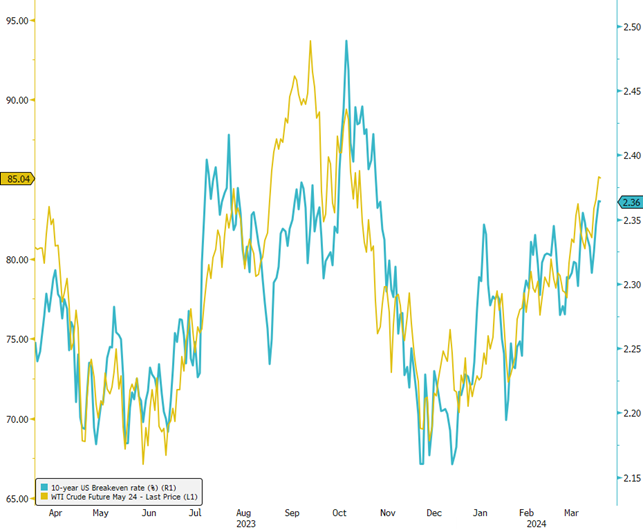

Impact of Higher Oil Prices on US Breakeven Rates 🛢️

📈 In recent months, the surge in oil prices has played a pivotal role in the noticeable increase in US Long Term breakeven rates, with a significant rise of 20 bps since the end of December. This trend underscores the nuanced dynamics that influence US Treasury nominal rates, which are comprised of the sum of real yields and inflation expectations (as captured by breakeven rates), alongside the impact of the term premium on longer maturities. Traditionally, long-term US breakeven rates have closely mirrored the Federal Reserve's inflation target of 2%, maintaining a 25-year average of 2.05%. This long-term alignment has served as a benchmark for inflation expectations and a guide for monetary policy. However, the aftermath of the pandemic has ushered in an era of elevated breakeven rates, with the 10-year US Breakeven rate averaging 2.33% since September 2020. This elevation signals market anticipations of persistently higher inflation over the next decade, influenced by factors such as deglobalization trends, sustained supply chain challenges, and increased commodity prices, notably oil. The correlation between rising oil prices and the uptick in US Long Term breakeven rates is stark, highlighting how energy costs can act as a bellwether for inflation expectations. The accompanying chart illustrates this relationship, with oil prices' sharp rebound since December propelling breakeven rates upwards, suggesting a potential for continued increases. This resurgence in oil prices coincides with a broader recovery in global economic activity, posing significant considerations for the Federal Reserve's approach to monetary policy. The crucial question now is whether the Fed will adjust its easing policy plan in response to these inflationary signals. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks