Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

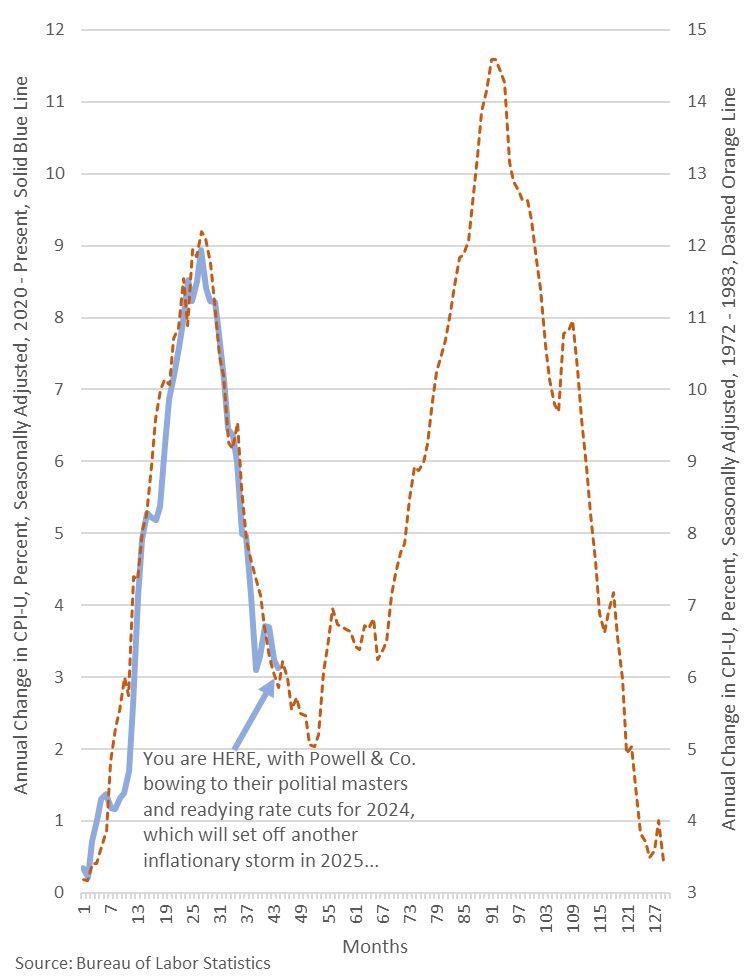

Is Fed making the same error as the mid 1970s?

In the 1970s they also thought they had beat inflation in 1974-1975, they lowered rates and then inflation roared back to even higher levels in the late 1970s. Inflation on came down in early 1980s because of two factors. 1) massive new oil (energy) supply from Alaska, Gulf of Mexico, North Sea and huge new fields in Mexico coming online. 2) 18% interest rates crushed the economy. Source: Wall Street Silver

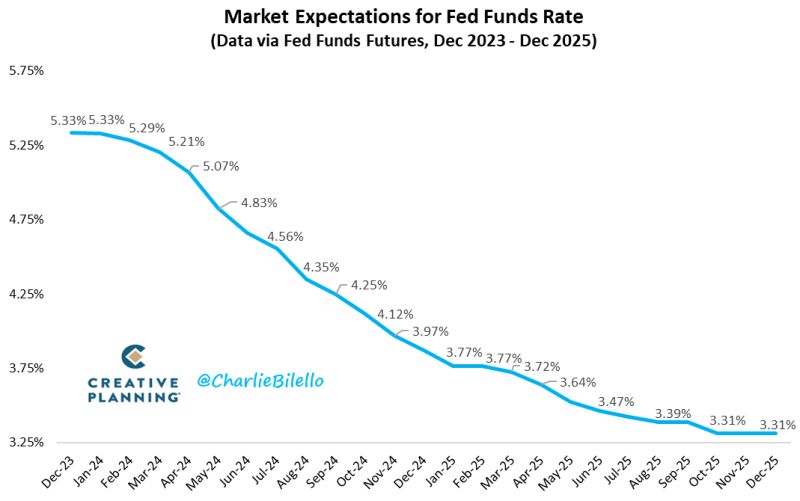

The Fed is still behind the curve...

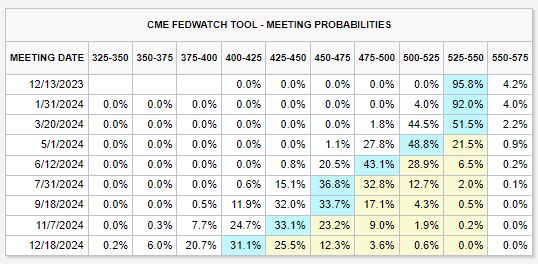

The market is now pricing in a Fed Funds Rate of 3.8% by the end of 2024, expecting significantly more easing than the Fed's projection of a move down to 4.6%. Source: Charloe Bilello

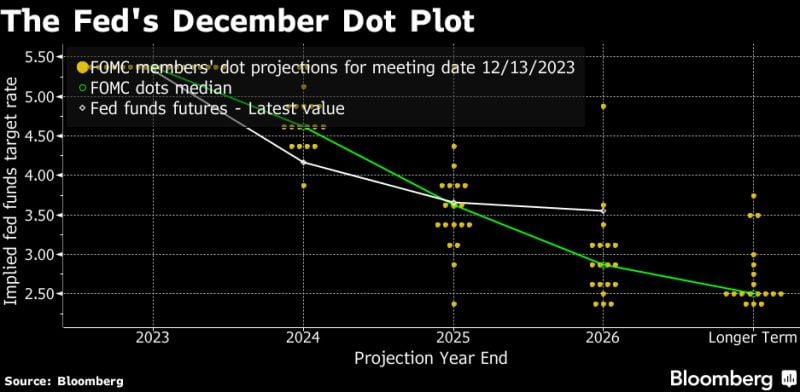

The Fed is finally giving up...

Fed holds rates steady but indicates three cuts coming in 2024. Indeed, the Dot Plot is adjusted down significantly more dovishly than expected, narrowing the gap to the market's expectation significantly... The US 10 year is down 20bp to 4%, the Dow surges by 300 points!

⚠️BREAKING:

*FED'S POWELL: IT IS NOT LIKELY WE WILL HIKE FURTHER *POWELL: POLICYMAKERS ARE THINKING AND TALKING ABOUT WHEN IT WILL BE APPROPRIATE TO CUT RATES Source: www.investing.com

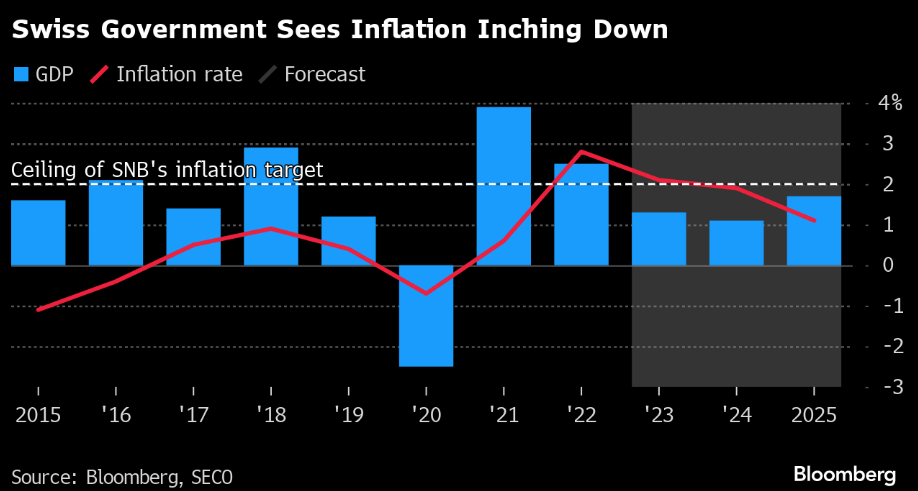

Switzerland’s inflation forecast backs SNB rate staying on hold

Switzerland’s government sees next year’s

inflation within the central bank’s target range, the latest evidence supporting a likely hold from policymakers this week. Consumer prices will grow at an annual 1.9% in 2024, in line with the previous forecast, the State Secretariat for Economic Affairs said on Wednesday.

Source: Bloomberg

Futures are now showing a ~45% chance that FED rate CUTS begin as soon as March 2024

There's also a growing (but small) chance that rate cuts begin in January 2024, at 4%. Prior to the most recent CPI inflation data, the base case showed rate cuts beginning in June 2024. There was also a 50% chance of another rate HIKE in 2024. This has been a quick turnaround... Source: The Kobeissi Letter

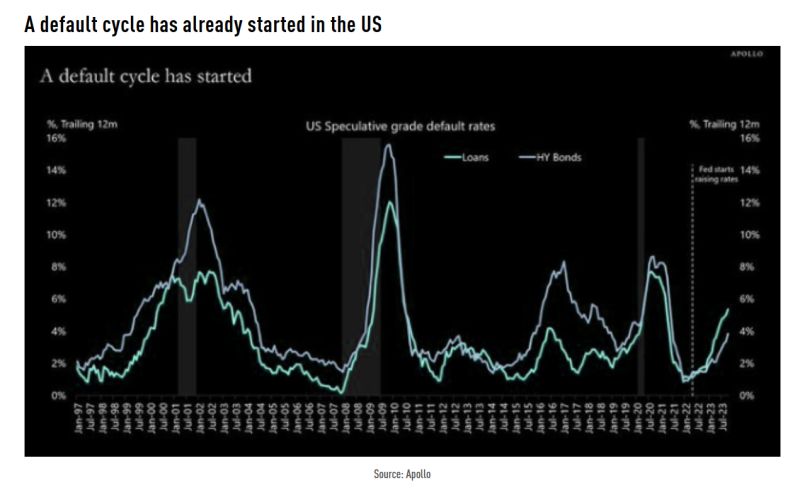

Since the Fed started raising rates in March 2022, default rates have gone from 1% to 5%+

Source: Apollo, TME

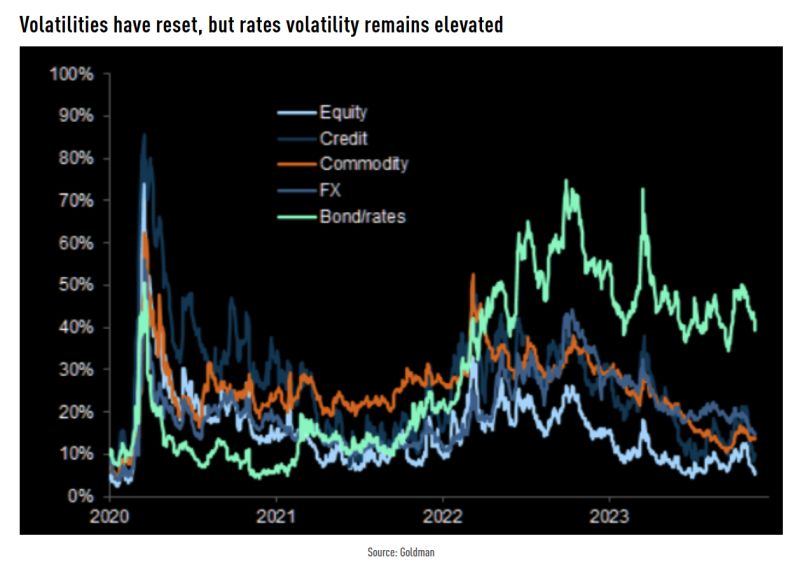

Below the average 3-month ATM implied volatility (max/min range since 2008)

Source: TME, GS

Investing with intelligence

Our latest research, commentary and market outlooks