Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

Yields on 10-year Treasuries are now almost equal to the trailing 12-month earnings yield on the S&P 500 index. This is the first time that's the case going back to 2002

Source: Bloomberg, Lisa Abramowitz

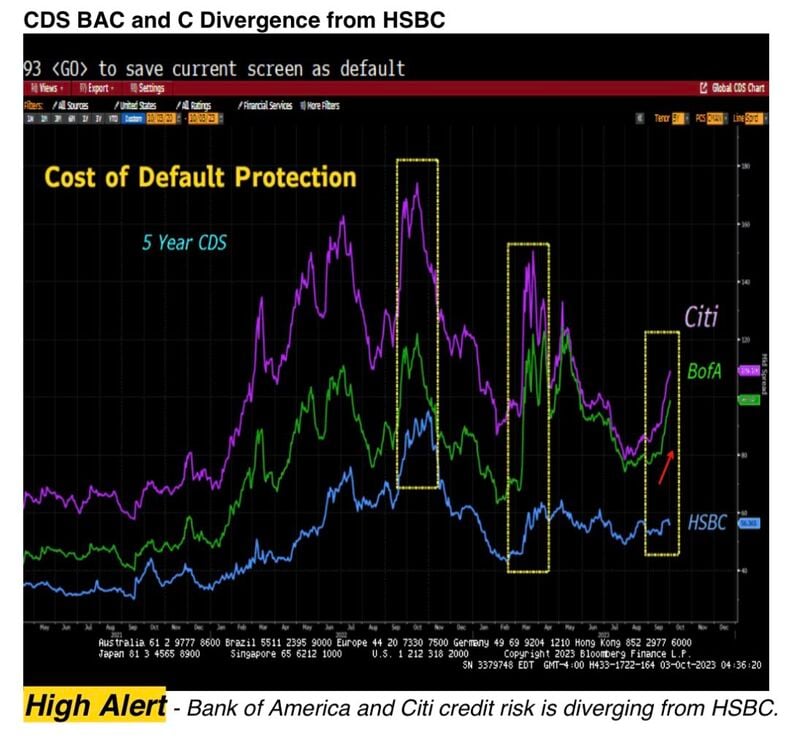

Rising bond yields is hurting US banks and it starts to show up in the CDS- see below.

With US Treasuries at 5%, Bank of America is close to 45x levered, at 6-7% infinitely levered. Maybe the Fed should have stress-tested the banks not only on credit quality but also duration... Source: Lawrence McDonald

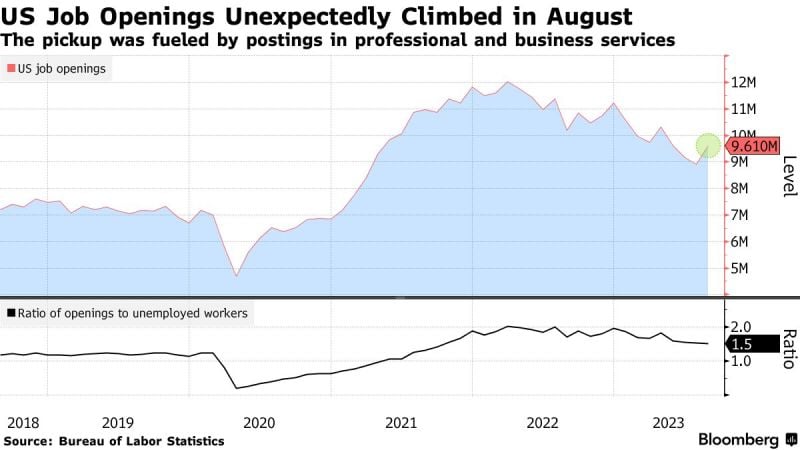

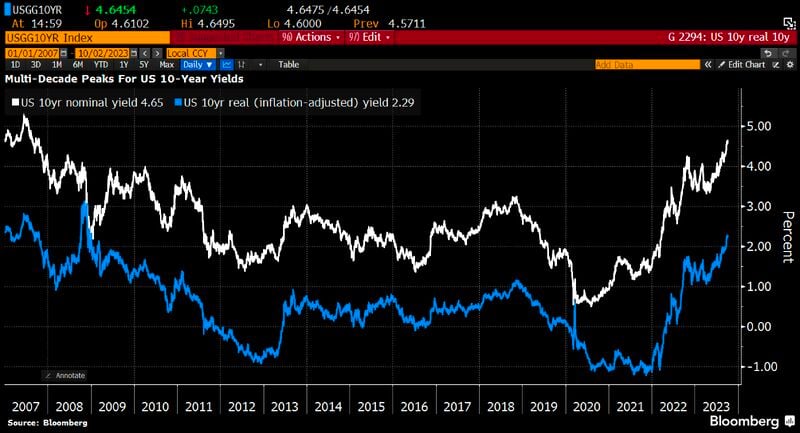

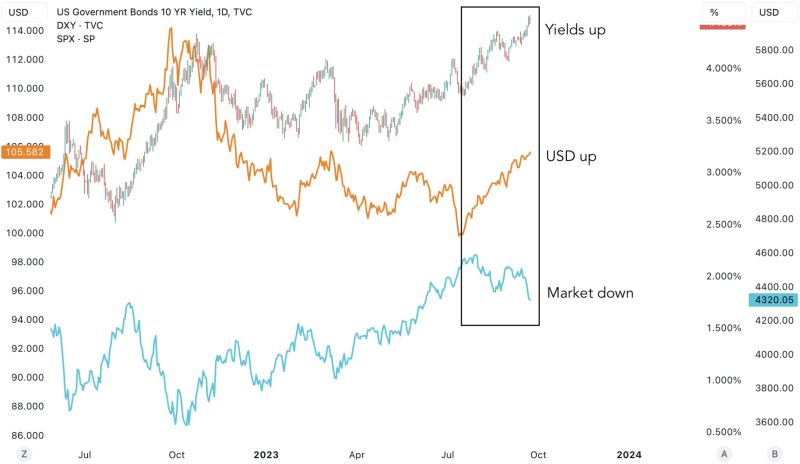

US job openings top all forecasts as white-collar positions jumped: equity markets tanking as US 10 year yields hit fresh 16y high with all of the increase is due to a rise in real yields

US 10y nominal yields is now at 4.73%, 10y real yields (nominal yields-10y inflation expectations) at 2.37%. THE FACTS - US job openings unexpectedly increased in August, fueled by a surge in white-collar postings, highlighting the durability of labor demand. - The number of available positions increased to 9.61 million from a revised 8.92 million in July, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS, showed Tuesday. Hiring edged up, while layoffs remained low. - The level of openings topped all estimates in a Bloomberg survey of economists. - The so-called quits rate, which measures voluntary job leavers as a share of total employment, held at 2.3%, matching the lowest since 2020. Fewer quits implies Americans are less confident in their ability to find another job in the current market. OUR TAKE In the current context of "higher rates for longer" fears, investors are probably over-reacting to this report which is adding some confusion to the current trend (which has been a progressive cooling down of the job market). Source chart: Bloomberg

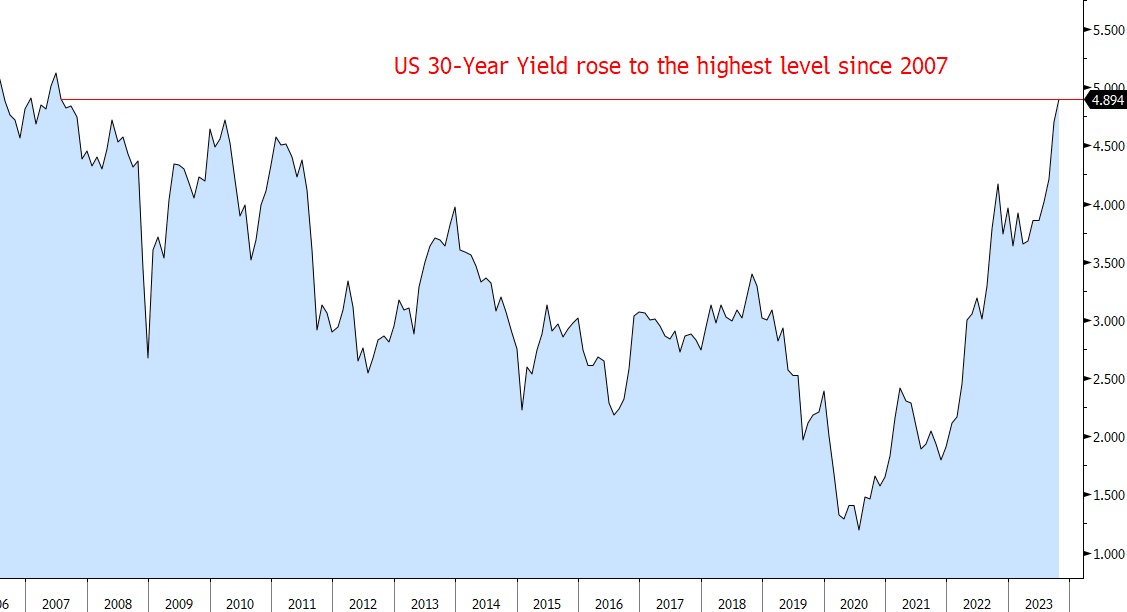

US 10 year yields keep rising in tandem with oil

WTI oil now trades at $93.5/bbl. So is oil & inflation fears the only reason for bond yields to move upward? Probably not. The fact that real yields are also on the rise shows that inflation is not the only culprit. Investors are adjusting to the reality of rates staying high for longer than expected. They are also requesting positive real yield to get compensated for being invested in US treasuries at the time the US Treasury is issuing massive amount of debt while the FED keeps shrinking its balance sheet through QT. Source chart: Bloomberg

This chart by Goldman shows the regime change which has been in place over the last few weeks

Despite the rise in 30-year real yields, short duration stocks (i.e value and the likes) were underperforming long duration ones (i.e IT/growth stocks). Things are now normalizing as short duration stocks are progressively catching up in terms of relative performance. The growth/IT basket probably needs 30-year real yield to reverse trend in order to outperform again...

Investing with intelligence

Our latest research, commentary and market outlooks