Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

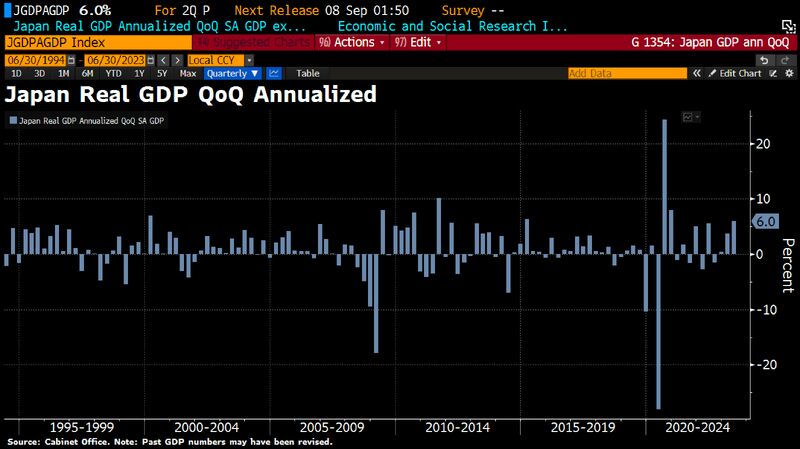

Japan GDP grew 6%, handily beating expectations on robust exports - but domestic demand disappoints

Japan Q2 GDP improves to 1.5% QoQ vs 0.8% expected and 0.1% prior, meaning Japan grows 6.0% on annualized basis, far more than expected (+2.9% yoy). However, some details of the report weren’t as impressive as the headline. As pointed out by analysts in CNBC report, nearly all of the increase in output was driven by a 1.8%-pts boost from net trade. That marked the second-largest contribution from net trade in the 28-year history of the current GDP series, with only the bounce back in exports from the first lockdown at the beginning of the pandemic providing a larger boost. Exports rebounded 3.2% from the previous quarter — largely driven by the spike in car shipments — while imports plunged 4.3% over the time period. Source: Bloomberg, HolgerZ, CNBC

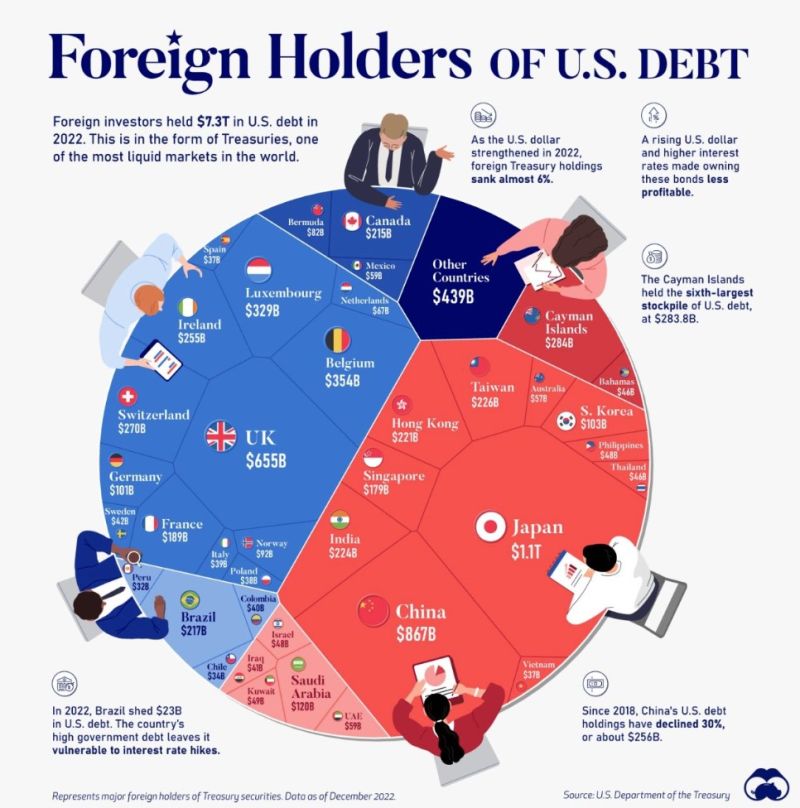

Which Countries Hold the Most U.S. Debt (which just got downgraded)?

With $1.1 trillion in Treasury holdings, #japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries. Source: Visual Capitalist

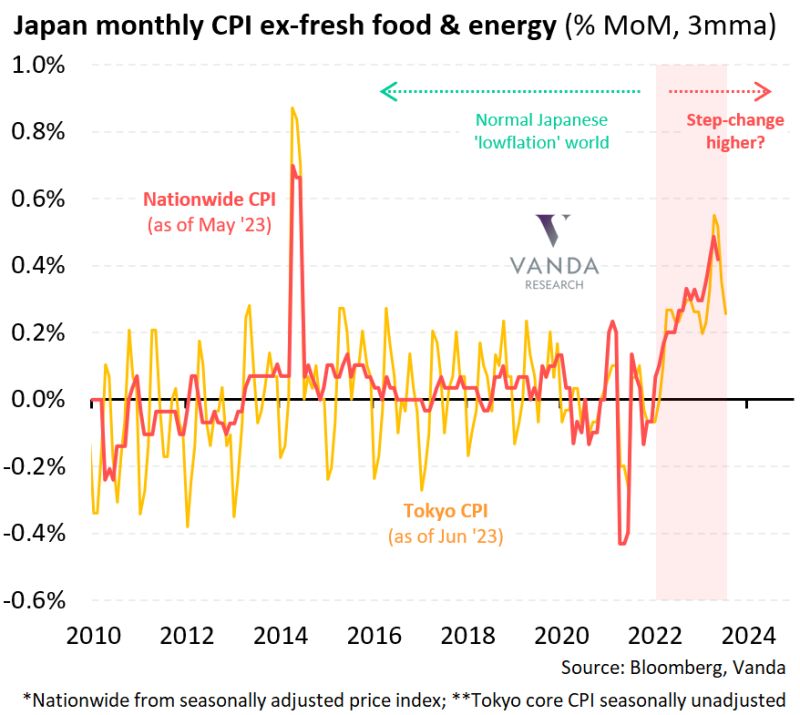

Tokyo core-core CPI inflation printed at +0.575% MoM

That's the 2nd biggest monthly increase since Covid. And one of the biggest monthly increases over the last 30 years outside of sales tax hikes. Inflation is not transitory in Japan... $JPY. Source: Viraj Patel, Vanda Research

There it is. The BoJ adjusts Yield Curve Control (YCC)

Japan’s central bank on Friday pledged greater flexibility in yield curve control policy, while keeping its ultra loose interest rate intact and revising its median consumer inflation forecast upward for the current fiscal year. - The Bank of Japan added it will offer to purchase 10-year JGBs at 1% every business day through fixed-rate operations, unless no bids are submitted — a move that effectively expands its tolerance by a further 50 basis points. - In a policy statement, the Bank of Japan said it will “continue to allow 10-year JGB yields to fluctuate in the range of around plus and minus 0.5 percentage points from the target level.” - “While it will conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations,” it added. - Still, the BOJ held its short-term interest rate target at -0.1% after a two-day meeting. It also raised its median forecast for inflation to 2.5% for fiscal 2023 after its July meeting, up from its 1.8% prediction in April. Market reaction? The Japanese yen strengthened and 10-year JGB yield rose after the Bank of Japan statement: - Yields for 10-year Japanese government bonds rose to 0.575% for the first time since September 2014. - The yen was trading at 138.64 against the dollar at 12:35p.m. Hong Kong and Singapore time. Source: Viraj Patel, CNBC, Bloomberg

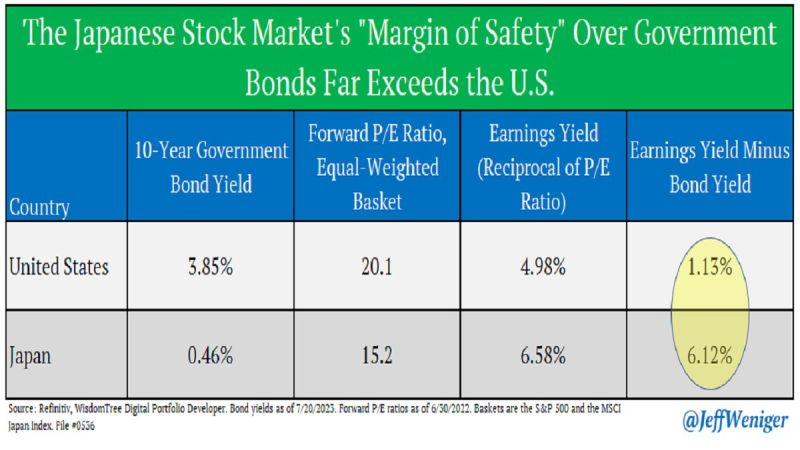

Japanese stocks have an earnings yield that is 612bps above the yield on 10-year Japanese government bonds

Put that in context; in the US, the gap is only 113bps. Little room for error in the US, plenty of room in Japan. This is a margin of safety concept. Source: Jeff Weniger

Fun fact is that Japanese inflation is now higher than that in the US for the first time since October 2015.

Source: Bloomberg, www.zerohedge.com

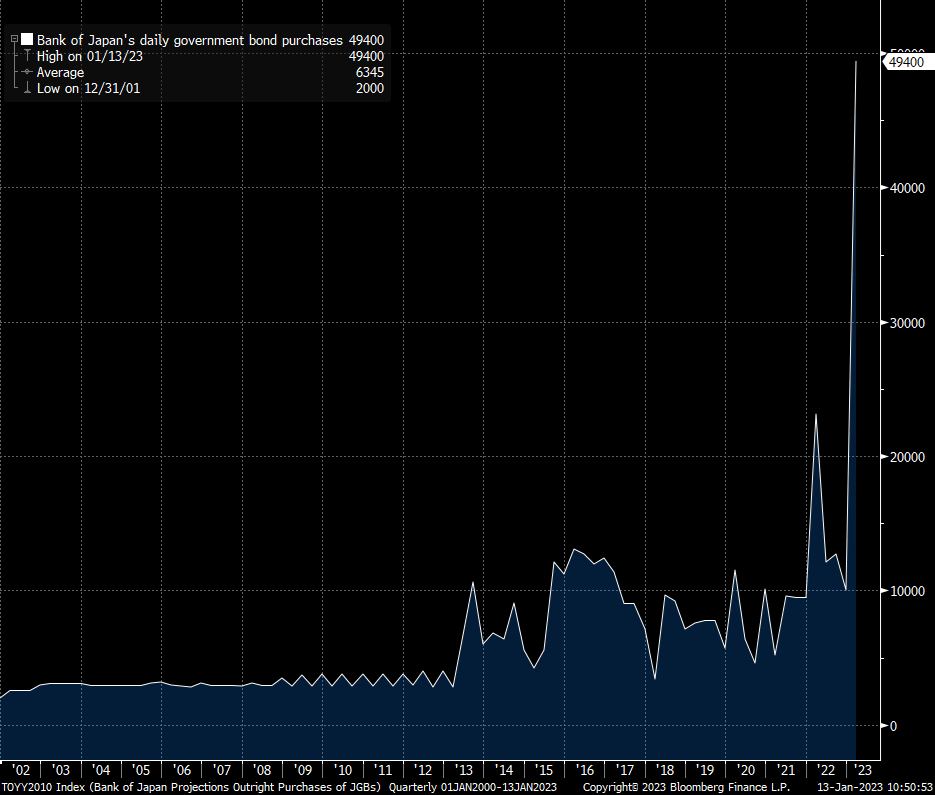

Bank of Japan's daily government bond purchases at an all-time high!

The Bank of Japan is buying huge amounts of government bonds in order to cap the yield on Japanese 10-year government bonds to 0.5%. Yesterday the BoJ bought 4.6 trillion yen and today it is close to 5t yen. Note that at the last meeting, the BoJ had decided on a 9t yen bond buying program ...per month! Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks