Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

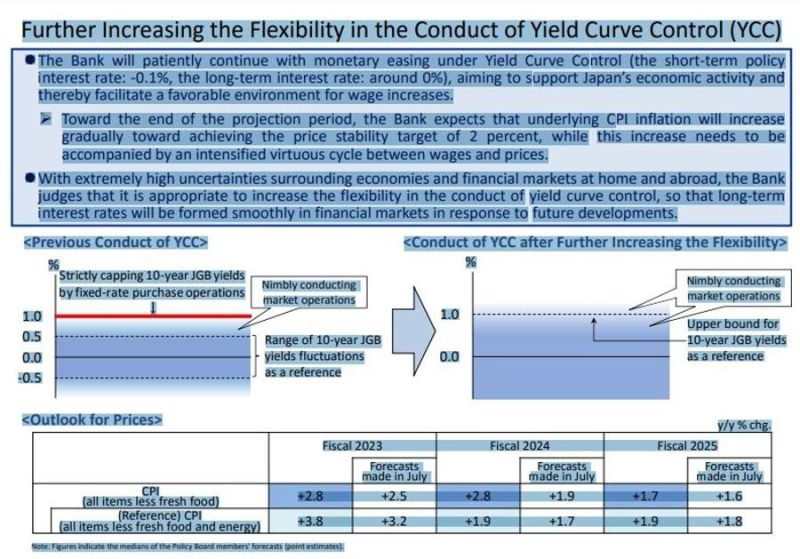

BREAKING: The yen falls near 150 after the Bank of Japan makes only modest tweaks to its yield control program, defying market expectations

Japan’s centralbank decided to make its yield curve control (YCC) policy more flexible, shifting the language used to describe the upper bound of the 10-year Japanese government bond yield. The BoJ said it will patiently continue monetary easing under YCC to support economic activities. BOJ makes the decisions on YCC by an 8-1 vote. The decision is sending the $USDJPY back to above 150.

Here's a chart of gold in yen

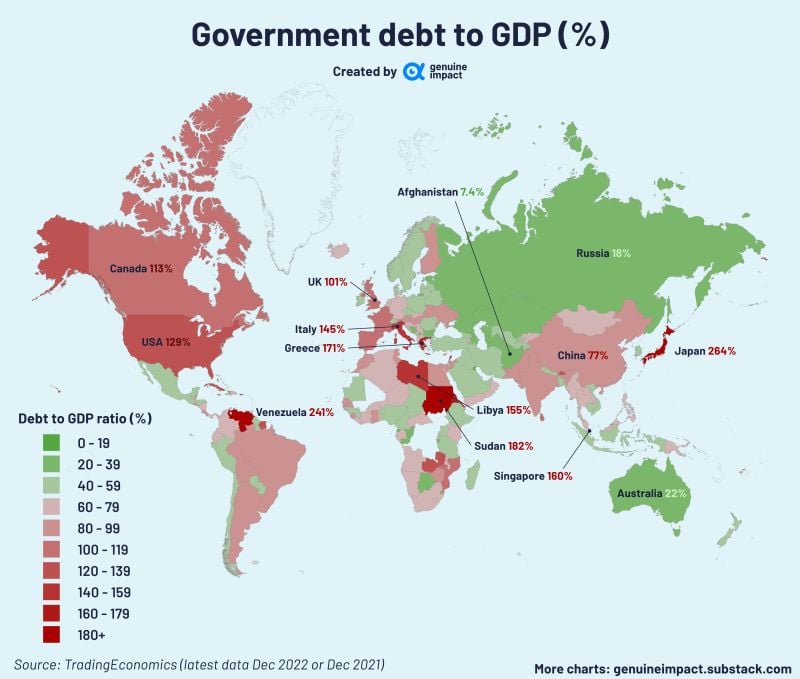

Japan has been ahead of the curve when it comes to FIAT currency debasement and the way its currency is trading against gold is rather frightening with another huge ~10% new ATH move this month. Will other FIAT currencies follow the yen path? Source: Graddhy - Commodities TA+Cycles

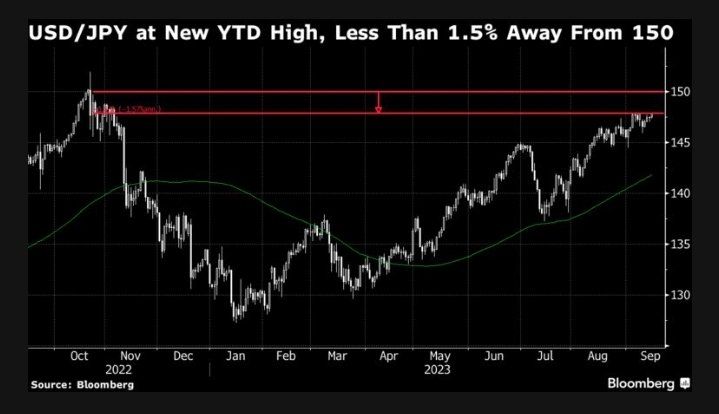

Japanese Yen falling to lowest levels against the U.S. Dollar since the BOJ intervened last year

150 level approaching fast 👀 Meanwhile, The Bank of Japan announced an extra bond-buying plan for this week as a global debt selloff forces policymakers into the market to curb sharp increases in yields. The BOJ will purchase extra amounts of 5-to-10-year debt on Wednesday as it strives to slow rising yields that are at the highest level in a decade. The benchmark 10-year maturity climbed to 0.775% Monday, a level last seen in 2013. Japan’s 20- and 30-year yields are at similar peaks while Treasury yields also keep moving higher. Japanese sovereign yields have risen as speculation grows the central bank will end its negative interest rate sooner rather than later, while the US Federal Reserve will also keep borrowing costs high. The BOJ has already conducted three unscheduled buying operations since late July to manage yields after adjusting policy to let them rise more. Source: Barchart, Bloomberg

BOJ Update

Japan | BOJ left its monetary settings unchanged and offered no clear sign of a shift in its policy stance, putting a damper on market speculation over the prospects for a near-term interest rate hike and adding pressure on the yen. The Bank of Japan kept its negative interest rate and the parameters of its yield curve control program intact on Friday in an outcome predicted by all 46 economists surveyed by Bloomberg. It also maintained a pledge to add to its stimulus without hesitation if needed, a vow that offers yen bears a reason to keep betting against it. Japan’s currency weakened as much as 0.4% after the decision to around the 148.20 mark against the dollar. This helped stocks, which trimmed about half of their losses for the day. The benchmark 10-year bond yield was down half a basis point from Thursday’s closing level at 0.74%. Source: Bloomberg

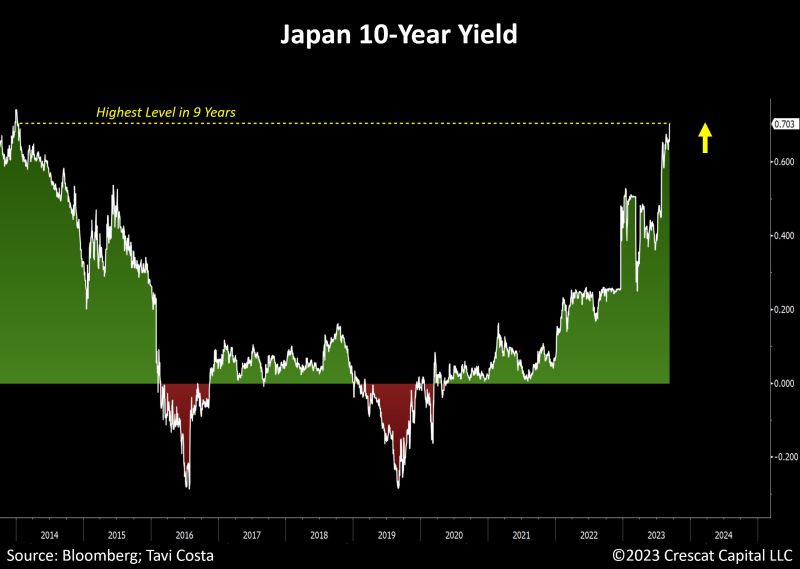

Japan's 10-year yield surged this morning to 0.70%, its highest level in almost a decade, following weekend comments by Bank of Japan (boj) Governor Kazuo Ueda

Ueda said the central bank’s lifting of its negative interest rate policy will become an option if wages and prices rise, revealing his thinking during an interview with The Yomiuri Shimbun. Ueda said that “there are various options” including lifting the negative interest rate policy once the central bank is confident that Japan has achieved sustainable price increases accompanied by rising wages. The negative interest rate policy is a pillar of the Bank of Japan’s large-scale monetary easing measures. While an easy monetary policy environment will be maintained for the time being, signs of factors could emerge that would allow a decision to be made by the end of the year, he indicated. This is the first time Ueda has given an exclusive interview to any media organization since taking office in April. Source: The Japan News, Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks