Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

True power according to Warren Buffet

Thru Compounding Quality

How do you make your money work while you're sleeping?

Source: Markets & Mayhem

Buffett's longest held stocks:

$KO - 34 years $AXP - 29 years $MCO - 22 years $GLBE - 22 years $PG - 18 years He has returned 20% CAGR since 1965. Source: The Investing for Beginners Podcast

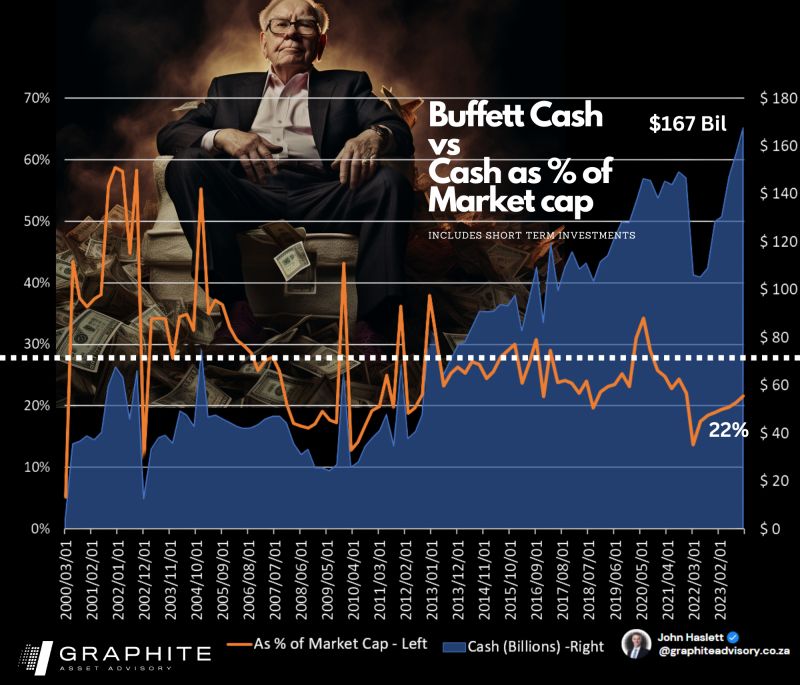

𝗕𝘂𝗳𝗳𝗲𝘁𝘁'𝘀 𝗖𝗮𝘀𝗵 𝗕𝗼𝗻𝗮𝗻𝘇𝗮 𝗡𝗼𝘁 𝗮𝘀 𝗕𝗶𝗴 𝗮𝘀 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸 💰

While Berkshire Hathaway is hoarding a record-breaking $167 billion cash pile, it accounts for just 22% of the market cap, trailing the 𝗵𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝟮𝟳% 𝗮𝘃𝗲𝗿𝗮𝗴𝗲 the last 23 years. Source: John Haslett, CA(SA), FRM

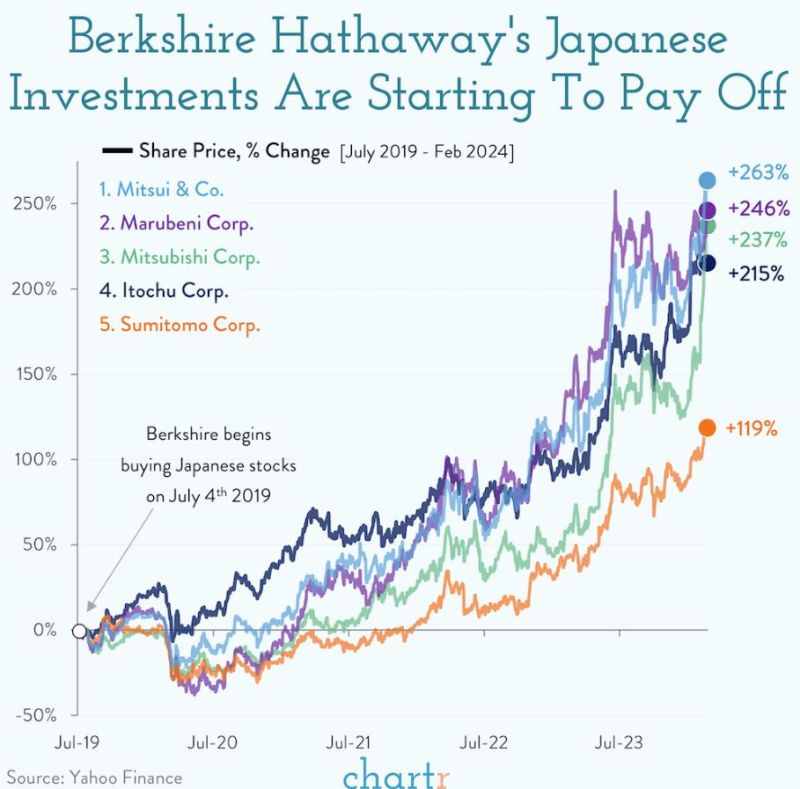

Berkshire Hathaway's Japanese Investment Are Starting To Pay Off

Source : chartr, yahoofinance

Respect !

source : Graphite Asset Advisory, John Haslett, CA(SA), FRM

Warren Buffett says Berkshire may only do slightly better than the average company due to its sheer size

Berkshire Hathaway’s Warren Buffett said his sprawling conglomerate may only slightly outperform the average American company due to its sheer size and the lack of buying opportunities that could make an impact. “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others,” Buffett wrote. “Some we can value; some we can’t. And, if we can, they have to be attractively priced.” Berkshire held a record $167.6 billion in cash in the fourth quarter. Berkshire did build a 9% stake in five Japanese trading companies — Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo, which Buffett intends to own long term. ‘With our present mix of businesses, Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital,” Buffett said. “Anything beyond ‘slightly better,’ though, is wishful thinking.” Berkshire recently hit consecutive record highs, trading above $620,000 for Class A shares and boasting a market value above $900 billion. The conglomerate’s stock has gained about 16% in 2024, more than double the S&P 500′s return, after climbing 16% in all of 2023. Warren Buffett released Saturday his annual letter to shareholders. In it, he renders a tribute to his longtime friend and right hand man Charlie Munger, who died late in 2023. He also discusses his outlook for the company. link : https://lnkd.in/egEj-Pc6 source : cnbc

Investing with intelligence

Our latest research, commentary and market outlooks