Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

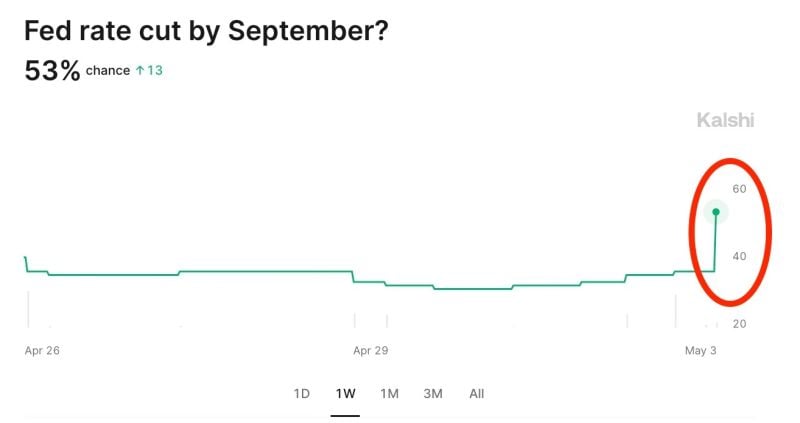

Odds of a September 2024 rate cut jump to 53% after the weaker than expected jobs report, according to Kalshi.

The base case now shows TWO interest rate cuts in 2024, up from ONE prior to the report. On Wednesday, Fed Chair Powell specifically said weakening of the labor market could spur rate cuts. Market implied odds of zero interest rate cuts this year have dropped from 35% to 27%. The Fed rollercoaster ride continues. Source: The Kobeissi Letter

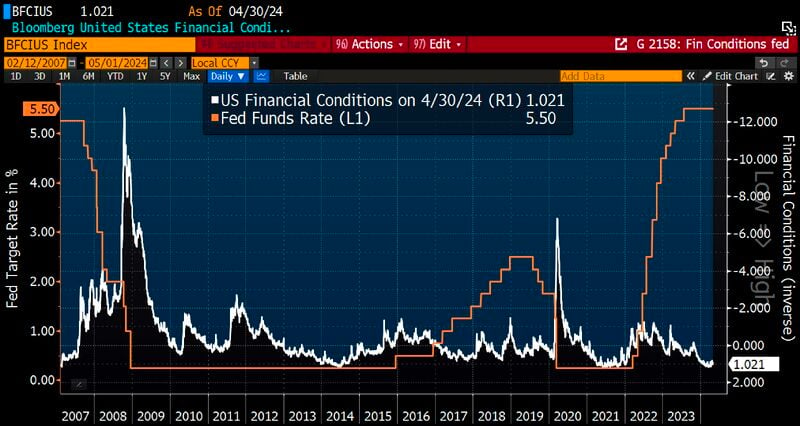

The Fed just eased its policy stance into this...

Source: Lawrence McDonald, Bloomberg

FOMC: No rate change, QT tapering in June is DOVISH (timing + amount)

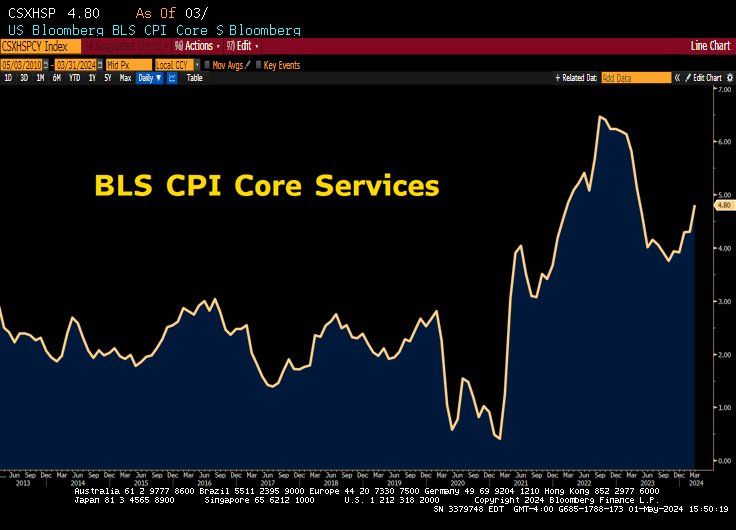

Stocks, bonds, gold, bitcoin are all rallying. dollar dumped In a nutshell: 1. Fed leaves rates unchanged for 6th straight meeting *FED HOLDS BENCHMARK RATE IN 5.25%-5.5% TARGET RANGE 2. Rate cuts not appropriate until greater confidence inflation is heading to 2% 3. Fed adds following sentence to the statement: "In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective." Inflation has eased "but remains elevated" 4. Fed to slow pace of balance sheet runoff starting in June. The Fed is tapering QT by MORE than the $30BN consensus estimate, instead will taper QT by $35BN, meaning monthly redemption cap on us treasuries goes down from $60BN to $25BN (starting June 1st). This means $105BN less gross issuance needed in Q3 (i.e The Fed implicitly saying 'yields are too high'). 5. Fed maintains mortgage-backed securities redemption cap at $35 bln per month, will reinvest excess MBS principal payments into treasuries. 6. Economic activity continues to expand at solid pace, job gains have remained strong, unemployment rate has remained low. 7. Risks to achieving employment and inflation goals 'have moved toward better balance over the past year,' as opposed to 'are moving into better balance' in the March policy statement. 8. Fed Chair Powell says it is "unlikely that the next policy move will be a rate HIKE." BOTTOM-LINE: There are some hawkish comments but overall Fed QT tapering in June is DOVISH (timing + amount) -> Stocks, bonds, gold, bitcoin are all rallying. dollar dumped Fed Chair Powell's press conference is dovish as well in terms of content and the tone of his remarks. As a reminder, we live at a time of fiscal dominance, i.e fiscal policy leads monetary policy.

WELCOME TO FOMC WEEK. Here's what's happening:

In the US: ◦ April ADP employment ◦ April ISM manufacturing ◦ March Job openings ◦ FOMC interest rate decision ◦ Fed Chair Powell press conference ◦ April employment rate ◦ $AAPL, $AMZN, $LLY, $MA, $KO, $AMD, $MCD, $QCOM earnings Rest of the world: ◦ In Europe, the focus will be on April CPI prints as well as the Q1 GDP reports. ◦ The latest economic activity and labour market indicators will also be in focus in Japan, and PMIs are due in China. Source: Trend spider

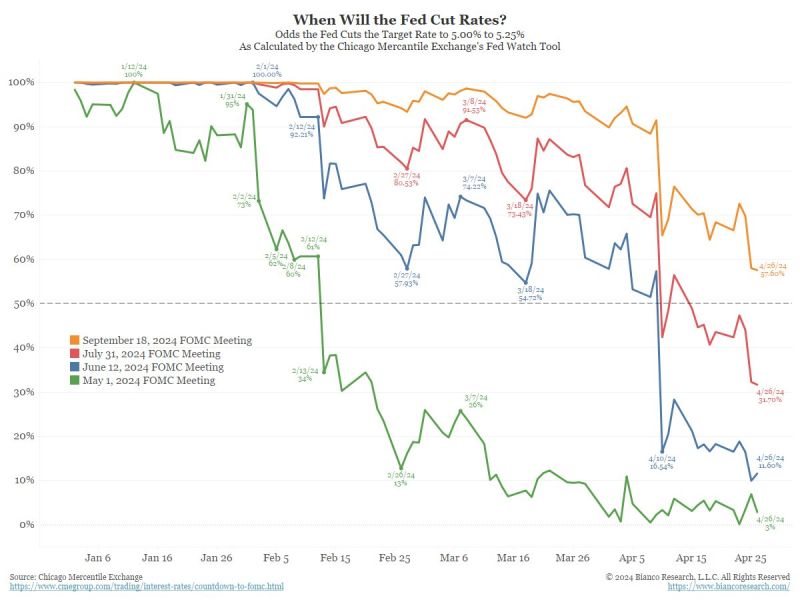

Fed Cut Probability Update - Jim Bianco (Bianco Research)

- May 1 FOMC meeting (green) less than 50% (meaning no move) - June 12 FOMC meeting (blue) less than 50% (meaning no move) - July 31 FOMC meeting (red) less than 50% (meaning no move) - September 18 FOMC meeting (orange) less than 60% (since it is 5 months away, effectively a coin-toss) After this, the next FOMC meeting is Thursday, November 7, two days after the election.

Bonds rally as the Fed’s preferred inflation metric cam out not as bad as feared.

PCE deflator rose to 2.7% in March from 2.5% in Feb vs 2.6% expected. Core PCE, the Fed's preferred measure of underlying price pressures, remained at 2.8%, compared with an anticipated fall to 2.7%. First full rate cut is now priced for November. Note that we now have CPI, PPI and PCE inflation RISING for 2 straight months. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks