Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

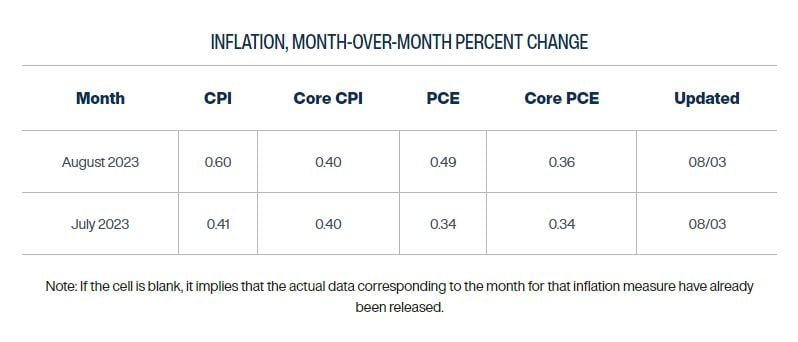

Consumer price inflation is creeping higher again on a month-over-month basis, driven in part by higher gas prices, according to the Cleveland Fed's forecast

Source: Lisa Abramowicz

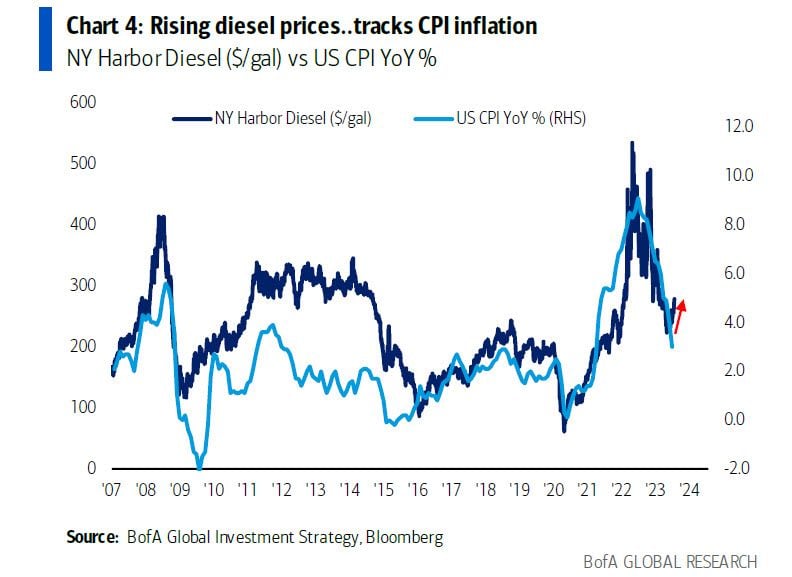

US diesel vs inflation: if history is any guide, recent pop of US diesel prices could imply CPI going back over 4%

Source: BofA

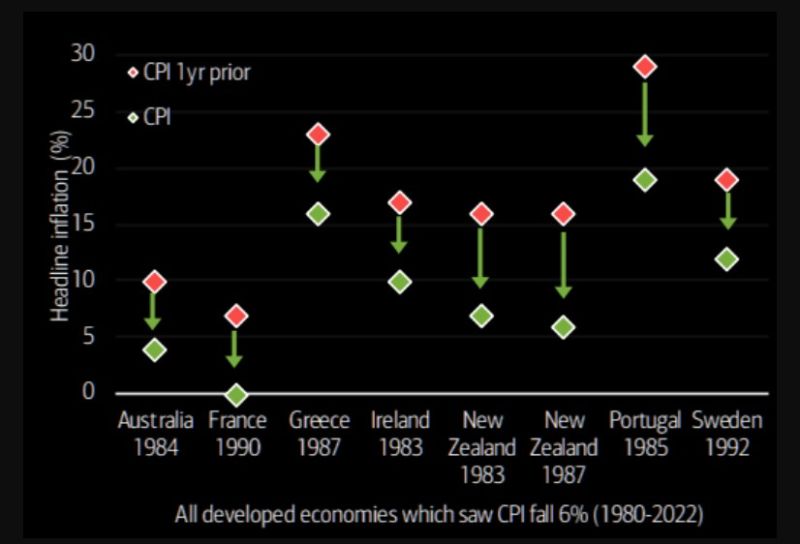

What goes up must come down...

The collapse in US CPI over the past year is extreme, falling from 9.1% to 3%. BofA writes: "...since 1980, only in 8 cases had inflation fallen by more than 6% in a year, and only in France in 1990 from a starting point lower than 10%." Source: TME, BofA

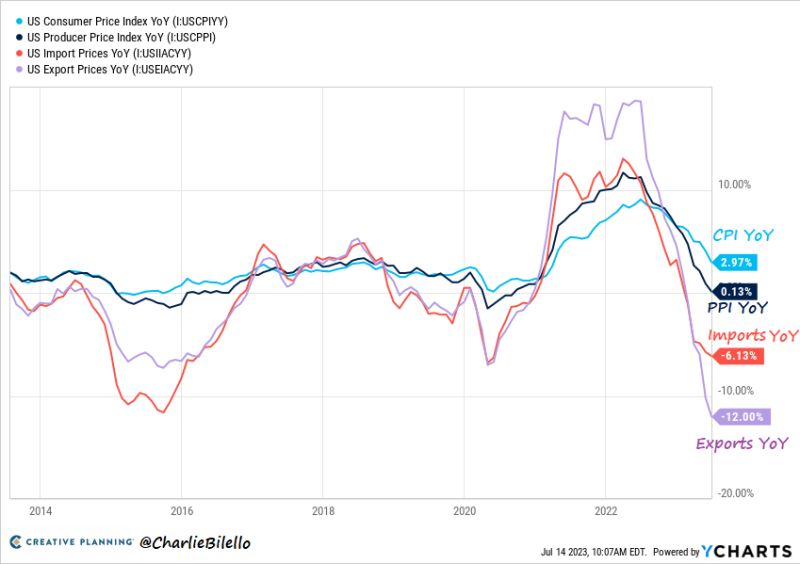

Disinflationary trends in the US

Disinflationary trends in the US 1) CPI Inflation: 3.0%, Lowest since March 2021. 2) PPI Inflation: 0.1%, Lowest since August 2020. 3) Import Prices: -6.1%, Lowest since May 2020. 4) Export Prices: -12%, Lowest on record. Source: Charlie Bilello

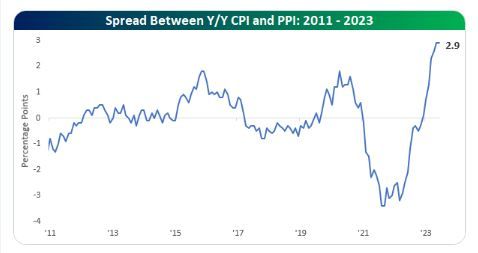

The spread between US CPI and PPI is a good omen for corporate profit margins

The spread between US CPI and PPI is a good omen for corporate profit margins. This is key to widening profit margins. Companies are able to boost the prices they charge consumers more and more relative to their input cost. The spread between y/y CPI and PPI remains at the widest levels since the current incarnation of PPI started in 2011. Source: Bespoke, Lisa Abramowicz

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected. This is smallest pace since Aug 2020 and is down from the all-time high of 11.7% YoY from March 2022 in a promising sign for CPI. Source: Bloomberg, HolgerZ

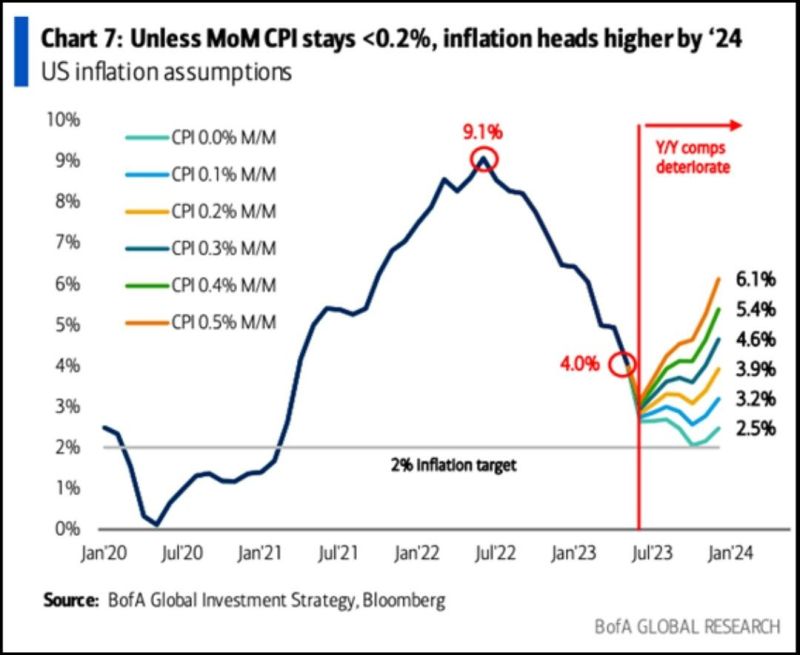

The easy part is over for disinflation as disinflationary base effects are behind us

The easy part is over for disinflation as disinflationary base effects are behind us. The MoM CPI now needs to be lower than 0.2% for #inflation to continue moving lower. Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks