Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- Treasury

- debt

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- magnificent-7

- geopolitics

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- manufacturing

- spx

- FUND

- africa

- deflation

- investmentgrade

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- jobs

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- savings

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

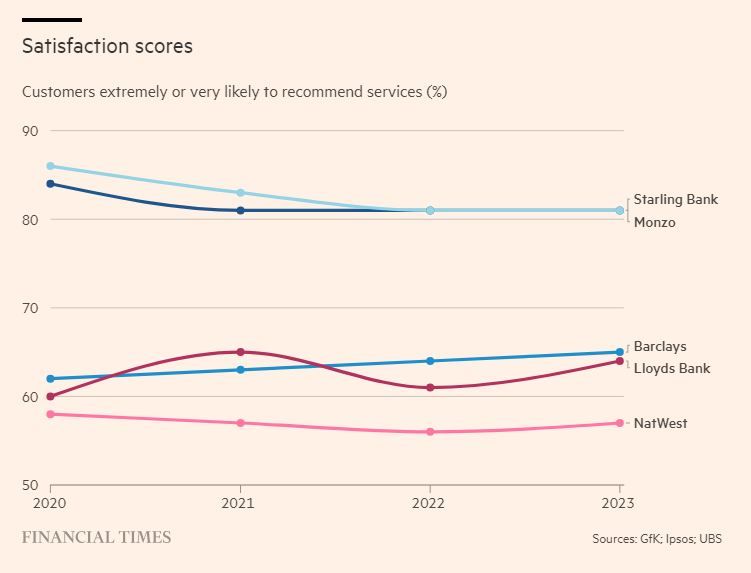

Interesting FT article on UK neobanks: "UK fintech: neobanks may end up blending in"

Low fees mean profits have remained elusive. But higher interest rates are now compensating for that, not least with better returns on client money put out on deposit. Satisfaction scores by customers are also much higher than traditional banks. Some lessons need to be learned. Source: https://lnkd.in/emZyY76d

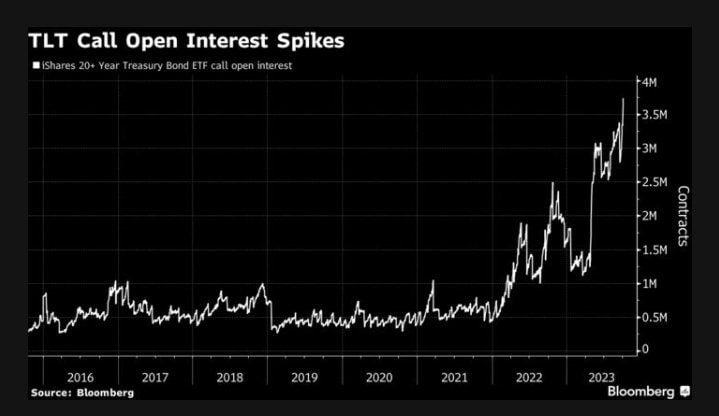

Open interest for bullish call contracts has soared to an all-time high for $TLT

Traders see an end to the market rout that has led to TLT’s longest streak of weekly losses since 2022. Source: Credit From Macro to Micro

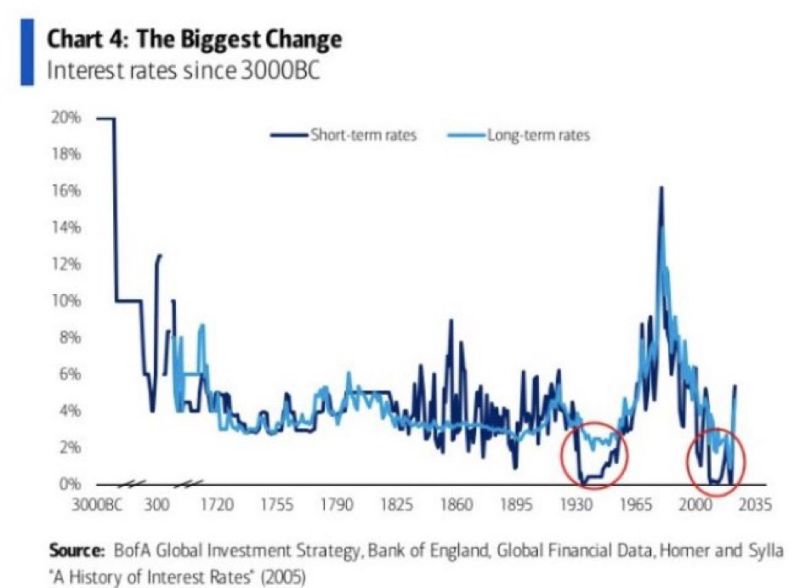

The longest time period chart on US interest rates you will ever find...

Source: BofA

While mega-caps tech stocks are recording huge returns on their cash pile thanks to the rise of interest rates, this is not the case for the rest of the market

Small cap companies are paying the most interest expense ever recorded and unfortunately their interest income is not keeping pace. This will become an even larger problem when small companies are forced to refinance at significantly higher rates. Source: FT, barchart

World trade volumes fell at their fastest annual pace for almost three years in July

Closely watched figures signal rising interest rates are beginning to impact global demand for goods. Trade volumes were down 3.2 per cent in July compared with the same month last year, the steepest drop since the early months of the coronavirus pandemic in August 2020. The latest World Trade Monitor figure, published by the Netherlands Bureau for Economic Policy Analysis, or CPB, followed a 2.4 per cent contraction in June and added to evidence that global growth was slowing. After booming during the pandemic, demand for global goods exports has weakened on the back of higher inflation, bumper rate rises by the world’s central banks in 2022, and more spending on domestic services as economies reopened following lockdowns. The about-turn in export volumes was broad based, with most of the world reporting falling trade volumes in July. China, the world’s largest goods exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent decrease. Source: FT

Private equity firms are redirecting their focus from mega buyouts to businesses such as private credit as higher interest rates disrupt their strategies

Over the past year, buyouts have been halted due to the impact of higher rates, resulting in private equity firms being burdened with portfolio companies acquired at high prices. In response to this challenging environment, some of the industry’s largest firms are venturing into new areas, including lending to companies, which has become more lucrative as central banks raise interest rates to combat inflation. Top executives from Apollo and Blackstone recently highlighted the potential of private credit and infrastructure investing at the annual IPEM industry conference in Paris. https://lnkd.in/exw5bqWp. Source: https://lnkd.in/eSMS2Q-k

Investing with intelligence

Our latest research, commentary and market outlooks