Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

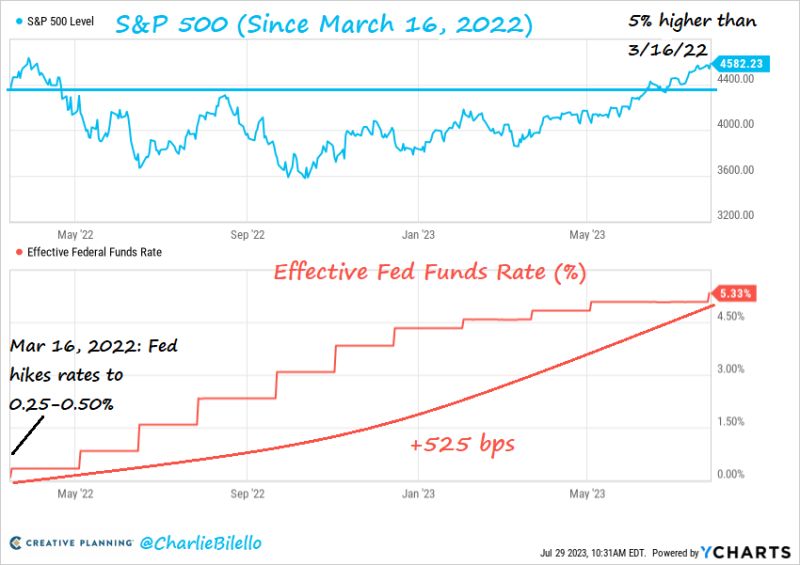

The SP500 is now 5% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

The disconnect between Fed net liquidity (grey) and the S&P 500 (purple) is growing by the day

source: Markets & Mayhem

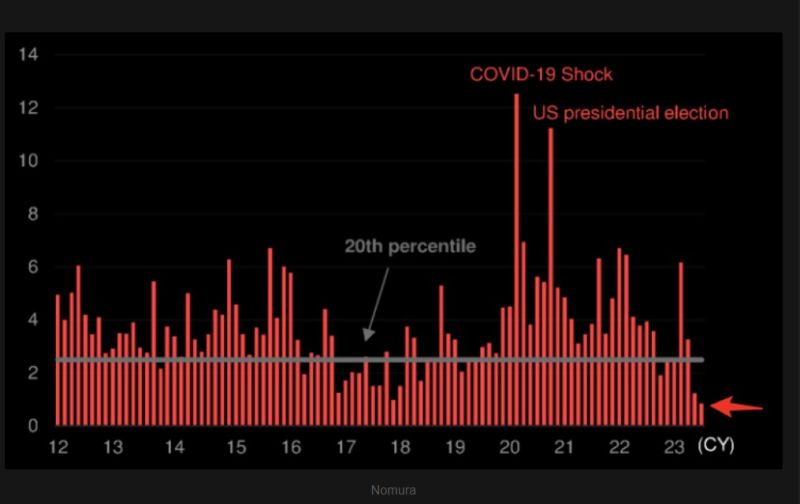

The market has NO FEAR. Extremely little risk priced for the FOMC meeting.

Chart shows SPX 1 week implied volatility skew within one week of FOMC meetings. Source: TME, Nomura

FED QT continues w/balance sheet dropped by $22.4bn past week.

It is 6th week in a row that total assets shrink. Fed more than leveled the increase in the wake of the banking crisis from March. Fed balance sheet now equal to 31% of US's GDP vs #ECB's 53%, SNB's 121%, BoJ's 128%. Source: Bloomberg, HolgerZ

M2 money supply has declined at the fastest rate ever recorded since the Fed began collecting data in 1959

Probably has helped cool inflation but could it usher in a new set of problems? Source: Fred, Barchart

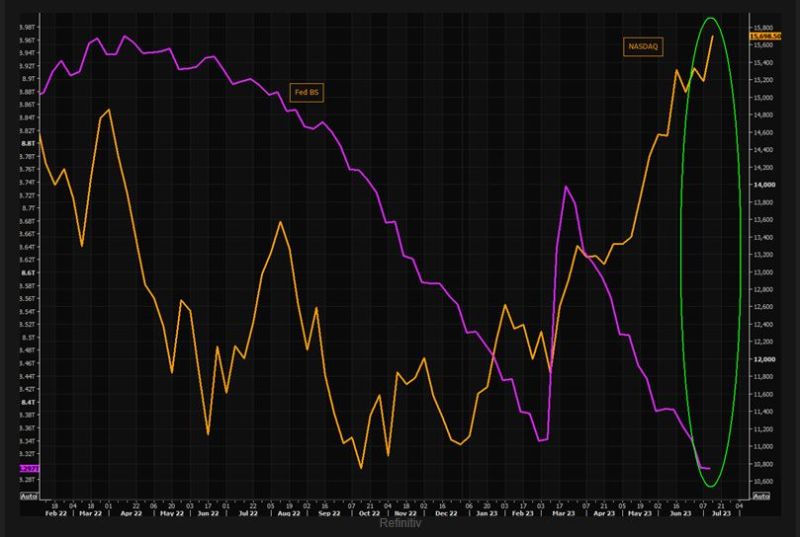

The NASDAQ (in yellow) has been massively decoupling from the FED balance sheet (in purple)

Source: The Market Ear, Refinitiv

The sp500 is now 3% above the level it was at when The Fed first hiked #rates in March 2022...

The #sp500 is now 3% above the level it was at when The #Fed first hiked #rates in March 2022...

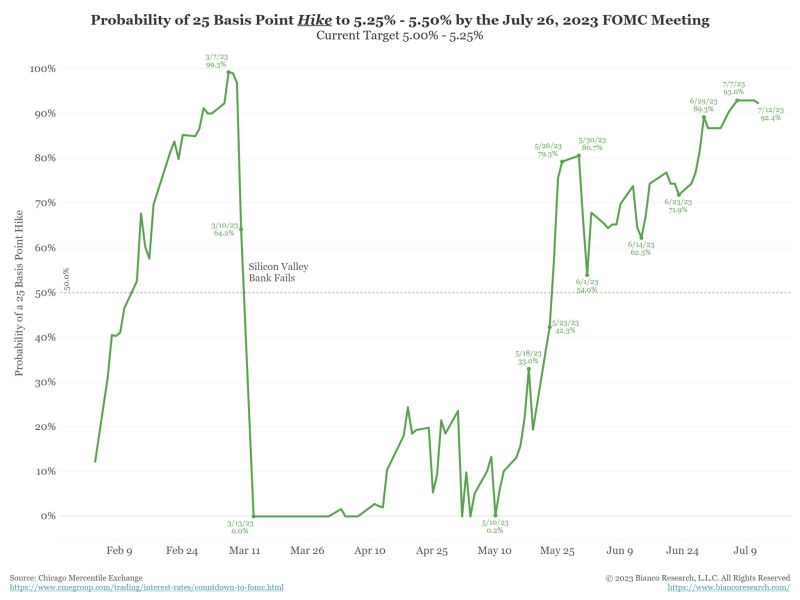

The probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved

Despite the better-than-expected CPI report today, the probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved. The market is strongly expecting a hike in two weeks. Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks