Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- Crypto

- investing

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- warren-buffett

- nasdaq

- oil

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- highyield

- Volatility

- economy

- options

- recession

- cash

- semiconductor

- vix

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

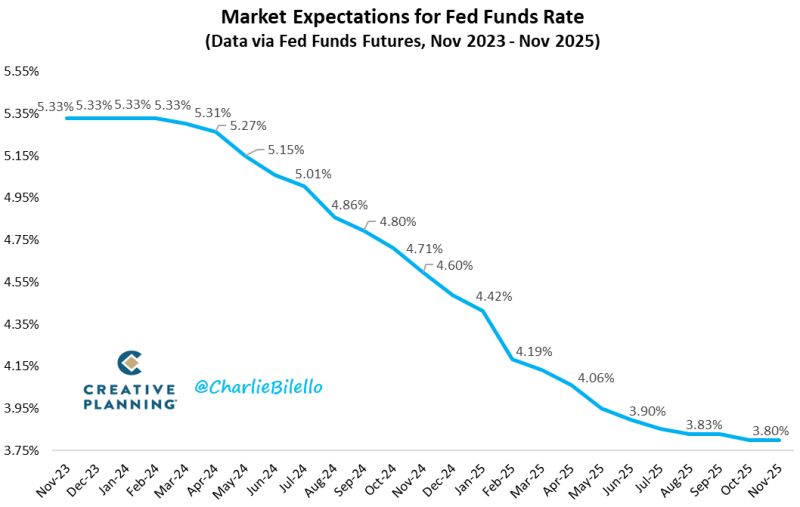

Ahead of Fed minutes... The market is now pricing in a 0% probability of a rate hike in December and rate cuts starting in May 2024

Source: Charlie Bilello

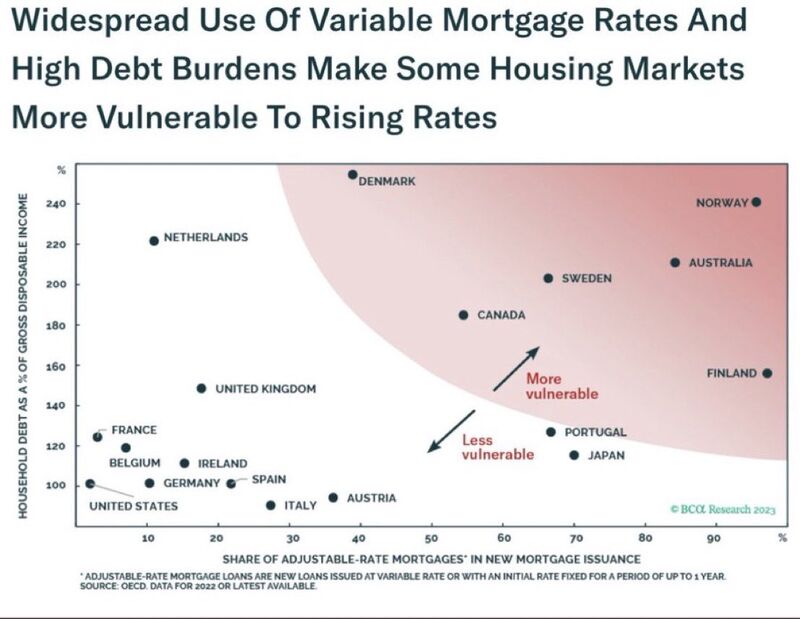

Which countries have the most rate sensitive household sectors?

Source: BCA, The Longview

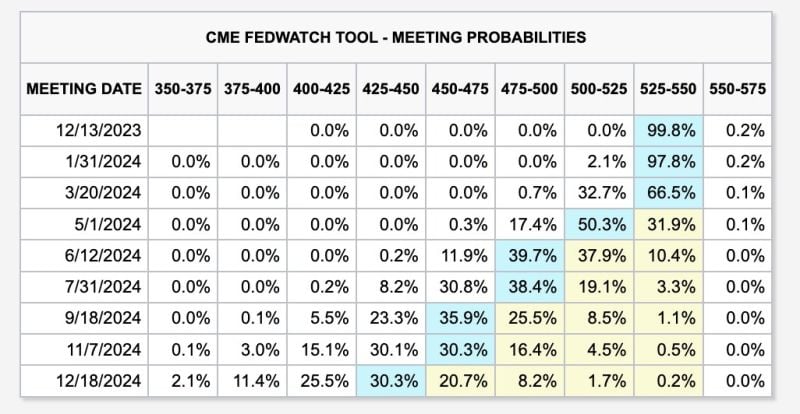

JUST IN: Futures now show a 0% chance of additional rate hikes with rate cuts beginning in May 2024

Prior to today's CPI report, there was a 30% chance of at least one more rate hike ahead. Rate cuts were expected to begin in June 2024. Now, markets are pricing-in at least 4 rate CUTS in 2024. Markets are betting that the Fed is done. Source: The Kobeissi Letter

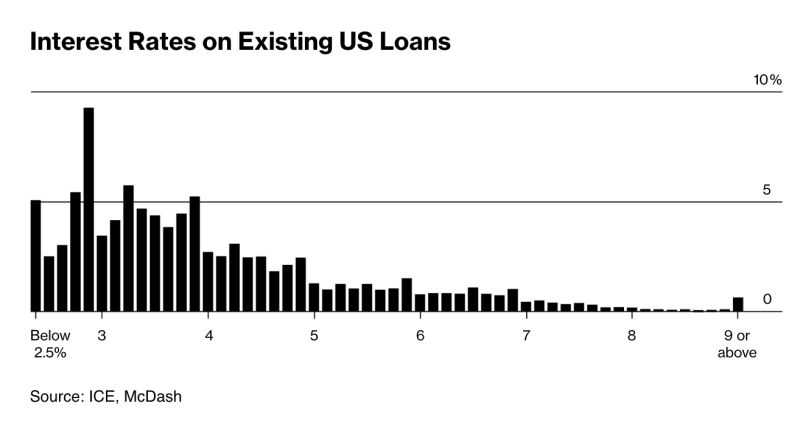

The chart below shows the distribution of interest rates on outstanding US mortgages

Over 30% of borrowers have rates below 3%, up from just ~5% of borrowers prior to the pandemic. Virtually no new mortgages are being taken out at 7%+ interest rates that we currently see. real estate market seems to be frozen Source: The Kobeissi Letter, ICE

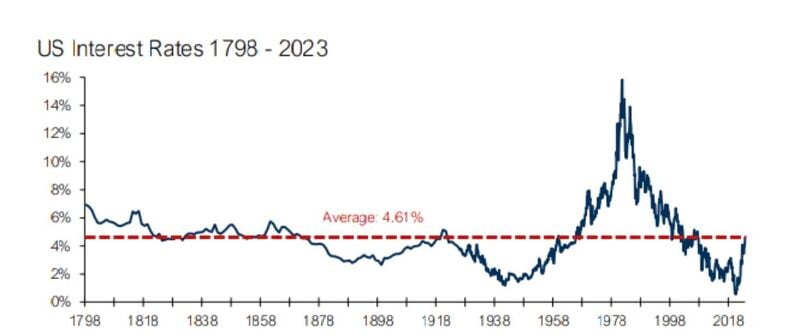

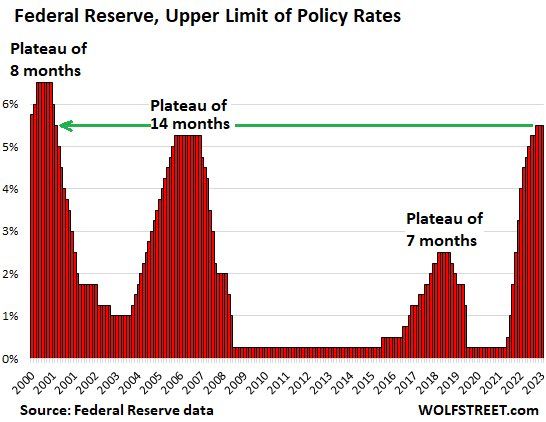

The end of the rate hikes is typically followed by plateaus before rate cuts begin

The end of the rate hikes may not be here yet, and the Fed has already said a many times for months that the plateau is going to be “higher for longer". How long will the plateau be this time? Source: Wolfstreet

No change as expected

Nothing really new except that they acknowledge strong growth and strong wage gains versus September, effectively upgrading their economic assessment. This is the 3rd time they upgrade their view on growth. Our view is unchanged: we are due for a long pause. High rates is the new normal.

Investing with intelligence

Our latest research, commentary and market outlooks