Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

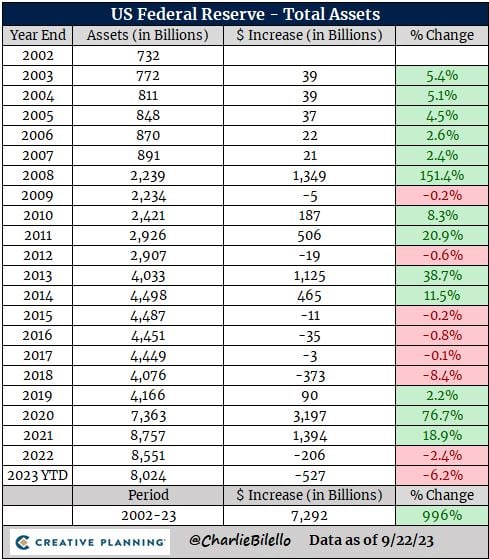

The Fed's balance sheet hit its lowest level since June 2021 this week, down $941 billion from the peak in April 2022

Changes in the Fed's balance sheet since 2002... Source: Charlie Bilello

In case you missed it: now that the Fed's blackout window is over, everyone said the same thing in the days that follow the FOMC meeting: "higher for longer":

*FED'S COLLINS: FURTHER FED HIKES 'CERTAINLY NOT OFF THE TABLE', EXPECT RATES MAY HAVE TO STAY HIGHER FOR LONGER *FED's BOWMAN: MORE RATE HIKES LIKELY NEEDED TO GET INFLATION TO 2%, NEED TO REPEAT MONETARY POLICY ISN'T ON PRESET COURSE *FED'S DALY: I DON'T GET TO A POINT WHERE I'M READY TO DECLARE VICTORY, UNLIKELY INFLATION WILL REACH 2% GOAL IN 2024

Maybe this is why Powell said that a soft landing is not the core scenario...

Recession confirmed?

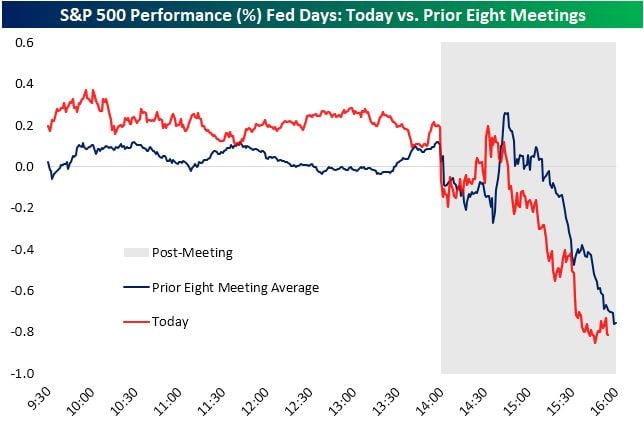

Another Powell Fed Day

Incredible how closely today's action tracked the average. Source: bespoke (read "today" red line as yesterday)

FED'S POWELL:

"I WOULD NOT CALL SOFT LANDING A BASELINE EXPECTATION"

BREAKING: A HAWKISH PAUSE BY THE FED

FOMC KEEPS RATES UNCHANGED AS EXPECTED BUT MAKES CLEAR THAT HIGHER RATES ARE THE NEW NORMAL...US 2y yields hit highest since 2006 after somewhat hawkish Fed. Bottom-line: #Fed futures now no longer show rate CUTS beginning until September 2024. To put this in perspective, three months ago futures were expecting 4 rate CUTS in 2023. Now, interest rates are expected to PAUSE for at least 1 year... One remark: Fed estimates that r* (the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable) remains at 0.5%, and yet rates in 2026, when US debt may hit $50 trillion will be 3%. This means that blended interest on US debt will be ~$2 trillion, double where it is now. Source: Bloomberg, The Kobeissi Letter, HolgerZ, www.zerohedge.com

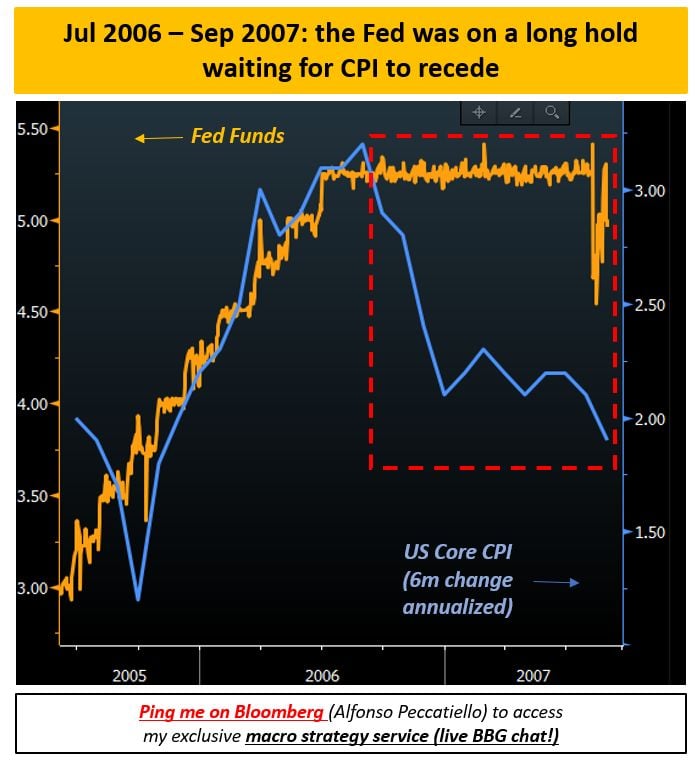

Can be the second half of 2007 be a good parallel for today's market?

As highlighted by MacroAlf, back in 2007, the FED kept rates at 5.25% (orange) despite core inflation was trending around 2% (blue) for quarters already. That ''higher for longer'' stubborness kept policy unnecessarily tight - as we figured out in 2008... Source: Alfonso Peccatiello

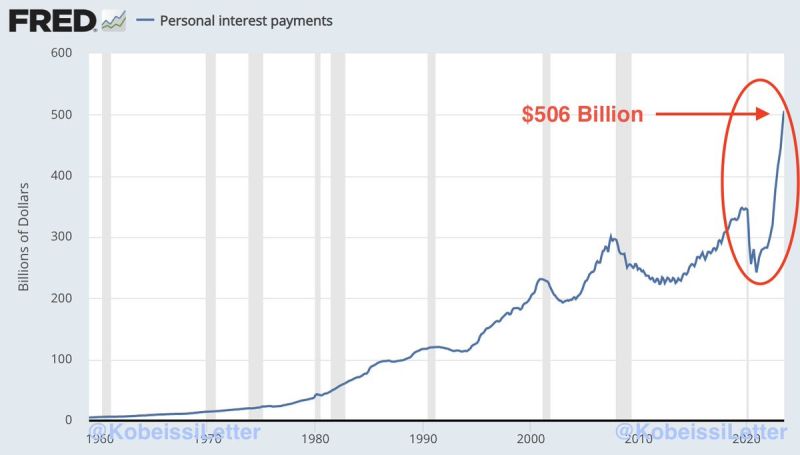

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July

During the first 7 months of 2023, Americans paid a total of $3.3 TRILLION in personal interest. This is up a staggering 80% since 2021 and nearly above the entire 2022 total. The worst part? These numbers do NOT include interest on mortgage payments. Source: The Kobeissi Letter, FRED

Investing with intelligence

Our latest research, commentary and market outlooks