Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

Egypt inflation soars to 37.4% y/y in August as higher food costs add to currency angst

Another month, another record inflation number. Consumer prices in Egypt rose 37.4% in August compared with a year earlier. This is the highest number since 2010 -- higher than even the levels reached after the 2016 currency crisis. Note that food costs were up 71.4%

French CPI a little hotter than expected, rising 50bp in August

This was all due to energy (including higher regulated prices) and the end of the summer sales, but services inflation is still easing driven by transports and "other services". FRENCH CPI YOY NSA PRELIM ACTUAL 4.8% (FORECAST 4.6%, PREVIOUS 4.3%) FRENCH CPI MOM NSA PRELIM ACTUAL 1% (FORECAST 0.8%, PREVIOUS 0.1%) FRENCH HICP MOM PRELIM ACTUAL 1.1% (FORECAST 1%, PREVIOUS 0.0%) FRENCH CONSUMER SPENDING MOM ACTUAL 0.3% (FORECAST 0.3%, PREVIOUS 0.9%) Source: Bloomberg

Disinflationary forces are intensifying in Germany

Producer Prices drop for 1st time since 2020, a good leading indicator for Consumer Prices. In July, producer prices (PPI) fell by 6.0% YoY, the biggest decline since October 2009, when the financial crisis has caused prices to collapse. Last year, the prices received by manufacturers for their goods had at times risen at a record rate of 45.8%. Source: HolgerZ, Bloomberg

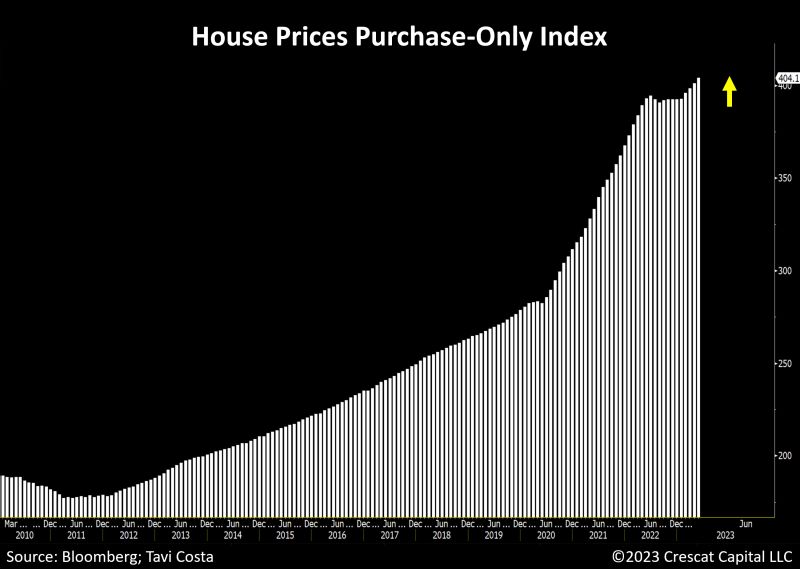

Looking at the recent sales transactions, house prices have accelerated significantly in the last 4 months to record levels, now growing at almost a 10% annualized rate

As a remainder, shelter costs / rents jave been putting upward pressure on core CPI and are expected to ease. Really? Source: Tavi Costa, Crescat Capital, Bloomberg

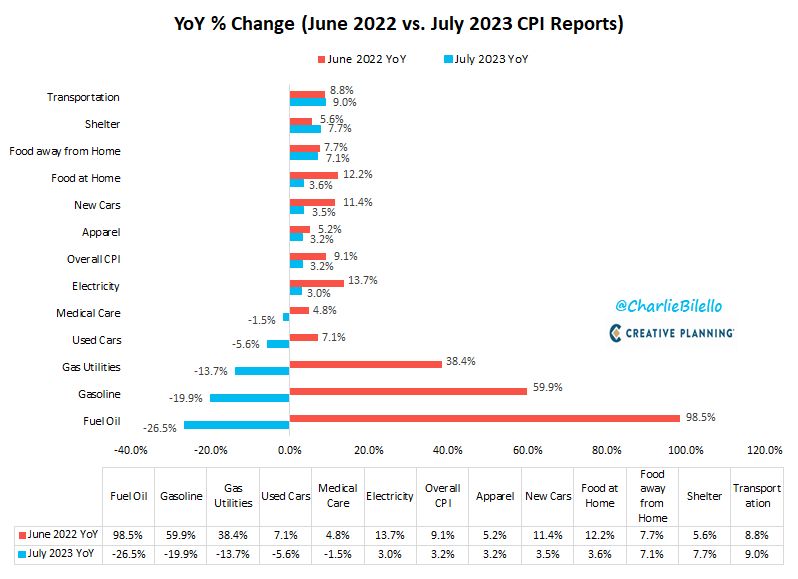

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today. What's driving that decline?

Lower rates of inflation in Fuel Oil, Gasoline, Gas Utilities, Used Cars, Medical Care, Electricity, Apparel, New Cars, Food at Home, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate than June 2022. Source: Charlie Bilello

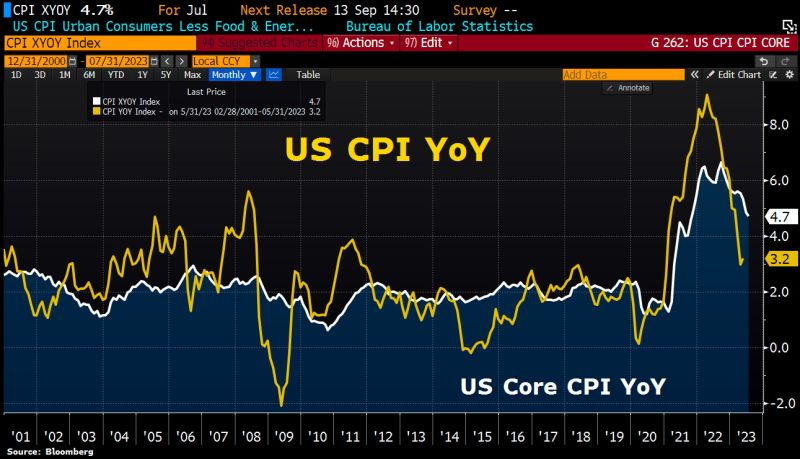

US inflation a tad lower than what economists expected: US July CPI accelerates to 3.2% YoY from 3% in June vs 3.3% expected, BUT the first acceleration after 12 consecutive months of decline

Both Goods and Services inflation (YoY) slowed in July - but Services remain extremely high at +6.1%... Core CPI slows to 4.7% YoY from 4.8% in June as expected. Shelter costs contributed to about 90% of the increase in July CPI. Note that #Fed's favorite inflation indicator - Core Services CPI Ex-Shelter - remains sticky' as it reaccelerated in July (+0.2% MoM, and from +3.9% to +4.0% YoY)... Fed Swaps price in lower odds (20%) of another rate hike this year. Source: Bloomberg, HolgerZ, www.zerohedge.com

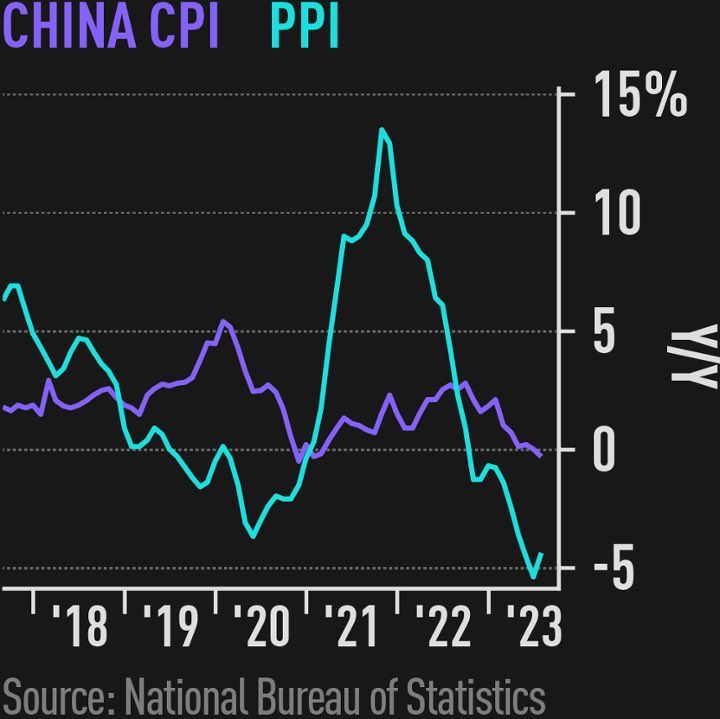

China's consumer and producer prices both declined in July for the first time since November 2020, a sign of deflation pressure amid weakening demand

CPI dipped 0.3% from a year earlier while PPI retreated for a 10th consecutive month, sliding 4.4%. "China is in deflation for sure," said Robin Xing at Morgan Stanley. "The question is how long." The statistics bureau attributed the CPI decline to the high base of comparison, saying the dip is likely to be temporary. Source: J-C Gand

Investing with intelligence

Our latest research, commentary and market outlooks