Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

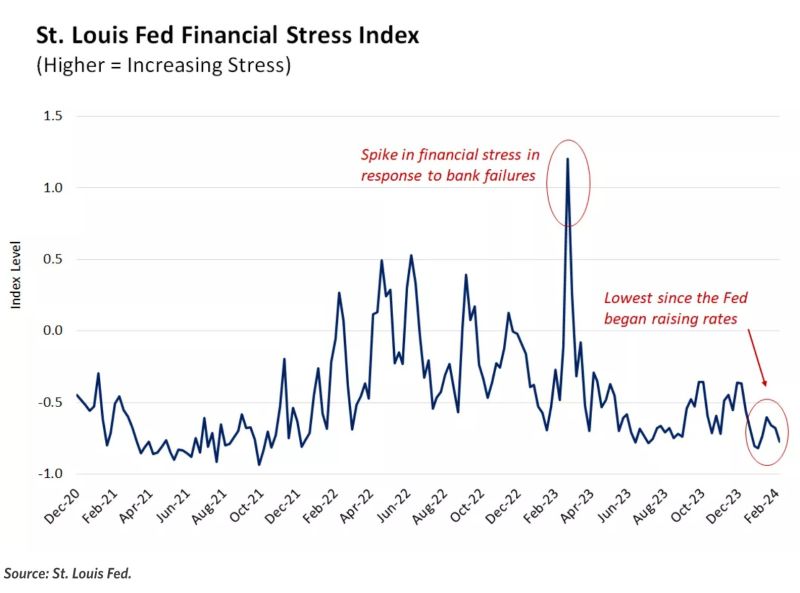

Financial stress is the lowest since the Fed began raising rates, which begs the question -- why cut this year? 🤔

Source: Markets & Mayhem, St Louis Fed

The Atlanta Fed's gauge of sticky inflation has risen to about 5% on a 3-month annualized basis.

Inflation is moving in the wrong direction for the Fed, so it's interesting that the market's base case is still that the Fed is going to cut rates by about 100bp by January 2025. Source: Bloomberg, Lisa Abramowitz.

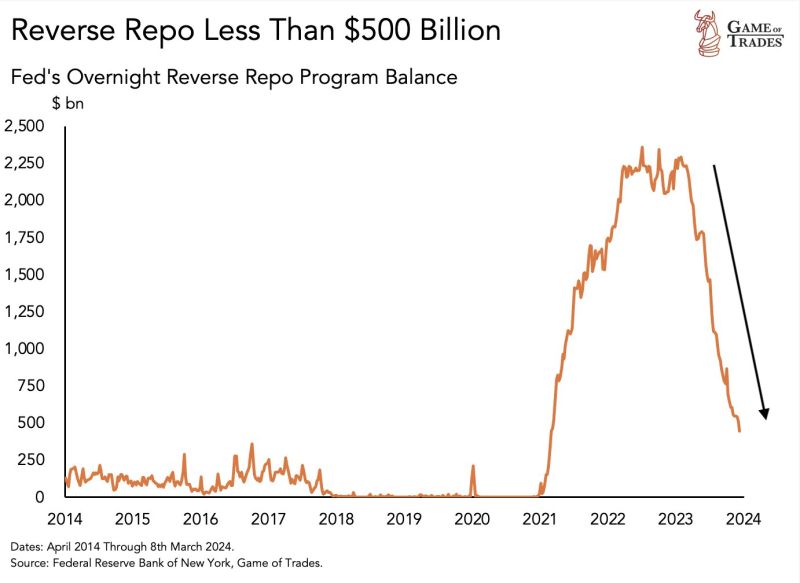

WARNING: Reverse Repo is falling off a cliff.

And has declined from more than $2500 billion to less than $500 billion since 2023. Source: Game of Trades

With Powell's remarks, Wall Street's hopes for a March rate cut (once 97%) officially hit 0.

With Powell's remarks today, Wall Street's hopes for a March rate cut (once 97%) officially hit 0. "Maybe he should consider using models that have been consistently accurate, instead of listening to those who give him 'different answers' (his words) that have been consistently wrong." From : Mitchel Krause, hedgeye : With Powell's remarks today, Wall Street's hopes for a March rate cut (once 97%) officially hit 0. "Maybe he should consider using models that have been consistently accurate, instead of listening to those who give him 'different answers' (his words) that have been consistently wrong." From : Mitchel Krause, hedgeye :https://app.hedgeye.com/insights/147337-mitchel-krause-how-wall-street-s-hopes-for-march-cuts-quickly-collaps?type=guest-contributors

Goldman Sachs' analysts no longer expect a U.S. interest rate cut in May and see four 25 basis point cuts this year.

"Because there are only two rounds of inflation data and a little over two months until the May (Fed) meeting, the comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely," Goldman Sachs analysts said in a note. They now forecast an extra cut next year instead, with an unchanged terminal rate forecast of 3.25-3.5%." source : goldmansachs, reuters

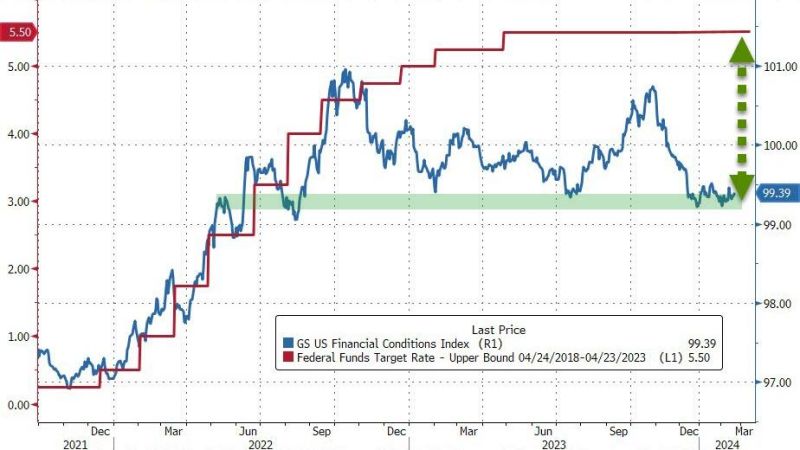

US financial conditions are very easy compared to Fed Funds...

Too easy? Bear in mind what the FOMC said in the Minutes on Wednesday: "Several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall." Could this lead the fed to keep rates higher for longer? How long will the market be able to shrug off high rates and higher bond yields? Source: www.zerohedge

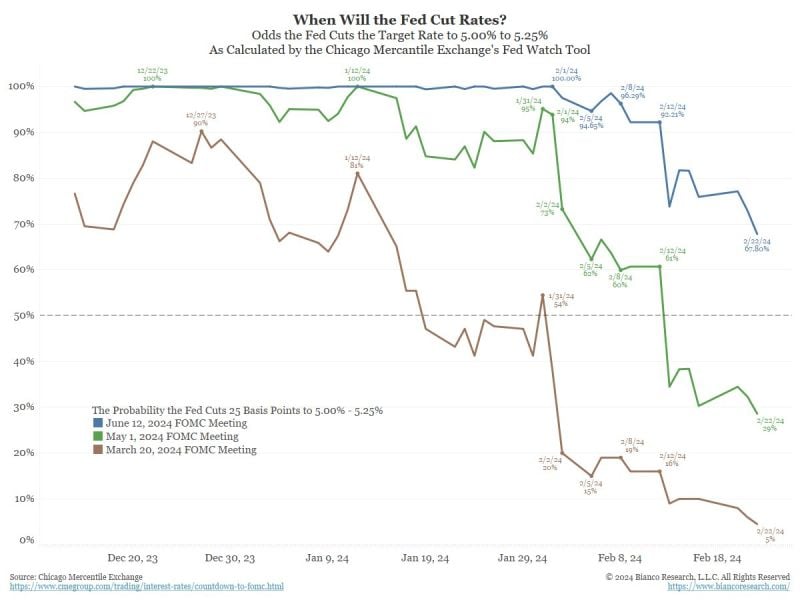

This chart shows the market pricing of a rate cut over the next three FOMC meetings.

March probability = 5% (was 80% at the start of the year) May probability = 29% (was 100% at the start of the year) June probability = 67% (was 100% at the start of the year) Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks