Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- performance

- AI

- gold

- earnings

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- Germany

- Japan

- europe

- bank

- nasdaq

- oil

- fed

- cpi

- warren-buffett

- Forex

- apple

- useful

- interest

- humor

- interest-rates

- market cap

- dollar

- energy

- returns

- GDP

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- semiconductor

- vix

- growth

- mortgage

- Money Market

- cash

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- UK

- assetmanagement

- bearish

- wages

- EV

- Flows

- credit-card

- russia

- saudiarabia

- spending

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- yen

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Brazil

- Election

- amazon

- car

- copper

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- sharebuybacks

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

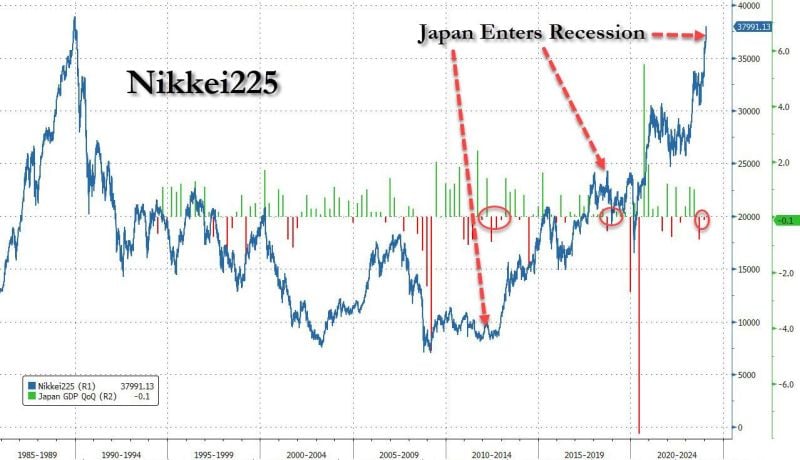

Japan enters recession with Nikkei about to hit All Time High as the yen trades at 150

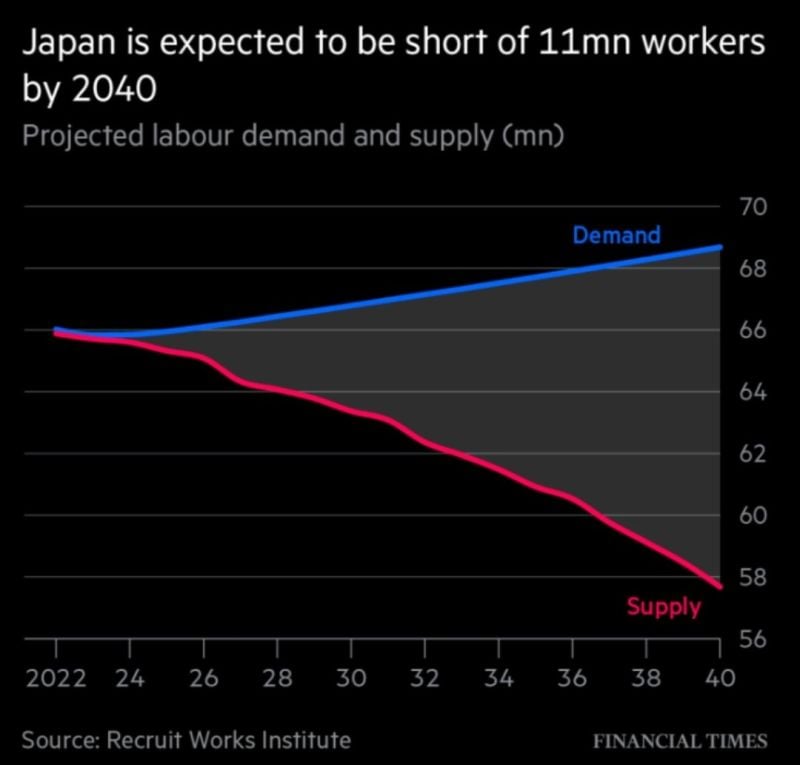

The Nikkei has more than doubled from the covid lows and is about to breach its all time bubble highs set in in the last days of 1989... and moments ago Japan entered a recession. In fact, From its generational low set a decade ago, the Nikkei has almost quadrupled even as Japan's economy has slumped into recession three times! Once the second largest economy in the world, Japan reported two consecutive quarters of contraction on Thursday — falling 0.4% on an annualized basis in the fourth quarter after a revised 3.3% contraction in the third quarter. Fourth quarter GDP sharply missed forecasts for a 1.4% growth in a Reuters poll of economists. Source: CNBC, www.zerohedge.com

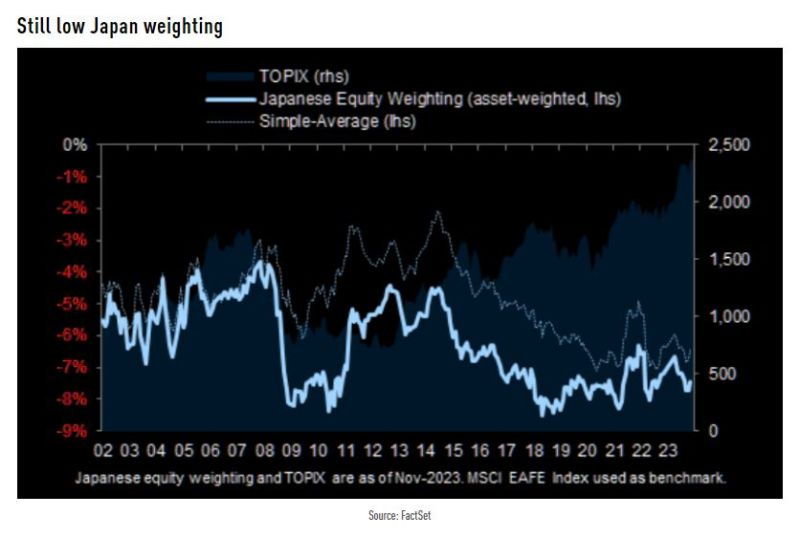

THE SILENT BULL MARKET...

Japanese stocks index Nikkei 225 closes up 1066.55 points and within striking distance of all time high 38957! It briefly crossed the 38,000 mark for the first time since the asset bubble burst in 1990 as it rallied about 3% and pushed 34-year highs. In times of financial repression aka negative real rates, real assets go up. January PPI came weaker than expected (+0.0% m/m vs. 0.1% expected) Futures going higher still: Nikkei 38110 Source chart: IG

Japanese Stocks Hit 34-Year High

For the first time in 34 years, the Nikkei jumped above 37,000. The index is now about 5% away from taking out the all-time high set all the way back in December 1989. Source: barchart

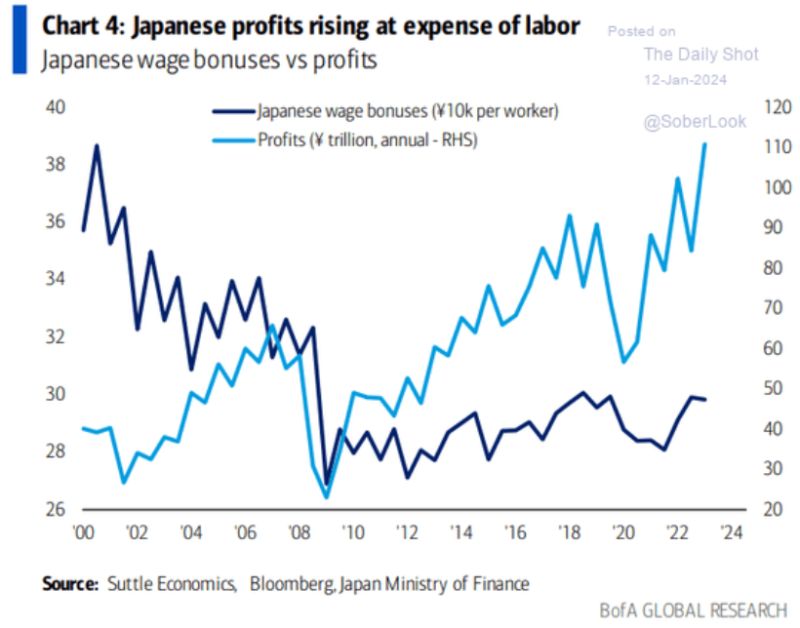

Japanese companies profits are surging

but that's not translating into rising domestic wages, keeping a lid on domestic inflationary pressures, and allowing easy monetary & FX policy to persist. The main winners are japan equity investors. Source: DB, Bob Elliott, The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks