Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

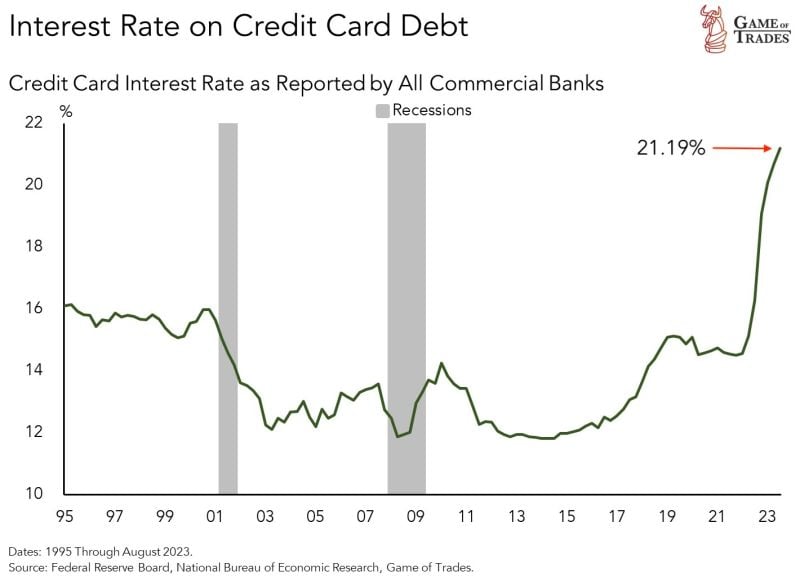

The average credit card interest rate right now has risen to 27.81%

And that's with U.S. credit card debt hitting new record highs north of $1,000,000,000,000 Source: Hedgeye

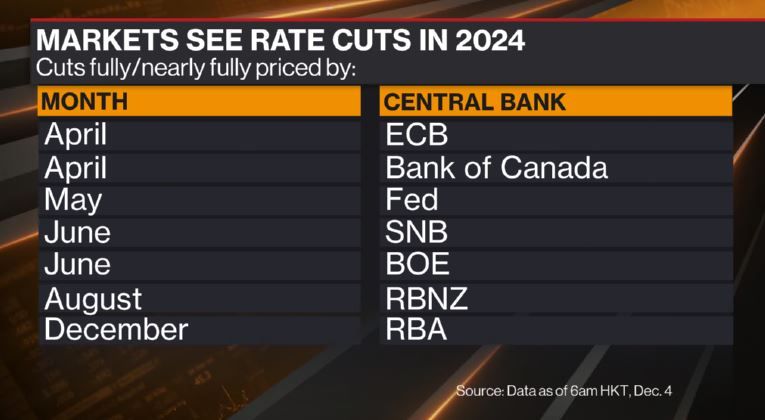

2024 is expected to be a year of interest rate cuts

Here's what's currently priced in markets of who does what when. Source: Bloomberg, David Ingles

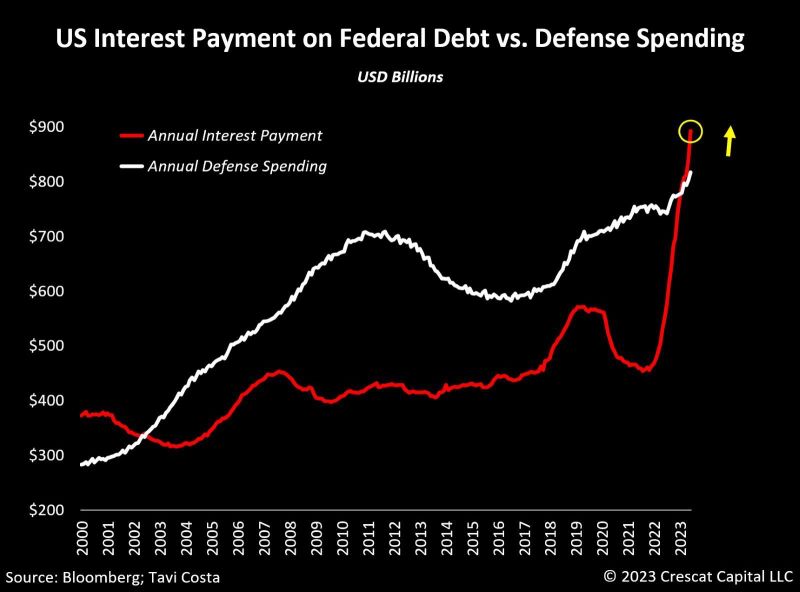

As highlighted in the Kobeissi Letter and in the chart below from Tavi Costa >>> Annualized interest expense on US Federal debt is nearing $1.1 TRILLION

To put this in perspective, 2023 defense spending was $821 billion. This means the US is on track to spend 34% MORE on interest expense than defense spending. In 2023, the US government produced $4.4 trillion in revenue. This means that 25% of receipts in the entire 2023 are equivalent to Uncle Sam's annual interest expense. Rising rates and falling tax revenue are both occurring at the same time. A tricky combination

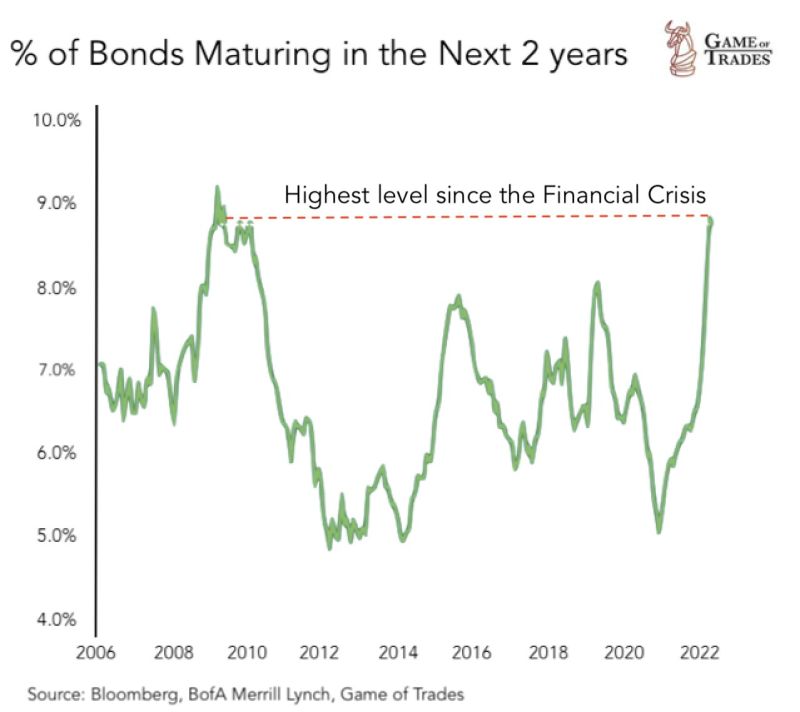

Interest rate on credit card debt has risen to 21.19%

To put this in perspective, this rate was at 14.56% in early 2022. That’s a 6% + jump in less than 2 years. Current levels have NEVER been seen in over 25 years. This is happening at a time when credit card debt has crossed the $1 trillion threshold. To make things worse, personal interest payments have crossed $500 billion. Source: Game of Trades

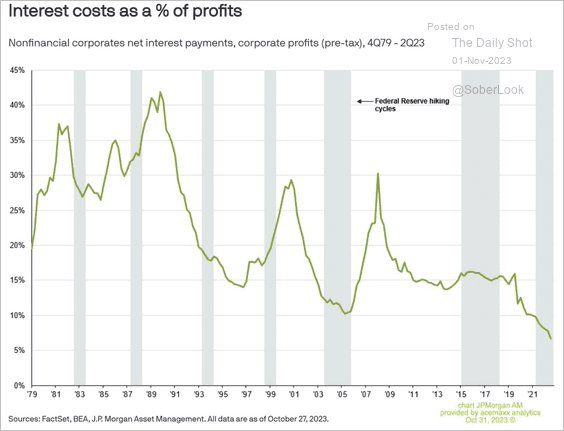

Interest costs as a share of US corporate profits are near the lowest levels in 40 years

This is partly because many companies have locked in long-term financing at low rates. This has kept profit margins elevated. Maybe companies are better to manage their debt schedule than the US Treasury... Source: The daily shot, Lance Roberts

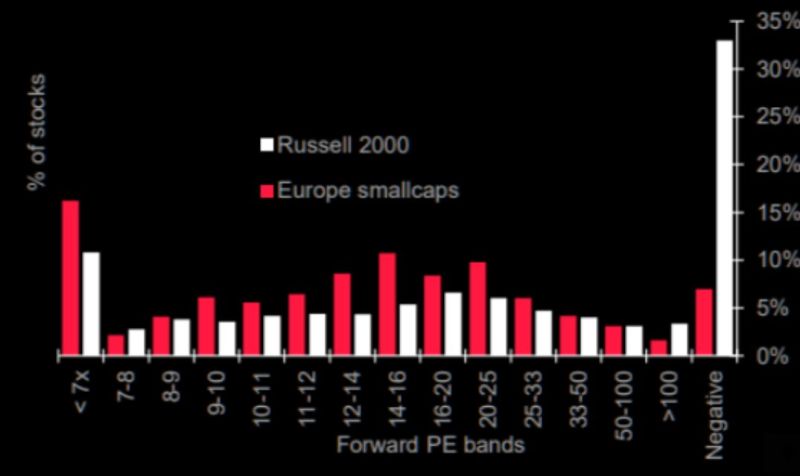

Welcome to Zombie Land

"There are some serious problems in small-caps, especially in the US. Good luck paying interest without profits. Great chart via Soc Gen showing the distribution of stock forward P/E valuations in the MSCI Europe small cap and Russell 2000 index. Source: SG, Themarketear, Lance Roberts

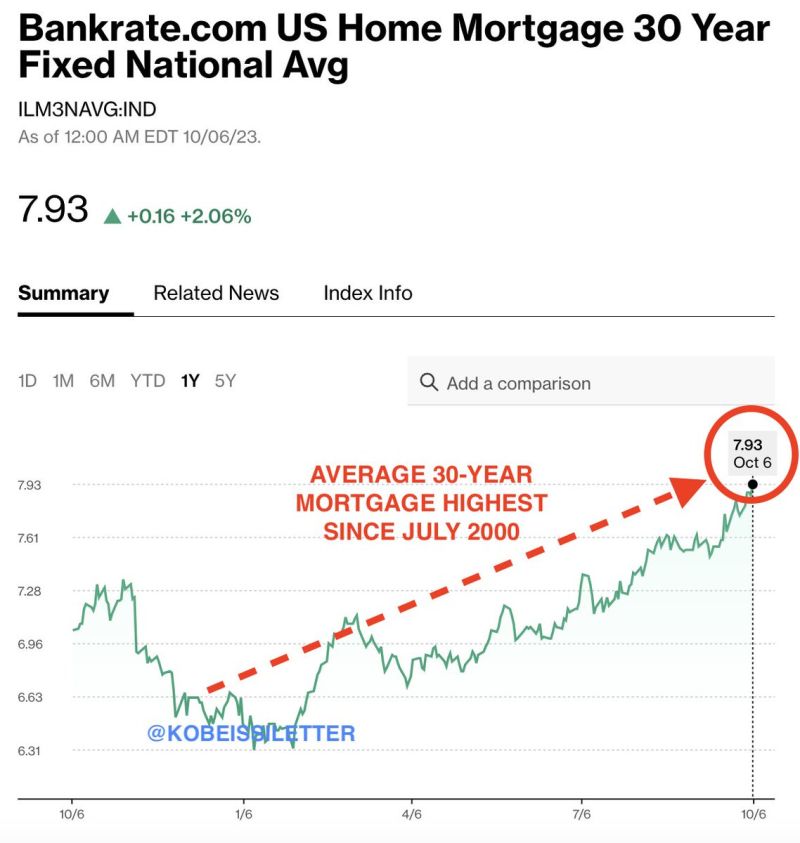

BREAKING: Average interest rate on a 30-year mortgage rises to 7.93%, its highest since July 2000

Since January 2021, less than 3 years ago, interest rates have gone from 2.65% to 7.93%. This means that homebuyers just 3 years ago would see their interest rate TRIPLE if they decided to move. This is exactly why existing home sales are at their lowest since 2010. The average new home is about to cost LESS than the average existing home for the first time since 2005. You know something is wrong when old costs more than new. Why sell if your mortgage rate triples? From The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks