Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

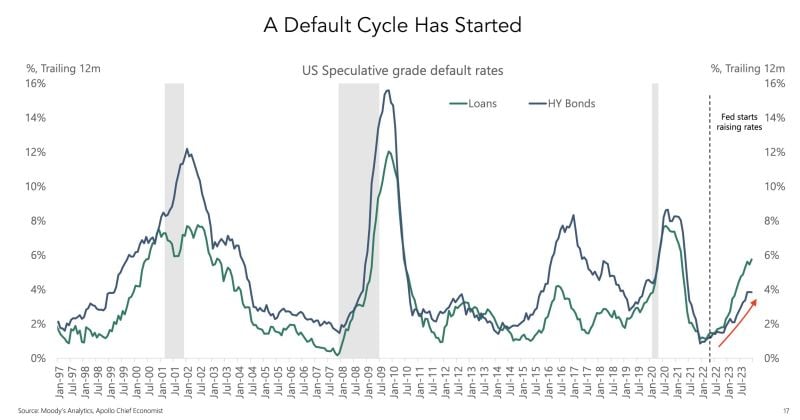

FOMC Minutes Show 'Most Officials Fear Risk Of Cutting Too Quickly'

The discussion came as policymakers not only decided to leave their key overnight borrowing rate unchanged but also altered the post-meeting statement to indicate that no cuts would be coming until the rate-setting Federal Open Market Committee held “greater confidence” that inflation was receding. The meeting summary indicated a general sense of optimism that the Fed’s policy moves had succeeded in lowering the rate of inflation, which in mid-2022 hit its highest level in more than 40 years. However, officials noted that they wanted to see more before starting to ease policy while saying that rate hikes are likely over. Members cited the “risks of moving too quickly” on cuts. Source: CNBC Activate to view larger image,

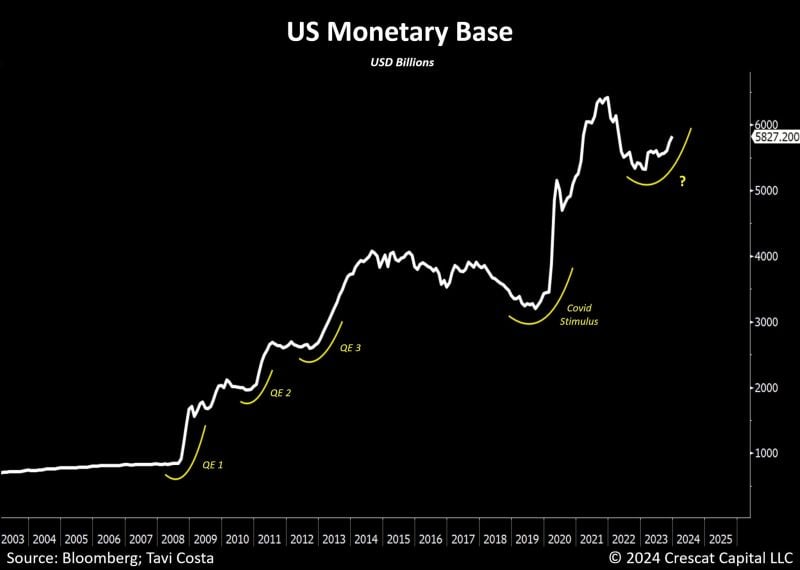

The US monetary base has been rising significantly recently.

In the last 12 months alone, there has been a rise of $420 billion, primarily fueled by bank reserves. While the Fed should not classify this as QE due to mechanical differences, it seems to echo the patterns of previous periods of monetary stimulus following the Global Financial Crisis. The economy (and markets) are addicted to liquidity. Source: Bloomberg, Tavi Costa

A rare image of a dove...

The Federal Reserve should cut rates in March says former St. Louis Fed President James Bullard Source: Barchart, FT

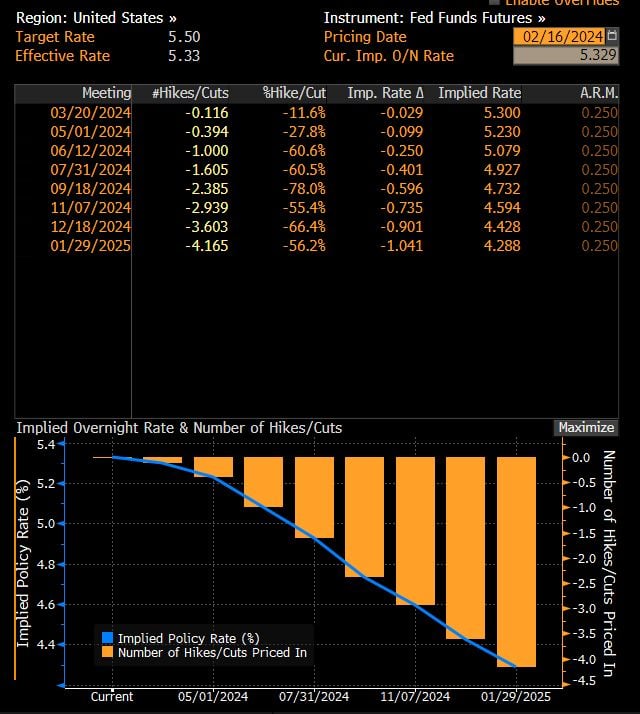

Traders no long expect Fed to cut rates in May and switched to June.

*Approximately 90 bps of cuts are now priced in for the full year, down from 137 bps expected before the Jan. 30-31 FOMC meeting. Source: Bloomberg

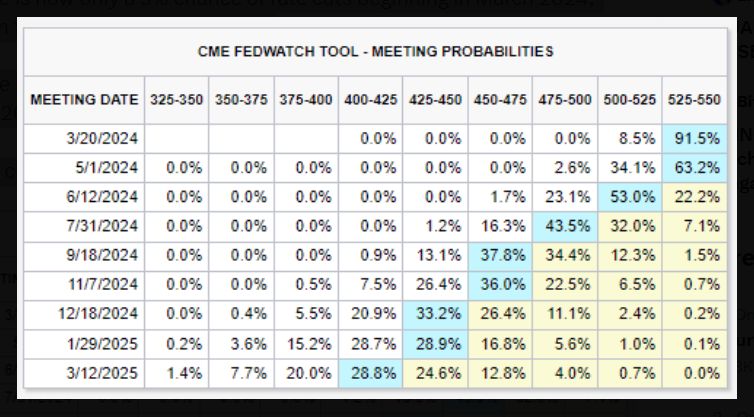

It's official, higher for longer is back! For the first time this year, markets are now pricing-in just 4 interest rate cuts in 2024.

Just 6 weeks ago, markets were expecting 6 interest rate cuts in 2024. More importantly, the timing of the first rate cut has been pushed all the way back to June 2024. There is now only a 9% chance of rate cuts beginning in March 2024, down from 90% just 6 weeks ago. There is also a ~63% chance that interest rates are unchanged through May 2024. Rate cuts are all but guaranteed. Source: The Kobeissi Letter

Has the fed won the party?

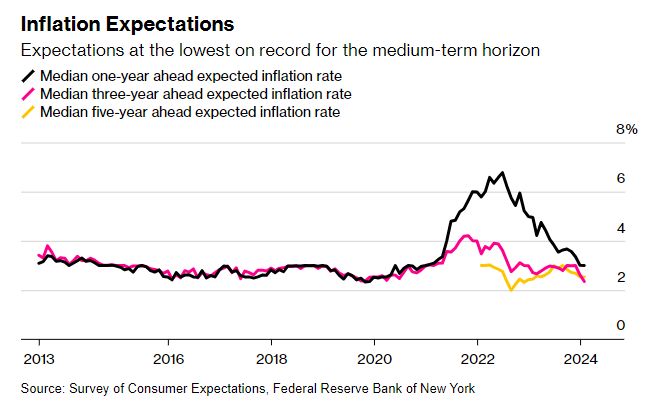

US Medium-Term Inflation Expectations Lowest in 11 Years of Data – Source: Bloomberg

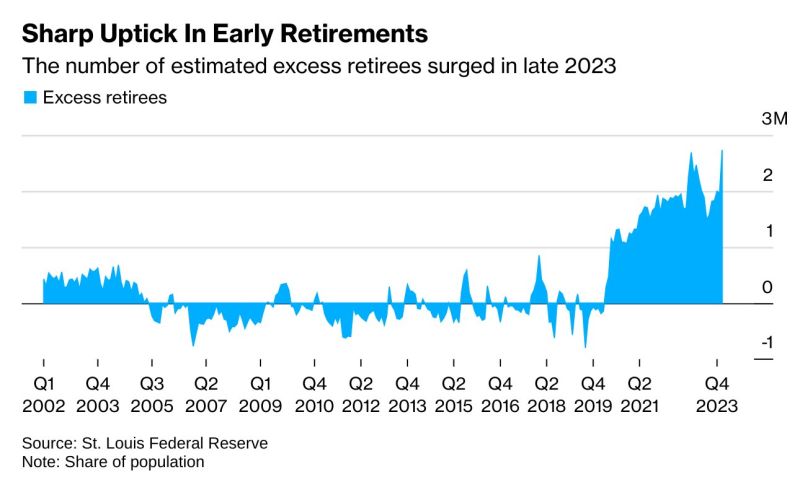

Another wave of early retirements is hitting as the stock market surges

This complicates the Fed's goals for the labor market to some degree, as it means there are more exiting the workforce. There's already 1.45 jobs available for every unemployed person seeking work. Source: Bloomberg, Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks