Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

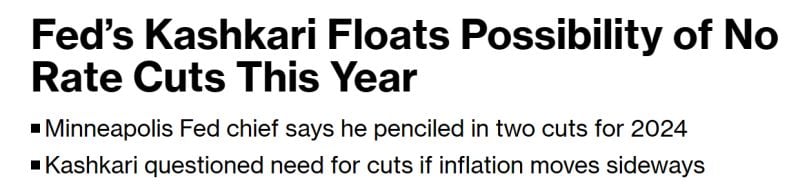

Some hawkish comments by fed officials seemed to be behind yesterday sell-off in stocks.

Among the comments: *BARR: BANKS' OFFICE COMMERCIAL REAL-ESTATE ISSUES TO TAKE TIME *KUGLER: `SOME LOWERING' OF RATES THIS YEAR LIKELY APPROPRIATE *FED'S HARKER SAYS INFLATION IS STILL TOO HIGH *BARKIN: FED HAS TIME TO GAIN MORE CLARITY BEFORE LOWERING RATES *GOOLSBEE: WORTH STAYING ATTUNED TO DETERIORATION IN JOBS MARKET *MESTER: NEED MORE PROGRESS ON HOUSING, CORE SERVICES INFLATION But the key market driver (to the downside) was Kashkari - President and CEO of the Federal Reserve Bank of Minneapolis - who hinted at the potential of NO RATE-CUTS. *KASHKARI: QUESTION OF WHY CUT RATES IF ECONOMY REMAINS STRONG “In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target,” Kashkari said in a virtual event with LinkedIn on Thursday. “If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.” His comments seemed to trigger a wave of selling in stocks.

NOTHING NEW FROM POWELL YESTERDAY...

Fed Chairman Powell reiterated the Federal Reserve's cautious stance on interest-rate cuts, stating that they would wait and observe before making any decisions. While Powell didn't introduce any significant changes, his comment provided relief to Wall Street by suggesting that recent inflation data hadn't substantially altered the overall economic outlook. He also reiterated the likelihood of rate reductions at some point during the year. “On inflation, it is too soon to say whether the recent readings represent more than just a bump,” Mr. Powell stated. “We do not expect that it will be appropriate to lower our policy hashtag#rate until we have greater confidence that inflation is moving sustainably down toward 2 percent.” At the same time, he said that cuts to the benchmark federal funds rate are “likely to be appropriate at some point this year” as he does not believe “inflation is reversing higher.”

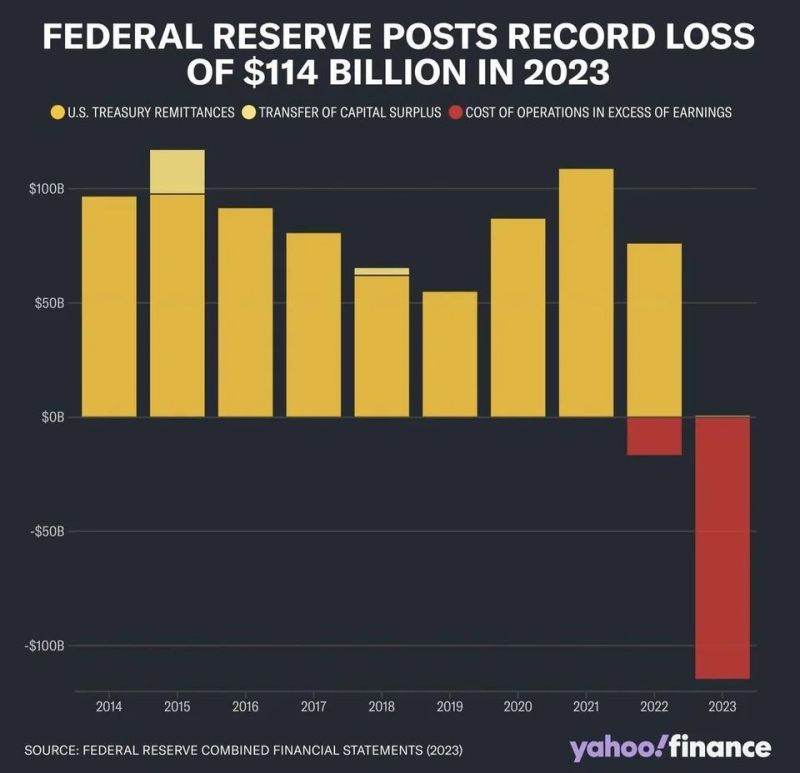

BREAKING: Federal Reserve

The Fed said on Tuesday that it officially saw a net negative income of $114.3 billion in 2023, a record loss tied to expenses related to managing the U.S. central bank's short-term interest rate target. The loss last year follows $58.8 billion in net income in 2022, the Fed said. Source: Barchart

THE WEEK AHEAD... All eyes on inflation data + Powell speech on Friday

>>> In the US: 1. New Home Sales data - Monday 2. CB Consumer Confidence - Tuesday 3. US Q4 2023 GDP data - Thursday 4. February PCE Inflation data - Friday 5. hashtag#Fed Chair Powell Speaks - Friday 6. Total of 5 Fed Speaker Events >>> Inflation will also be the key theme in europe as flash CPI reports start to come in. >>> In Japan, the focus will be on the summary of opinions from this week's BoJ meeting as well as the Tokyo CPI, labour market data and industrial production. Picture via openart.ai/midjourney

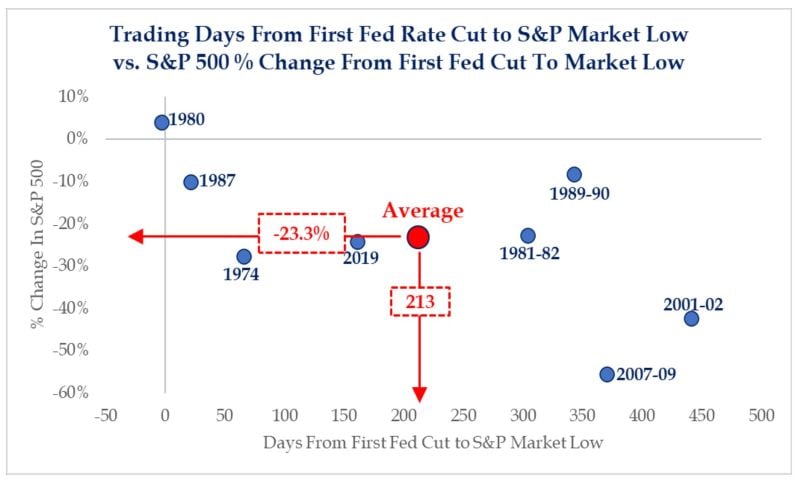

Don't be too excited about Fed rate cuts.

Examining Fed rate cycles since 1970s has revealed that investors have more to fear from 1st cut in a cycle than the pause. On average, sp500 is up +5% over 100 days between last Fed tightening and 1st cut. The trough in broader market is -23% over 200 days after 1st cut in a series, SRP has calculated. Source: HolgerZ

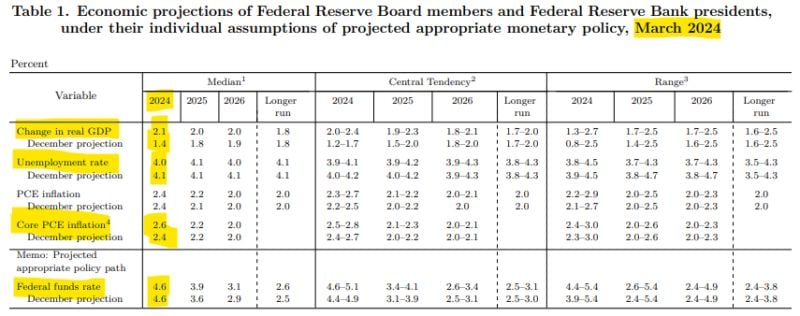

This table explains why markets were soooo... happy yesterday.

As shown by Charlie Bilello: as compared to their December forecasts, the Fed is expecting higher Real GDP growth (2.1% vs. 1.4%), lower Unemployment (4.0% vs. 4.1%), & higher Core PCE Inflation (2.6% vs. 2.4%) but is still anticipating 3 rate CUTS this year. This uber-dovish and bullish for risk assets and gold...

FED holds benchmark rate, May cut remains unlikely

The US Federal reserve holds benchmark rate in 5.25-5.5% target range. Jerome Powell prepared remarks and Q&A answers were more dovish than during the January meeting. FOMC median forecast remains at 75 BPS rate cuts for 2024, but the forecast increased from 3.6% to 3.9% in 2025.

Gold reacted to Powell's dovish tone by jumping to a new record high and breaking the 2200 level.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks