Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

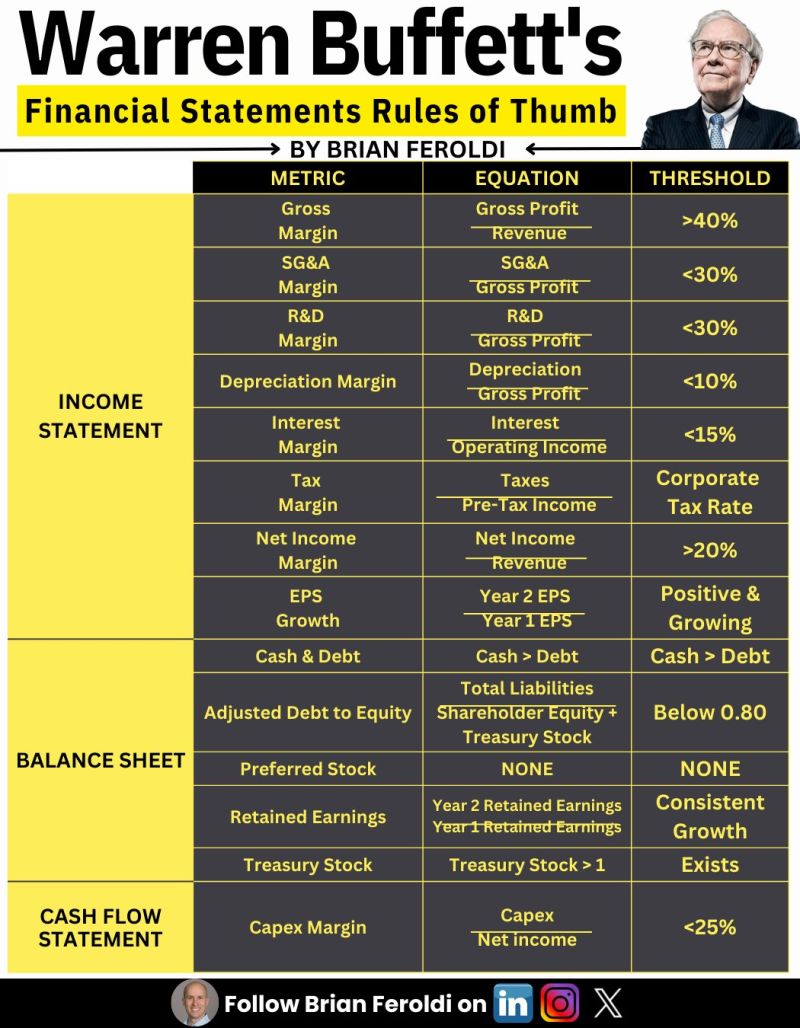

Warren Buffett’s Financial Statement Rules of Thumb

Source: Brian Feroldi

Warren Buffett's Berkshire Hathaway reported $1 trillion of assets for the first time last quarter

That's roughly triple the assets of Apple, 10 times Tesla's figure, and 20 times Nvidia's total. Berkshire's assets have ballooned 33,000-fold under Buffett, from under $30 million when he started. Source: business insider

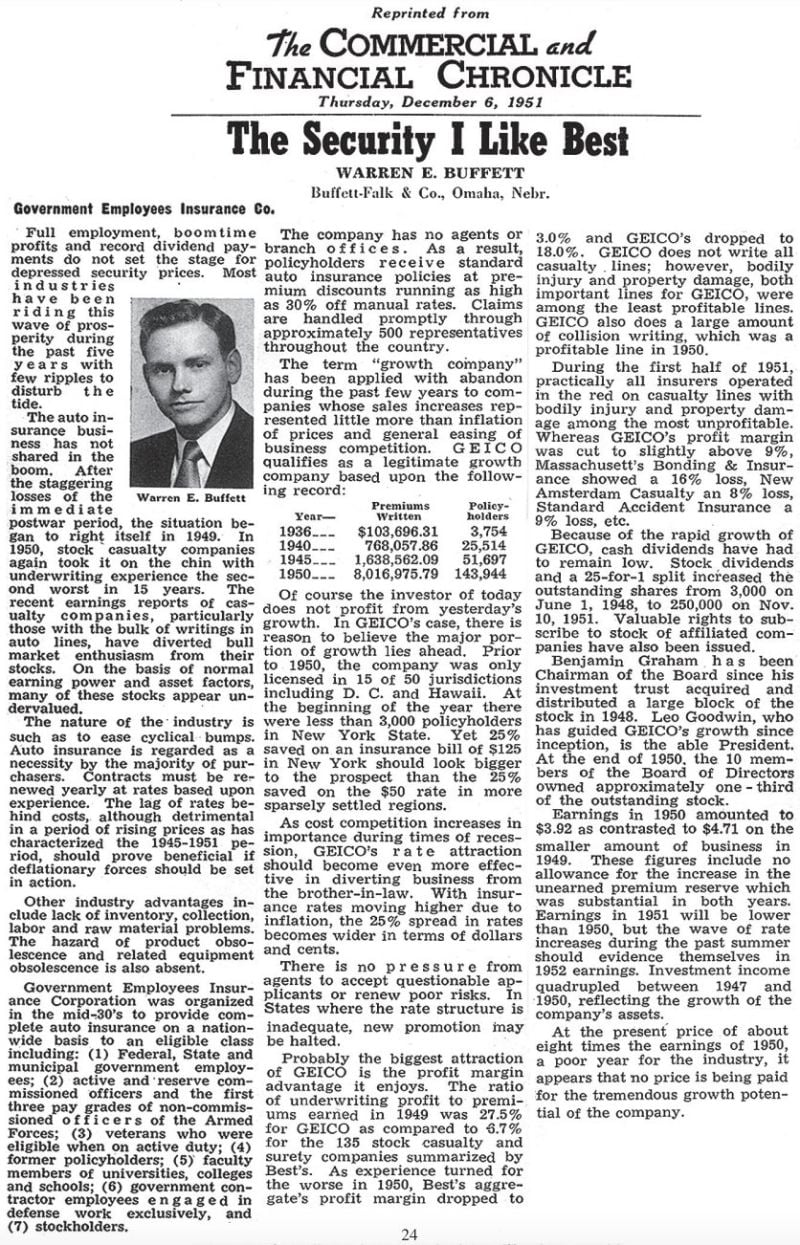

The young Warren Buffett with GEICO Analysis - a simple one-pager, so much powerful than an endless investment analysis

Source: The Investing for Beginners Podcast - IFB_podcast

Warren Buffett's Berkshire Hathaway invested a total of $814 million in 3 home builder companies during the 2nd quarter. Those investments include D.R. Horton $DHI, Lennar $LEN, and $NVR

Warren Buffett’s Berkshire Hathaway on Monday unveiled an $814mn investment in three US housebuilders, a bet on a sector that has benefited from dearth of supply. Berkshire disclosed it had purchased 6mn shares of DR Horton, worth about $726mn at the end of the second quarter, as well as 152,572 shares in Lennar and 11,112 shares of NVR. Shares of housebuilders and companies who service the industry have rallied this year after a difficult 2022 during which higher interest rates crimped demand. However, while higher mortgage rates have cooled the pace of existing homes sales, new homes sales have remained surprisingly robust owing to the limited supply.

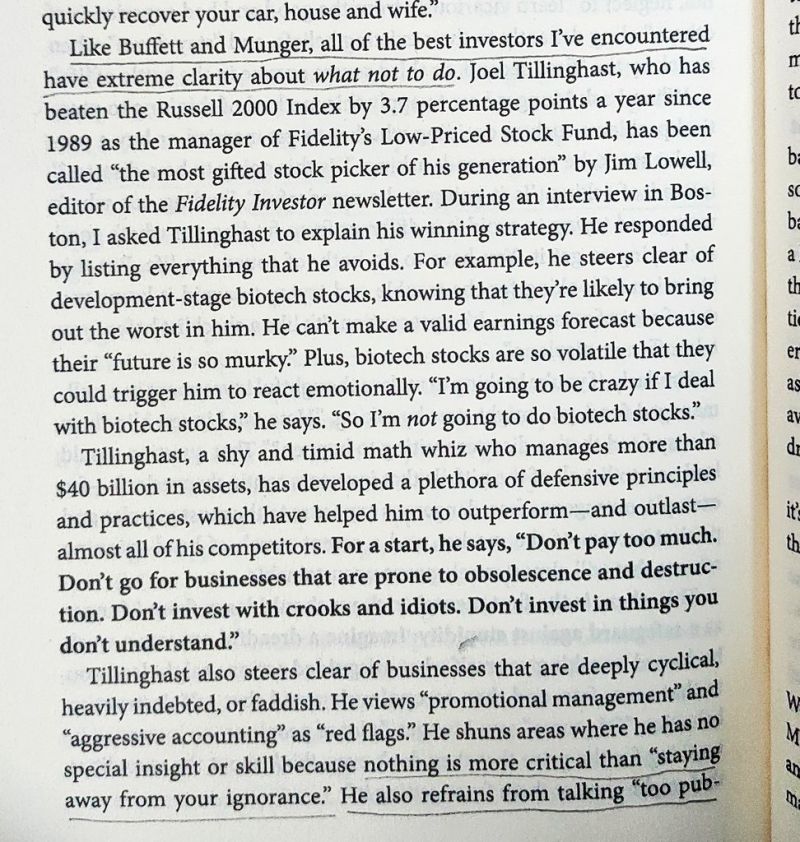

What not to do is more important than what to do in the stock market What not to do?

🔷 Don't pay too much. 🔷 Don't go for businesses that are prone to obsolescence and destruction. 🔷 Don't invest with crooks and idiots. 🔷 Don't invest in things you don't understand Source: Investment Books (Dhaval)

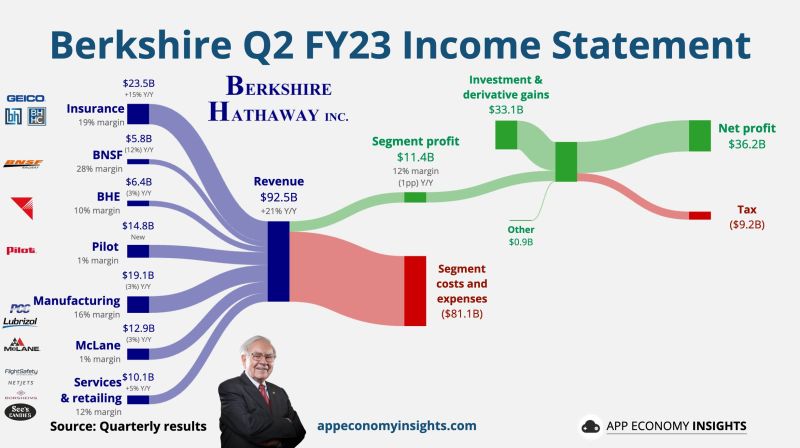

Berkshire Hathaway on Saturday reported a solid increase in second-quarter operating earnings, while the cash hoard at Warren Buffett’s conglomerate swelled to nearly $150 billion.

The Omaha-based giant’s operating earnings — which encompass profits made from the myriad of businesses owned by the company, like insurance, railroads and utilities — totaled $10.043 billion last quarter, 6.6% higher than the figure from the same quarter a year ago. Net income totaled $35.91 billion, compared with a $43.62 billion loss during the second quarter last year. The strong results were bolstered by a jump in Berkshire’s insurance underwriting and investment income. Berkshire reported a near $26 billion unrealized gain from its investments as its gigantic stake in #Apple led the market rally in the second quarter. The tech giant soared nearly 18% during the quarter and Berkshire’s bet has ballooned to $177.6 billion. The “Oracle of Omaha” trimmed his Chevron stake by $1.4 billion to $19.4 billion at the end of June. Berkshire’s massive cash pile grew to $147.377 billion at the end of June, near a record and much higher than the $130.616 billion in the first quarter. Share repurchase activity slowed down as the conglomerate’s stock climbed back to a record high. The company spent just about $1.4 billion in buybacks during the quarter, bringing the year-to-date total to $5.8 billion. Link to CNBC article: $BRK Berkshire Hathaway Q2 FY23: • Segment margin 12% (-1pp Y/Y). • $AAPL Apple stake now worth $178B. • Stock repurchase $1.4B ($4.4B in Q1). • Cash and short-term securities $147B. Source: App Economic Insights, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks