Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

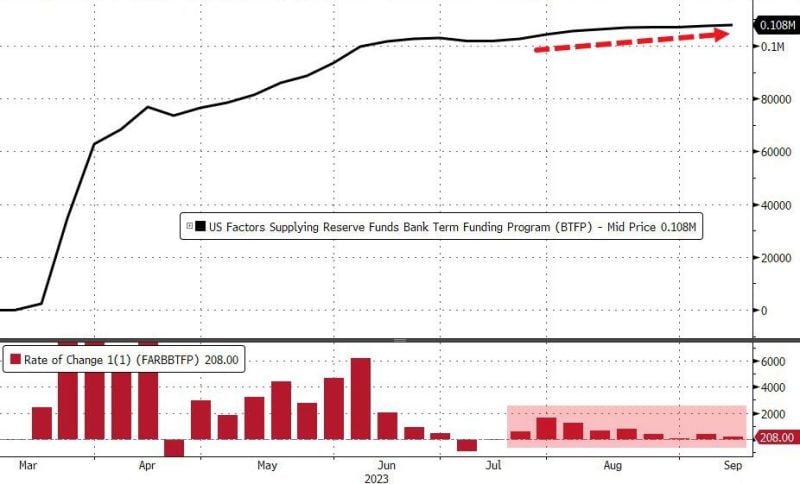

OOPS! A bank liquidity indicator sounds the alarm!

Usage of The Fed's emergency bank funding facility rose once again (+$208M) to a new record high over $108BN as long-term government bond yields keep rising... Source: Bloomberg

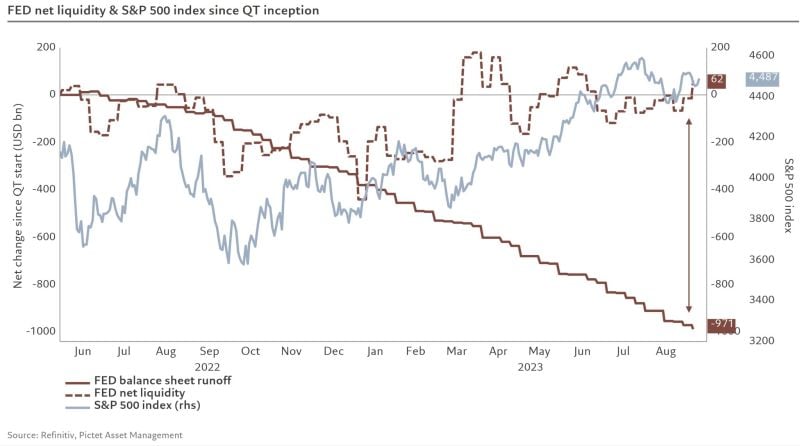

Despite QT of almost 1T$, Fed net liquidity* actually increased fueling the rally in big tech

Remarkable chart from Steve Donze at Pictet Asset Management thru Michel A.Arouet. *Net liquidity is a term that refers to the amount of cash and credit available for transactions, purchases, or investments. It is calculated by adding up the money supply and the outstanding credit in a given currency or region. Source: Pictet Asset Management, Michel A.Arouet

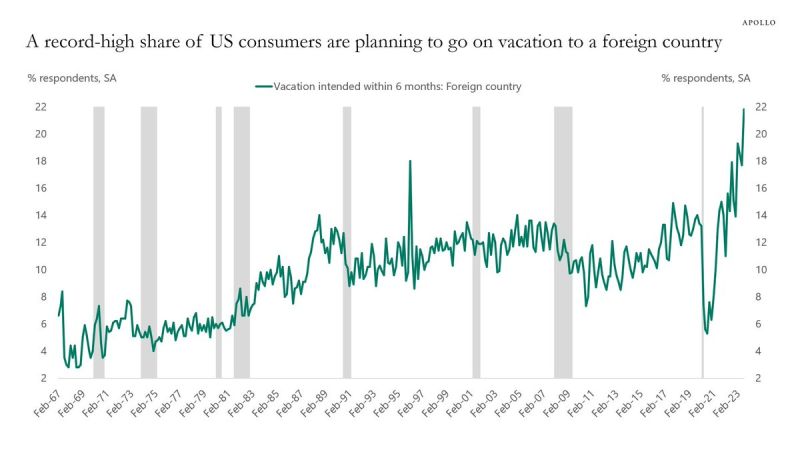

The continued strong demand for consumer services is why the Fed is unable to contain core inflation

According to Apollo, a record 22% of US consumers are planning to vacation in a foreign country. US households want to travel on airplanes, stay at hotels and eat out. The Kobeissi Letter: "That is why inflation in the non-housing service sector continues to be so high. No wonder credit card debt is skyrocketing". Source: The Kobeissi Letter, Apollo

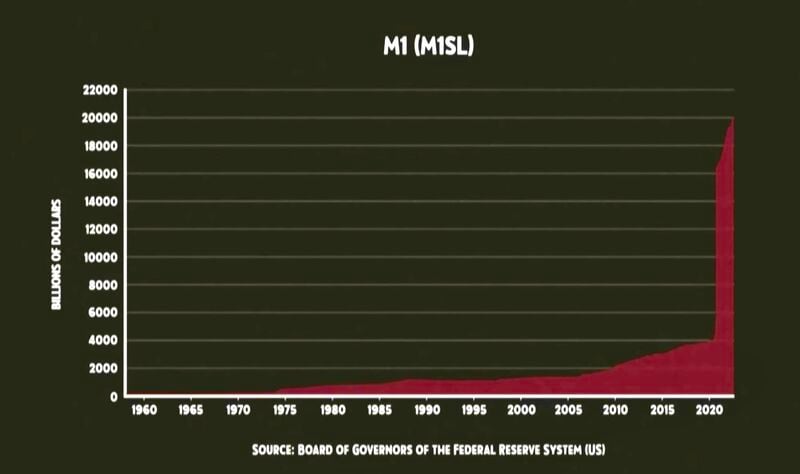

Over 80% of all US money created (US Dollars printed) took place between 2020 and 2023

Source: Win Smart

Next FOMC rate hike probabilities:

No hike → 93% 25 bps hike → 7% Source: Game of Trades

Usage of the Fed's emergency bank funding facility jumped by $328 million last week

It now stands at a new record high of $108 billion, even as the regional bank crisis is "over." The current rate banks are paying the Fed on these loans is an alarming ~5.5%. i.e . the banks that almost collapsed are now borrowing record levels of expensive debt from the Fed. Is the US regional banks crisis really over? Source: zerohedge, Bloomberg, The Kobeissi Letter

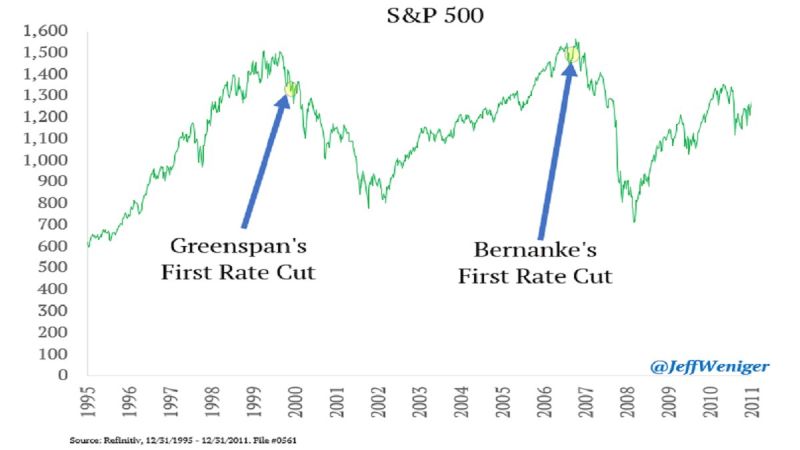

If the Fed cuts rates next year, is that a good thing?

Source: Jeff Weniger

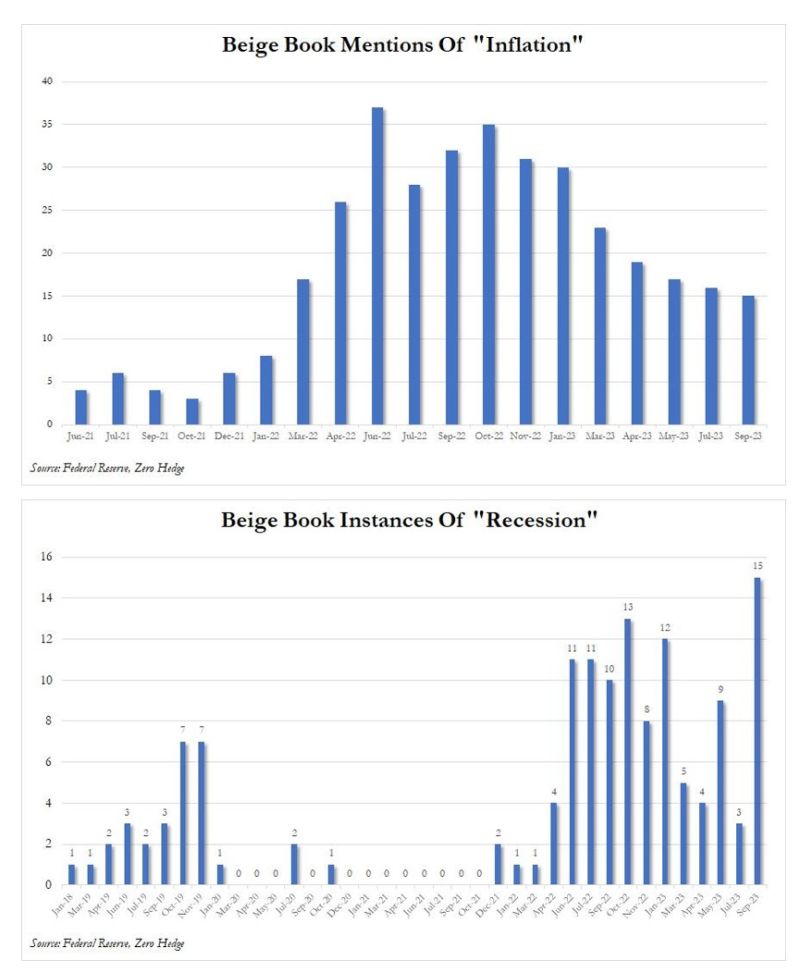

Are FED priorities shifting?

Mentions of inflation in the Fed's Beige book were the fewest since Jan 2022...Meanwhile, mentions of recession jumped to the highest level since at least 2018. The fact that there have been so many mentions of a word which as recently as 2020 and 2021 barely existed in the Beige Book vocabulary could give an indication what the Fed is most worried about today. Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks