Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

What a day...

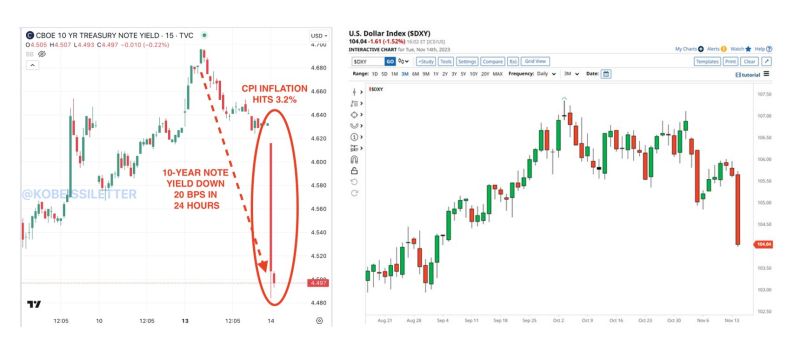

The US 10-year note yield fell sharply to 4.49%, after CPI inflation hits 3.2% in October. The 10-year note yield went down 20 basis points in 24 hours. Meanwhile, the U.S. Dollar Index $DXY had its biggest drop in more than a year. Source: The Kobeissi Letter, Barchart

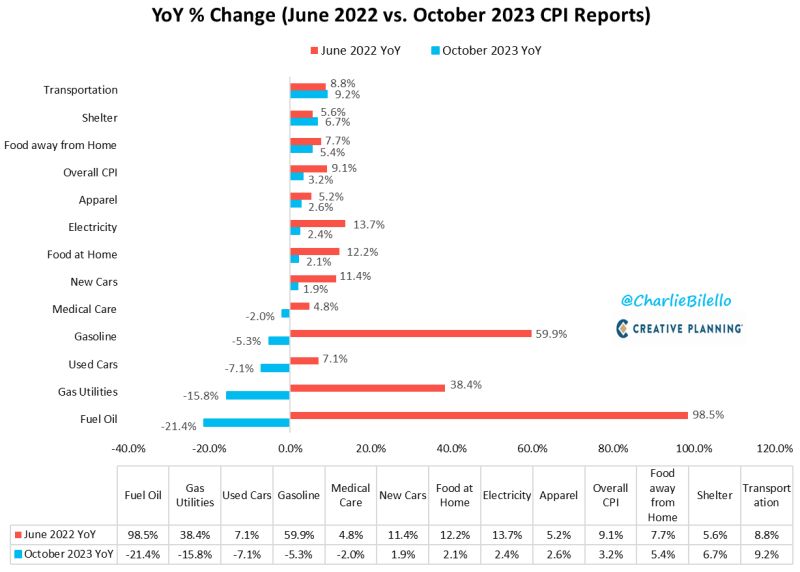

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Used Cars, Gasoline, Medical Care, New Cars, Food at Home, Electricity, Apparel, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

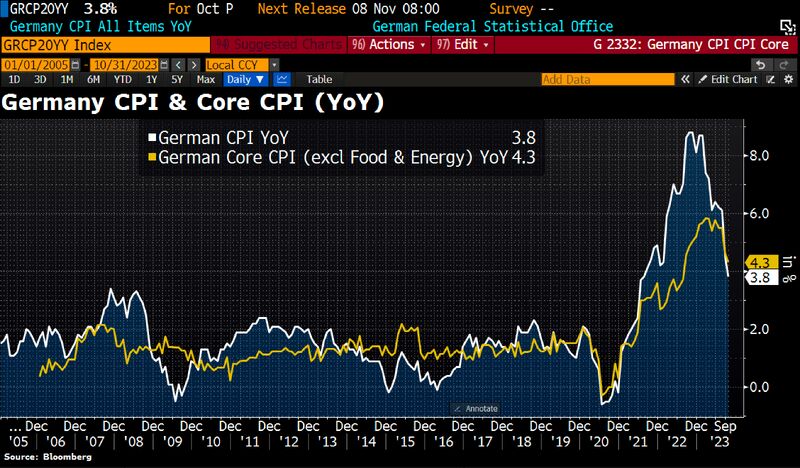

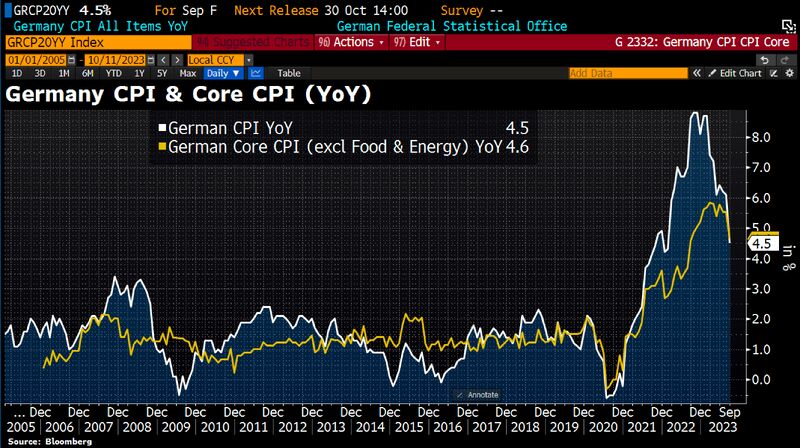

German inflation in September fell to its lowest rate since outbreak of war in Ukraine, confirming prior estimates

CPI slowed to 4.5% in September YoY from 6.1% in August. Headline CPI is now lower than Core CPI BUT food prices are already on the rise again. Compared to previous month, food has become 0.4% more expensive. Source: Bloomberg, HolgerZ

An ugly canadian CPI, surging crude oil prices and cautious positioning ahead of tomorrow's FOMC decision have pushed #us treasuries yields to their highest since 2007...

Bonds are now at their cheapest to stocks since Oct 2007... Source: Bloomberg, www.zerohedge.com

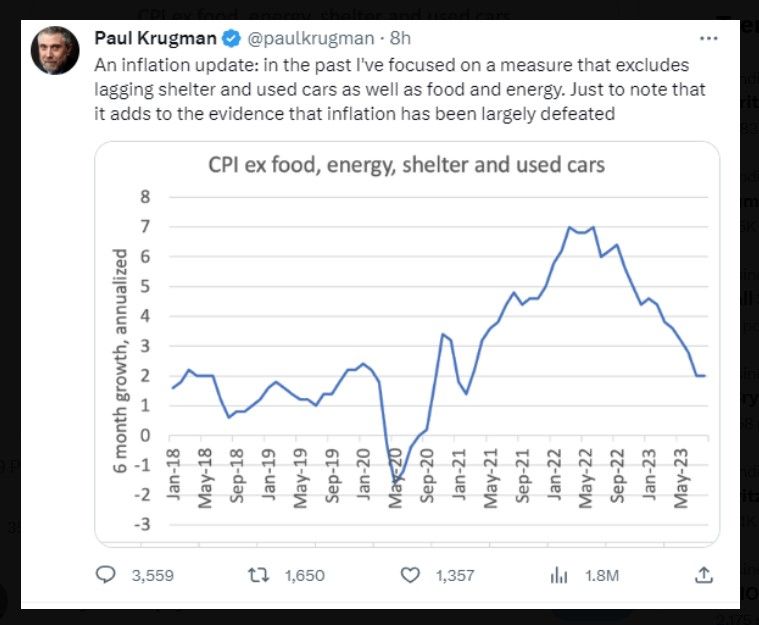

Translation: If you exclude everything you need in life, inflation has been vanquished!

Source: Barchart

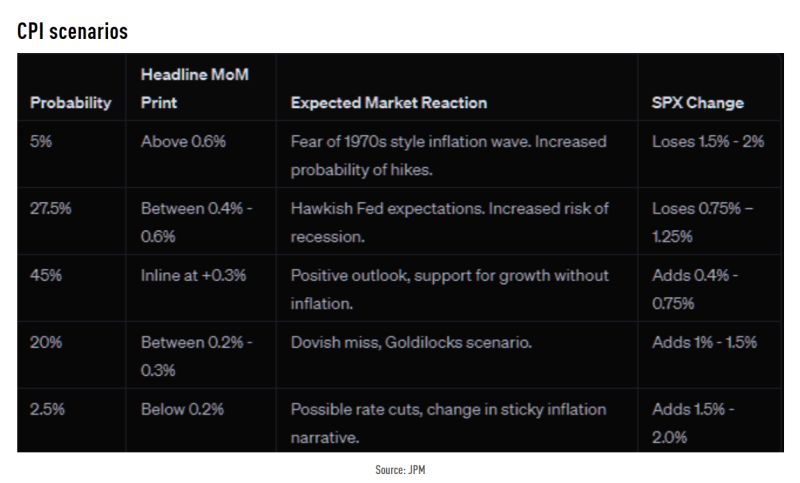

US CORE CPI LITTLE HOTTER THAN EXPECTED => A FED PAUSE IS LIKELY BUT NO RATE CUT ANYTIME SOON

Consensus expected a reacceleration of Headline inflation (+0.6% MoM after +0.2% in July) and a stabilisation of “core” inflation (+0.2% MoM after +0.16% in July). Key actual numbers are the following: ON A SEQUENTIAL BASIS (MoM) Headline inflation numbers are in-line with expectations (+0.6%). That is the biggest MoM since June 2022 and the second straight monthly increase in CPI...The energy index rose 5.6% in August after increasing 0.1% in July. There was a big turn-around in airline fares. They rose 4.9% after dropping 8.1% in each of the previous two months. But the gasoline index dominated with an increase of 10.6 percent in August, following a 0.2% increase in the previous month.

Investing with intelligence

Our latest research, commentary and market outlooks