Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

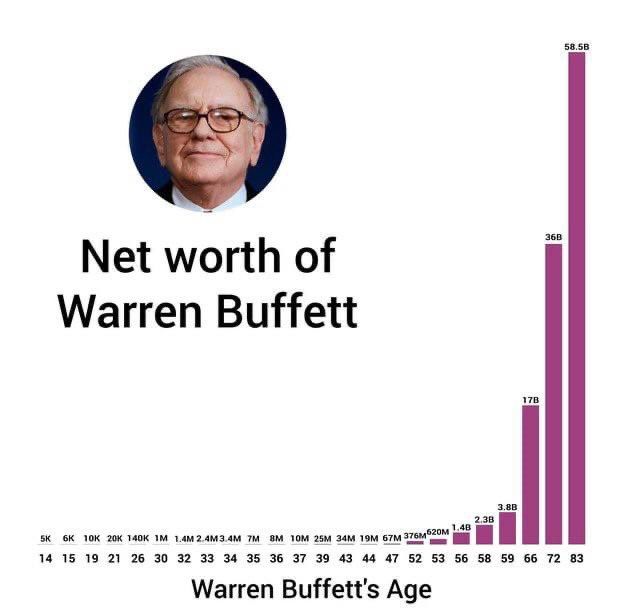

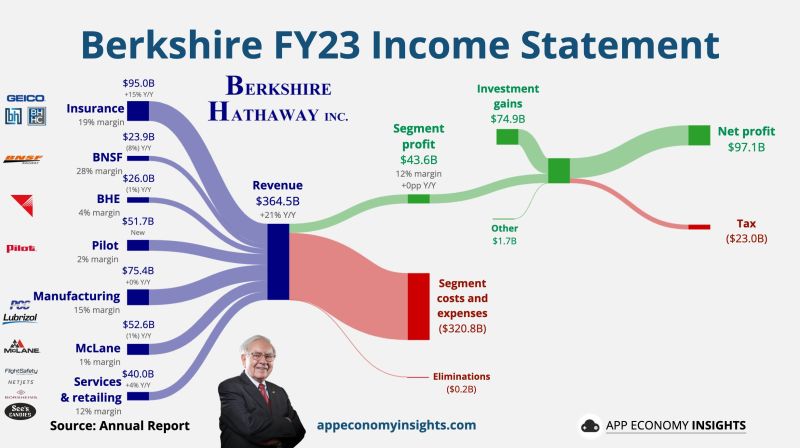

$BRK Berkshire Hathaway FY23 by App Economy Insight

• Net profit $97B. • Stock repurchase $9B. • Segment margin 12% (+0.5pp Y/Y). • Investment gains (unrealized) of $75B. • Cash and short-term securities $168B.

JUST IN: Berkshire Hathaway posts +28% surge in operating earnings and RECORD CASH OF $167.6 billion as Warren Buffett warns there are ‘ESSENTIALLY NO CANDIDATES FOR CAPITAL DEPLOYMENT’ outside US...

Berkshire Hathaway Q4 2023 highlights: • Berkshire Hathaway posted operating earnings — which refers to profits from businesses across insurance, railroads and utilities — of $8.481 billion in the fourth quarter, up 28% yoy • Net earnings of $37.6 billion • $2.2 billion of stock buybacks The cash pile grows to $163.3 billion in the fourth quarter, a record level that surpasses the $157.2 billion the conglomerate held in the prior quarter. 👀 Importantly, Warren Buffett has warned Berkshire Hathaway shareholders that his sprawling $905bn conglomerate has virtually “no possibility of eye-popping performance” in the years ahead, laying bare the challenges that will confront his successors. The so-called Oracle of Omaha said in his annual letter on Saturday there were very few deals that offer the kind of transformative impact past takeovers have had, such as its purchases of insurers Geico and National Indemnity or the BNSF railroad. “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others,” he said. “Outside the US, there are essentially no candidates that are meaningful options for capital deployment at Berkshire.” Berkshire Class A shares have rallied roughly 16% this year. Source: CNBC, Kevin Carpenter, FT

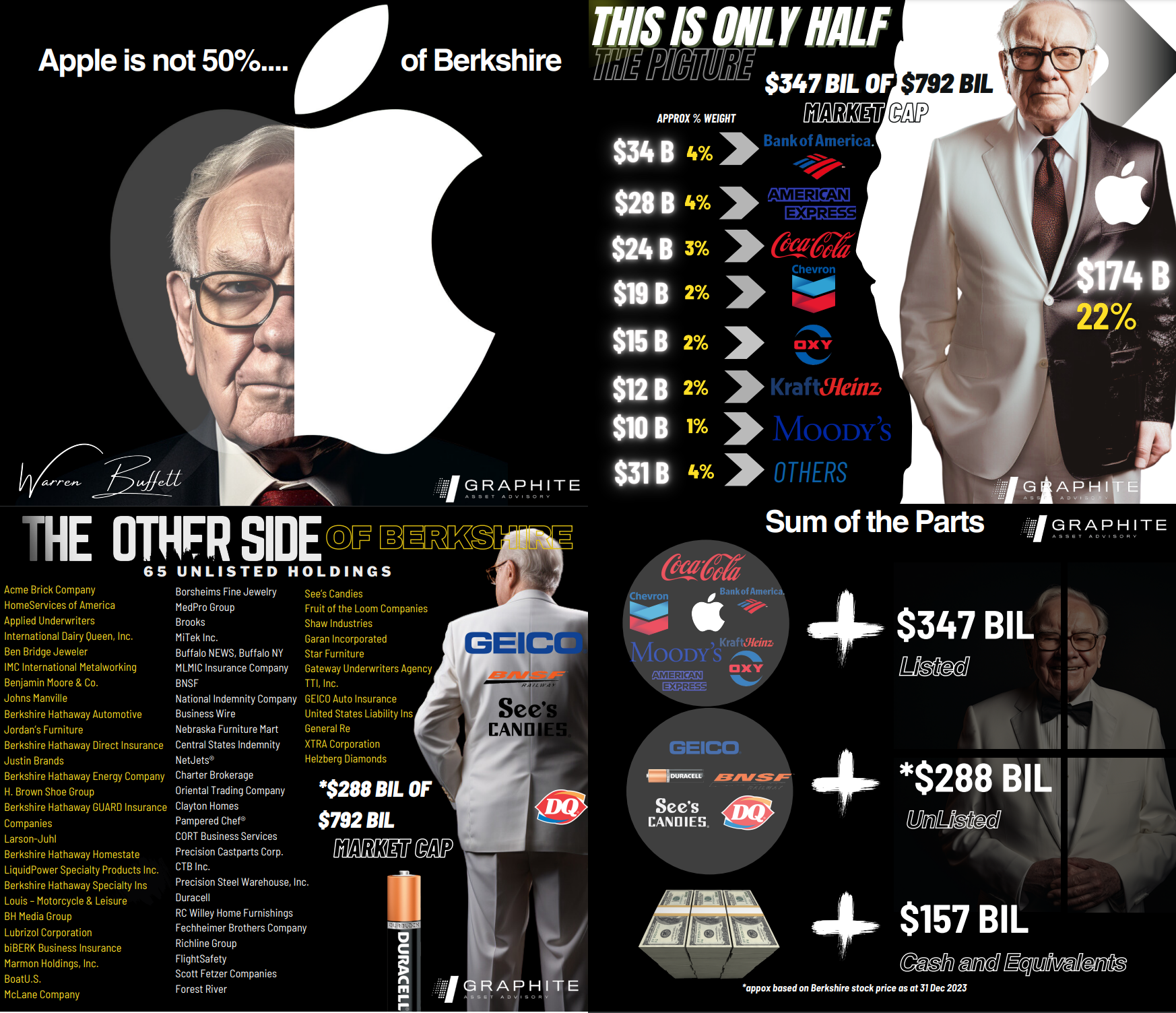

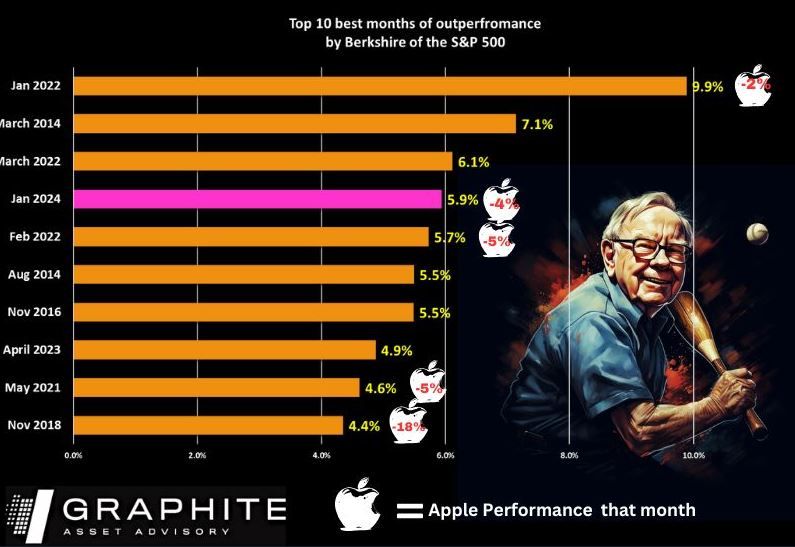

Nice visual by Graphite Asset Advisory and John Haslett, CA(SA), FRM

𝗛𝗮𝗹𝗳 𝘁𝗵𝗲 𝗦𝘁𝗼𝗿𝘆: 𝗪𝗵𝘆 𝗔𝗽𝗽𝗹𝗲' 𝗶𝘀 𝗻𝗼𝘁 𝗮 𝟱𝟬% 𝗦𝗹𝗶𝗰𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗕𝗲𝗿𝗸𝘀𝗵𝗶𝗿𝗲 𝗛𝗮𝘁𝗵𝗮𝘄𝗮𝘆 𝗣𝗶𝗲 Apple isn't half of Berkshire Hathaway. Why? Because the pie is much bigger ! 𝗪𝗶𝘁𝗵 𝟲𝟱 𝗱𝗶𝘀𝘁𝗶𝗻𝗰𝘁 𝘂𝗻𝗹𝗶𝘀𝘁𝗲𝗱 𝗴𝗲𝗺𝘀 (swipe right for full list) in its treasure chest along with interest bearing cash and fixed income, Berkshire Hathaway's empire stretches far beyond the realms of just the listed stock market.

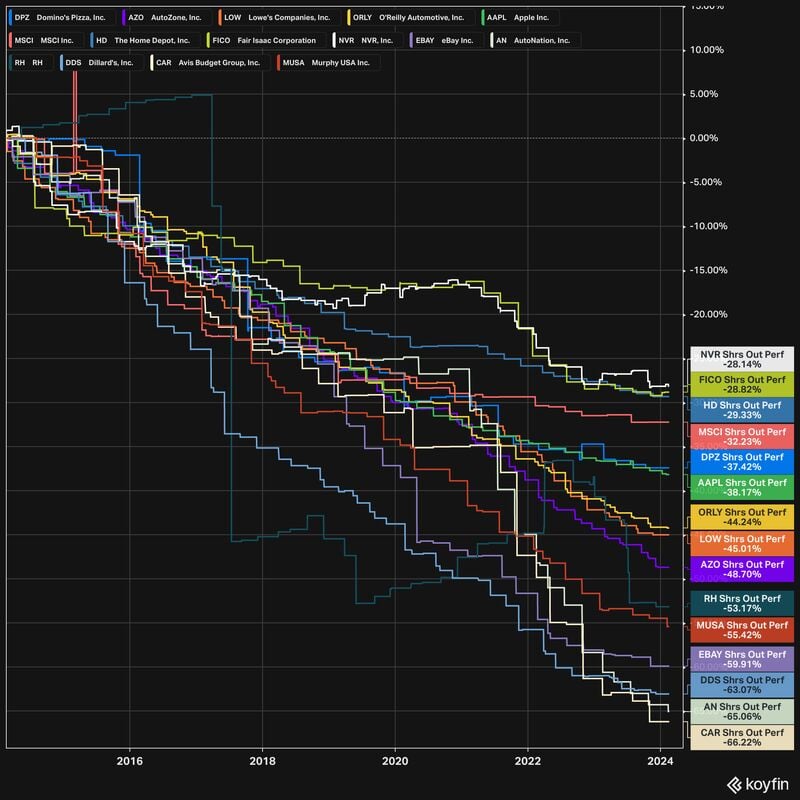

Warren Buffett loves share cannibals.

"The math isn't complicated. When the share count goes down, your interest in the businesses goes up. Every small bit helps if repurchases are made at value-accretive prices". Source: Koyfin Charts

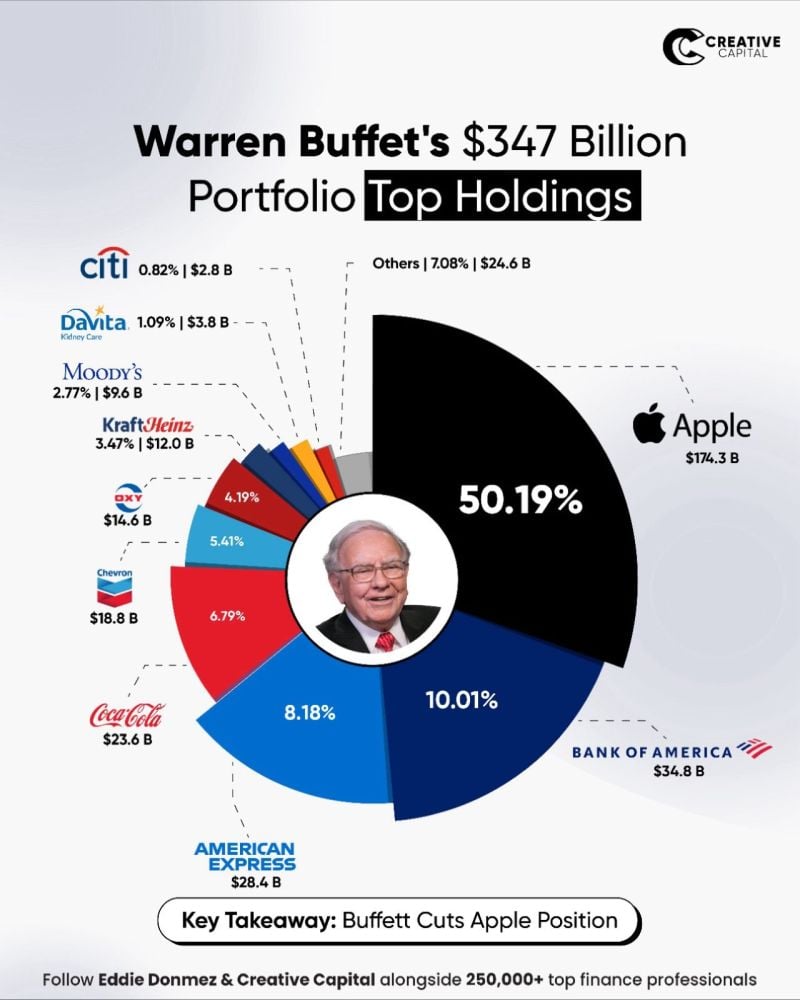

Legendary Investor Warren Buffet’s Updated $347 BILLION Portfolio - sold some Apple shares

Warren Buffett's Berkshire Hathaway sold off about 10 million shares or almost $2 billion of Apple stock in the final quarter of 2023, according to the firm's 13-F filing. Berkshire also sold off the majority of its position in HP and about half of its shares of Paramount Global. The firm boosted its positions in Chevron and Occidental Petroleum, as well as Sirius XM Holdings. Berkshire exited large positions in StoneCo and D.R. Horton, as well as two smaller positions in insurance firms Globe Life and Markel. Source: Creative Capital, Reuters

All-Time Highs

BRK.A and BRK.B both hit new all-time highs on Monday, Tuesday, and Wednesday. The Class A shares also rose above $600,000 for the first time ever. source : keja

Buffett's Berkshire Beats the S&P 500 in Jan 2024 by 6%

Berkshire Hathaway outperformed the S&P 500 by an impressive 6% in January 2024, marking the fourth highest monthly outperformance over the last decade. Despite Apple, which represents 50% of Berkshire's portfolio, being down more than 3% (indicated by white bars), Berkshire's value soared. In an extraordinary display in November 2018, despite Apple's plunge of over 18%, Berkshire Hathaway saw an increase of more than 4%. source : John Haslett, CA(SA), FRM, Graphite Asset Advisory

Investing with intelligence

Our latest research, commentary and market outlooks