Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

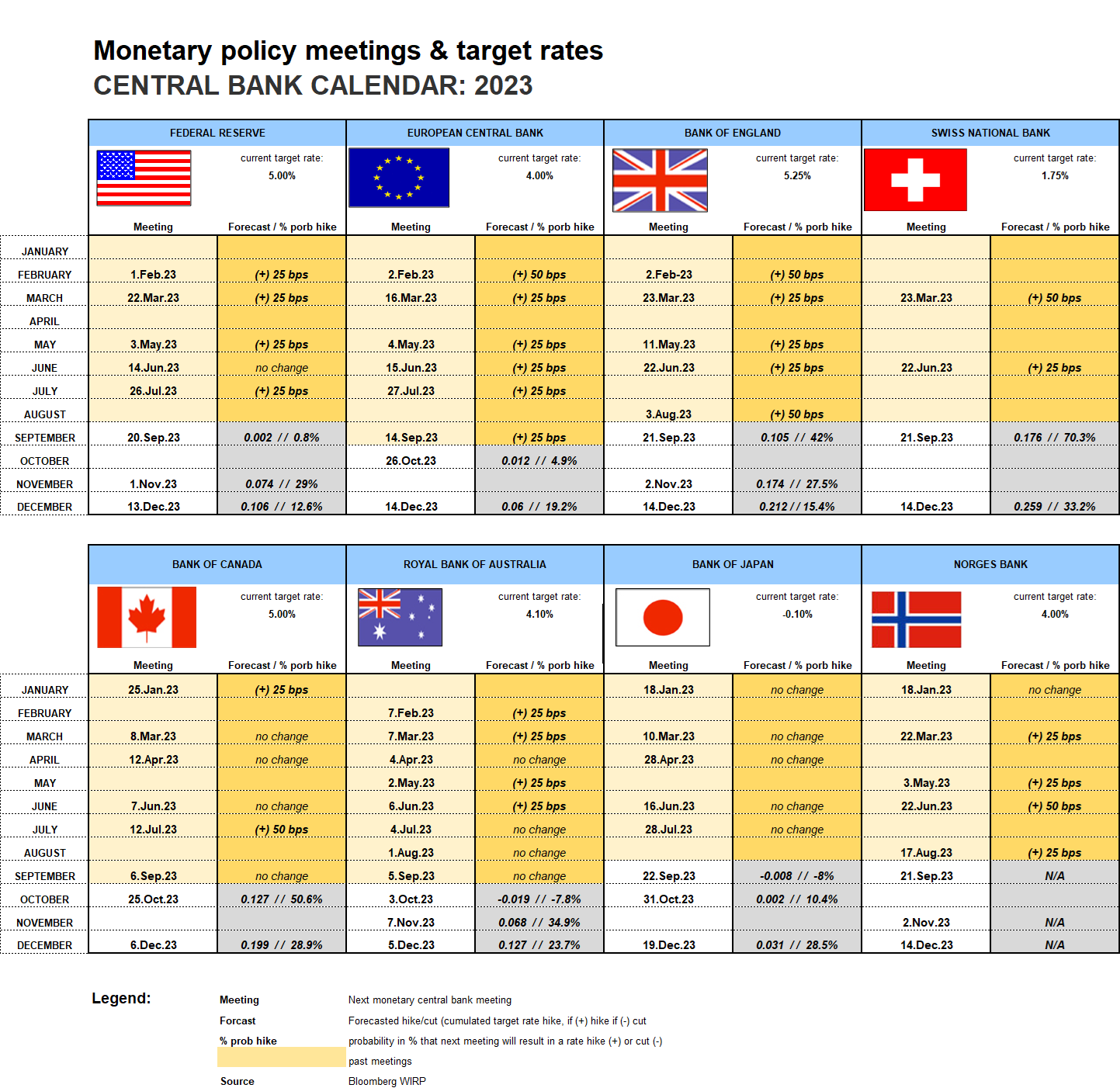

SNB unexpectedly leaves policy rate unchanged at 1.75%.

The Swiss national bank unexpectedly leaves its policy rate unchanged at 1.75%. Market was estimating the probability of a 25bps hike at more than 70% yesterday.

USDCHF broke the 200 daily moving average of 0.9036 and now trading higher over 0.9060.

EURCHF also trading higher at 0.9650.

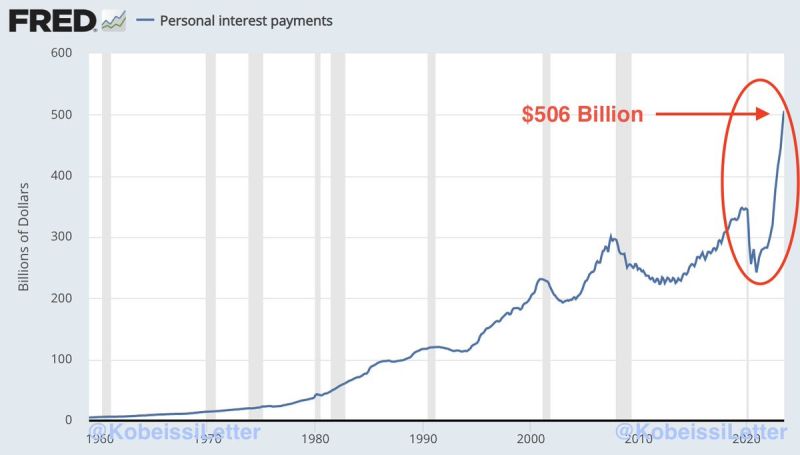

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July

During the first 7 months of 2023, Americans paid a total of $3.3 TRILLION in personal interest. This is up a staggering 80% since 2021 and nearly above the entire 2022 total. The worst part? These numbers do NOT include interest on mortgage payments. Source: The Kobeissi Letter, FRED

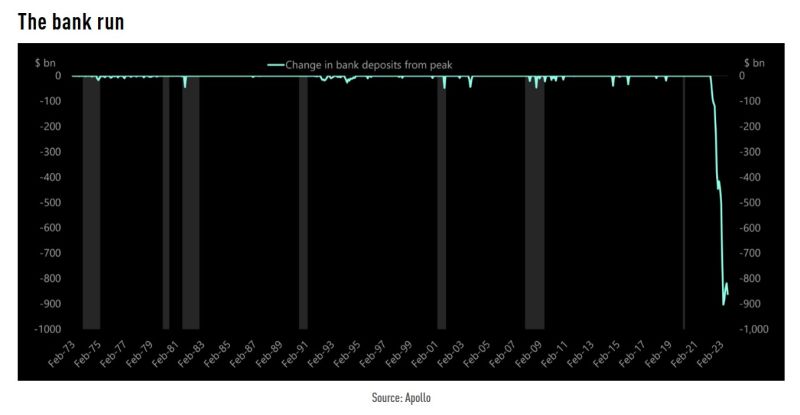

$862bn in deposits have left the banks since the Fed began to raise interest rates

Source: Apollo, TME

Trafigura says ‘fragile’ oil market may be prone to price spikes as higher interest rates and underinvestment squeeze the market according to a Bloomberg article

- The consensus view is for prices to remain near current levels, but the market is “more fragile than it looks,” Ben Luckock, the co-head of oil trading said in an interview at APPEC in Singapore. Brent crude is nearing $90 a barrel after OPEC+ heavyweights reduced supply — curbs that could continue further. - “One reason is underinvestment in new oil production,” he said on Monday. “Combined with higher interest rates, which make it more expensive to hold oil in storage, it means there isn’t much slack or flex in the system. Put all together, and you have a market that’s susceptible to price spikes.” - Oil options traders are showing confidence in the recent sustained surge in prices, bolstering wagers that crude will rally toward $100, even as questions remain over China’s outlook. However, Luckock and other attendees at the conference said it wasn’t all bad when it came to nation’s economy.

Investing with intelligence

Our latest research, commentary and market outlooks