Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- sp500

- bitcoin

- Stocks

- inflation

- China

- macro

- Federal Reserve

- ETF

- investing

- Crypto

- performance

- Central banks

- AI

- earnings

- gold

- Rate

- Real Estate

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- fed

- oil

- warren-buffett

- nasdaq

- cpi

- apple

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- quotes

- dollar

- energy

- returns

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- india

- finance

- BOJ

- ECB

- sentiment

- crudeoil

- Swiss

- Volatility

- highyield

- economy

- recession

- vix

- options

- cash

- semiconductor

- growth

- mortgage

- Money Market

- tesla

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- price

- EM

- ESG

- EV

- deficit

- sales

- UK

- assetmanagement

- bearish

- wages

- Flows

- copper

- credit-card

- revenue

- russia

- saudiarabia

- spending

- yen

- Election

- Turkey

- cocoa

- futures

- index

- meta

- profit

- watches

- EUR

- bankruptcy

- chart

- consumers

- supply

- unemployment

- Brazil

- airlines

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- sec

- sharebuybacks

- spy

- taiwan

- yuan

- Alternatives

- Hong Kong

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- smallcaps

- sustainable

- switzerland

- world-economy

- BOE

- Focus

- Industrial-production

- ceo

- chatgpt

- dowjones

- economic surprise

- ethereum

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- EM Sovereign

- Granolas

- Market Outlook

- Nikkei

- TIPS

- brics

- corporate

- cost-of-living

- demographics

- dividend

- emerging-markets

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

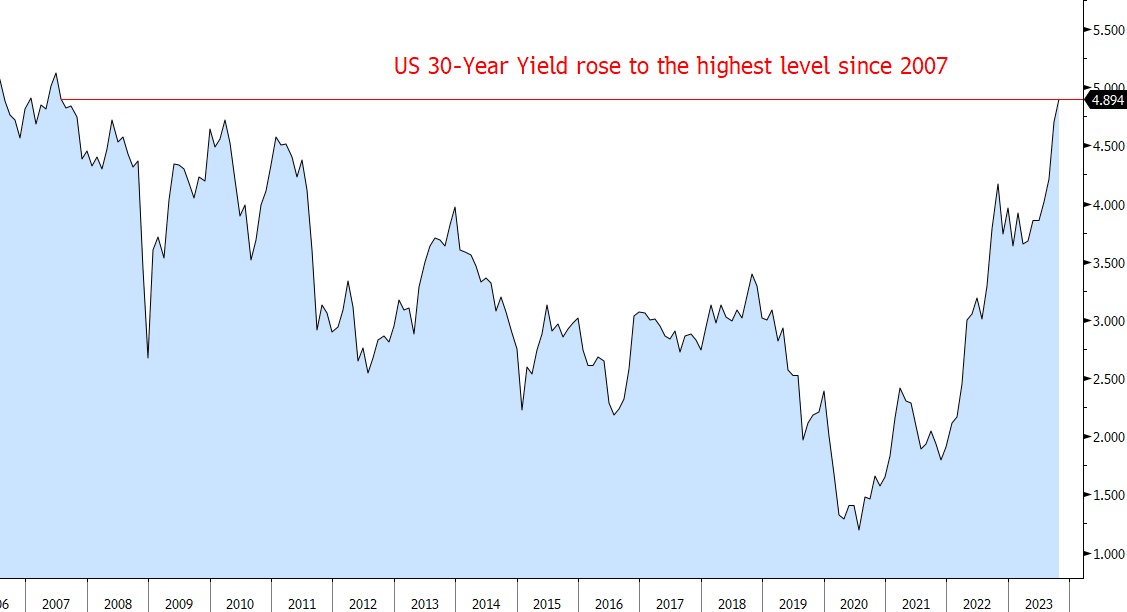

Big opportunities ahead for fixed income investors?

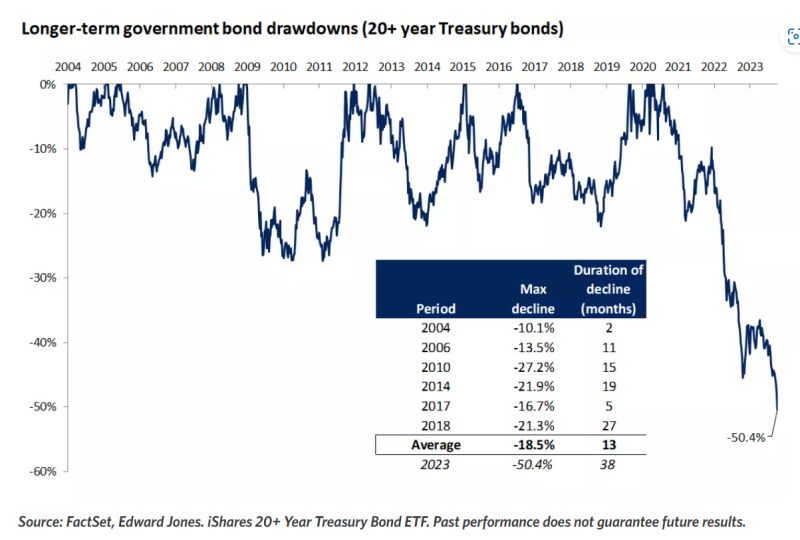

The past three years' pain in bonds could indeed be setting the stage for outsized gains ahead. To put the decline into perspective, long-term government bonds, with maturities greater than 20 years, have dropped 50% from their 2020 peak, a drawdown that is comparable to the 56% decline in stocks during the height of the Global Financial Crisis in 2008 Source: Edward Jones

As highlighted in a tweet by HolgerZ, the S&P 500 is running in tandem with the Fed net liquidity

So it's not so much the peak or pause in rate hikes that matters, but rather what happens to the Fed balance sheet & reverse repo operations. Source: HolgerZ, Bloomberg

World trade volumes fell at their fastest annual pace for almost three years in July

Closely watched figures signal rising interest rates are beginning to impact global demand for goods. Trade volumes were down 3.2 per cent in July compared with the same month last year, the steepest drop since the early months of the coronavirus pandemic in August 2020. The latest World Trade Monitor figure, published by the Netherlands Bureau for Economic Policy Analysis, or CPB, followed a 2.4 per cent contraction in June and added to evidence that global growth was slowing. After booming during the pandemic, demand for global goods exports has weakened on the back of higher inflation, bumper rate rises by the world’s central banks in 2022, and more spending on domestic services as economies reopened following lockdowns. The about-turn in export volumes was broad based, with most of the world reporting falling trade volumes in July. China, the world’s largest goods exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent decrease. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks